English HKSI Paper 12 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP12ET1

Quiz-summary

0 of 101 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

Information

HKSIP12ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 101 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

-

HKSIP12ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- Answered

- Review

-

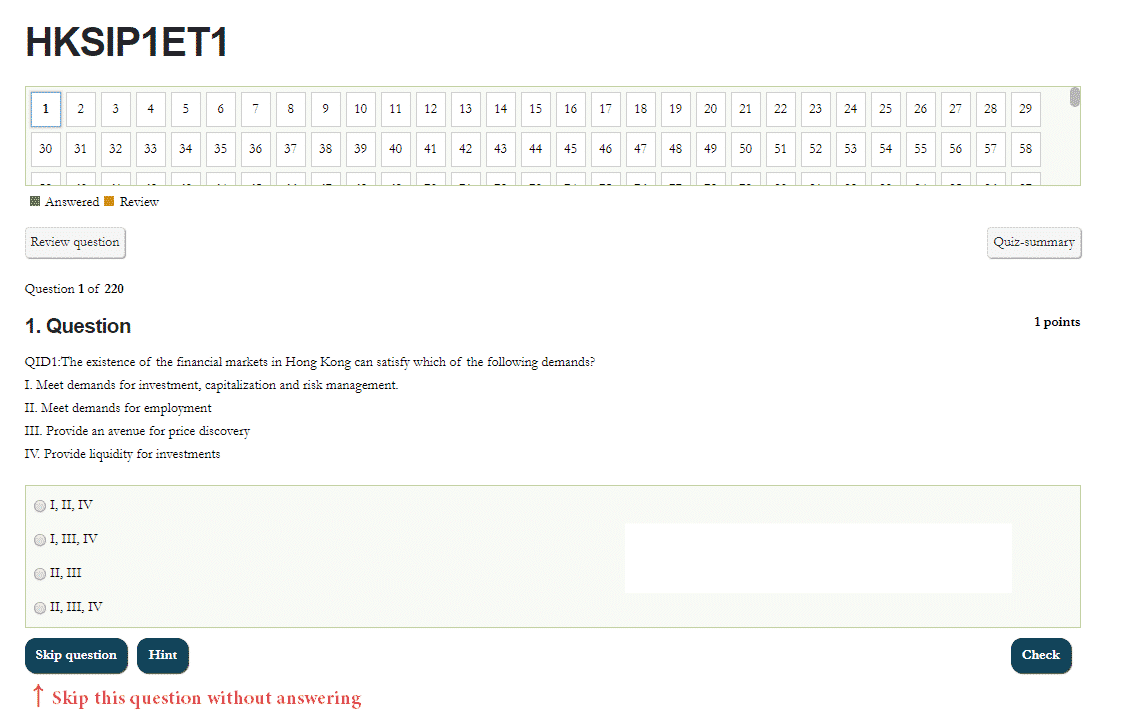

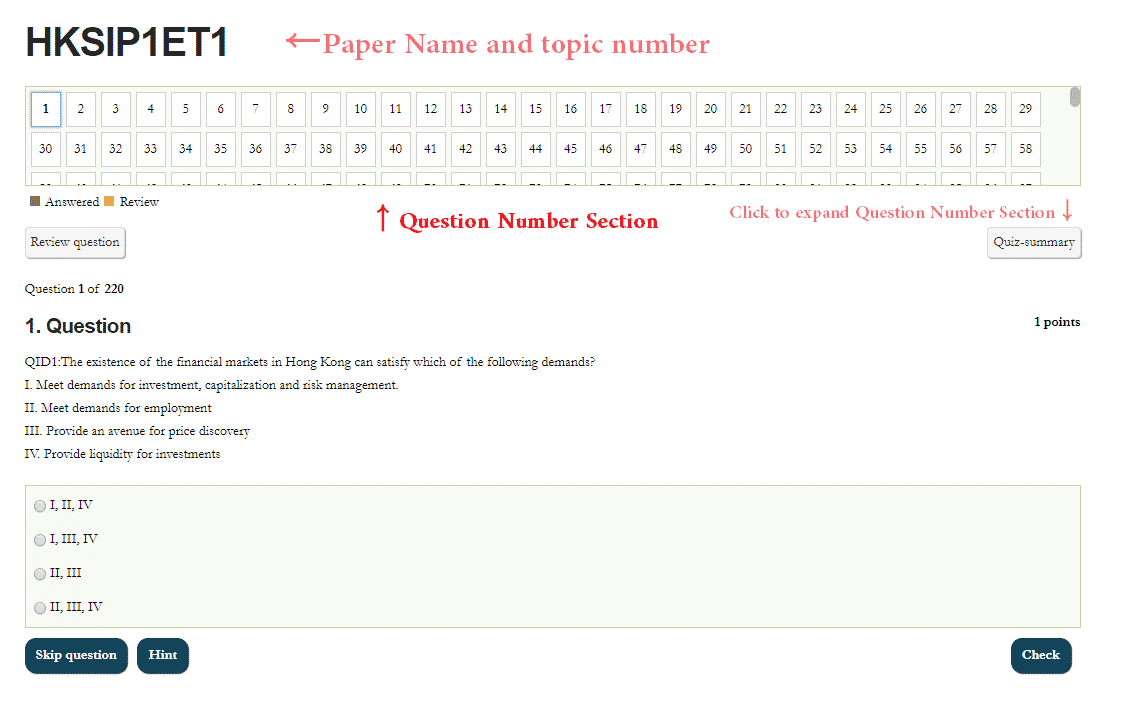

Question 1 of 101

1. Question

1 pointsQID2272:Which of the following statement is the most accurate in describing the work of a personal financial advisor?

Correct

The role of a personal financial advisor is to identify the needs of their customers and assist their customers in planning investment strategies and ideas

Incorrect

The role of a personal financial advisor is to identify the needs of their customers and assist their customers in planning investment strategies and ideas

Hint

Reference Chapter:1.3.5

-

Question 2 of 101

2. Question

1 pointsQID2273:Which of the following is not the function of the asset management industry?

Correct

The function of a corporate finance advisor is to provide companies with financial advises, especially in the area of listing and mergers and acquisitions, which is not the function of asset management industries. The asset management industry provides different entities including individuals, enterprises, and national entities with asset management services. The asset management industry manages retirement funds of most people through professional asset allocation, and builds and implements investment strategies through the use of economics knowledge, professional skills, and technical analysis.

Incorrect

The function of a corporate finance advisor is to provide companies with financial advises, especially in the area of listing and mergers and acquisitions, which is not the function of asset management industries. The asset management industry provides different entities including individuals, enterprises, and national entities with asset management services. The asset management industry manages retirement funds of most people through professional asset allocation, and builds and implements investment strategies through the use of economics knowledge, professional skills, and technical analysis.

Hint

Reference Chapter:1.3.

-

Question 3 of 101

3. Question

1 pointsQID2244:Analysts don’t work for which of the following people?

Correct

Analysts generally don’t work for trustee.

