English IIQE Paper 3 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

IIQEP3ET1

Quiz-summary

0 of 183 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

Information

IIQEP3ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 183 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic_1 0%

-

IIQEP3ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- Answered

- Review

-

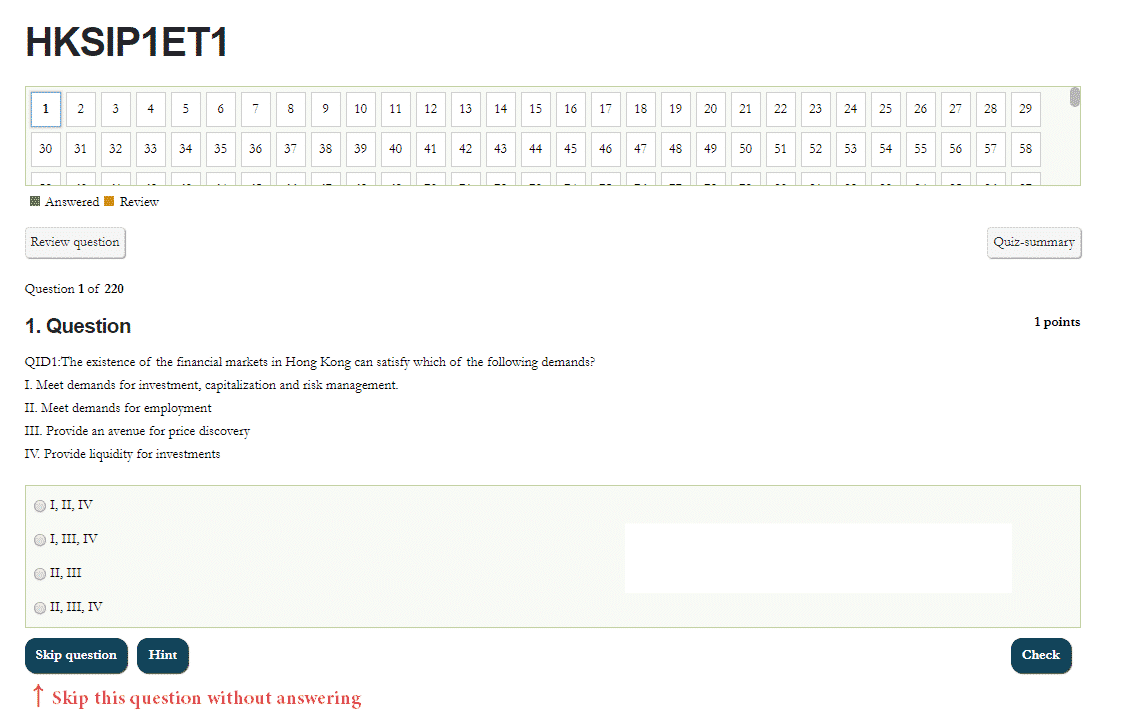

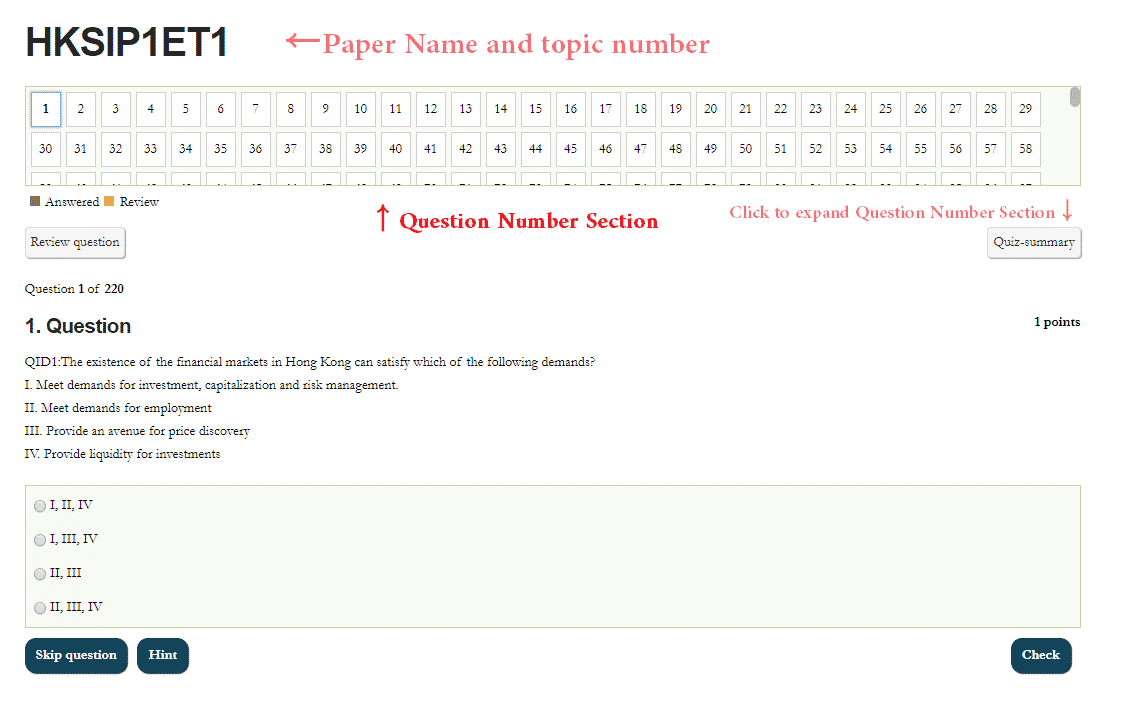

Question 1 of 183

1. Question

1 pointsQID11:Which of the following is not the purpose of life insurance?

Correct

The purpose of life insurance is for savings, short-term insurance arrangement, retirement preparation, etc. Tax evasion is not the purpose of life insurance. The answer is A.

Incorrect

The purpose of life insurance is for savings, short-term insurance arrangement, retirement preparation, etc. Tax evasion is not the purpose of life insurance. The answer is A.

Hint

References:1.1.

