English IIQE Paper 5 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

IIQEP5ET1

Quiz-summary

0 of 64 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

Information

IIQEP5ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 64 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic_1 0%

-

IIQEP5ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- Answered

- Review

-

Question 1 of 64

1. Question

1 pointsQID25:Commonly used in the US to describe investment-linked business is:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Hint

References:1.1.

-

Question 2 of 64

2. Question

1 pointsQID32:Commonly used in the US to describe investment-linked business is:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Hint

References:1.1.

-

Question 3 of 64

3. Question

1 pointsQID19:In the United States, the term commonly used to describe investment-linked long term business is:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Hint

References:1.1.

-

Question 4 of 64

4. Question

1 pointsQID20:How did the “Guideline on Classification of Class C – Linked Long Term Business” come into being?

Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is D.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is D.Hint

References:1.1.

-

Question 5 of 64

5. Question

1 pointsQID21:Which of the following is true about variable life/annuity?

i. Investment-linked annuities are not commonly found in Hong Kong

iv. Based on universal life (a flexible premium derivative of whole life)

iii. The most popular investment-linked life insurance in Hong Kong is flexible premium variable life insurance

iv. Variable universal life and flexible premium variable life insurance are two types of insurance products with a very big distinctionCorrect

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The other three are true statements. The answer is C.

Incorrect

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The other three are true statements. The answer is C.

Hint

References:1.1.

-

Question 6 of 64

6. Question

1 pointsQID22:The term often used to describe investment-linked long term business is variable life/annuity. “Variable” illustrates that:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The term “variable” illustrates that the returns vary with the value of the underlying investment. The answer is A.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The term “variable” illustrates that the returns vary with the value of the underlying investment. The answer is A.

Hint

References:1.1.

-

Question 7 of 64

7. Question

1 pointsQID17:Insurers in Hong Kong who wish to underwrite investment-linked long term insurance policies must be authorised to carry on:

Correct

It should be noted that only insurance companies authorised under the “Insurance

Ordinance” (Cap 41) to carry on Class C business in or from Hong Kong can underwrite

investment-linked long term insurance policies. The answer is C.Incorrect

It should be noted that only insurance companies authorised under the “Insurance

Ordinance” (Cap 41) to carry on Class C business in or from Hong Kong can underwrite

investment-linked long term insurance policies. The answer is C.Hint

References:1.1.

-

Question 8 of 64

8. Question

1 pointsQID24:In the UK, the unit-linked life illustrates that the values of the policies are linked to:

Correct

Unit-linked life/annuity is a common term used in the UK. The term “unit-linked” illustrates that the values of the policies are linked to the price of the units. The answer is A.

Incorrect

Unit-linked life/annuity is a common term used in the UK. The term “unit-linked” illustrates that the values of the policies are linked to the price of the units. The answer is A.

Hint

References:1.1.

-

Question 9 of 64

9. Question

1 pointsQID16:Which of the following statements about investment-linked long term insurance is true?

i. It is not authorized by the Securities and Futures Commission

ii. The business of effecting and carrying out of insurance on human life or contracts to pay annuities on human life

iii. The benefits are wholly or partly to be determined by reference to the value of, or the income from, property of any description

iv. The benefits are wholly or partly to be determined by reference to fluctuations in, or in an index of, the value of property of any descriptionCorrect

Linked Long Term Business is defined as the business of effecting and carrying out of insurance on human life or contracts to pay annuities on human life where the benefits are wholly or partly to be determined by reference to the value of, or the income from, property of any description (whether or not specified in the contracts) or by

reference to fluctuations in, or in an index of, the value of property of any description (whether or not so specified).As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public.

The answer is D.

Incorrect

Linked Long Term Business is defined as the business of effecting and carrying out of insurance on human life or contracts to pay annuities on human life where the benefits are wholly or partly to be determined by reference to the value of, or the income from, property of any description (whether or not specified in the contracts) or by

reference to fluctuations in, or in an index of, the value of property of any description (whether or not so specified).As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public.

The answer is D.

Hint

References:1.1.

-

Question 10 of 64

10. Question

1 pointsQID26:Which of the following is true about the investment-linked annuity?

Correct

In Hong Kong, investment-linked annuities are not commonly found. The answer is B.

Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The answer is B.

Hint

References:1.1.

-

Question 11 of 64

11. Question

1 pointsQID27:In which region is an investment-linked policy also known as a variable life/annuity?

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is C.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is C.

Hint

References:1.1.

-

Question 12 of 64

12. Question

1 pointsQID28:There are two different types of variable life. One is variable universal life, which can also be called:

Correct

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The answer is A.

Incorrect

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The answer is A.

Hint

References:1.1.

-

Question 13 of 64

13. Question

1 pointsQID29:Which of the following products is most common in Hong Kong?

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Hint

References:1.1.

-

Question 14 of 64

14. Question

1 pointsQID30:In Hong Kong, investment-linked annuities are:

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is A.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is A.Hint

References:1.1.

-

Question 15 of 64

15. Question

1 pointsQID1:The Insurance Authority issued the “Guideline on Classification of Class C – Linked Long Term Business” in order to:

Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Hint

References:1.1.