Incorrect

Analysts generally don’t work for trustee.

Hint

Reference Chapter:1.3.3

-

Question 4 of 101

4. Question

1 pointsQID492:What is the advantage of investing in managed funds?

I. Professional management

II. Risk diversification

III. Exempt from capital appreciation tax

IV. Higher returns than other investors for certainCorrect

The key benefits of managed funds are (i) access to professional investment management services; and (ii) diversification. Diversification is the ability to spread your assets across different asset classes, sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting losses from some securities with gains in others.

Incorrect

The key benefits of managed funds are (i) access to professional investment management services; and (ii) diversification. Diversification is the ability to spread your assets across different asset classes, sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting losses from some securities with gains in others.

Hint

Reference Chapter:1.1.7.1

-

Question 5 of 101

5. Question

1 pointsQID1046:People who assist individual investors in making financial plans are more likely to be:

Correct

Financial advising is a process where an individual moves towards meeting his personal and financial goals through the development and implementation of a comprehensive financial plan.

Incorrect

Financial advising is a process where an individual moves towards meeting his personal and financial goals through the development and implementation of a comprehensive financial plan.

Hint

Reference Chapter:1.3.5.1

-

Question 6 of 101

6. Question

1 pointsQID1691:An agent that holds and safeguards the assets of an individual, a financial institution or corporation is called

Correct

A custodian is an agent that holds and safeguards the assets of an individual, a financial institution or corporation.

Incorrect

A custodian is an agent that holds and safeguards the assets of an individual, a financial institution or corporation.

Hint

Reference Chapter:1.3.6

-

Question 7 of 101

7. Question

1 pointsQID837:Mr. Zhang and his wife who is formerly an artist are both over 60 year-old and prepare to retire. They have collectively HKD$600,000 deposits and a stock portfolio worth over $6,000,000. They have no idea about investments. You are their investment advisor. How would you suggest them to plan for their future?

Correct

The wealth protection phase comes into operation as they approach retirement. Mr. Zhang and his wife may not earn a regular salary income, so they need to manage wealth they have created during their working lives to enable them to meet their lifestyle needs in retirement. Having much less risk than stock and more stability to generate income, fixed-income securities and bonds are suitable to retirees.

Incorrect

The wealth protection phase comes into operation as they approach retirement. Mr. Zhang and his wife may not earn a regular salary income, so they need to manage wealth they have created during their working lives to enable them to meet their lifestyle needs in retirement. Having much less risk than stock and more stability to generate income, fixed-income securities and bonds are suitable to retirees.

Hint

Reference Chapter:1.3.

-

Question 8 of 101

8. Question

1 pointsQID825:Which of the following fund does not violate the diversification rule in《Code on Unit Trusts and Mutual Funds》?

Correct

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds, and include: (1) A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value. (2) A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Incorrect

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds, and include: (1) A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value. (2) A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Hint

Reference Chapter:1.1.7.1

-

Question 9 of 101

9. Question

1 pointsQID1799:The main difference between mutual fund and unit investment trust is

Correct

Mutual funds are similar to investment trusts from an investment perspective, and the difference lies only in their legal structure. A unit trust is established in the form of a trust, while a mutual fund is established in the form of a company.

Incorrect

Mutual funds are similar to investment trusts from an investment perspective, and the difference lies only in their legal structure. A unit trust is established in the form of a trust, while a mutual fund is established in the form of a company.

Hint

Reference Chapter:1.1.3.2

-

Question 10 of 101

10. Question

1 pointsQID2219:The ones who trades securities on behalf of clients are mainly:

Correct

The ones who trades securities on behalf of clients are brokers at brokerages. Traders generally don’t trade on behalf of their clients.

Incorrect

The ones who trades securities on behalf of clients are brokers at brokerages. Traders generally don’t trade on behalf of their clients.

Hint

Reference Chapter:1.3.5.4

-

Question 11 of 101

11. Question

1 pointsQID8:Generally demand curve is:

Correct

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price. Thus, demand curve is generally shown as negatively sloped curve.

Incorrect

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price. Thus, demand curve is generally shown as negatively sloped curve.

Hint

Reference Chapter:1.1.1

-

Question 12 of 101

12. Question

1 pointsQID9:Which factor most likely determines the supply of goods and services?

Correct

The objective of the producer is to make a profit from the item. Hence, the most important factor, from the producer’s perspective, is the price that can be obtained from selling the item.

Incorrect

The objective of the producer is to make a profit from the item. Hence, the most important factor, from the producer’s perspective, is the price that can be obtained from selling the item.

Hint

Reference Chapter:1.1.1

-

Question 13 of 101

13. Question

1 pointsQID678:Professionals managing investment plans are called:

Correct

Managed funds allow individual investors to pool their money with other investors who have similar investment goals. Investment professionals (known as fund or asset managers) invest this pool of money in assets such as equities, fixed interest, real estate and/or cash. Investments in a particular fund will be made in line with the fund’s investment objective and strategy.

Incorrect

Managed funds allow individual investors to pool their money with other investors who have similar investment goals. Investment professionals (known as fund or asset managers) invest this pool of money in assets such as equities, fixed interest, real estate and/or cash. Investments in a particular fund will be made in line with the fund’s investment objective and strategy.

Hint

Reference Chapter:1.3.3

-

Question 14 of 101

14. Question

1 pointsQID826:Investing in managed fund has which of the following advantages?

I. Have more investment opportunities than direct investment

II. Have professional services of investment management

III. Cost advantages with lower commission

IV. Focused investment to increase returnCorrect

The key benefits of managed funds are (i) access to professional investment management services; and (ii) diversification. Diversification is the ability to spread your assets across different asset classes, sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting losses from some securities with gains in others.

Incorrect

The key benefits of managed funds are (i) access to professional investment management services; and (ii) diversification. Diversification is the ability to spread your assets across different asset classes, sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting losses from some securities with gains in others.

Hint

Reference Chapter:1.1.7.1

-

Question 15 of 101

15. Question

1 pointsQID827:Investing in managed fund doesn’t have which of the following advantages?

Correct

Individuals, employers, institutions and companies are generally attracted to managed funds because their money is handled by professionals who have the expertise to produce a higher return for a given risk level than they would achieve themselves.

Incorrect

Individuals, employers, institutions and companies are generally attracted to managed funds because their money is handled by professionals who have the expertise to produce a higher return for a given risk level than they would achieve themselves.

Hint

Reference Chapter:1.1.7.1

-

Question 16 of 101

16. Question

1 pointsQID828:Investing in managed fund has which of the following shortcomings?

I. Managed fund is less likely to be used as collateral.

II. Higher risk than bank deposit.

III. More cost and fees including subscription fee and management fee

IV. No control over the operation of fundCorrect

The return of fund cannot be guaranteed since it involves investments. The return of the fund, less fees and charges for managing the fund, is subsequently passed on to the investor. Managed funds are indirect investments and thus there is no control over the operation of fund.