-

Question 2 of 183

2. Question

1 pointsQID1:What is the basic intention of life insurance:

Correct

“Life insurance provides a sum of money if the person who is insured dies

whilst the policy is in effect.” According to this definition, the basic intention of life insurance is to provide help to the insured’s family instead of giving money to the insured. As for retirement protection and savings, life insurance is a very useful tool for those needs but not the basic intention of it. So the answer is B.Incorrect

“Life insurance provides a sum of money if the person who is insured dies

whilst the policy is in effect.” According to this definition, the basic intention of life insurance is to provide help to the insured’s family instead of giving money to the insured. As for retirement protection and savings, life insurance is a very useful tool for those needs but not the basic intention of it. So the answer is B.Hint

References:1.1.

-

Question 3 of 183

3. Question

1 pointsQID18:What is the reason why customers buy life insurance?

Correct

People purchase life insurance for savings, investment, and temporary needs/threats. So D is the right answer.

Incorrect

People purchase life insurance for savings, investment, and temporary needs/threats. So D is the right answer.

Hint

References:1.1.

-

Question 4 of 183

4. Question

1 pointsQID17:What is the main purpose and viewpoint that people purchase life insurance in modern times?

Correct

To provide the insurance benefit for the family in the event of unfortunate death is still the main purpose and reason why people purchasing life insurance in modern society. So the answer is A.

Incorrect

To provide the insurance benefit for the family in the event of unfortunate death is still the main purpose and reason why people purchasing life insurance in modern society. So the answer is A.

Hint

References:1.1.

-

Question 5 of 183

5. Question

1 pointsQID16:Which of the following is the original purpose of a life insurance contract:

Correct

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. Originally, policies were for short periods of time.

So the answer is C.Incorrect

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. Originally, policies were for short periods of time.

So the answer is C.Hint

References:1.1.

-

Question 6 of 183

6. Question

1 pointsQID15:What is the original purpose of life insurance:

Correct

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death. So the answer is B.

Incorrect

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death. So the answer is B.

Hint

References:1.1.

-

Question 7 of 183

7. Question

1 pointsQID14:The original purpose of life insurance and some modern insurance products (such as term insurance), is to get the insurance benefit from which of the following circumstance:

Correct

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. So option A is right.

Incorrect

The original intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. So option A is right.

Hint

References:1.1.

-

Question 8 of 183

8. Question

1 pointsQID12:Which of the following motives for purchasing insurance represents the original purpose of such insurance:

Correct

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death. Originally, policies were for short periods of time. So D is the correct answer.

Incorrect

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death. Originally, policies were for short periods of time. So D is the correct answer.

Hint

References:1.1.

-

Question 9 of 183

9. Question

1 pointsQID10:The function of life insurance does not include?

Correct

The function of life insurance is for savings, retirement and in case of premature death. Tax evasion is not the function of life insurance.

Incorrect

The function of life insurance is for savings, retirement and in case of premature death. Tax evasion is not the function of life insurance.

Hint

References:1.1.

-

Question 10 of 183

10. Question

1 pointsQID9:The original type of life insurance contract is:

Correct

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. Originally, policies were for short periods of time.

So the answer is D.Incorrect

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death, especially premature death. Originally, policies were for short periods of time.

So the answer is D.Hint

References:1.1.

-

Question 11 of 183

11. Question

1 pointsQID8:The function of life insurance does not include which of the following?

Correct

The function of life insurance is for saving, investment, retirement protection, and other needs. Speculation is not the function of life insurance. So the answer is A.

Incorrect

The function of life insurance is for saving, investment, retirement protection, and other needs. Speculation is not the function of life insurance. So the answer is A.

Hint

References:1.1.

-

Question 12 of 183

12. Question

1 pointsQID7:The original purpose of life insurance is:

Correct

Life insurance provides a sum of money if the person who is insured dies

whilst the policy is in effect. According to this definition, the basic intention of life insurance is to provide sum insured in the event of the insured’s death instead of the policyowners.

Pay attention to the difference between the sum insured and premium.

The answer is A.Incorrect

Life insurance provides a sum of money if the person who is insured dies

whilst the policy is in effect. According to this definition, the basic intention of life insurance is to provide sum insured in the event of the insured’s death instead of the policyowners.

Pay attention to the difference between the sum insured and premium.

The answer is A.Hint

References:1.1.

-

Question 13 of 183

13. Question

1 pointsQID6:What is the original and basic intention of life insurance:

Correct

The original purpose of life insurance remains an important element in life insurance, that is for the temporary needs/threats. C is the best answer.

Options A,B and D are not the original and basic purpose of life insurance.Incorrect

The original purpose of life insurance remains an important element in life insurance, that is for the temporary needs/threats. C is the best answer.

Options A,B and D are not the original and basic purpose of life insurance.Hint

References:1.1.

-

Question 14 of 183

14. Question

1 pointsQID5:From the modern point of view, the primary purpose of purchasing life insurance is

Correct

Life insurance can be used as a tool for finance and investment. But the primary purpose of life insurance still is to provide help for the insured’s family. So the answer is B.

Incorrect

Life insurance can be used as a tool for finance and investment. But the primary purpose of life insurance still is to provide help for the insured’s family. So the answer is B.

Hint

References:1.1.

-

Question 15 of 183

15. Question

1 pointsQID4:Which of the following represents the purpose of life insurance in modern society?

Correct

Compare to A, B, and C, D still is the basic and most representative purpose of life insurance.

Incorrect

Compare to A, B, and C, D still is the basic and most representative purpose of life insurance.

Hint

References:1.1.

-

Question 16 of 183

16. Question

1 pointsQID3:”Life insurance provides a sum of money if the person who is insured dies

whilst the policy is in effect.” The above definition of life insurance is:Correct

First of all, this definition is right so we can eliminate option B. As for all life insurance contracts mentioned in A, C, and D. Some of the life contracts can be used for other needs such as savings, investment or retirement. So this definition is not fully describing all types of life insurance contracts. The answer is C.

Incorrect

First of all, this definition is right so we can eliminate option B. As for all life insurance contracts mentioned in A, C, and D. Some of the life contracts can be used for other needs such as savings, investment or retirement. So this definition is not fully describing all types of life insurance contracts. The answer is C.