-

Question 16 of 64

16. Question

1 pointsQID23:Which of the following does not require authorization from the Securities and Futures Commission (SFC)?

Correct

As investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is D.

Incorrect

As investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is D.

Hint

References:1.1.

-

Question 17 of 64

17. Question

1 pointsQID9:In which region is the investment-linked policy called a variable life/annuity?

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is B.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is B.

Hint

References:1.1.

-

Question 18 of 64

18. Question

1 pointsQID2:The purpose of issuing the Guideline on Classification of Class C – Linked Long Term Business is to:

Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Hint

References:1.1.

-

Question 19 of 64

19. Question

1 pointsQID3:The Guideline on Classification of Class C –Linked Long Term Business was:

Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is D.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is D.Hint

References:1.1.

-

Question 20 of 64

20. Question

1 pointsQID4:The purpose of issuing the Guideline on Classification of Class C – Linked Long Term Business is to:

Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is A.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is A.Hint

References:1.1.

-

Question 21 of 64

21. Question

1 pointsQID5:The Insurance Authority issued the

“Guideline on Classification of Class C – Linked Long Term Business”(GL11), which

highlights the features of Class C Linked Long Term business, including:Correct

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Incorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Hint

References:1.1.

-

Question 22 of 64

22. Question

1 pointsQID6:The “Guideline on Classification of Class C – Linked Long Term Business” highlights the features of Class C Linked Long Term business, including:

Correct

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Incorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Hint

References:1.1.

-

Question 23 of 64

23. Question

1 pointsQID18:Which of the following is the most common investment-linked annuity in Hong Kong?

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Hint

References:1.1.

-

Question 24 of 64

24. Question

1 pointsQID8:The benefits of the policy are wholly or partly to be determined by reference to fluctuations in the value of property of any description. This product is called:

Correct

Linked Long Term Business is defined as the business of effecting and carrying out of insurance on human life or contracts to pay annuities on human life where the benefits are wholly or partly to be determined by reference to the value of, or the income from, property of any description (whether or not specified in the contracts) or by

reference to fluctuations in, or in an index of, the value of property of any description (whether or not so specified). The answer is C.Incorrect

Linked Long Term Business is defined as the business of effecting and carrying out of insurance on human life or contracts to pay annuities on human life where the benefits are wholly or partly to be determined by reference to the value of, or the income from, property of any description (whether or not specified in the contracts) or by

reference to fluctuations in, or in an index of, the value of property of any description (whether or not so specified). The answer is C.Hint

References:1.1.

-

Question 25 of 64

25. Question

1 pointsQID33:In the US market, investment-linked long term life is called:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is A.

Hint

References:1.1.

-

Question 26 of 64

26. Question

1 pointsQID10:Which of the following statements about the definition of an investment-linked policy is incorrect?

Correct

In GL11, it is stated that a Class C policy must either be a life or annuity contract. The answer is A.

Incorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract. The answer is A.

Hint

References:1.1.

-

Question 27 of 64

27. Question

1 pointsQID11:In the UK, the term “unit-linked” illustrates that the values of the policies are linked to:

Correct

Unit-linked life/annuity is a common term used in the UK for the investment-linked insurance policy. The term “unit-linked” illustrates that the values of the policies are linked to the price of the units. The answer is B.

Incorrect

Unit-linked life/annuity is a common term used in the UK for the investment-linked insurance policy. The term “unit-linked” illustrates that the values of the policies are linked to the price of the units. The answer is B.

Hint

References:1.1.

-

Question 28 of 64

28. Question

1 pointsQID12:Which of the following is true about variable life/annuity?

i. It’s called unit-variable life in the UK

ii. Flexible premium variable life is based on whole life

iii. Fixed premium variable life provides a fixed premium payment schedule

iv. The term “variable” illustrates that the

returns vary with the value of the underlying investmentCorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The term “variable” illustrates that the returns vary with the value of the underlying investment. There are two different types of variable life insurance:

(1)Fixed premium variable life is based on whole life. It provides a fixed premium payment schedule.

(2)Flexible premium variable life is based on universal life (a flexible premium

derivative of whole life).

The answer is C.Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The term “variable” illustrates that the returns vary with the value of the underlying investment. There are two different types of variable life insurance:

(1)Fixed premium variable life is based on whole life. It provides a fixed premium payment schedule.

(2)Flexible premium variable life is based on universal life (a flexible premium

derivative of whole life).

The answer is C.Hint

References:1.1.

-

Question 29 of 64

29. Question

1 pointsQID13:The Insurance Authority issued the

“Guideline on Classification of Class C – Linked Long Term Business” to:Correct

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Incorrect

In order to minimise the confusion with the classification of business between Class A (Life and Annuity) and Class C (Linked Long Term), the Insurance Authority has issued a

“Guideline on Classification of Class C – Linked Long Term Business” (GL11). The answer is B.Hint

References:1.1.

-

Question 30 of 64

30. Question

1 pointsQID14:The “Guideline on Classification of Class C – Linked Long Term Business” highlights some of the predominant features of Class C Linked Long Term policies, including:

i. The policy has a term of at least ten years

ii. Falling policy investment returns will reduce the value of policies

iii. The market value adjustment of the policy or similar adjustment will be applied to the surrender/withdrawal value on the terms of the policy

iv. Market value adjustment refers to the deduction of the involved expenses or commissions in the refund of premiums during the cooling-off periodCorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is B.Incorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is B.Hint

References:1.1.

