英文證券卷三 HKSI Paper 3 第一章

This post is also available in: 繁體中文 English (英語)

HKSIP3ET1

測驗概述

已完成 0/108 個問題

問題:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

資訊

HKSIP3ET1

您已完成過測驗,因此您不能再測驗。

測驗載入中...

您必須登入或註冊才能開始測驗。

您必須先完成以下測驗才能開始:

百分比

答對 0/108 個問題

答題時間:

時間已花費

您獲得 0/0 分數 (0)

| 平均分數 |

|

| 您的成績 |

|

類別

- Topic 1 0%

-

HKSIP3ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 已答

- 回顧

-

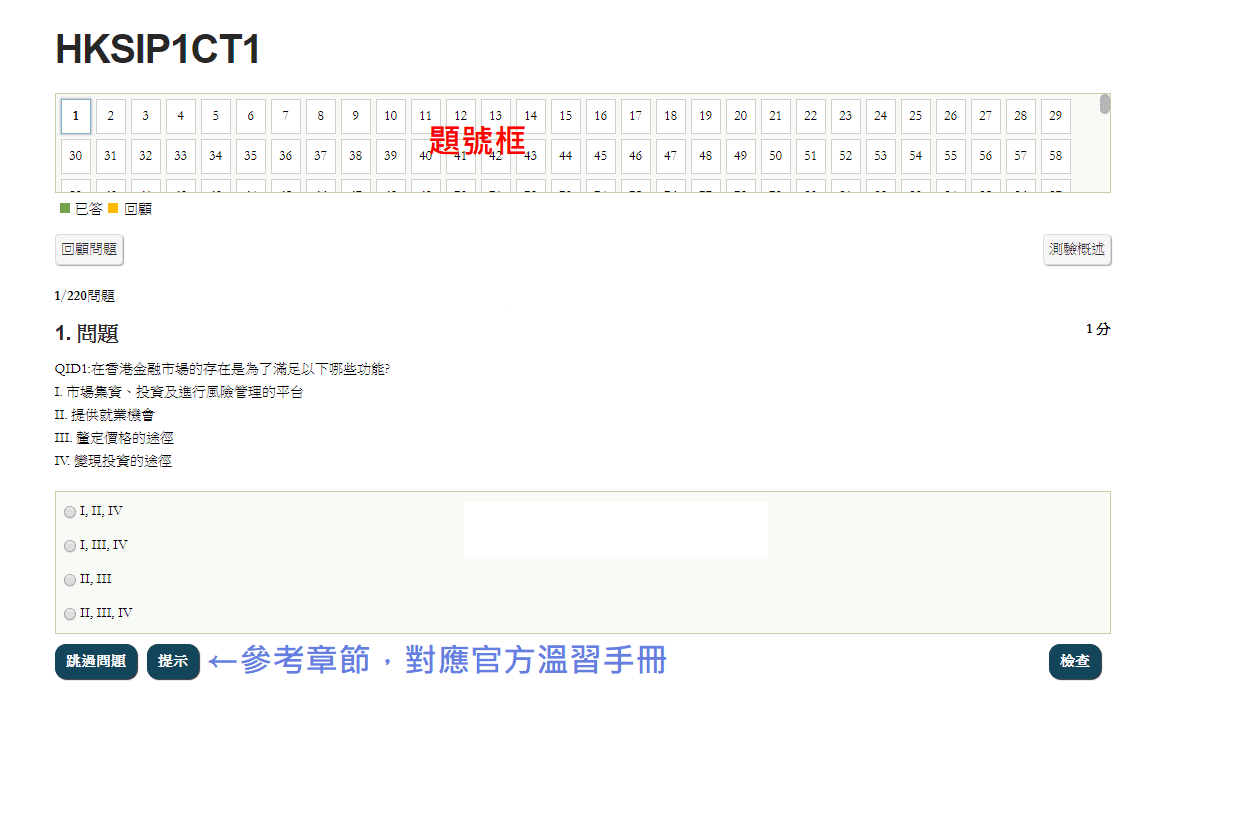

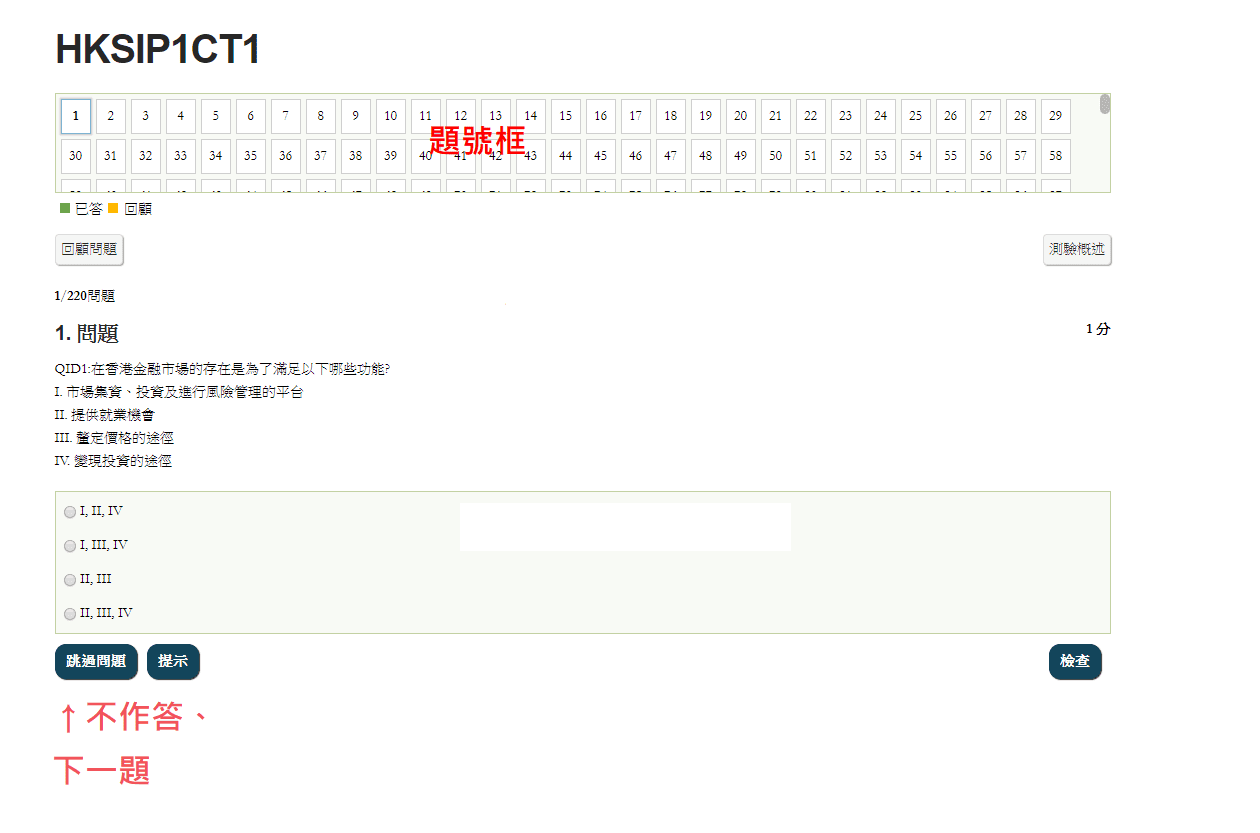

1/108問題

1. 問題

1 分QID835:Which of the following is not a derivative/ structural product of company A?

正確

Answer A is not an structured product since the return of none of them is tied to the other in any way.

錯誤

Answer A is not an structured product since the return of none of them is tied to the other in any way.

提示

Reference Chapter:1.1.1

-

2/108問題

2. 問題

1 分QID2396:Which of the following people can trade stock options directly?

正確

People who hold rights to trade and have registered to be participants of options exchanges can trade stock options directly. Although market participants have to be type 1 licensed corporations, type 1 licensed corporations don’t necessarily hold rights to trade and are registered as market participants.

錯誤

People who hold rights to trade and have registered to be participants of options exchanges can trade stock options directly. Although market participants have to be type 1 licensed corporations, type 1 licensed corporations don’t necessarily hold rights to trade and are registered as market participants.

提示

Reference Chapter:1.1.4

-

3/108問題

3. 問題

1 分QID2724:Which of the following is not an objective of the Securities and Futures Ordinance?