Incorrect

The return of fund cannot be guaranteed since it involves investments. The return of the fund, less fees and charges for managing the fund, is subsequently passed on to the investor. Managed funds are indirect investments and thus there is no control over the operation of fund.

Hint

Reference Chapter:1.1.7.2

-

Question 17 of 101

17. Question

1 pointsQID829:Managed fund has four kinds of fees including:

I. Subscription fee

II. Redemption fee

III. Administration fee

IV. Performance feeCorrect

Fees and charges charged by Managed fund include: Subscription fee; Redemption fee; Administration fee; Performance fee and Fund switching charge.

Incorrect

Fees and charges charged by Managed fund include: Subscription fee; Redemption fee; Administration fee; Performance fee and Fund switching charge.

Hint

Reference Chapter:1.2.

-

Question 18 of 101

18. Question

1 pointsQID830:Who picks fund managers who take responsibility of investing the fund’s assets for managed funds?

Correct

The issuer of the fund refers to the institution that initiated the establishment of the fund. One of the function of such institution is picking fund managers.

Incorrect

The issuer of the fund refers to the institution that initiated the establishment of the fund. One of the function of such institution is picking fund managers.

Hint

Reference Chapter:1.3.

-

Question 19 of 101

19. Question

1 pointsQID831:Who is responsible for setting investment goal, investment strategy, and principle of management, operating the fund and making decisions?

Correct

A fund manager receives money from investors to pool in an investment portfolio. A typical example is pension fund management. Fund managers have large amount of money to invest in various asset classes such as shares, property, bonds and cash. Owing to the needs and demands of their clients, some funds will invest in markets overseas in order to maximize profit-generating opportunities. Others will have the specific objective of generating returns from investing in overseas markets.

Incorrect

A fund manager receives money from investors to pool in an investment portfolio. A typical example is pension fund management. Fund managers have large amount of money to invest in various asset classes such as shares, property, bonds and cash. Owing to the needs and demands of their clients, some funds will invest in markets overseas in order to maximize profit-generating opportunities. Others will have the specific objective of generating returns from investing in overseas markets.

Hint

Reference Chapter:1.3.

-

Question 20 of 101

20. Question

1 pointsQID832:A managed fund called Great China Culinary fund issued by Conning investment company invests in shares of We Drink company. The trustee of Great China Culinary fund is Gawain trust whereas the fund manager is Han Sheng Capital. The trading of the shares of We Drink company under the Great China Culinary fund is executed by:

Correct

Han Sheng Capital is the fund manager. So Han Sheng Capital is responsible to execute the trading of the shares of We Drink company.

Incorrect

Han Sheng Capital is the fund manager. So Han Sheng Capital is responsible to execute the trading of the shares of We Drink company.

Hint

Reference Chapter:1.3.

-

Question 21 of 101

21. Question

1 pointsQID833:After taking his customer’s needs and goals into consideration, Mr. Gao would provide his customers with investment and finance advice. If needed, Mr. Gao would execute transactions with respect to managed funds and other securities on behalf of his customers. Mr. Gao is more likely to be a:

Correct

Financial planners assess the needs of the individual and his family in the light of his general age and lifestyle needs. Financial products provide different levels of return relative to their risk, and provide solutions for the individual’s specific needs. Financial planners use their specialist knowledge and skill to construct a financial plan, made up of strategies and actions, designed to meet their client’s goals. Generally speaking, Discount Brokers do not provide investment advice.

Incorrect

Financial planners assess the needs of the individual and his family in the light of his general age and lifestyle needs. Financial products provide different levels of return relative to their risk, and provide solutions for the individual’s specific needs. Financial planners use their specialist knowledge and skill to construct a financial plan, made up of strategies and actions, designed to meet their client’s goals. Generally speaking, Discount Brokers do not provide investment advice.

Hint

Reference Chapter:1.3.

-

Question 22 of 101

22. Question

1 pointsQID834:After taking his customer’s needs and goals into consideration, Mr. Yin would provide his customers with investment and finance advice. If needed, Mr. Gao would execute transactions with respect to managed funds and insurance on behalf of his customers. Mr. Yin is more likely to be a:

Correct

Financial planners assess the needs of the individual and his family in the light of his general age and lifestyle needs. Financial products provide different levels of return relative to their risk, and provide solutions for the individual’s specific needs. Financial planners use their specialist knowledge and skill to construct a financial plan, made up of strategies and actions, designed to meet their client’s goals.

Incorrect

Financial planners assess the needs of the individual and his family in the light of his general age and lifestyle needs. Financial products provide different levels of return relative to their risk, and provide solutions for the individual’s specific needs. Financial planners use their specialist knowledge and skill to construct a financial plan, made up of strategies and actions, designed to meet their client’s goals.

Hint

Reference Chapter:1.3.

-

Question 23 of 101

23. Question

1 pointsQID1032:Which of the following is more likely to be institutional investors?

I. Investment banks

II. Brokers

III. Fund management company

IV. Insurance companyCorrect

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Incorrect

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Hint

Reference Chapter:1.2.1

-

Question 24 of 101

24. Question

1 pointsQID1033:What is the main difference between institutional investors and high net-worth investors?

Correct

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions. High net-worth investors are Retail/private investors, which are individuals who invest on their own behalf.

Incorrect

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions. High net-worth investors are Retail/private investors, which are individuals who invest on their own behalf.

Hint

Reference Chapter:1.2.1

-

Question 25 of 101

25. Question

1 pointsQID2540:According to CUTMF, managed funds should not

I. Hold more than 10 per cent of its total NAV in securities issued by a single issuer

II. Hold more than 10 per cent of the ordinary shares issued by a single issuer

III. Hold more than 10% of its total NAV of securities neither listed, quoted nor dealt in on a market

IV. Hold more than 15% of its total NAV of securities neither listed, quoted nor dealt in on a marketCorrect

According to CUTMF, managed funds should not

I. Hold more than 10 per cent of its total NAV in securities issued by a single issuer

II. Hold more than 10 per cent of the ordinary shares issued by a single issuer

III. Hold more than 15% of its total NAV of securities neither listed, quoted nor dealt in on a marketIncorrect

According to CUTMF, managed funds should not

I. Hold more than 10 per cent of its total NAV in securities issued by a single issuer

II. Hold more than 10 per cent of the ordinary shares issued by a single issuer

III. Hold more than 15% of its total NAV of securities neither listed, quoted nor dealt in on a marketHint

Reference Chapter:1.1.7.1

-

Question 26 of 101

26. Question

1 pointsQID133:People who help clients manage pension funds or hedge funds are called:

Correct

Types of products offered by fund managers in Hong Kong include:

unit trusts and mutual funds;

pension funds;

insurance policies;

MPFs;

hedge funds (usually not open to retail customers).Incorrect

Types of products offered by fund managers in Hong Kong include:

unit trusts and mutual funds;

pension funds;

insurance policies;

MPFs;

hedge funds (usually not open to retail customers).Hint

Reference Chapter:1.4.3

-

Question 27 of 101

27. Question

1 pointsQID135:Securities brokers are more likely to do which of the following work?