-

Question 31 of 64

31. Question

1 pointsQID15:Which of the following investment-linked annuities is common in Hong Kong?

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Hint

References:1.1.

-

Question 32 of 64

32. Question

1 pointsQID7:According to the “Guideline on Classification of Class C – Linked Long Term Business”, which of the following features must a class C policy have?

Correct

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Incorrect

In GL11, it is stated that a Class C policy must either be a life or annuity contract and possess one or more of the following features:

(a) The benefits of the policy are calculated in whole or in part by reference to the value of, or the income from, specified assets or group of assets or by reference to movements in a share price or other index, whether or not subject to deductions in respect of expenses or charges;

(b) The policyholder is given the options to choose the underlying investment assets

from a range of investment fund options; and

(c) The policy is designed in such a way that the policyholder is contractually bound

to bear partly or wholly the risk of the investments to which the benefits are linked.

The answer is D.Hint

References:1.1.

-

Question 33 of 64

33. Question

1 pointsQID42:Which of the following is not to have fixed premium normally?

Correct

Investment-linked insurance policies may come in a variety of forms, but there is a common factor. Part of the premiums will be used to purchase units in a fund at the price applicable at the time of purchase. The value of the policy will then fluctuate according to the value of the units allocated to it. The answer is A.

Incorrect

Investment-linked insurance policies may come in a variety of forms, but there is a common factor. Part of the premiums will be used to purchase units in a fund at the price applicable at the time of purchase. The value of the policy will then fluctuate according to the value of the units allocated to it. The answer is A.

Hint

References:1.1.

-

Question 34 of 64

34. Question

1 pointsQID31:In Hong Kong, investment-linked annuities are:

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is A.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is A.Hint

References:1.1.

-

Question 35 of 64

35. Question

1 pointsQID43:Flexible premium variable life is also known as:

Correct

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The answer is B.

Incorrect

Flexible premium variable life may also be called “variable universal life” or “universal variable life.” The answer is B.

Hint

References:1.1.

-

Question 36 of 64

36. Question

1 pointsQID41:Fixed premium variable life is based on:

Correct

Fixed premium variable life is based on whole life. The answer is A.

Incorrect

Fixed premium variable life is based on whole life. The answer is A.

Hint

References:1.1.

-

Question 37 of 64

37. Question

1 pointsQID40:Which of the following descriptions of investment-linked life/annuities is correct?

I. Unit-linked/annuities (in the US)

ii. Variable life/annuities(in the UK)

iii. Fixed premium variable life

iv. Flexible premium variable lifeCorrect

In other parts of the world, investment-linked insurance policies are also known by the following terms:

(a) Unit-linked life/annuities: This is a common term used in the UK.

(b) Variable life/annuities: This is the common term used to describe investment-linked business in the US. There are two different types of variable life insurance: fixed premium variable life and flexible premium variable life.

The answer is C.Incorrect

In other parts of the world, investment-linked insurance policies are also known by the following terms:

(a) Unit-linked life/annuities: This is a common term used in the UK.

(b) Variable life/annuities: This is the common term used to describe investment-linked business in the US. There are two different types of variable life insurance: fixed premium variable life and flexible premium variable life.

The answer is C.Hint

References:1.1.

-

Question 38 of 64

38. Question

1 pointsQID39:Variable life is:

Correct

Fixed premium variable life is based on whole life. When talking about this product, life insurance practitioners generally drop the “fixed premium”

qualifier and refer to the product simply as variable life. The answer is C.Incorrect

Fixed premium variable life is based on whole life. When talking about this product, life insurance practitioners generally drop the “fixed premium”

qualifier and refer to the product simply as variable life. The answer is C.Hint

References:1.1.

-

Question 39 of 64

39. Question

1 pointsQID38:Which of the following is the most accepted class of investment-linked policies?

Correct

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Incorrect

In Hong Kong, investment-linked annuities are not commonly found. The most popular

type of investment-linked insurance product is flexible premium variable life insurance

(also called “variable universal life” or “universal variable life”). The answer is D.Hint

References:1.1.

-

Question 40 of 64

40. Question

1 pointsQID37:A type of life insurance has the flexibility of universal life insurance products and combines with the investment variable characteristics of variable life insurance. This type of life insurance is:

Correct

Flexible premium variable life combines

the premium and death benefit flexibility of universal life insurance and adopts

its feature of unbundling of the pricing factors with the investment characteristics of variable life policies. The answer is B.Incorrect

Flexible premium variable life combines

the premium and death benefit flexibility of universal life insurance and adopts

its feature of unbundling of the pricing factors with the investment characteristics of variable life policies. The answer is B.Hint

References:1.1.

-

Question 41 of 64

41. Question

1 pointsQID36:Flexible premium and sum insured are based on the features of which of the following?

Correct

Flexible premium variable life is based on universal life (a flexible premium derivative of whole life). The answer is C.