正確

Objectives of the SFO:

I. Promoting fair, orderly and transparent markets

II. Build an advanced technological infrastructure that is flexible enough to accommodate new products and other new services

III. Regulators are highly transparent and accountable to stakeholders through a mechanism of checks and balancesPromoting cooperation among financial regulators around the world is not the goal of the SFO.

錯誤

Objectives of the SFO:

I. Promoting fair, orderly and transparent markets

II. Build an advanced technological infrastructure that is flexible enough to accommodate new products and other new services

III. Regulators are highly transparent and accountable to stakeholders through a mechanism of checks and balancesPromoting cooperation among financial regulators around the world is not the goal of the SFO.

提示

Reference Chapter:1.2.1

-

4/108問題

4. 問題

1 分QID186:Which of the following descriptions about the single license regime is correct?

正確

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

錯誤

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

提示

Reference Chapter:1.2.15

-

5/108問題

5. 問題

1 分QID187:Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the

正確

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

錯誤

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

提示

Reference Chapter:1.2.15

-

6/108問題

6. 問題

1 分QID228:If an AFI wishes to conduct regulated activities as defined by the SFO, which of the following entities should it approach for it to be licensed or registered?

正確

AFIs (including banks) that are authorised and regulated by the HKMA and conduct the SFC regulated activities must be registered with the SFC as “Registered Institutions”, such status having been set up as a special category because of the special features of AFIs.

錯誤

AFIs (including banks) that are authorised and regulated by the HKMA and conduct the SFC regulated activities must be registered with the SFC as “Registered Institutions”, such status having been set up as a special category because of the special features of AFIs.

提示

Reference Chapter:1.2.18

-

7/108問題

7. 問題

1 分QID33:British Construction Bank is an AFI regulated by the HKMA. Which of the following entities is responsible for supervising the regulated activities it conducts under the SFO?

正確

The HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered

institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime.錯誤

The HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered

institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime.提示

Reference Chapter:1.2.18

-

8/108問題

8. 問題

1 分QID32:Which of the following descriptions are correct?

I. All banks in Hong Kong are supervised by the SFC.

II. Some of the activities conducted by registered institutions are regulated by the SFO.

III. A memorandum of understanding (“MOU”) has been signed between the SFC and the HKMA to minimize regulatory overlaps.

IV. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. Clearly, the HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.

錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. Clearly, the HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.

提示

Reference Chapter:1.2.18

-

9/108問題

9. 問題

1 分QID31:Which of the following is the regulator of Authorised Financial

Institutions?正確

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.

錯誤

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.

提示

Reference Chapter:1.2.18

-

10/108問題

10. 問題

1 分QID30:Which of the following is the regulator of Registered Institutions?

正確

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.錯誤

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.提示

Reference Chapter:1.2.18

-

11/108問題

11. 問題

1 分QID28:Which entity is the frontline regulator of registered institution that conducts regulated activity as defined by the SFO?

正確

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections.

錯誤

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections.

提示

Reference Chapter:1.2.18

-

12/108問題

12. 問題

1 分QID341:A person engaging in any activity regulated by the SFO, which includes asset management, will need to be licensed by the

正確

Any person that wish to conduct a regulated activity must be licensed by the SFC.

錯誤

Any person that wish to conduct a regulated activity must be licensed by the SFC.

提示

Reference Chapter:1.2.18

-

13/108問題

13. 問題

1 分QID25:British Construction Bank is an authorised financial institution (AFI). Due to the rapid development of the securities markets, the company plans to provide securities trading services to its customer. How should the company proceed?

正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as

registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as

registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.提示

Reference Chapter:1.2.18

-

14/108問題

14. 問題

1 分QID29:Which of the following descriptions about Authorised Financial

Institutions (AFI) are true?

I. All Registered Institutions are banks.

II. If the AFIs are conducting the regulated activities as defined by the SFO, the AFIs should register with the SFC.

III. SFC is responsible for licensing AFIs for all businesses

IV. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFC正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFC, which may directly review those institutions.

錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFC, which may directly review those institutions.

提示

Reference Chapter:1.2.18

-

15/108問題

15. 問題

1 分QID24:If an AFI plans to conduct regulated activities as defined by the SFO, which of the following entities should it register with ?

正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

提示

Reference Chapter:1.2.18

-

16/108問題

16. 問題

1 分QID23:British Construction Bank is an AFI regulated by the HKMA. If it plans to conduct Type 9 Regulated Activity (Asset Management) in the near future, how should it proceed?

