English IIQE Paper 4 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

IIQEP4ET1

Quiz-summary

0 of 30 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

Information

IIQEP4ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 30 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic_1 0%

-

IIQEP4ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- Answered

- Review

-

Question 1 of 30

1. Question

1 pointsQID94:In 2064, the projected percentage of the population of Hong Kong aged 65 or above is?

Correct

In 2064, the projected percentage of the population of Hong Kong aged 65 or above is 36%. The answer is D.

Incorrect

In 2064, the projected percentage of the population of Hong Kong aged 65 or above is 36%. The answer is D.

Hint

References:1.2.

-

Question 2 of 30

2. Question

1 pointsQID1222:”Mandatory” in mandatory provident fund means:

Correct

“Mandatory” in mandatory provident fund means that both employers and employees are required to participate in. The answer is B.

Incorrect

“Mandatory” in mandatory provident fund means that both employers and employees are required to participate in. The answer is B.

Hint

References:1.2.

-

Question 3 of 30

3. Question

1 pointsQID95:It is predicted that, by 2064, the male and female life expectancy at birth will become?

Correct

It is predicted that, by 2064, the male and female life expectancy at birth will become 87.0 and 92.5 years respectively. The answer is D.

Incorrect

It is predicted that, by 2064, the male and female life expectancy at birth will become 87.0 and 92.5 years respectively. The answer is D.

Hint

References:1.2.

-

Question 4 of 30

4. Question

1 pointsQID6:Hong Kong’s ageing population is attributed to which of the following factors?

I. Increase in life expectancy

II. Decrease in migrant population

III. Increase in unemployment rate

IV. Lower fertility rateCorrect

Hong Kong’s ageing population is attributed to the combined effect of an increase in

life expectancy and lower fertility rate. The answer is C.Incorrect

Hong Kong’s ageing population is attributed to the combined effect of an increase in

life expectancy and lower fertility rate. The answer is C.Hint

References:1.2.

-

Question 5 of 30

5. Question

1 pointsQID11:Apart from longer life expectancy and lower fertility rate, which of the following factors contribute to Hong Kong’s ageing population?

Correct

In addition to an increase in life expectancy and lower fertility rate, Hong Kong’s ageing population can be attributed to the shrinking family size. The answer is A.

Incorrect

In addition to an increase in life expectancy and lower fertility rate, Hong Kong’s ageing population can be attributed to the shrinking family size. The answer is A.

Hint

References:1.2.

-

Question 6 of 30

6. Question

1 pointsQID1080:Which of the following statements are correct?

I. The MPF scheme was fully implemented in 1998

II. The Mandatory Provident Fund Scheme Ordinance was enacted in 1995

III. Members include self-employed persons and employees

IV. The employer is responsible for part of the employee’s contributionCorrect

In July 1995, the Mandatory Provident Fund Schemes Ordinance was passed by the

Legislative Council and supplemented by detailed subsidiary legislation in March 1998. The Mandatory Provident Fund Schemes Authority (MPFA), the statutory body charged with regulating and supervising MPF schemes, was set up in September 1998. The MPF System commenced operations in December 2000. The answer is B.Incorrect

In July 1995, the Mandatory Provident Fund Schemes Ordinance was passed by the

Legislative Council and supplemented by detailed subsidiary legislation in March 1998. The Mandatory Provident Fund Schemes Authority (MPFA), the statutory body charged with regulating and supervising MPF schemes, was set up in September 1998. The MPF System commenced operations in December 2000. The answer is B.Hint

References:1.3.

-

Question 7 of 30

7. Question

1 pointsQID13:When was the MPF System implemented?

Correct

The MPF System commenced operations in December 2000. The answer is D.

Incorrect

The MPF System commenced operations in December 2000. The answer is D.

Hint

References:1.3.

-

Question 8 of 30

8. Question

1 pointsQID14:The MPF System can be viewed as which pillar in the three-pillar framework?

Correct

The MPF System can be viewed as the second pillar in the three-pillar framework. The answer is B.

Incorrect

The MPF System can be viewed as the second pillar in the three-pillar framework. The answer is B.

Hint

References:1.4.

-

Question 9 of 30

9. Question

1 pointsQID10:The World Bank recommended which of the following approaches in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, do not include:

Correct

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, do not include mandatory personal savings and insurance. The answer is B.

Incorrect

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, do not include mandatory personal savings and insurance. The answer is B.

Hint

References:1.4.