Hint

References:1.1.

-

Question 17 of 183

17. Question

1 pointsQID2:Life insurance refers to provide the death benefit by the insurer if the life insured dies whilst the policy is in effect. This statement is:

Correct

Except for providing the death benefit by the insurer if the person who is insured dies whilst the policy is in effect, life insurance can also be a useful tool for savings, retirement protection, and other needs. So this statement is partially right. The answer is C.

Incorrect

Except for providing the death benefit by the insurer if the person who is insured dies whilst the policy is in effect, life insurance can also be a useful tool for savings, retirement protection, and other needs. So this statement is partially right. The answer is C.

Hint

References:1.1.

-

Question 18 of 183

18. Question

1 pointsQID13:Originally, life insurance:

Correct

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death. Originally, policies were for short periods of time. A, B and C are wrong.

Incorrect

The original, basic intention of life insurance is to provide for one’s family and perhaps others in the event of death. Originally, policies were for short periods of time. A, B and C are wrong.

Hint

References:1.1.

-

Question 19 of 183

19. Question

1 pointsQID26:Which of the following is a business need for life insurance policies rather than a personal need?

Correct

Business partner life insurance is for a business need. So A is the right answer.

Incorrect

Business partner life insurance is for a business need. So A is the right answer.

Hint

References:1.1.1

-

Question 20 of 183

20. Question

1 pointsQID25:Which of the following is/are a “personal need” rather than a “business need”?

i. Dependants’living expenses

ii. Retirement income

iii. Emergencies fund

iv. Educational fundsCorrect

All the options are for personal needs. So D is the right answer.

Incorrect

All the options are for personal needs. So D is the right answer.

Hint

References:1.1.1

-

Question 21 of 183

21. Question

1 pointsQID29:As far as life insurance is concerned, which of the following is most likely to be a “business need” rather than a “personal need”?

Correct

Key person life insurance is for a business need, so C is the right answer.

Incorrect

Key person life insurance is for a business need, so C is the right answer.

Hint

References:1.1.1

-

Question 22 of 183

22. Question

1 pointsQID27:When considering the needs of life insurance, which of the following is not a business need, but a personal need:

Correct

Retirement income is a personal need for life insurance. So C is the right one.

Incorrect

Retirement income is a personal need for life insurance. So C is the right one.

Hint

References:1.1.1

-

Question 23 of 183

23. Question

1 pointsQID22:Which of the following is/are a “business need” rather than a “personal need”?

i. Educational funds

ii. Emergencies fund

iii. Business partner life insurance

iv. Key person life insuranceCorrect

Life insurance for business partners and key persons are a “business need”. So D is correct.

Incorrect

Life insurance for business partners and key persons are a “business need”. So D is correct.

Hint

References:1.1.1

-

Question 24 of 183

24. Question

1 pointsQID28:When considering the needs of life insurance, which of the following are for personal needs, not a business need:

i. Partners

ii . Dependants’living expenses

iii . Educational funds

iv Mortgage repayment fundCorrect

Business partner life insurance is a business need. So the answer is D.

Incorrect

Business partner life insurance is a business need. So the answer is D.

Hint

References:1.1.1

-

Question 25 of 183

25. Question

1 pointsQID21:Which of the following is/are a “personal need” rather than a “business need”?

i. Dependants’ living expenses

ii. Retirement income

iii. Mortgage repayment fund

iv. Educational fundsCorrect

i, ii, iii, iv are all a “personal need”. So D is the answer.

Incorrect

i, ii, iii, iv are all a “personal need”. So D is the answer.

Hint

References:1.1.1

-

Question 26 of 183

26. Question

1 pointsQID19:Which of the following is/are a “business need” rather than a “personal need”?

Correct

Key person life insurance is an important form of business insurance. So D is the right answer.

Incorrect

Key person life insurance is an important form of business insurance. So D is the right answer.

Hint

References:1.1.1

-

Question 27 of 183

27. Question

1 pointsQID20:Which of the following is/are a “business need” rather than a “personal need”?

i. Key persons

ii. Partnerships

iii. Retirement income

iv. Employee benefitsCorrect

The retirement income is a “personal need. Other three are a “business need”. So B is the answer.

Incorrect

The retirement income is a “personal need. Other three are a “business need”. So B is the answer.

Hint

References:1.1.1

-

Question 28 of 183

28. Question

1 pointsQID23:Which of the following are for personal needs when considering to buy a life insurance?

i. Dependants’living expenses

ii. Key persons

iii. Disability income

iv. Mortgage repayment fundCorrect

Key persons life insurance is for a business need. The other three are for personal needs. So C is the answer.

Incorrect

Key persons life insurance is for a business need. The other three are for personal needs. So C is the answer.

Hint

References:1.1.1

-

Question 29 of 183

29. Question

1 pointsQID31:To buy a life insurance policy for a key person of an enterprise, to which the insured belongs:

Correct

The key person refers to the important person of a company instead of any other normal employee. So the answer is B.

Incorrect

The key person refers to the important person of a company instead of any other normal employee. So the answer is B.

Hint

References:1.1.1(b)

-

Question 30 of 183

30. Question

1 pointsQID32:Which of the following principles would apply to life insurance?

Correct

In simple terms, insurable interest is such relationship with the subject

matter of insurance (a person’s life, in the case of life insurance) that is

recognised at law or in equity as giving rise to a right to insure that person’s

life. So D is the answer.Incorrect

In simple terms, insurable interest is such relationship with the subject

matter of insurance (a person’s life, in the case of life insurance) that is

recognised at law or in equity as giving rise to a right to insure that person’s

life. So D is the answer.Hint

References:1.2.

-

Question 31 of 183

31. Question

1 pointsQID66:A husband bought a life insurance policy for his wife with a single premium. Later his wife died, but they had already divorced. So:

Correct

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time.

So D is the answer.Incorrect

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time.

So D is the answer.Hint

References:1.2.1

-

Question 32 of 183

32. Question

1 pointsQID65:Which of the following statements about insurable interest in life insurance is incorrect?