Correct

Brokers execute trades on behalf of others in the exchange or earn commissions from matching the trades of buyers and sellers.

Incorrect

Brokers execute trades on behalf of others in the exchange or earn commissions from matching the trades of buyers and sellers.

Hint

Reference Chapter:1.3.5.4

-

Question 28 of 101

28. Question

1 pointsQID927:Which of the following statements is correct regarding the impact of stocks on interest rate.

Correct

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities.

The relation between interest rate and the stock price is negatively correlated and thus the unexpected increase in interest rate has a bad impact on the stock price.Incorrect

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities.

The relation between interest rate and the stock price is negatively correlated and thus the unexpected increase in interest rate has a bad impact on the stock price.Hint

Reference Chapter:1.4.1

-

Question 29 of 101

29. Question

1 pointsQID679:Why is Hong Kong a popular place for fund management?

I. Low tax rate

II. Have many professionals to back up

III. Transparent and sound rules

IV. It is the only place where investors in mainland China can invest overseas.Correct

With the globalization of investment activity, many independent fund managers have come to Hong Kong. Hong Kong attracts fund managers for several reasons, including: (1) its central location in Asia; (2) clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation);

(3) a simple and low-tax regime; (4) a window to mainland China (and its mass market); (5) a world class and technologically advanced communications system and telecommunication network; (6) high liquidity in the local stock market; (7) a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.Incorrect

With the globalization of investment activity, many independent fund managers have come to Hong Kong. Hong Kong attracts fund managers for several reasons, including: (1) its central location in Asia; (2) clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation);

(3) a simple and low-tax regime; (4) a window to mainland China (and its mass market); (5) a world class and technologically advanced communications system and telecommunication network; (6) high liquidity in the local stock market; (7) a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.Hint

Reference Chapter:1.1.5.3

-

Question 30 of 101

30. Question

1 pointsQID680:Why is collective investment schemes more popular to investors?

I. It is managed by group of professionals.

II. Costs reduction

III. Increase investment opportunities

IV. DiversificationCorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Certain investment opportunities may only be available to large investors, such as bonds and direct property. Through managed funds, small retail investors can gain exposure to such assets.

Incorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Certain investment opportunities may only be available to large investors, such as bonds and direct property. Through managed funds, small retail investors can gain exposure to such assets.

Hint

Reference Chapter:1.1.7.1

-

Question 31 of 101

31. Question

1 pointsQID682:Which of the following statement correctly describes the activities of asset management?

I. A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value.

II. A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

III. A fund should manage its assets according to its target and strategy.

IV. A fund can be sold publicly in Hong Kong only if it is registered in Hong Kong.Correct

– A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value.

– A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Investments in a particular fund will be made in line with the fund’s investment objective and strategy.Incorrect

– A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value.

– A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Investments in a particular fund will be made in line with the fund’s investment objective and strategy.Hint

Reference Chapter:1.1.7.1

-

Question 32 of 101

32. Question

1 pointsQID683:Mr. Gao is an elderly retiree who knows little about investments. What is the more likely reason for Mr. Gao to invest in fund?

I. Increase investment opportunity

II. Diversification

III. Increase the control for investment

IV. Reduce the cost of investmentCorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Certain investment opportunities may only be available to large investors, such as bonds and direct property. Through managed funds, small retail investors can gain exposure to such assets.

Incorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Certain investment opportunities may only be available to large investors, such as bonds and direct property. Through managed funds, small retail investors can gain exposure to such assets.

Hint

Reference Chapter:1.1.7.1

-

Question 33 of 101

33. Question

1 pointsQID684:A fund cannot hold securities issued by a single issuer with value more than how many percent of its total net assets value?

Correct

A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value.

Incorrect

A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value.

Hint

Reference Chapter:1.1.7.1

-

Question 34 of 101

34. Question

1 pointsQID685:A fund cannot hold more than how many percent of the ordinary shares issued by a single issuer.

Correct

A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Incorrect

A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Hint

Reference Chapter:1.1.7.1

-

Question 35 of 101

35. Question

1 pointsQID1956:QFIIs are foreign institutional investors who are allowed to invest

Correct

Qualified Domestic Institutional Investors (“QDIIs”) and Qualified Foreign Institutional Investors (“QFIIs”) are introduced in China in 2002. QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities brokerages) in Mainland China who have been granted permission to invest in overseas financial markets, while QFIIs are foreign institutional investors who are allowed to invest in China A shares. These have an impact on the flow of funds in the market. Investment by QFIIs, for instance, has a positive impact

on the flow of funds into the country.Incorrect

Qualified Domestic Institutional Investors (“QDIIs”) and Qualified Foreign Institutional Investors (“QFIIs”) are introduced in China in 2002. QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities brokerages) in Mainland China who have been granted permission to invest in overseas financial markets, while QFIIs are foreign institutional investors who are allowed to invest in China A shares. These have an impact on the flow of funds in the market. Investment by QFIIs, for instance, has a positive impact

on the flow of funds into the country.Hint

Reference Chapter:1.1.5.2

-

Question 36 of 101

36. Question

1 pointsQID686:Why does Code on Unit Trusts and Mutual Funds prohibit funds from holding too much shares issued by a single issuer?

Correct

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds.

Incorrect

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds.

Hint

Reference Chapter:1.1.7.1

-

Question 37 of 101

37. Question

1 pointsQID687:Asset management professionals need to be equipped with which of the following professional knowledges?

I. Economic analysis

II. Econometric and statistic analysis

III. Accounting and financial analysis

IV. Technical analysisCorrect

This work requires a high level of local and international financial knowledge and skill, including: (1) macro-economic and micro-economic analysis; (2) quantitative and statistical analysis; (3) global economic and political analysis; (4) accounting knowledge and skills; (5) financial statement analysis; (6) finance and investment portfolio management theory; (7)asset valuation of a full range of financial asset types.

Incorrect

This work requires a high level of local and international financial knowledge and skill, including: (1) macro-economic and micro-economic analysis; (2) quantitative and statistical analysis; (3) global economic and political analysis; (4) accounting knowledge and skills; (5) financial statement analysis; (6) finance and investment portfolio management theory; (7)asset valuation of a full range of financial asset types.

Hint

Reference Chapter:1.3.3

-

Question 38 of 101

38. Question

1 pointsQID688:The duties of asset management professionals include:

I. To build asset allocation strategy for funds

II. To analyse certain market, past performance of individual company and securities

III. To build and implement strategies for funds

IV. To provide corporations with advice related to raising capitalCorrect

Providing corporations with advice related to raising capital is the responsibility of cooperate finance professional.

Incorrect

Providing corporations with advice related to raising capital is the responsibility of cooperate finance professional.