-

Question 10 of 30

10. Question

1 pointsQID9:The World Bank recommended which of the following approaches in 1994 to address the issue of old-age protection?

Correct

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The answer is B.

Incorrect

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The answer is B.

Hint

References:1.4.

-

Question 11 of 30

11. Question

1 pointsQID278:In 2005, the World Bank had proposed a retirement protection framework. How many pillars are there in this framework?

Correct

In 2005, in the light of operational experience, the World Bank expanded the

three-pillar framework into a five-pillar framework. The answer is D.Incorrect

In 2005, in the light of operational experience, the World Bank expanded the

three-pillar framework into a five-pillar framework. The answer is D.Hint

References:1.4.

-

Question 12 of 30

12. Question

1 pointsQID8:The World Bank recommended which of the following approaches in 1994 to address the issue of old-age protection?

Correct

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The answer is B.

Incorrect

The World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The answer is B.

Hint

References:1.4.

-

Question 13 of 30

13. Question

1 pointsQID7:With reference to the retirement protection systems in many countries, the World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, should serve the goal of:

Correct

With reference to the retirement protection systems in many countries, the World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, should serve the goal of old age protection. The answer is A.

Incorrect

With reference to the retirement protection systems in many countries, the World Bank recommended a three-pillar approach in 1994 to address the issue of old-age protection. The three pillars, as proposed at that time, should serve the goal of old age protection. The answer is A.

Hint

References:1.4.

-

Question 14 of 30

14. Question

1 pointsQID12:In 2005, the World Bank expanded the three-pillar framework into a five-pillar framework by adding two pillars. One of the pillars is?

Correct

In 2005, the World Bank expanded the three-pillar framework into a five-pillar framework by adding two pillars:

I. informal support, other formal social programmes, and other individual assets

II. a non-contributory, publicly-financed and managed system that provides a minimal level of protection for retirement.The answer is D.

Incorrect

In 2005, the World Bank expanded the three-pillar framework into a five-pillar framework by adding two pillars:

I. informal support, other formal social programmes, and other individual assets

II. a non-contributory, publicly-financed and managed system that provides a minimal level of protection for retirement.The answer is D.

Hint

References:1.4.

-

Question 15 of 30

15. Question

1 pointsQID96:Under the three-pillar framework for retirement protection proposed by the World Bank in 1994, which pillar does the MPF belong to?

Correct

MPF belongs to Pillar Two of the three-pillar approach. The answer is C.

Incorrect

MPF belongs to Pillar Two of the three-pillar approach. The answer is C.

Hint

References:1.4.

-

Question 16 of 30

16. Question

1 pointsQID274:In 1994, the second pillar of World Bank’s three-pillar framework is:

Correct

In 1994, the second pillar of World Bank’s three-pillar framework is a mandatory, privately-managed, fully-funded contribution scheme. The answer is D.

Incorrect

In 1994, the second pillar of World Bank’s three-pillar framework is a mandatory, privately-managed, fully-funded contribution scheme. The answer is D.

Hint

References:1.4.

-

Question 17 of 30

17. Question

1 pointsQID276:World Bank’s three-pillar framework includes?

I. Social safety net

II. Mandatory provident fund

III. Personal savings

IV. Mandatory personal savings and insuranceCorrect

World Bank’s three-pillar framework includes a publicly-financed and managed social safety net; a mandatory, privately-managed, fully-funded contribution scheme; and voluntary personal savings. The answer is C.

Incorrect

World Bank’s three-pillar framework includes a publicly-financed and managed social safety net; a mandatory, privately-managed, fully-funded contribution scheme; and voluntary personal savings. The answer is C.

Hint

References:1.4.

-

Question 18 of 30

18. Question

1 pointsQID3:Before MPF was implemented, what proportion of the Hong Kong employed population was covered by any sort of retirement protection?

Correct

Before MPF was implemented, one-third proportion of the Hong Kong employed population was covered by any sort of retirement protection. The answer is A.

Incorrect

Before MPF was implemented, one-third proportion of the Hong Kong employed population was covered by any sort of retirement protection. The answer is A.

Hint

References:1.5(a).

-

Question 19 of 30

19. Question

1 pointsQID18:Under the MPF System, who is responsible for selecting MPF trustee(s)?

Correct

Under the MPF System, employers are responsible for selecting MPF trustee(s). The answer is B.

Incorrect

Under the MPF System, employers are responsible for selecting MPF trustee(s). The answer is B.