Correct

A parent of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. This is the relationships

constitute an insurable interest arising from blood connection. So C is the answer.Incorrect

A parent of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. This is the relationships

constitute an insurable interest arising from blood connection. So C is the answer.Hint

References:1.2.1

-

Question 33 of 183

33. Question

1 pointsQID64:The following life insurance policies have no insurable interest at the time of claim. Which of the following will not get compensation?

Correct

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time.

It is legally to insure the debtor’s life, have the debt repaid, keep the policy in force, and be “paid again” in due time by the insurer.

After the assignment, the assignee can claim the compensation even he/she has no insurable interests in the life insured if the assignment is legitimate.

So the answer is D.Incorrect

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time.

It is legally to insure the debtor’s life, have the debt repaid, keep the policy in force, and be “paid again” in due time by the insurer.

After the assignment, the assignee can claim the compensation even he/she has no insurable interests in the life insured if the assignment is legitimate.

So the answer is D.Hint

References:1.2.1

-

Question 34 of 183

34. Question

1 pointsQID63:According to Section 64B of the Insurance Ordinance, any policy of which the policyowner has no insurable interest in the life insured is:

Correct

Section 64B of the Insurance Ordinance renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is C.

Incorrect

Section 64B of the Insurance Ordinance renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is C.

Hint

References:1.2.1

-

Question 35 of 183

35. Question

1 pointsQID67:Under Section 64B of the Insurance Ordinance, life insurance contracts entered into when there is no insurable interest in the life insured:

Correct

Section 64B renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is A.

Incorrect

Section 64B renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is A.

Hint

References:1.2.1

-

Question 36 of 183

36. Question

1 pointsQID61:Which of the following statements is/are incorrect?

Correct

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. It does not matter whether the insured is bankrupt or not. So the answer is B.

Incorrect

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. It does not matter whether the insured is bankrupt or not. So the answer is B.

Hint

References:1.2.1

-

Question 37 of 183

37. Question

1 pointsQID73:In most jurisdictions of the U.S., a family relationship prescribed by the relevant law (brother, sister, parent, child, grandparent, grandchild, etc.) is sufficient to constitute an insurable interest. While in Hong Kong:

Correct

By virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option D is the right answer.

Incorrect

By virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option D is the right answer.

Hint

References:1.2.1

-

Question 38 of 183

38. Question

1 pointsQID60:In the case of insurable interest, when assigning a life insurance contract, the assignee:

Correct

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So A is correct.

Incorrect

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So A is correct.

Hint

References:1.2.1

-

Question 39 of 183

39. Question

1 pointsQID62:Which of the following has an insurable interest in life insurance

i . To insure a debtor’s life

ii . To insure a 25-year-old son’s life

iii . To insure a business partner’s life

iv . To insure a divorced spouse’s lifeCorrect

Any one person has no insurable interest in his/her adult child (i.e. a person aged over 18) and his/her divorced spouse. So the answer is B.

Incorrect

Any one person has no insurable interest in his/her adult child (i.e. a person aged over 18) and his/her divorced spouse. So the answer is B.

Hint

References:1.2.1

-

Question 40 of 183

40. Question

1 pointsQID68:Which of the following statements is incorrect?

Correct

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So C is the answer.

Incorrect

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So C is the answer.

Hint

References:1.2.1

-

Question 41 of 183

41. Question

1 pointsQID69:Any person has an unlimited insurable interest in which of the following person?

Correct

It is judicially presumed that any one person has an unlimited insurable interest in the life of his or her spouse. So A is the right answer.

Incorrect

It is judicially presumed that any one person has an unlimited insurable interest in the life of his or her spouse. So A is the right answer.

Hint

References:1.2.1

-

Question 42 of 183

42. Question

1 pointsQID71:Which of the following statement is right about the principle of insurable interest?

Correct

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Incorrect

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Hint

References:1.2.1

-

Question 43 of 183

43. Question

1 pointsQID74:When buying a life insurance policy, the applicant needs to have a legal relationship with the insured, what is this called

Correct

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is C.

Incorrect

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is C.

Hint

References:1.2.1

-

Question 44 of 183

44. Question

1 pointsQID131:A person’s relationship with another person’s life is recognised at law giving rise for the former to insure the latter’s life. This is based on which of the following life insurance principle?

Correct

In simple terms, insurable interest is such a relationship with a person’s life that is

recognised at law or in equity as giving rise to a right to insure that person’s life. B is the answer.Incorrect

In simple terms, insurable interest is such a relationship with a person’s life that is

recognised at law or in equity as giving rise to a right to insure that person’s life. B is the answer.Hint

References:1.2.1

-

Question 45 of 183

45. Question

1 pointsQID75:What’s the amount of insurable interest a person has in his/her own life?

Correct

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Incorrect

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Hint

References:1.2.1

-

Question 46 of 183

46. Question

1 pointsQID76:What’s the amount of insurable interest a person has in his/her own life?

Correct

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Incorrect

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Hint

References:1.2.1

-

Question 47 of 183

47. Question

1 pointsQID84:Which of the following statement about the insurable interest of life insurance is incorrect?

Correct

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. So option C is the right answer.

Incorrect

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. So option C is the right answer.

Hint

References:1.2.1

-

Question 48 of 183

48. Question

1 pointsQID59:As far as life insurance is concerned, when is an insurable interest needed for the insurance?

Correct

An insurable interest is only needed when the contract begins and becomes irrelevant

thereafter. So option C is the right answer.Incorrect

An insurable interest is only needed when the contract begins and becomes irrelevant

thereafter. So option C is the right answer.Hint

References:1.2.1

-

Question 49 of 183

49. Question

1 pointsQID53:In Hong Kong, a person has an insurable interest in which of the following people?

i. A 17-year-old son

ii. A 17-year-old spouse

iii. A 17-year-old ward

iv. A 17-year-old sisterCorrect

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships

just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option A is the right answer.Incorrect

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships

just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option A is the right answer.Hint

References:1.2.1

-

Question 50 of 183

50. Question

1 pointsQID70:Mr. Qu bought a life insurance policy on Mrs. Qu’s life with a single premium payment. Three years later, he assigned it to their daughter. Two years after that Mrs. Qu died and at that time they had already divorced. Which of the following questions needed to be considered when filing a claim according to the policy?