Incorrect

Flexible premium variable life is based on universal life (a flexible premium derivative of whole life). The answer is C.

Hint

References:1.1.

-

Question 42 of 64

42. Question

1 pointsQID35:Flexible premium variable life is also known as:

Correct

Flexible premium variable life is based on universal life (a flexible premium derivative of whole life). This product may also be called “variable universal life” or “universal variable life.” The answer is B.

Incorrect

Flexible premium variable life is based on universal life (a flexible premium derivative of whole life). This product may also be called “variable universal life” or “universal variable life.” The answer is B.

Hint

References:1.1.

-

Question 43 of 64

43. Question

1 pointsQID34:The term commonly used to describe investment-linked businesses in the US is:

Correct

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is B.

Incorrect

Variable life/annuity is the common term used to describe investment-linked business in the US. The answer is B.

Hint

References:1.1.

-

Question 44 of 64

44. Question

1 pointsQID48:Authorisation has to be sought if investment-linked policies are sold to the general investing public because:

Correct

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is A.

Incorrect

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is A.

Hint

References:1.2.

-

Question 45 of 64

45. Question

1 pointsQID54:Which of the following is directly related to the unit value of an investment-linked policy?

Correct

Investment-linked insurance policies are insurance policies with its policy value directly linked to the performance of its underlying investment. The value of the units is directly related to the value of the underlying assets of the fund. This value may fluctuate according to the performance of the investments concerned. The answer is C.

Incorrect

Investment-linked insurance policies are insurance policies with its policy value directly linked to the performance of its underlying investment. The value of the units is directly related to the value of the underlying assets of the fund. This value may fluctuate according to the performance of the investments concerned. The answer is C.

Hint

References:1.2.

-

Question 46 of 64

46. Question

1 pointsQID61:All investment-linked policies have to obtain authorisation from which of

the following organisations if they are sold to the general investing public?Correct

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Hint

References:1.2.

-

Question 47 of 64

47. Question

1 pointsQID60:Which of the following statements about investment-linked policies is true?

Correct

With the investment-linked policies, all the

investment risk is borne by the policyholder. The value of the investment-linked policy will fluctuate according to the value of the units allocated to it. The answer is A.Incorrect

With the investment-linked policies, all the

investment risk is borne by the policyholder. The value of the investment-linked policy will fluctuate according to the value of the units allocated to it. The answer is A.Hint

References:1.2.

-

Question 48 of 64

48. Question

1 pointsQID59:To sell a new investment-linked policy, the insurer must ensure that:

Correct

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Hint

References:1.2.

-

Question 49 of 64

49. Question

1 pointsQID58:Which of the following statements about investment-linked long term policies is/are true?

Correct

All the statements are true. The answer is D.

Incorrect

All the statements are true. The answer is D.

Hint

References:1.2.

-

Question 50 of 64

50. Question

1 pointsQID57:Which of the following is true about the traditional life insurance and annuities? i. Net premiums are invested in the company’s general investment

ii. The death benefit and cash value are

usually fixed and guaranteed

iii. The investment risk is borne by the policyholder

iv. Part of the incomes earned on the investment will be distributed to the policyholders and/or shareholders in the form of cash bonus/dividendsCorrect

With traditional life insurance and annuity policies, the insurance company assumes the investment risk. The other three options are true. The answer is D.

Incorrect

With traditional life insurance and annuity policies, the insurance company assumes the investment risk. The other three options are true. The answer is D.

Hint

References:1.2.

-

Question 51 of 64

51. Question

1 pointsQID56:Authorisation has to be sought from the SFC if the investment-linked long term policies are going to be sold to the general investing public in Hong Kong because:

Correct

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Hint

References:1.2.

-

Question 52 of 64

52. Question

1 pointsQID55:Which of the following statements about investment-linked policies is true?

i. The policy value is directly linked to the performance of the relevant investment

ii. All or part of the premiums will be used to purchase units of the fund

iii. The death benefit of the policy is generally fixed and guaranteed

iv. The value of the policy will then fluctuate according to the value of the units allocated to itCorrect

For the investment-linked insurance policies, the policy value, death benefit or annuity payment amounts will vary depending on the performance of these investment fund accounts. The answer is A.

Incorrect

For the investment-linked insurance policies, the policy value, death benefit or annuity payment amounts will vary depending on the performance of these investment fund accounts. The answer is A.

Hint

References:1.2.

-

Question 53 of 64

53. Question

1 pointsQID62:Which of the following statements about the Securities and Futures Ordinance is true?

i. Authorisation has to be sought from the SFC if the policies are sold to the general investing public

ii. The SFC may take action against violators of the Ordinance

iii. Investment-linked policies are collective investment schemes

iv. The SFC may make an order to indemnify investors who have suffered losses as a result of the contravention of the OrdinanceCorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is A.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is A.

Hint

References:1.2.

-

Question 54 of 64

54. Question

1 pointsQID53:Which of the following is the correct description of traditional life insurance and annuities?

Correct

All the statements about traditional life insurance and annuities are true. The answer is D.

Incorrect

All the statements about traditional life insurance and annuities are true. The answer is D.

Hint

References:1.2.