Hint

References:1.5(b).

-

Question 20 of 30

20. Question

1 pointsQID92:MPF schemes are managed by?

Correct

MPF schemes are managed by private entities. The answer is C.

Incorrect

MPF schemes are managed by private entities. The answer is C.

Hint

References:1.5(d).

-

Question 21 of 30

21. Question

1 pointsQID4:Before MPF was implemented, out of the 3 million working population in Hong Kong, what proportion of the Hong Kong employed population was not covered by any sort of retirement protection?

Correct

Before MPF was implemented, out of the 3 million working population in Hong Kong, two-third of the Hong Kong employed population was not covered by any sort of retirement protection. The answer is C.

Incorrect

Before MPF was implemented, out of the 3 million working population in Hong Kong, two-third of the Hong Kong employed population was not covered by any sort of retirement protection. The answer is C.

Hint

References:1.5.

-

Question 22 of 30

22. Question

1 pointsQID1:Hong Kong has been facing the challenge of an ageing population. According to the Census and Statistics Department, the proportion of the population aged 65 and over for the year 2064 is projected to rise to what percentage of the overall population?

Correct

Hong Kong has been facing the challenge of an ageing population. According to the Census and Statistics Department, the proportion of the population aged 65 and over for the year 2064 is projected to rise to 36% of the overall population. The answer is C.

Incorrect

Hong Kong has been facing the challenge of an ageing population. According to the Census and Statistics Department, the proportion of the population aged 65 and over for the year 2064 is projected to rise to 36% of the overall population. The answer is C.

Hint

References:1.5.

-

Question 23 of 30

23. Question

1 pointsQID17:As at 31 December 2015, what percentage of Hong Kong’s employed population (about 3.2 million) were covered by the MPF System or some other forms of retirement schemes?

Correct

As at 31 December 2015, 85% of Hong Kong’s employed population (about 3.2 million) were covered by the MPF System or some other forms of retirement schemes. The answer is C.

Incorrect

As at 31 December 2015, 85% of Hong Kong’s employed population (about 3.2 million) were covered by the MPF System or some other forms of retirement schemes. The answer is C.

Hint

References:1.5.

-

Question 24 of 30

24. Question

1 pointsQID86:Under the MPF System, which of the following individuals or entities are required to make regular mandatory contributions?

I. Employees

II. Employers

III. MPFA

IV. MPF IntermediariesCorrect

The MPF System is a mandatory system. Except for exempt persons, all relevant

employers, relevant employees and self-employed persons are required to join MPF. The answer is A.Incorrect

The MPF System is a mandatory system. Except for exempt persons, all relevant

employers, relevant employees and self-employed persons are required to join MPF. The answer is A.Hint

References:1.5.

-

Question 25 of 30

25. Question

1 pointsQID93:Which of the following statements correctly describe the MPF System?

I. Employment-based

II. Mandatory participation

III. Defined contribution

IV. Privately-managedCorrect

All the statements are true. The answer is D.

Incorrect

All the statements are true. The answer is D.

Hint

References:1.5.

-

Question 26 of 30

26. Question

1 pointsQID97:Which three of the following are the key characteristics of the MPF System?

I. Employment-based

II. Fully-funded

III. Privately-managed

IV. Defined benefitCorrect

The key characteristics of the MPF System are mandatory participation, employment-based, defined contribution, privately-managed, and fully-funded. The answer is A.

Incorrect

The key characteristics of the MPF System are mandatory participation, employment-based, defined contribution, privately-managed, and fully-funded. The answer is A.

Hint

References:1.5.

-

Question 27 of 30

27. Question

1 pointsQID15:The MPF System is

I. Mandatory

II. Employment-based

III. Privately managed

IV. Defined contributionCorrect

The MPF System is a mandatory, privately-managed, employment-based, fully-funded contribution system. The answer is D.

Incorrect

The MPF System is a mandatory, privately-managed, employment-based, fully-funded contribution system. The answer is D.

Hint

References:1.5.

-

Question 28 of 30

28. Question

1 pointsQID2:Before MPF was implemented, what proportion of the Hong Kong employed population was not covered by any sort of retirement protection?

Correct

Before MPF was implemented, two-third proportion of the Hong Kong employed population was not covered by any sort of retirement protection. The answer is A.

Incorrect

Before MPF was implemented, two-third proportion of the Hong Kong employed population was not covered by any sort of retirement protection. The answer is A.