Correct

It is judicially presumed that any one person has an unlimited insurable interest in his/her own life and the life of his or her spouse (even after divorce).

As for the assignment of a life insurance policy, we should consider the intention of the assignment, that is whether it is for a specific person who has no insurable interest in the life insured.

So C is the answerIncorrect

It is judicially presumed that any one person has an unlimited insurable interest in his/her own life and the life of his or her spouse (even after divorce).

As for the assignment of a life insurance policy, we should consider the intention of the assignment, that is whether it is for a specific person who has no insurable interest in the life insured.

So C is the answerHint

References:1.2.1

-

Question 51 of 183

51. Question

1 pointsQID48:Legally a creditor may insure his/her debtor’s life. After the debt is paid,

Correct

It is legally possible to insure the debtor’s life, have the debt repaid, keep the policy in force, and be “paid again” in due

time by the insurer. So C is the right answer.Incorrect

It is legally possible to insure the debtor’s life, have the debt repaid, keep the policy in force, and be “paid again” in due

time by the insurer. So C is the right answer.Hint

References:1.2.1

-

Question 52 of 183

52. Question

1 pointsQID36:A relationship with a person who is alive, which gives rise to a legal right to insure that person’s life. This is called:

Correct

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So A is the answer.

Incorrect

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So A is the answer.

Hint

References:1.2.1

-

Question 53 of 183

53. Question

1 pointsQID38:Which of the following has an insurable interest in the insured?

i. A half-year-old daughter

ii. A spouse

iii. A creditor

iv. A debtorCorrect

A person can not insure his/her creditor’s life. So B is the answer.

Incorrect

A person can not insure his/her creditor’s life. So B is the answer.

Hint

References:1.2.1

-

Question 54 of 183

54. Question

1 pointsQID39:Which three of the following have an insurable interest in the insured?

i. Oneself

ii. One’s Spouse

iii. One’s daughter under the age of 15

iv. One’s mother of the spouseCorrect

A mother of the spouse has no insurable interest in the insured. So the answer is A.

Incorrect

A mother of the spouse has no insurable interest in the insured. So the answer is A.

Hint

References:1.2.1

-

Question 55 of 183

55. Question

1 pointsQID40:Which of the following has an insurable interest in the insured?

i. Oneself

ii. Spouse

iii. A daughter under the age of 17

iv. A divorced ex-husbandCorrect

A divorced ex-husband has no insurable interest in the insured. So the answer is A.

Incorrect

A divorced ex-husband has no insurable interest in the insured. So the answer is A.

Hint

References:1.2.1

-

Question 56 of 183

56. Question

1 pointsQID43:Which of the following is true about insurable interest?

Correct

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Incorrect

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Hint

References:1.2.1

-

Question 57 of 183

57. Question

1 pointsQID45:Which of the following is true about insurable interest?

Correct

It is judicially presumed that we all have an insurable interest in our own lives for an unlimited amount. This, of course, includes every married woman. So A is the right answer.

Incorrect

It is judicially presumed that we all have an insurable interest in our own lives for an unlimited amount. This, of course, includes every married woman. So A is the right answer.

Hint

References:1.2.1

-

Question 58 of 183

58. Question

1 pointsQID58:An applicant does not have an insurable interest in which of the following person?

Correct

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships

just mentioned constitute an insurable interest arising from blood or family connection. So option C is the right answer.Incorrect

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships

just mentioned constitute an insurable interest arising from blood or family connection. So option C is the right answer.Hint

References:1.2.1

-

Question 59 of 183

59. Question

1 pointsQID47:For a life insurance policy, a person’s legal rights allow him or her to insure the life of others. This principle is called:

Correct

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is A.

Incorrect

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is A.

Hint

References:1.2.1

-

Question 60 of 183

60. Question

1 pointsQID49:A wife has an insurable interest in her husband, so she may purchase a life insurance for her husband. The insurable interest is:

Correct

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. So A is the right answer.

Incorrect

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. So A is the right answer.

Hint

References:1.2.1

-

Question 61 of 183

61. Question

1 pointsQID51:Which of the following is true about insurable interest?

Correct

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Incorrect

It is judicially presumed that we all have an unlimited insurable interest in our own lives. So A is the right answer.

Hint

References:1.2.1

-

Question 62 of 183

62. Question

1 pointsQID52:There is a legal relationship which allows a person to insure another person’s life. This relationship is called:

Correct

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is C.

Incorrect

Insurable interest is such a relationship with a person’s life, in the case of life insurance that is recognised at law as giving rise to a right to insure that person’s life. So the correct answer is C.

Hint

References:1.2.1

-

Question 63 of 183

63. Question

1 pointsQID55:In Hong Kong, an insurable interest effected on the basis of any blood relationship is technically void. However, by virtue of Section 64A of the Insurance Ordinance, which of the following relationship still has an insurable interest?

Correct

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that only the relationships just mentioned constitute an insurable interest arising from blood. So C is the right answer.

Incorrect

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that only the relationships just mentioned constitute an insurable interest arising from blood. So C is the right answer.

Hint

References:1.2.1

-

Question 64 of 183

64. Question

1 pointsQID54:Which of the following has an insurable interest in life insurance?

Correct

A parent is given an insurable interest in children aged under 18. So option B is wrong.

A spouse may insure his/her spouse before

divorced, so options C is also wrong.

It is legally to insure a debtor’s life. So A is correct.Incorrect

A parent is given an insurable interest in children aged under 18. So option B is wrong.

A spouse may insure his/her spouse before

divorced, so options C is also wrong.

It is legally to insure a debtor’s life. So A is correct.Hint

References:1.2.1

-

Question 65 of 183

65. Question

1 pointsQID34:Which of the following has an insurable interest in the insured?

Correct

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to

collect the benefit in due time. So A is the correct answer.