Hint

Reference Chapter:1.3.3

-

Question 39 of 101

39. Question

1 pointsQID689:Which of the following is not one of the most important characteristic of asset management professional?

Correct

Personal skills and attributes required for effective asset managers include: (1) communication and relationship skills; (2) analytical skills; (3) teamwork.

Incorrect

Personal skills and attributes required for effective asset managers include: (1) communication and relationship skills; (2) analytical skills; (3) teamwork.

Hint

Reference Chapter:1.3.3

-

Question 40 of 101

40. Question

1 pointsQID815:In the classification of managed fund market, large institutional investors like insurance companies and pension fund are classified:

Correct

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Incorrect

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Hint

Reference Chapter:1.1.2

-

Question 41 of 101

41. Question

1 pointsQID816:”Investment requirement is usually simpler than institutional investors, complexity of investment goal is lower, and there is no need of documentation of investment entrusted” Which kind of investor/customer is it more likely to be?

Correct

Retail/private investors: these are individuals invest on their own behalf. Their complexity of investment goal is lower, and there is no need of documentation of investment entrusted since they trade for themselves.

Incorrect

Retail/private investors: these are individuals invest on their own behalf. Their complexity of investment goal is lower, and there is no need of documentation of investment entrusted since they trade for themselves.

Hint

Reference Chapter:1.1.2

-

Question 42 of 101

42. Question

1 pointsQID817:”They are natural person who has an investment amount lower than institutional investor but higher than retail investor” Which kind of investor/customer is it more likely to be?

Correct

Private customer has an investment amount lower than institutional investor but higher than retail investor.

Incorrect

Private customer has an investment amount lower than institutional investor but higher than retail investor.

Hint

Reference Chapter:1.1.2

-

Question 43 of 101

43. Question

1 pointsQID818:Which of the following is not the major classification of managed fund?

Correct

In a competitive global market, many types of managed funds are offered, including unit trusts, mutual funds, retirement or corporate funds and private equity funds. The management of all such funds is called asset management.

Incorrect

In a competitive global market, many types of managed funds are offered, including unit trusts, mutual funds, retirement or corporate funds and private equity funds. The management of all such funds is called asset management.

Hint

Reference Chapter:1.1.

-

Question 44 of 101

44. Question

1 pointsQID819:Which of the following is the major classification of managed fund?

Correct

Hedge fund is the major classification of managed fund.

Incorrect

Hedge fund is the major classification of managed fund.

Hint

Reference Chapter:1.1.

-

Question 45 of 101

45. Question

1 pointsQID820:Which of the following is not the reason why offshore fund is popular?

Correct

There are three reasons for their success: low taxes, less burdensome regulation and supervision, and (in most cases) strict secrecy laws protecting bank clients.

Incorrect

There are three reasons for their success: low taxes, less burdensome regulation and supervision, and (in most cases) strict secrecy laws protecting bank clients.

Hint

Reference Chapter:1.1.

-

Question 46 of 101

46. Question

1 pointsQID821:There is a huge increase in the market for managed fund in Hong Kong. Which of the following is not the main reason?

Correct

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Incorrect

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Hint

Reference Chapter:1.1.

-

Question 47 of 101

47. Question

1 pointsQID822:In the future, the advantage of the market for funds in Hong Kong doesn’t include:

Correct

Local tax rate is not the main concern because fund is tended to invest in many other countries.

Incorrect

Local tax rate is not the main concern because fund is tended to invest in many other countries.

Hint

Reference Chapter:1.1.

-

Question 48 of 101

48. Question

1 pointsQID823:Through managed fund, investors can:

I. achieve higher return than direct investment for sure.

II. delegate their investment management to professionals

III. pool their money to invest with other investors of similar goals.

IV. have more investment opportunity than direct investment.Correct

Managed funds are indirect investments known as collective, pooled or investment funds. Managed funds allow individual investors to pool their money with other investors who have similar investment goals. Investment professionals invest this pool of money in assets such as equities, fixed interest, real estate and/or cash. Investments in a particular fund will be made in line with the fund’s investment objective and strategy. Also, investors can invest in managed funds offering a wide scope of securities with a low minimum investment.

Incorrect

Managed funds are indirect investments known as collective, pooled or investment funds. Managed funds allow individual investors to pool their money with other investors who have similar investment goals. Investment professionals invest this pool of money in assets such as equities, fixed interest, real estate and/or cash. Investments in a particular fund will be made in line with the fund’s investment objective and strategy. Also, investors can invest in managed funds offering a wide scope of securities with a low minimum investment.

Hint

Reference Chapter:1.1.7.1

-

Question 49 of 101

49. Question

1 pointsQID824:Which of the following fund violates the diversification rule in《Code on Unit Trusts and Mutual Funds》?

I. Spring fund-invest 30% of the fund’s net assets value in corporate bond of company A

II. Summer fund-invest 5% of the fund’s net assets value in shares of company A

III. Autumn fund-invest 10% of the fund’s net assets value in shares of company A and 5% of the fund’s net assets value in corporate bond of company A

IV. Winter fund-invest 10% of the fund’s net assets value in shares of company ACorrect

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds, and include : (1)A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value. (2)A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Incorrect

The Securities and Futures Commission has set standards on diversification in Hong Kong. These requirements are stated in the Code on Unit Trusts and Mutual Funds, and include : (1)A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets value. (2)A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Hint

Reference Chapter:1.1.7.1

-

Question 50 of 101

50. Question

1 pointsQID1165:Kaohsiung company starts a collective investment scheme called “Garbage Dealing Fund” which is managed by a fund manager called Mr. Ye and mainly invests in foreign stocks. Many retail investors buy “Garbage Dealing Fund” through banks. What kind of product is the “Garbage Dealing Fund”?

Correct

A unit trust refers to a collective investment scheme pooling money from individual investors, with a large portfolio of securities managed according to pre-set investment objectives by professional fund managers.

Incorrect

A unit trust refers to a collective investment scheme pooling money from individual investors, with a large portfolio of securities managed according to pre-set investment objectives by professional fund managers.

Hint

Reference Chapter:1.1.3

-

Question 51 of 101

51. Question

1 pointsQID1166:The advantages of investing in unit trusts or mutual funds doesn’t include:

Correct

Having long investment periods is the disadvantage of investing in unit trusts or mutual funds. It is because it is more risky.

Incorrect

Having long investment periods is the disadvantage of investing in unit trusts or mutual funds. It is because it is more risky.

Hint

Reference Chapter:1.1.7.1

-

Question 52 of 101

52. Question

1 pointsQID1167:The disadvantages of investing in unit trusts or mutual funds doesn’t include:

Correct

Having various and diversified investment channels is the advantage of investing in unit trusts or mutual funds because the investment risk can be diversified.

Incorrect

Having various and diversified investment channels is the advantage of investing in unit trusts or mutual funds because the investment risk can be diversified.