Hint

References:1.5.(a)

-

Question 29 of 30

29. Question

1 pointsQID19:Under the MPF System, which of the following choose among the funds offered by the scheme(s) chosen by the employers?

Correct

Under the MPF System, employees choose among the funds offered by the scheme(s) chosen by the employers. The answer is A.

Incorrect

Under the MPF System, employees choose among the funds offered by the scheme(s) chosen by the employers. The answer is A.

Hint

References:1.5.b

-

Question 30 of 30

30. Question

1 pointsQID91:The amount of accrued benefits accumulated in the scheme member’s account depends on which of the following factors?

I. Hong Kong Dollar interest rate

II. Amount contributed

III. Investment return

IV. Government subsidiesCorrect

The amount of accrued benefits accumulated in the scheme member’s account depends on the amount contributed to the scheme and the

investment return thereon. The answer is B.Incorrect

The amount of accrued benefits accumulated in the scheme member’s account depends on the amount contributed to the scheme and the

investment return thereon. The answer is B.Hint

References:1.5©.

✎ Tutorial 操作方法

You can email your questions enquiry to our company email [email protected], please provide:

(1)Client email address which you used to purchase the book

(2)QID (題庫號)

(3)Subject of enquiry

(4)Your enquiry

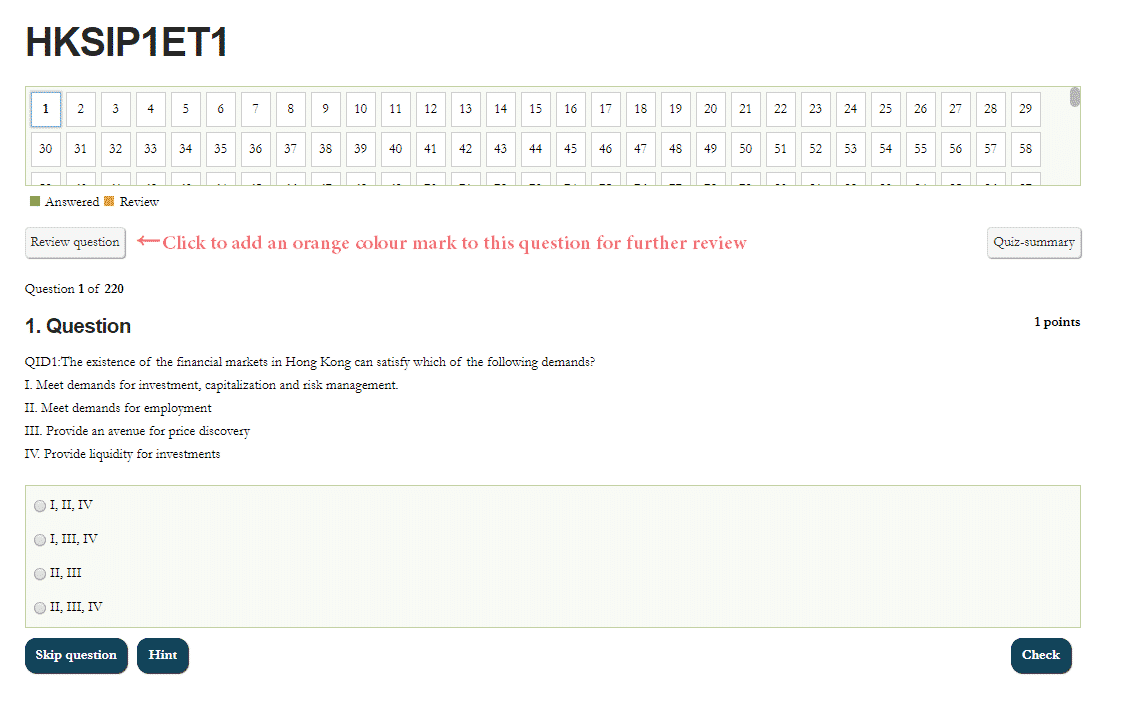

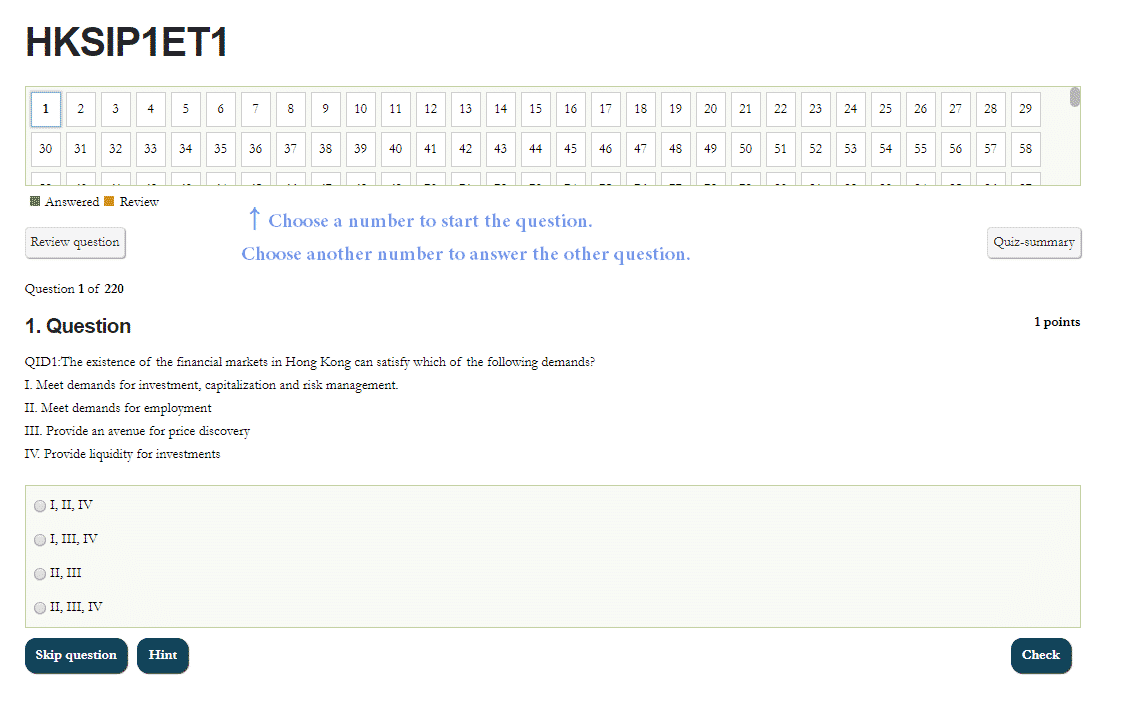