-

Question 55 of 64

55. Question

1 pointsQID52:Which of the following statements relates to traditional life insurance and annuity policies rather than investment-linked policies?

Correct

With traditional life insurance and annuity policies, the insurance company assumes the investment risk. With the investment-linked policies, all the investment risk is borne by the policyholder. The answer is B.

Incorrect

With traditional life insurance and annuity policies, the insurance company assumes the investment risk. With the investment-linked policies, all the investment risk is borne by the policyholder. The answer is B.

Hint

References:1.2.

-

Question 56 of 64

56. Question

1 pointsQID51:What is the policy that the insurer assumes all the investment risks related to the policy?

Correct

With traditional life insurance policies, the insurance company assumes the investment risk. The answer is A.

Incorrect

With traditional life insurance policies, the insurance company assumes the investment risk. The answer is A.

Hint

References:1.2.

-

Question 57 of 64

57. Question

1 pointsQID49:What are the features of investment-linked policies?

Correct

The investment-linked insurance policies allow investment gains to be passed through to the policyholders, but it also means that investment losses are borne by the

policyholders. The answer is D.Incorrect

The investment-linked insurance policies allow investment gains to be passed through to the policyholders, but it also means that investment losses are borne by the

policyholders. The answer is D.Hint

References:1.2.

-

Question 58 of 64

58. Question

1 pointsQID47:Before launching a new investment-linked product, the insurer has to ensure that:

Correct

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is C.

Incorrect

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is C.

Hint

References:1.2.

-

Question 59 of 64

59. Question

1 pointsQID46:Under the Securities and Futures Ordinance, before the investment-linked policies are sold to the general investing public, authorisation has to be sought from the:

Correct

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Incorrect

As the investment-linked policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Hint

References:1.2.

-

Question 60 of 64

60. Question

1 pointsQID45:Which of the following statements about the features of investment-linked policies is/are incorrect?

Correct

The investment-linked insurance policies allow investment gains to be passed through to the policyholders, but it also means that investment losses are borne by the

policyholders. The answer is B.Incorrect

The investment-linked insurance policies allow investment gains to be passed through to the policyholders, but it also means that investment losses are borne by the

policyholders. The answer is B.Hint

References:1.2.

-

Question 61 of 64

61. Question

1 pointsQID44:Which of the following describes the characterizes of traditional endowment insurance not the investment-linked life insurance?

Correct

Under the traditional life policies and annuities, the insurance company assumes the investment risk. However, for the investment-linked insurance policies, all the investment risk is borne by the policyholder. The answer is A.

Incorrect

Under the traditional life policies and annuities, the insurance company assumes the investment risk. However, for the investment-linked insurance policies, all the investment risk is borne by the policyholder. The answer is A.

Hint

References:1.2.

-

Question 62 of 64

62. Question

1 pointsQID50:Compared with investment-linked policies, traditional life insurance is generally:

Correct

With traditional life insurance and annuity policies, net premiums (i.e. premiums net of the insurer’s costs of doing business) once paid will become part of the company’s general investments. The death benefit and cash value of these policies are usually fixed and guaranteed. Under these types of policies, the insurance company assumes the investment risk. The answer is D.

Incorrect

With traditional life insurance and annuity policies, net premiums (i.e. premiums net of the insurer’s costs of doing business) once paid will become part of the company’s general investments. The death benefit and cash value of these policies are usually fixed and guaranteed. Under these types of policies, the insurance company assumes the investment risk. The answer is D.

Hint

References:1.2.

-

Question 63 of 64

63. Question

1 pointsQID64:Investment-linked long term policies have the features of non-participating policies and participating policies, namely:

Correct

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is B.

Hint

References:1.2.4.11

-

Question 64 of 64

64. Question

1 pointsQID63:Under the Securities and Futures Ordinance, the investment-linked life policies are:

Correct

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is D.

Incorrect

As the investment-linked long term policies are considered collective investment schemes under the definition provided for in the “Securities and Futures Ordinance” (Cap 571) authorisation has to be sought from the SFC if they are sold to the general investing public. The answer is D.

Hint

References:1.2.4.11

✎ Tutorial 操作方法

You can email your questions enquiry to our company email [email protected], please provide:

(1)Client email address which you used to purchase the book

(2)QID (題庫號)