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. So option B is not right about the age of 20.

A creditor can only insure his/her debtor’s life after the loan.Incorrect

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to

collect the benefit in due time. So A is the correct answer.

In Hong Kong, by virtue of Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. So option B is not right about the age of 20.

A creditor can only insure his/her debtor’s life after the loan.Hint

References:1.2.1

-

Question 66 of 183

66. Question

1 pointsQID56:What is the amount of the insurable interest for a wife in the life of her husband:

Correct

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. So A is the right answer.

Incorrect

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. So A is the right answer.

Hint

References:1.2.1

-

Question 67 of 183

67. Question

1 pointsQID57:Mr. Qu bought a life insurance policy on the life of Mrs. Qu and then assigned it to their daughter. Two years later, they divorced. Five years after that, Mrs. Qu died. Which of the following is not included for the compensation?

Correct

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. Since Mr. Qu had already assigned the life insurance contract to his daughter. The daughter has an unlimited insurable interest in Mrs. Qu. So C is the right answer.

Incorrect

It is judicially presumed that any one person has an unlimited insurable interest for the life of his or her spouse. Since Mr. Qu had already assigned the life insurance contract to his daughter. The daughter has an unlimited insurable interest in Mrs. Qu. So C is the right answer.

Hint

References:1.2.1

-

Question 68 of 183

68. Question

1 pointsQID46:Under the laws of Hong Kong, a person is unlikely to have an insurable interest in which of the following person?

Correct

In Hong Kong, a person only has an insurable interest in the life of his/her debtor instead of the creditor. So C is the answer.

Incorrect

In Hong Kong, a person only has an insurable interest in the life of his/her debtor instead of the creditor. So C is the answer.

Hint

References:1.2.1

-

Question 69 of 183

69. Question

1 pointsQID77:According to Section 64B of the Insurance Ordinance, any policy of which the policyowner has no insurable interest in the life insured is:

Correct

Section 64B of the Insurance Ordinance renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is A.

Incorrect

Section 64B of the Insurance Ordinance renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no interest. So the answer is A.

Hint

References:1.2.1(b)

-

Question 70 of 183

70. Question

1 pointsQID41:Under the Insurance Ordinance, what happens when a contract is entered into with a lack of an insurable interest in the life insured?

Correct

Section 64B renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no insurable interest. So A is the right one.

Incorrect

Section 64B renders a contract of life insurance void where the person for whose use or benefit or on whose account it is made has no insurable interest. So A is the right one.

Hint

References:1.2.1(b)

-

Question 71 of 183

71. Question

1 pointsQID79:Which of the following has an insurable interest?

i. To insure a debtor’s life

ii. To insure a 25-year-old son’s life

iii. To insure a business partner’s life

iv. To insure a divorced spouse’s lifeCorrect

A person has no insurable interest in the life of his/her divorced spouse and adult children (aged over 18). So the answer is B.

Incorrect

A person has no insurable interest in the life of his/her divorced spouse and adult children (aged over 18). So the answer is B.

Hint

References:1.2.1(d)

-

Question 72 of 183

72. Question

1 pointsQID83:Under Section 64A of the Insurance Ordinance, which of the following identities can purchase a life insurance policy for a person aged under 18?

Correct

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. So option B is the right answer.

Incorrect

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. So option B is the right answer.

Hint

References:1.2.1(f)

-

Question 73 of 183

73. Question

1 pointsQID82:According to relevant laws, blood relationship cannot constitute an insurable interest, but there are exceptions. By virtue of Section 64A of the Insurance Ordinance, which of the following identities are an exception?

Correct

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option A is the right answer.

Incorrect

According to Section 64A of the Insurance Ordinance, a parent or guardian of a minor (i.e. a person aged under 18) is given an insurable interest in that young person. It means that, apart from one’s spouse, only the relationships just mentioned constitute an insurable interest arising from blood or family connection. An insurance effected on the basis of any other blood or family relationship is technically void. So option A is the right answer.

Hint

References:1.2.1(f)

-

Question 74 of 183

74. Question

1 pointsQID86:Party A has an insurable interest in Party B. But Party A purchased a life insurance for Party B for his own benefit. Which of the following is true?

Correct

According to Sections 64C and 64D of the Insurance Ordinance, the person interested in the life insured, or for whose use or benefit or on whose account the contract is entered into, must be named in the contract. So B is the answer.

Incorrect

According to Sections 64C and 64D of the Insurance Ordinance, the person interested in the life insured, or for whose use or benefit or on whose account the contract is entered into, must be named in the contract. So B is the answer.

Hint

References:1.2.1(g)(i)

-

Question 75 of 183

75. Question

1 pointsQID87:Mr. Qu bought a life insurance policy on Mrs. Qu’s life with a single premium. Three years later, he assigned it to their daughter. Two years after that Mrs. Qu died and at that time they had already divorced. Which of the following is not a key question when filing a claim?

Correct

It is said in the question that Mr. Qu bought a life insurance policy on Mrs. Qu’s life with a single premium. So the premium is not the key question. The answer is C.

Incorrect

It is said in the question that Mr. Qu bought a life insurance policy on Mrs. Qu’s life with a single premium. So the premium is not the key question. The answer is C.

Hint

References:1.2.1(h)

-

Question 76 of 183

76. Question

1 pointsQID88:Mr. Qu bought a life insurance policy on Mrs. Qu’s life with a single premium. Three years later, he assigned it to their daughter. Two years after that Mrs.Qu died and at that time they had already divorced. Which of the following fact needed to be considered when filing a claim?

Correct

It is judicially presumed that any one person has an unlimited insurable interest in his/her own life and the life of his or her spouse.

As for the assignment of a life insurance policy, we should consider the intention of assigning, that is whether it is for a specific person who has no insurable interest in the life insured.

So D is the answer.Incorrect

It is judicially presumed that any one person has an unlimited insurable interest in his/her own life and the life of his or her spouse.

As for the assignment of a life insurance policy, we should consider the intention of assigning, that is whether it is for a specific person who has no insurable interest in the life insured.