Hint

Reference Chapter:1.1.7.2

-

Question 53 of 101

53. Question

1 pointsQID1168:The advantages of investing in unit trusts or mutual funds include:

I. Professional management

II. Various and diversified investment channels

III. Simple procedure

IV. Tax incentivesCorrect

Individual investors benefit from professional management, diversification, a broader range of opportunities, cost benefits, and convenience through managed funds.

Incorrect

Individual investors benefit from professional management, diversification, a broader range of opportunities, cost benefits, and convenience through managed funds.

Hint

Reference Chapter:1.1.7.1

-

Question 54 of 101

54. Question

1 pointsQID695:Mr. Su, a factory owner, received piles of cash after selling is factory and business. Assume that he’s not clear how to use these cash, Whom should he contact?

Correct

Financial advising is a process where an individual moves towards meeting his personal and financial goals through the development and implementation of a comprehensive financial plan.

Incorrect

Financial advising is a process where an individual moves towards meeting his personal and financial goals through the development and implementation of a comprehensive financial plan.

Hint

Reference Chapter:1.4.3

-

Question 55 of 101

55. Question

1 pointsQID696:Why are the needs of individual financial advisors getting bigger and bigger?

I. Aging population in developed countries

II. Higher level of saving

III. The increased mobility of the labour force

IV. As the financial markets of investments becomes mature.Correct

In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial advisory industry. This aging has been brought about by increased longevity in the majority of developed world populations. This large segment of the population is more highly educated and wealthier than preceding generations. The high average savings of such people represent a larger percentage of the population than earlier or subsequent generations, and their accumulated savings have stimulated demand for financial advisory services.

Incorrect

In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial advisory industry. This aging has been brought about by increased longevity in the majority of developed world populations. This large segment of the population is more highly educated and wealthier than preceding generations. The high average savings of such people represent a larger percentage of the population than earlier or subsequent generations, and their accumulated savings have stimulated demand for financial advisory services.

Hint

Reference Chapter:1.1.5.3

-

Question 56 of 101

56. Question

1 pointsQID698:Which of the following factor is not the reason why there is sharp increase in services of financial advisor?

Correct

In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial advisory industry. This aging has been brought about by increased longevity in the majority of developed world populations. This large segment of the population is more highly educated and wealthier than preceding generations. The high average savings of such people represent a larger percentage of the population than earlier or subsequent generations, and their accumulated savings have stimulated demand for financial advisory services. The profession has gained importance in recent years as the financial and investment markets have become increasingly sophisticated.

Incorrect

In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial advisory industry. This aging has been brought about by increased longevity in the majority of developed world populations. This large segment of the population is more highly educated and wealthier than preceding generations. The high average savings of such people represent a larger percentage of the population than earlier or subsequent generations, and their accumulated savings have stimulated demand for financial advisory services. The profession has gained importance in recent years as the financial and investment markets have become increasingly sophisticated.

Hint

Reference Chapter:1.1.5.3

-

Question 57 of 101

57. Question

1 pointsQID703:Why is investing in fund better than investing in stocks?

I. Easy to diversify

II. Can invest in different markets

III. Cost reduction

IV. More easy to control investment directlyCorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Through managed funds, the investment range is broadened to include overseas investments. In Hong Kong, this is particularly relevant as the majority of authorized managed funds are based elsewhere, enabling the investor to choose the fund manager with the best skill set and local knowledge in the market in which he wants to invest.

Incorrect

The key benefits of managed funds are access to professional investment management services; and diversification. Fund managers can also invest in a broader range of securities, and usually faster and more cheaply, than individuals. Through managed funds, the investment range is broadened to include overseas investments. In Hong Kong, this is particularly relevant as the majority of authorized managed funds are based elsewhere, enabling the investor to choose the fund manager with the best skill set and local knowledge in the market in which he wants to invest.

Hint

Reference Chapter:1.1.7.1

-

Question 58 of 101

58. Question

1 pointsQID810:Managed funds are:

Correct

Managed funds are indirect investments known as collective, pooled or investment funds.

Incorrect

Managed funds are indirect investments known as collective, pooled or investment funds.

Hint

Reference Chapter:1.1.2

-

Question 59 of 101

59. Question

1 pointsQID811:Which of the following is not the reason why Hong Kong attracts fund managers?

Correct

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Incorrect

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Hint

Reference Chapter:1.2.

-

Question 60 of 101

60. Question

1 pointsQID812:Which of the following is the reason why Hong Kong attracts fund managers?

I. English is a common language.

II. Abundant management skills

III. Proximity to Asia

IV. A world class and technologically advanced communications system and telecommunication networkCorrect

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Incorrect

Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear regulations on how to establish and become authorized in the local market, a just and equitable legal system, the English language (mandatory for conducting international business) and administration skills (needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland China (and its mass market); a world class and technologically advanced communications system and telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals, such as accountants, lawyers and stockbrokers, to support the fund management industry.

Hint

Reference Chapter:1.2.

-

Question 61 of 101

61. Question

1 pointsQID813:Effectively investors of managed funds delegate the investment management of their money to professionals, who exercise their own discretion as to how it should be invested. So managed funds are:

Correct

Effectively, individuals delegate the investment management of their money to professionals, who exercise their own discretion as to how it should be invested.

Incorrect

Effectively, individuals delegate the investment management of their money to professionals, who exercise their own discretion as to how it should be invested.

Hint

Reference Chapter:1.1.

-

Question 62 of 101

62. Question

1 pointsQID814:__ is also called wholesale investor who has a larger investment amount and more complex investment goals.

Correct

Institutional investors: in Hong Kong, the main such investors include banks, insurance companies, fund managers and other financial institutions. They are called wholesale investor who has a larger investment amount and more complex investment goals.

Incorrect

Institutional investors: in Hong Kong, the main such investors include banks, insurance companies, fund managers and other financial institutions. They are called wholesale investor who has a larger investment amount and more complex investment goals.

Hint

Reference Chapter:1.1.2

-

Question 63 of 101

63. Question

1 pointsQID928:If the interest rate increases, generally the stock price will:

Correct

An increase in interest rates by institutions will increase borrowers’ loan interest and therefore effectively lower their disposable incomes. This results in investment in the economy, which could lead to capital market slowdown.

Incorrect

An increase in interest rates by institutions will increase borrowers’ loan interest and therefore effectively lower their disposable incomes. This results in investment in the economy, which could lead to capital market slowdown.

Hint

Reference Chapter:1.4.1

-

Question 64 of 101

64. Question

1 pointsQID1034:Which of the following is not likely to be institutional investor?

Correct

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Incorrect

In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and other financial institutions.

Hint

Reference Chapter:1.2.1

-

Question 65 of 101

65. Question

1 pointsQID1035:What is the difference between high net-worth investors and retail investors?

I. Better investment experience

II. Larger investment amount

III. Higher education

IV. Better investment performanceCorrect

High net-worth investors generally refer to individual whose personal financial assets and investment properties higher than other normal investors. Their investment experience, the amount of investment, education, investment performance are much better than that of normal investors.