(3)Subject of enquiry

(4)Your enquiry

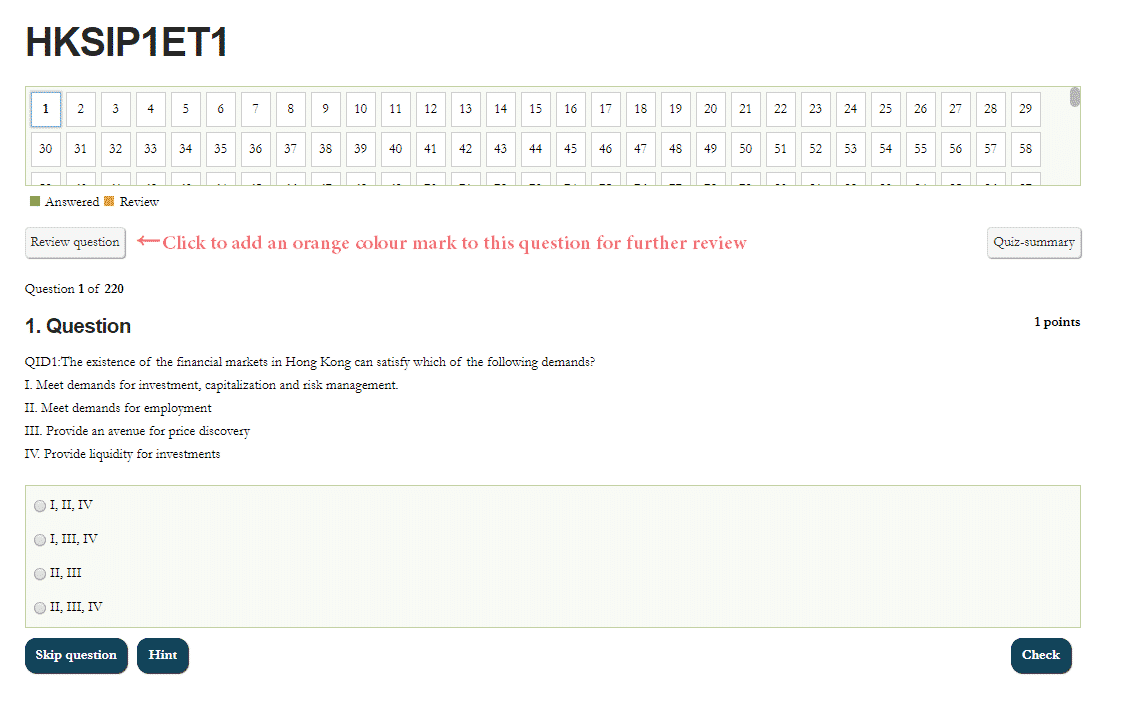

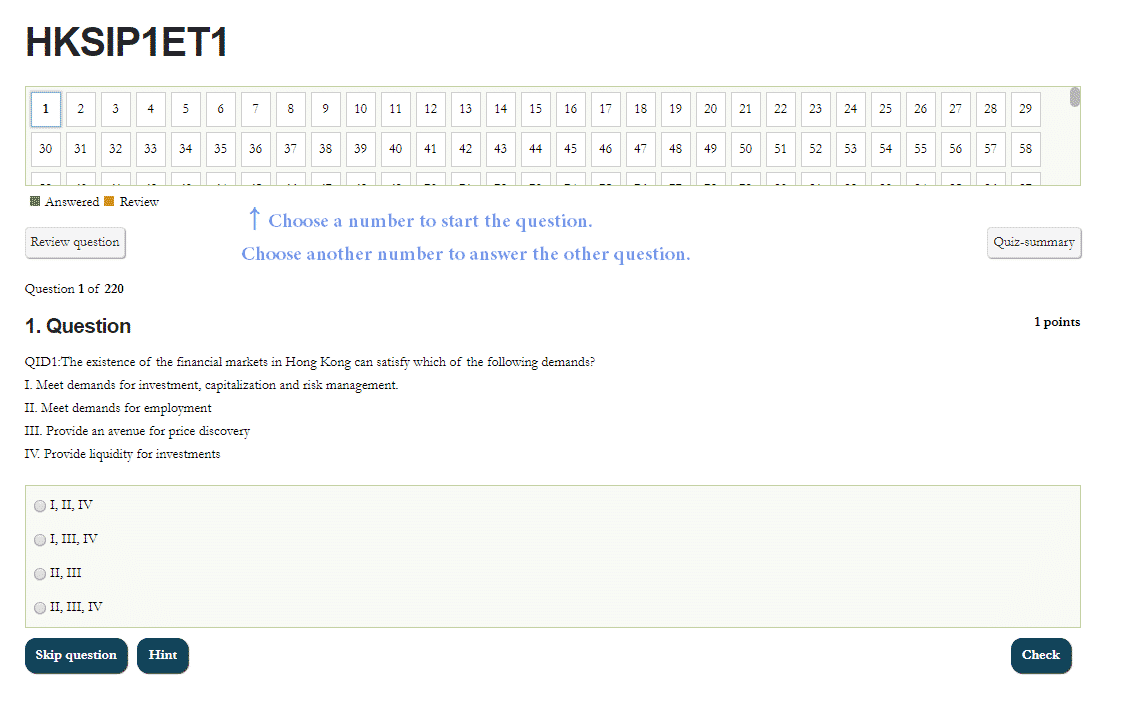

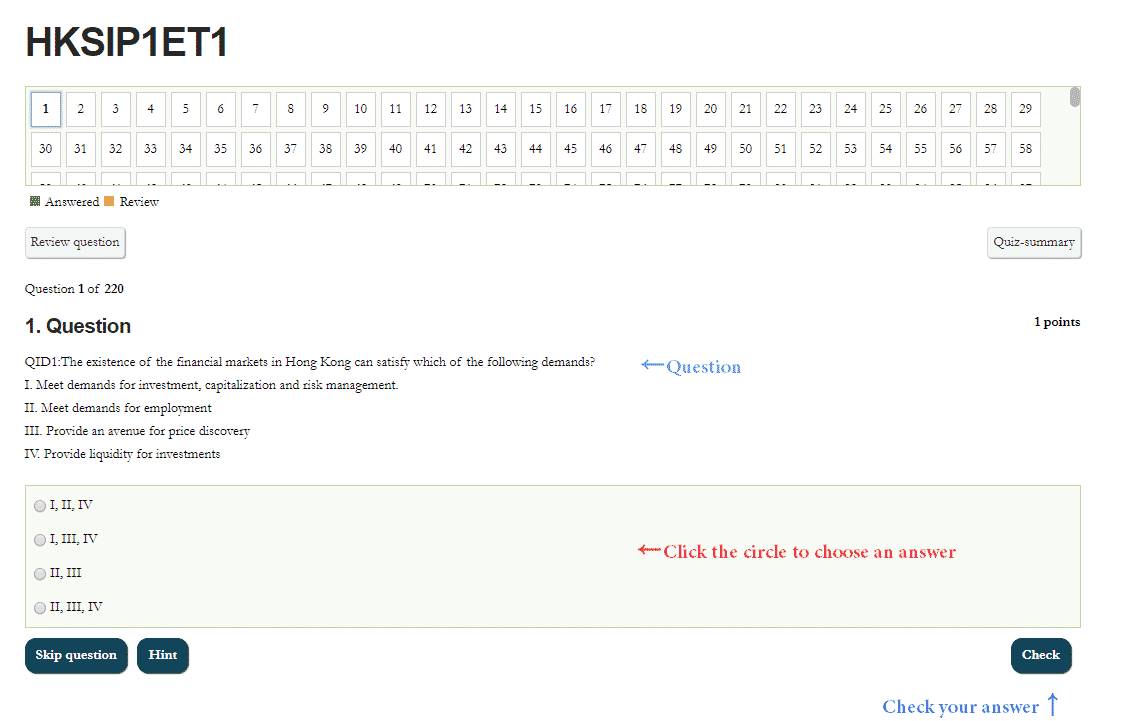

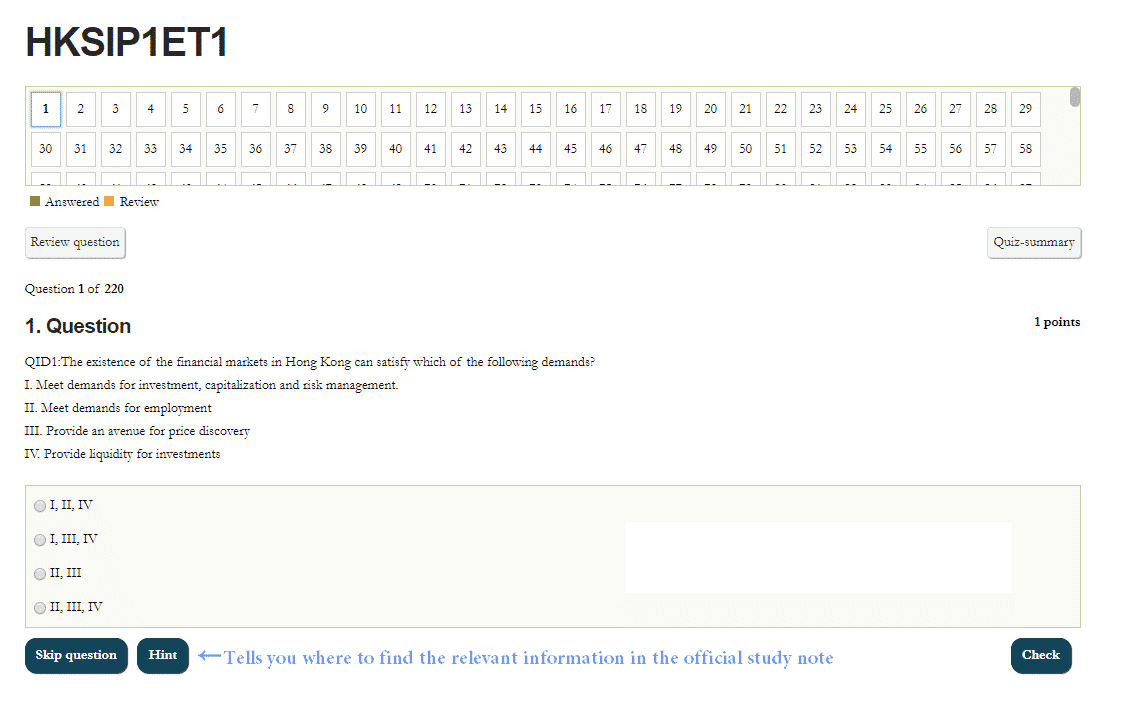