So D is the answer.Hint

References:1.2.1(h)

-

Question 77 of 183

77. Question

1 pointsQID37:A wife bought a life insurance policy for her husband, and then they divorced. The wife continued to pay premiums for the policy. Two years later, her ex-husband died. What about the compensation of the policy?

Correct

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time. So C is correct.

Incorrect

A spouse, who insures his/her spouse and then becomes divorced, can keep the policy in force and be perfectly entitled to collect the benefit in due time. So C is correct.

Hint

References:1.2.1(h)

-

Question 78 of 183

78. Question

1 pointsQID145:The policyowner may assign the insurance contract to which of the following persons?

Correct

A policyowner is capable of assigning a life insurance contract to a third party even though the latter has no insurable interest in the life insured. The answer is B.

Incorrect

A policyowner is capable of assigning a life insurance contract to a third party even though the latter has no insurable interest in the life insured. The answer is B.

Hint

References:1.2.1(h)(iii)

-

Question 79 of 183

79. Question

1 pointsQID89:Which of the following is correct?

Correct

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So C is the answer.

Incorrect

A policyowner can assign a properly arranged life insurance contract to a third party even though the latter has no insurable interest in the life insured. So C is the answer.

Hint

References:1.2.1(h)(iii)

-

Question 80 of 183

80. Question

1 pointsQID91:The definition of material facts is:

Correct

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Incorrect

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Hint

References:1.2.2

-

Question 81 of 183

81. Question

1 pointsQID103:Failure to disclose which of the following fact may be considered a breach of utmost

good faith in life insurance:Correct

The applicant cannot be expected to disclose what he reasonably cannot be

expected to know. Some conditions, for example, may be easily recognisable to qualified doctors, but the average layman cannot be expected to self-diagnose and reveal such things.

The occurred diseases may affect the insurer’s decision on taking the risk or fixing the premium. So the applicant is required to disclose this to the insurer. So C is the right answer.Incorrect

The applicant cannot be expected to disclose what he reasonably cannot be

expected to know. Some conditions, for example, may be easily recognisable to qualified doctors, but the average layman cannot be expected to self-diagnose and reveal such things.

The occurred diseases may affect the insurer’s decision on taking the risk or fixing the premium. So the applicant is required to disclose this to the insurer. So C is the right answer.Hint

References:1.2.2

-

Question 82 of 183

82. Question

1 pointsQID102:Which of the following is the most appropriate description of duty of disclosure when an applicant purchases a life insurance policy?

Correct

According to the rules that (1) an insurance applicant is only required to disclose material facts, rather than any facts he is being asked about, and that (2) the scope of “material facts” is restricted by an objective test so that those facts which only a particular insurer deems to be material are not actually material enough to enable this insurer to rely on the principle of utmost good faith. So the answer is C.

Incorrect

According to the rules that (1) an insurance applicant is only required to disclose material facts, rather than any facts he is being asked about, and that (2) the scope of “material facts” is restricted by an objective test so that those facts which only a particular insurer deems to be material are not actually material enough to enable this insurer to rely on the principle of utmost good faith. So the answer is C.

Hint

References:1.2.2

-

Question 83 of 183

83. Question

1 pointsQID99:In terms of the utmost good faith, which of the following for sure is a material fact?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Hint

References:1.2.2

-

Question 84 of 183

84. Question

1 pointsQID98:The utmost of good faith requires to disclose all material facts. Which of the following case does not violate the principle of the utmost of good faith when arranging a non-medical application?

Correct

Insurers wish to know all important facts, but applicants cannot be expected to disclose what they reasonably cannot be

expected to know. So A is the answer.Incorrect

Insurers wish to know all important facts, but applicants cannot be expected to disclose what they reasonably cannot be

expected to know. So A is the answer.Hint

References:1.2.2

-

Question 85 of 183

85. Question

1 pointsQID97:Which of the following statements about material facts is true?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Hint

References:1.2.2

-

Question 86 of 183

86. Question

1 pointsQID96:An insurer does not consider the fact that an applicant has a cough is material. The reason has to be:

Correct

The applicant’s cough would not influence the judgment of the insurer in fixing the premium or determining whether he will accept the risk. So cough is not material. The answer is A.

Incorrect

The applicant’s cough would not influence the judgment of the insurer in fixing the premium or determining whether he will accept the risk. So cough is not material. The answer is A.

Hint

References:1.2.2

-

Question 87 of 183

87. Question

1 pointsQID95:Applicants are required to disclose all material facts according to the principle of utmost good faith. Which of the following are material facts which are required to be disclosed?

Correct

According to the rules that (1) an insurance applicant is only required to disclose material facts, rather than any facts he is being asked about, and that (2) the scope of “material facts” is restricted by an objective test so that those facts which only a particular insurer deems to be material are not actually material enough to enable this insurer to rely on the principle of utmost good faith. So the answer is C.

Incorrect

According to the rules that (1) an insurance applicant is only required to disclose material facts, rather than any facts he is being asked about, and that (2) the scope of “material facts” is restricted by an objective test so that those facts which only a particular insurer deems to be material are not actually material enough to enable this insurer to rely on the principle of utmost good faith. So the answer is C.

Hint

References:1.2.2

-

Question 88 of 183

88. Question

1 pointsQID94:An important insurance principle, the utmost good faith, requires the applicant to disclose all material facts. What are material facts?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Hint

References:1.2.2

-

Question 89 of 183

89. Question

1 pointsQID92:The definition of material facts is:

Correct

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is C.

Incorrect

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is C.

Hint

References:1.2.2

-

Question 90 of 183

90. Question

1 pointsQID90:The definition of material facts is:

Correct

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Incorrect

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Hint

References:1.2.2

-

Question 91 of 183

91. Question

1 pointsQID106:Actively to disclose material facts which are called:

Correct

Utmost good faith requires the applicant to disclose all material facts, whether the insurer requests them or not. So A is the answer.

Incorrect

Utmost good faith requires the applicant to disclose all material facts, whether the insurer requests them or not. So A is the answer.

Hint

References:1.2.2

-

Question 92 of 183

92. Question

1 pointsQID93:In terms of the utmost good faith, which of the following for sure is a material fact?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So the answer is B.