Incorrect

High net-worth investors generally refer to individual whose personal financial assets and investment properties higher than other normal investors. Their investment experience, the amount of investment, education, investment performance are much better than that of normal investors.

Hint

Reference Chapter:1.2.1

-

Question 66 of 101

66. Question

1 pointsQID1070:An increase in interest rate will not lead to which of the following situations?

Correct

Cost-push inflation: this is caused by increases in costs that translate into increases in wages and prices in the economy. Cost-push inflation can also be caused by relatively expensive imports (i.e. imported inflation).

Incorrect

Cost-push inflation: this is caused by increases in costs that translate into increases in wages and prices in the economy. Cost-push inflation can also be caused by relatively expensive imports (i.e. imported inflation).

Hint

Reference Chapter:1.4.

-

Question 67 of 101

67. Question

1 pointsQID1987:The plan which allows foreign institutional investors to invest in China securities by RMB is

Correct

RQFII is a policy initiative of mainland China, which allows qualified RQFII holders to channel renminbi funds raised in Hong Kong to invest in the Mainland securities markets.

Incorrect

RQFII is a policy initiative of mainland China, which allows qualified RQFII holders to channel renminbi funds raised in Hong Kong to invest in the Mainland securities markets.

Hint

Reference Chapter:1.1.

-

Question 68 of 101

68. Question

1 pointsQID1988:The plan which allows foreign institutional investors to invest in China securities is

Correct

QFIIs are foreign institutional investors who are allowed to invest in China A shares.

Incorrect

QFIIs are foreign institutional investors who are allowed to invest in China A shares.

Hint

Reference Chapter:1.1.

-

Question 69 of 101

69. Question

1 pointsQID1989:The plan which allows local institutional investors in Mainland China to invest in overseas financial markets is

Correct

QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities brokerages) in Mainland China who have been granted permission to invest in overseas financial markets.

Incorrect

QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities brokerages) in Mainland China who have been granted permission to invest in overseas financial markets.

Hint

Reference Chapter:1.1.

-

Question 70 of 101

70. Question

1 pointsQID1990:The main differences between institutional, private and retail customer investments include:

I. The minimum investment amount

II. Requirements for sales documents

III. Fees and Charges

IV. Commission level paid to financial adviserCorrect

An institutional investor is an organisation with a large amount of money to invest. A retail investor is an individual who purchases small amounts of securities for himself. A high net worth investor is an individual investor with a substantial amount of money to invest.

Incorrect

An institutional investor is an organisation with a large amount of money to invest. A retail investor is an individual who purchases small amounts of securities for himself. A high net worth investor is an individual investor with a substantial amount of money to invest.

Hint

Reference Chapter:1.2.

-

Question 71 of 101

71. Question

1 pointsQID1991:Which of the following ways does an institutional investor buy a management fund or participate in managing the fund market?

Correct

Today, the asset management market in Hong Kong is mainly divided into three categories: institutional, retail and private client markets. Institutional investors include active fund management companies, passive fund management companies (e.g. ETF), insurance companies, banks, sovereign wealth funds, endowment funds, treasury management functions of corporations and retirement schemes. This last mainly include the Mandatory Provident Fund (“MPF”) and Occupational Retirement Schemes Ordinance (“ORSO”) schemes.

Incorrect

Today, the asset management market in Hong Kong is mainly divided into three categories: institutional, retail and private client markets. Institutional investors include active fund management companies, passive fund management companies (e.g. ETF), insurance companies, banks, sovereign wealth funds, endowment funds, treasury management functions of corporations and retirement schemes. This last mainly include the Mandatory Provident Fund (“MPF”) and Occupational Retirement Schemes Ordinance (“ORSO”) schemes.

Hint

Reference Chapter:1.2.

-

Question 72 of 101

72. Question

1 pointsQID1992:All managed funds describe their products and investment strategies in a document. For managed funds catering to the retail and private client markets, this is called

Correct

All managed funds describe their products and investment strategies in a document. For managed funds catering to the retail and private client markets, this is called a prospectus. Prospectuses must have the prior approval of the SFC before being released to the public.

Incorrect

All managed funds describe their products and investment strategies in a document. For managed funds catering to the retail and private client markets, this is called a prospectus. Prospectuses must have the prior approval of the SFC before being released to the public.

Hint

Reference Chapter:1.2.

-

Question 73 of 101

73. Question

1 pointsQID1993:Which of the following is a member of the fund management industry?

I. Investors

II. Promoter

III. Fund Manager

IV. Trustee companiesCorrect

Fund management industry participants include investors, promoters, fund managers, trustee companies.

Incorrect

Fund management industry participants include investors, promoters, fund managers, trustee companies.

Hint

Reference Chapter:1.3.

-

Question 74 of 101

74. Question

1 pointsQID1535:Greater China Catering Fund issued by Kangneng Investment Co., Ltd. is a management fund that invests the stocks of Café de Coral. The Trustee of Greater China Catering Fund is Kao Man Trust and the fund manager is Hongshing Capital. What kind of person is responsible for the promotion and sales of Greater China Catering Fund?

Correct

Kangneng Investment Co., Ltd. is the promoter of the fund. Promoters design, develop and maintain managed fund products. Essentially, they establish the managed fund and will oversee operations so that the products are marketable. This involves promoting their products either directly or indirectly via distributors.

Incorrect

Kangneng Investment Co., Ltd. is the promoter of the fund. Promoters design, develop and maintain managed fund products. Essentially, they establish the managed fund and will oversee operations so that the products are marketable. This involves promoting their products either directly or indirectly via distributors.

Hint

Reference Chapter:1.3.2

-

Question 75 of 101

75. Question

1 pointsQID1536:Which of the following types of institutions are more likely to be the promoter of the managed fund?

I. Bank

II. General Insurance Company

III. Investment Banking

IV. Fund companiesCorrect

Banks, life insurance companies, investment banks, specialist managed fund companies and some retirement fund trustees carry out the role of promoters.

Incorrect

Banks, life insurance companies, investment banks, specialist managed fund companies and some retirement fund trustees carry out the role of promoters.

Hint

Reference Chapter:1.3.2

-

Question 76 of 101

76. Question

1 pointsQID1537:Which of the following is a description of the trustee company is correct?

I.To be authorised in Hong Kong, unit trusts must have a trustee.

II. must be independent of the managed fund provider

III. The trustees are most likely to be an Authorized Institution established under the Securities & Futures Ordinance or a trust company established under the Trustee Ordinance.

IV. Sometimes promoters or fund managers nominate a trustee company to perform trustee duties for their trusts.Correct

To be authorised in Hong Kong, unit trusts must have a trustee. Sometimes promoters or fund managers nominate a trustee company to perform trustee duties for their trusts. They must be independent of the managed fund provider and, if domiciled outside Hong Kong, they must be authorised by the SFC to offer their products for sale locally. They must also have a paid-up capital of at least HKD10 million. The trustees are most likely to be an Authorized Institution established under the Banking Ordinance or a trust company established under the Trustee Ordinance.