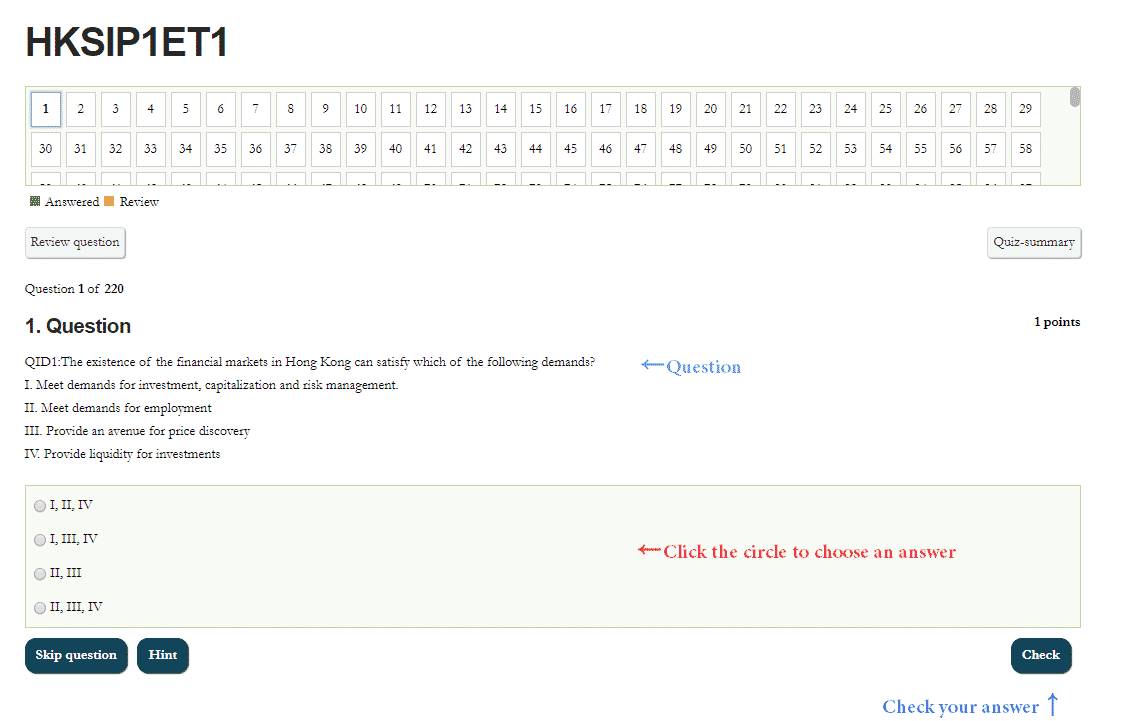

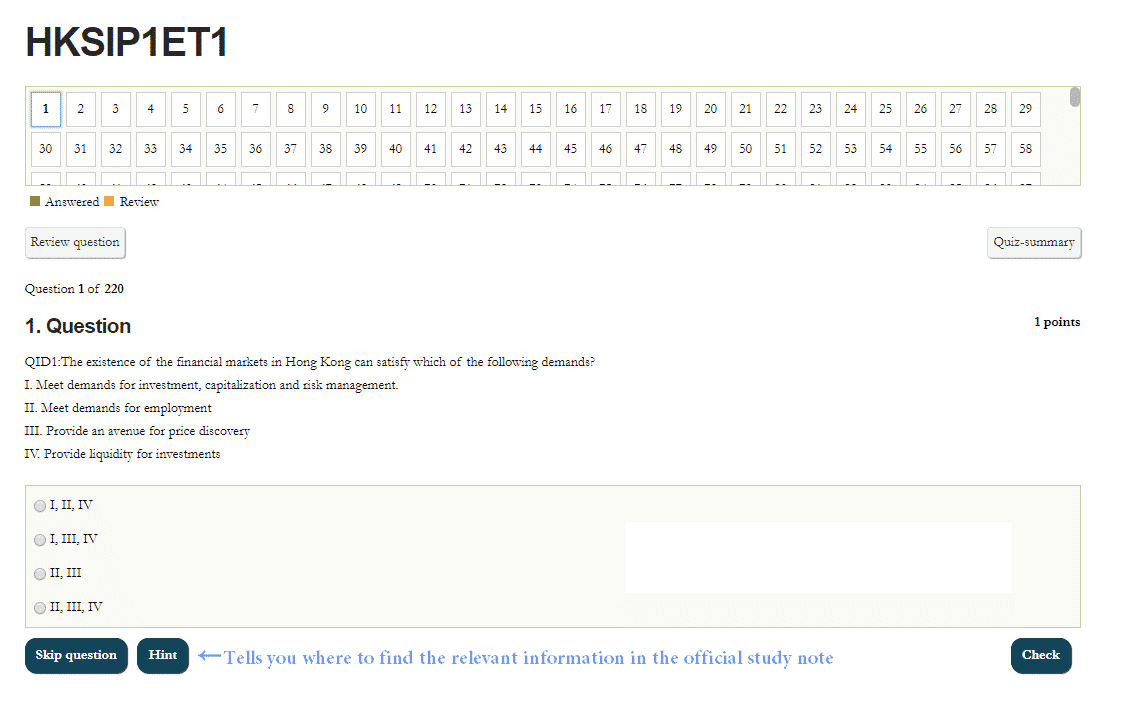

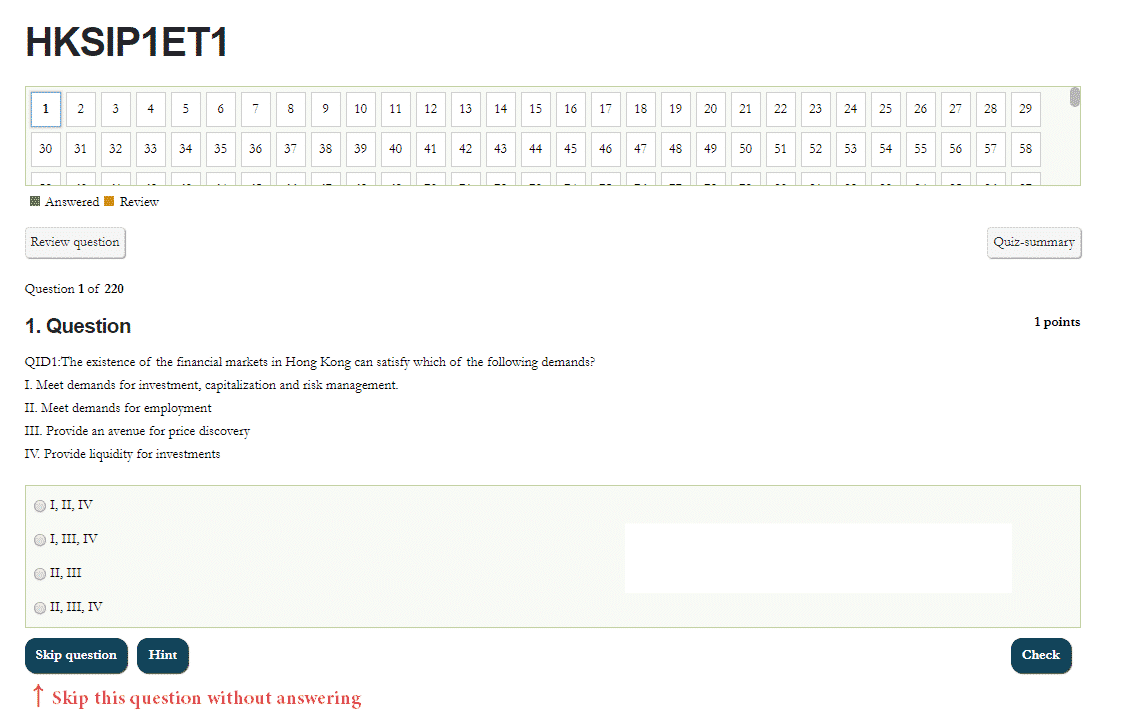

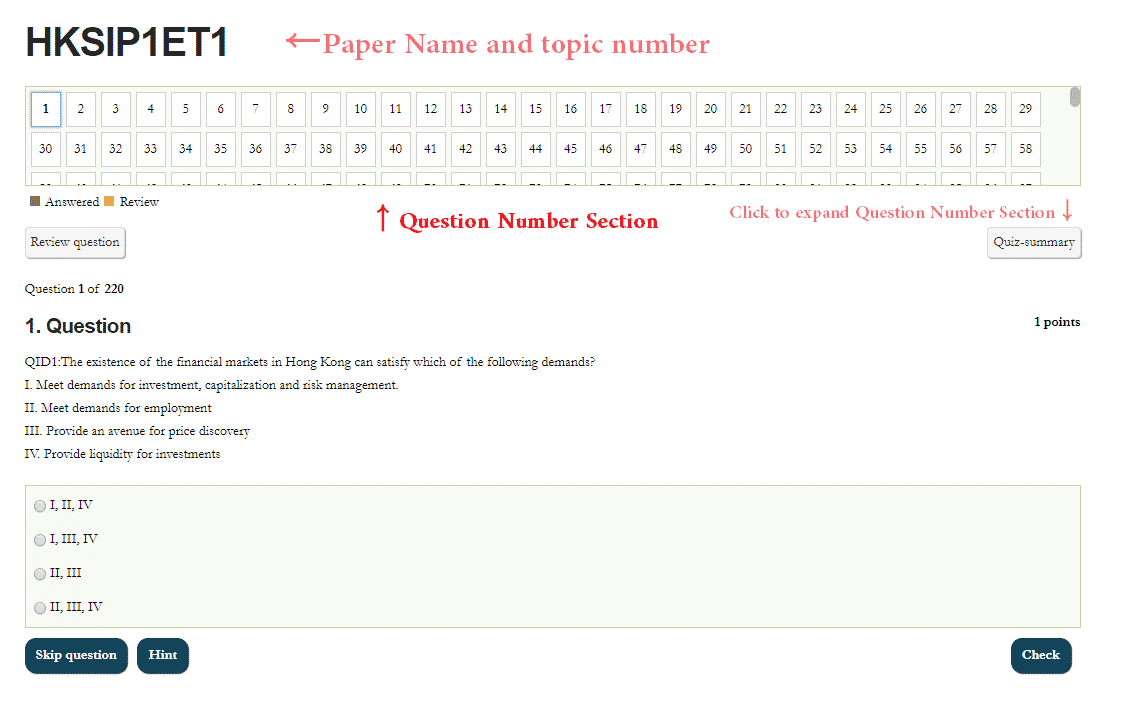

1. Quiz Summary:Expand the Question Number Section to see the colour marks of all the questions and the total number of questions in the topic

3. Review Question:Mark questions in orange colour so you can quickly find the question next time for studying/ testing again if necessary. Click once more to undo