Hint

References:1.2.2

-

Question 93 of 183

93. Question

1 pointsQID104:In life insurance, if some information will affect a prudent underwriter’s decision to make relevant conditions or determine whether he will accept the risk, it is called:

Correct

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So A is the answer.

Incorrect

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’. So A is the answer.

Hint

References:1.2.2

-

Question 94 of 183

94. Question

1 pointsQID107:The utmost good faith requires the applicant to disclose all material facts when buying a life insurance policy. Which of the following is a material fact?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Hint

References:1.2.2

-

Question 95 of 183

95. Question

1 pointsQID105:According to the insurance principle of utmost good faith. The applicant is required to disclose all

material facts, Which of the following statements is true about material facts?Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Hint

References:1.2.2

-

Question 96 of 183

96. Question

1 pointsQID108:A breach of utmost good faith by the policyowner renders the contract voidable by the insurer. But for the life policies in Hong Kong:

Correct

With most life policies in Hong Kong, regard should be taken of a policy condition known as an Incontestability Provision, which states that the insurer will not contest the policy after it has been in force for a specified period (contestable period), unless there is proof of fraud on the part of the policyowner. So D is the answer.

Incorrect

With most life policies in Hong Kong, regard should be taken of a policy condition known as an Incontestability Provision, which states that the insurer will not contest the policy after it has been in force for a specified period (contestable period), unless there is proof of fraud on the part of the policyowner. So D is the answer.

Hint

References:1.2.2

-

Question 97 of 183

97. Question

1 pointsQID109:The utmost good faith applies to all types of insurance. Under this principle, which of the following is the right definition of material facts?

Correct

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Incorrect

A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is C.Hint

References:1.2.2

-

Question 98 of 183

98. Question

1 pointsQID110:The requirement of providing important information is related to which of the insurance principle?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not.

So the answer is C.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not.

So the answer is C.Hint

References:1.2.2

-

Question 99 of 183

99. Question

1 pointsQID196:As far as the insurance principle of the utmost good faith is concerned, which of the following must be a material fact?

Correct

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Incorrect

According to the insurance principle of utmost good faith, it requires the applicant to disclose all material facts, whether the insurer requests them or not. A material fact is legally defined as ‘every circumstance which would influence the judgment of a prudent insurer in fixing the premium, or determining whether he will accept the risk’.

So the answer is D.Hint

References:1.2.2

-

Question 100 of 183

100. Question

1 pointsQID126:There is a legal principle which gives rise to a right to insure a person’s life. What is the legal principle called?

Correct

In simple terms, insurable interest is such a relationship with a person’s life that is

recognised at law or in equity as giving rise to a right to insure that person’s life. B is the answer.Incorrect

In simple terms, insurable interest is such a relationship with a person’s life that is

recognised at law or in equity as giving rise to a right to insure that person’s life. B is the answer.Hint

References:1.2.2

-

Question 101 of 183

101. Question

1 pointsQID112:An applicant may be required to supplement information supplied verbally with reasonable medical examinations or tests. According to the Personal Data (Privacy) Ordinance, the applicant can:

Correct

According to the Personal Data (Privacy)

Ordinance, it require insurers to explain the need for gathering information before any testing takes place. The subject of

the tests also has the right under that Ordinance to be told their results. So D is the answer.Incorrect

According to the Personal Data (Privacy)

Ordinance, it require insurers to explain the need for gathering information before any testing takes place. The subject of

the tests also has the right under that Ordinance to be told their results. So D is the answer.Hint

References:1.2.2(d)

-

Question 102 of 183

102. Question

1 pointsQID130:Which of the following statements about indemnity is true?

Correct

Indemnity means an exact financial compensation for the loss sustained and is very important in most types of General Insurance. As far as life insurance is concerned, it is impossible to over indemnify. It is because the insurable

interests (closely linked with indemnity) in the majority of cases is unlimited. So C is the right answer.Incorrect

Indemnity means an exact financial compensation for the loss sustained and is very important in most types of General Insurance. As far as life insurance is concerned, it is impossible to over indemnify. It is because the insurable

interests (closely linked with indemnity) in the majority of cases is unlimited. So C is the right answer.Hint

References:1.2.3

-

Question 103 of 183

103. Question

1 pointsQID134:Which of the following insurance principles is most important for accidental death claims?

Correct

The cause of death is critical when an accidental death benefit rider applies in life insurance. This is the application of proximate cause to life insurance. The answer is C.

Incorrect

The cause of death is critical when an accidental death benefit rider applies in life insurance. This is the application of proximate cause to life insurance. The answer is C.

Hint

References:1.2.3

-

Question 104 of 183

104. Question

1 pointsQID133:A life insurance policy with an accidental death benefit rider is subject to the cause of death when a death claim is made. The insurance principle is:

Correct

The cause of death is critical when an accidental death benefit rider applies in life insurance. This is the application of proximate cause to life insurance. The answer is B.

Incorrect

The cause of death is critical when an accidental death benefit rider applies in life insurance. This is the application of proximate cause to life insurance. The answer is B.

Hint

References:1.2.3

-

Question 105 of 183

105. Question

1 pointsQID128:Which of the following insurance principles are less relevant to life insurance?

i.Indemnity

ii.Subrogation

iii. Contribution

iv. Insurable interestCorrect

According to the definition of the insurable interest, we know that insurable interest is close related to life insurance. So the Answer is A.

Incorrect

According to the definition of the insurable interest, we know that insurable interest is close related to life insurance. So the Answer is A.

Hint

References:1.2.3

-

Question 106 of 183

106. Question

1 pointsQID124:Which of the following is the most important principle for accidental death insurance claims?

Correct

The principle of proximate cause is very important for accidental death insurance claims. The answer is C.

Incorrect

The principle of proximate cause is very important for accidental death insurance claims. The answer is C.

Hint

References:1.2.3

-

Question 107 of 183

107. Question

1 pointsQID334:If the deceased is found to have purchased more than one life insurance policy for his life, and each policy is valid:

Correct