Incorrect

To be authorised in Hong Kong, unit trusts must have a trustee. Sometimes promoters or fund managers nominate a trustee company to perform trustee duties for their trusts. They must be independent of the managed fund provider and, if domiciled outside Hong Kong, they must be authorised by the SFC to offer their products for sale locally. They must also have a paid-up capital of at least HKD10 million. The trustees are most likely to be an Authorized Institution established under the Banking Ordinance or a trust company established under the Trustee Ordinance.

Hint

Reference Chapter:1.3.4

-

Question 77 of 101

77. Question

1 pointsQID1538:Greater China Catering Fund issued by Kangneng Investment Co., Ltd. is a management fund that invests the stocks of Café de Coral. The Trustee of Greater China Catering Fund is Kao Man Trust and the fund manager is Hongshing Capital. The stocks of Café de Coral in Greater China Catering Fund are held in the name of which of the following institutions?

Correct

Trustees act as custodian. The custodian is mainly responsible for protecting the fund assets. The assets are held in the name of the custodian on behalf of the unit-holders. However, a custodian is not responsible for supervising the performance of the fund manager.

Incorrect

Trustees act as custodian. The custodian is mainly responsible for protecting the fund assets. The assets are held in the name of the custodian on behalf of the unit-holders. However, a custodian is not responsible for supervising the performance of the fund manager.

Hint

Reference Chapter:1.3.4

-

Question 78 of 101

78. Question

1 pointsQID1539:Trustees should perform which of the following task?

I.protecting the fund assets and the assets are held in the name of the custodian on behalf of the unit-holders.

II. supervising the performance of the fund manager

III. maintaining a register of the unit-holders

IV. Ensuring the managed fund provider complies with the conditions stated in the trust deedCorrect

Trustees perform the following tasks: Act as custodian. The custodian is mainly responsible for protecting the fund assets. The assets are held in the name of the custodian on behalf of the unit-holders. However, a custodian is not responsible for supervising the performance of the fund manager. Registry. The trustee should maintain a register of the unit-holders. Settling transactions by issuing and redeeming fund units. Ensuring the managed fund provider complies with the conditions stated in the trust deed. Where a breach arises, the trustee has the power to replace the fund manager or other service provider responsible (e.g. an administration company). Carrying out their role in the interest of the unit-holders. Liaison. The trustee is also responsible for liaising with the fund management company on behalf of the unit-holders.

Incorrect

Trustees perform the following tasks: Act as custodian. The custodian is mainly responsible for protecting the fund assets. The assets are held in the name of the custodian on behalf of the unit-holders. However, a custodian is not responsible for supervising the performance of the fund manager. Registry. The trustee should maintain a register of the unit-holders. Settling transactions by issuing and redeeming fund units. Ensuring the managed fund provider complies with the conditions stated in the trust deed. Where a breach arises, the trustee has the power to replace the fund manager or other service provider responsible (e.g. an administration company). Carrying out their role in the interest of the unit-holders. Liaison. The trustee is also responsible for liaising with the fund management company on behalf of the unit-holders.

Hint

Reference Chapter:1.3.4

-

Question 79 of 101

79. Question

1 pointsQID1540:Koshien company, which is the promoter of a managed fund, decides to launch US Food Science and Technology Managed Fund. Koshien company can sell the fund in which way?

I.Selling US Food Science and Technology Managed Fund through Kangneng Security, a SFC-licensed registered institution

II.Selling investment-related insurance plan which includes the US Food Science and Technology Managed Fund through the British life insurance company

III.Selling US Food Science and Technology Managed Fund through subsidiary of Koshien company – Koshien Wealth Management

IV. Selling US Food Science and Technology Managed Fund to investors through FUNDRIGHT which set up by discount brokersCorrect

A distribution channel is a set of marketing intermediaries that operate between the managed funds provider and the customer. Distribution channels can be direct (where the customer interfaces directly with the provider) or indirect (through one or more types of intermediate channels).

Incorrect

A distribution channel is a set of marketing intermediaries that operate between the managed funds provider and the customer. Distribution channels can be direct (where the customer interfaces directly with the provider) or indirect (through one or more types of intermediate channels).

Hint

Reference Chapter:1.3.5

-

Question 80 of 101

80. Question

1 pointsQID1541:Which of the following institutions and intermediaries can distributed managed fund?

I. Independent financial advisers

II. Life insurance agents

III. Banks

IV.General insurance agentsCorrect

Promoters rely on distributors to market their managed funds to clients. There are basically two types of distributors: direct (from the same or a subsidiary company of the promoter) and indirect (through an intermediary).

Some of the intermediaries are: Independent financial advisers; Life insurance agents; Banks; Discount brokers; Accountants and solicitors; Asset consultants.

Incorrect

Promoters rely on distributors to market their managed funds to clients. There are basically two types of distributors: direct (from the same or a subsidiary company of the promoter) and indirect (through an intermediary).

Some of the intermediaries are: Independent financial advisers; Life insurance agents; Banks; Discount brokers; Accountants and solicitors; Asset consultants.

Hint

Reference Chapter:1.3.5

-

Question 81 of 101

81. Question

1 pointsQID1542:To market managed funds to clients, promoters rely on

Correct

Promoters rely on distributors to market their managed funds to clients. There are basically two types of distributors: direct (from the same or a subsidiary company of the promoter) and indirect (through an intermediary).

Incorrect

Promoters rely on distributors to market their managed funds to clients. There are basically two types of distributors: direct (from the same or a subsidiary company of the promoter) and indirect (through an intermediary).

Hint

Reference Chapter:1.3.5

-

Question 82 of 101

82. Question

1 pointsQID1543:A company distribute their own products and serve as an intermediary for other fund houses as well. This company is likely to be?

Correct

Banks have become a very important channel to distribute managed fund products. They distribute their own products and serve as an intermediary for other fund houses as well. Professional financial planners and wealth managers are housed in most branch offices of banks to provide the necessary financial advice or services in the process.

Incorrect

Banks have become a very important channel to distribute managed fund products. They distribute their own products and serve as an intermediary for other fund houses as well. Professional financial planners and wealth managers are housed in most branch offices of banks to provide the necessary financial advice or services in the process.

Hint

Reference Chapter:1.3.5.3

-

Question 83 of 101

83. Question

1 pointsQID1544:A company distribute managed fund products at a greater discount than the traditional distributors. It provides no financial advice. This company is more likely to be

Correct

Discount brokers distribute managed fund products at a greater discount than the traditional distributors. However, no financial advice is provided.

Incorrect

Discount brokers distribute managed fund products at a greater discount than the traditional distributors. However, no financial advice is provided.

Hint

Reference Chapter:1.3.5.4

-

Question 84 of 101

84. Question

1 pointsQID1545:Which of the following is not the supporting participants for fund industry?

Correct

Other people supporting the managed fund industry are Actuaries; Accountants; Custodians; Fund research houses and fund rating agencies.

Incorrect