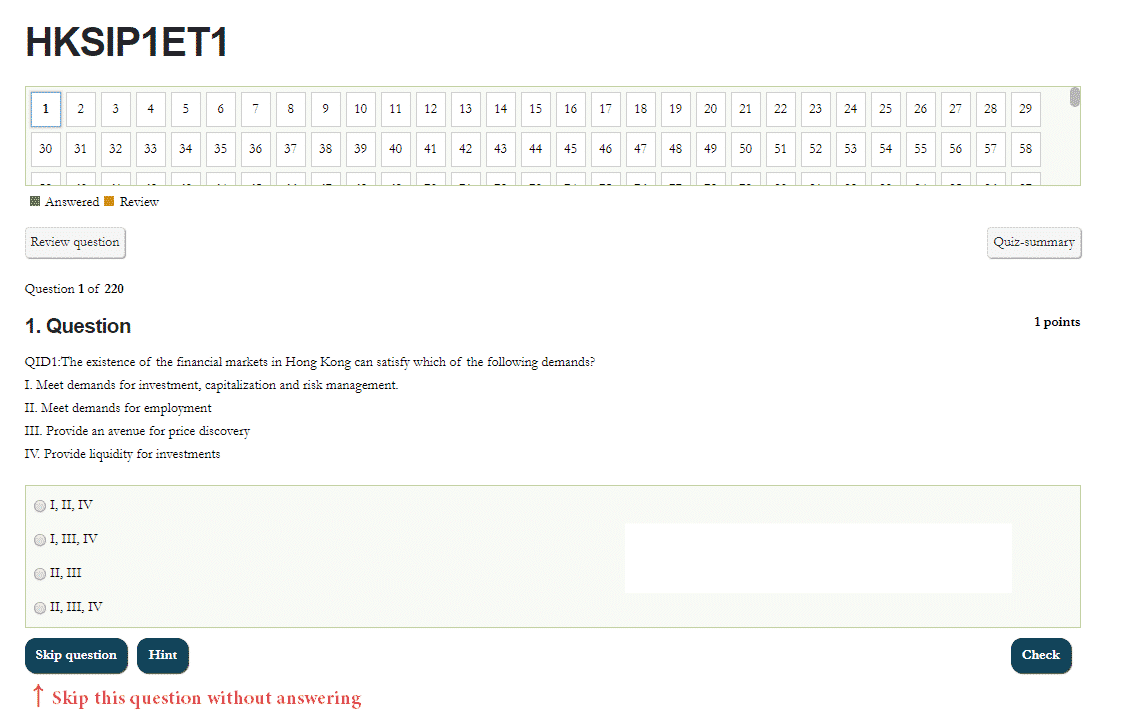

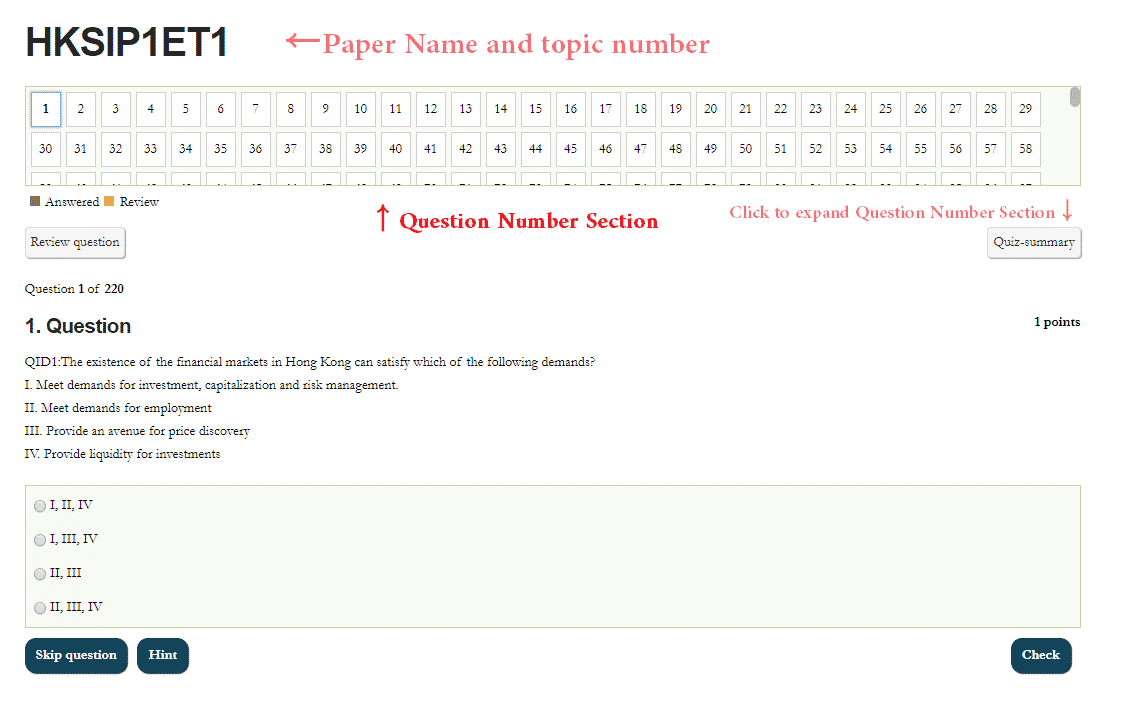

1. Quiz Summary:Expand the Question Number Section to see the colour marks of all the questions and the total number of questions in the topic

3. Review Question:Mark questions in orange colour so you can quickly find the question next time for studying/ testing again if necessary. Click once more to undo