正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

提示

Reference Chapter:1.2.18

-

17/108問題

17. 問題

1 分QID232:If an Authorised Financial Institution wishes to conduct regulated activities as defined by the SFO, which of the following entities should oversee its operation?

正確

AFIs (including banks) that are authorised and regulated by the HKMA and conduct the SFC regulated activities must be registered with the SFC as “Registered Institutions”, such status having been set up as a special category because of the special features of AFIs. They are jointly regulated by the HKMA and the SFC, with the HKMA being the front-line regulator that will apply all SFC regulatory criteria, including fitness and properness and business conduct, other than capital adequacy, the handling of client money and the audit requirements in supervising them.

錯誤

AFIs (including banks) that are authorised and regulated by the HKMA and conduct the SFC regulated activities must be registered with the SFC as “Registered Institutions”, such status having been set up as a special category because of the special features of AFIs. They are jointly regulated by the HKMA and the SFC, with the HKMA being the front-line regulator that will apply all SFC regulatory criteria, including fitness and properness and business conduct, other than capital adequacy, the handling of client money and the audit requirements in supervising them.

提示

Reference Chapter:1.2.18

-

18/108問題

18. 問題

1 分QID176:Which of the following institutions is required to become a “registered institution”?

正確

The provisions of the SFO have different applications to the following different classes of person:

(b) “registered institution”, which refers to authorised financial institutions (“AFIs”) directly supervised by the Hong Kong Monetary Authority (“HKMA”) and registered with the SFC.錯誤

The provisions of the SFO have different applications to the following different classes of person:

(b) “registered institution”, which refers to authorised financial institutions (“AFIs”) directly supervised by the Hong Kong Monetary Authority (“HKMA”) and registered with the SFC.提示

Reference Chapter:1.2.18

-

19/108問題

19. 問題

1 分QID26:British Construction Bank is an authorised financial institution. Amid the downfall of the Hong Kong banking sector, it would like to sell fund products of other companies to clients to generate revenue. Where should British Construction Bank apply for a license?

正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.提示

Reference Chapter:1.2.18

-

20/108問題

20. 問題

1 分QID27:Which of the following descriptions about intermediaries are correct?

I. Licensed Corporations are licensed by and supervised by the SFC.

II. Authorised Financial Institutions must register with the SFC in order to conduct regulated activities.

III. Registered Institutions need to comply with some of the codes and guidelines issued by the SFC.

IV. Registered Institutions need to be registered with the company registry.正確

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.錯誤

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.提示

Reference Chapter:1.2.18

-

21/108問題

21. 問題

1 分QID742:Which of the following is the objective of creating the SFO?

正確

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances; and

(d) is on a par with international standards and compatible with international practices, but tailored to meet local needs and circumstances.錯誤

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances; and

(d) is on a par with international standards and compatible with international practices, but tailored to meet local needs and circumstances.提示

Reference Chapter:1.2.2

-

22/108問題

22. 問題

1 分QID258:Which of the following is the purpose of establishing a capital requirement?

正確

The regulator must ensure that a licensed corporation has enough capital within the corporation (or available to it from external sources):

(a) to support the level of its business activities.錯誤

The regulator must ensure that a licensed corporation has enough capital within the corporation (or available to it from external sources):

(a) to support the level of its business activities.提示

Reference Chapter:1.2.22

-

23/108問題

23. 問題

1 分QID190:The SFO has provided powers for the SFC to make detailed rules relating to which of the following?

I. Financial Resources

II. Handling of client money and other client assets

III. The keeping of accounts and records

IV. Auditing matters正確

The SFO grants the SFC powers to make detailed

rules relating to:

(a) their financial resources;

(b) the handling of client money and other client assets;

© the keeping of accounts and records; and

(d) auditing matters.錯誤

The SFO grants the SFC powers to make detailed

rules relating to:

(a) their financial resources;

(b) the handling of client money and other client assets;

© the keeping of accounts and records; and

(d) auditing matters.提示

Reference Chapter:1.2.23

-

24/108問題

24. 問題

1 分QID744:Which of the following individuals or entities should adhere to Securities and Futures (Accounts and Audit) Rules?

正確

The SFC has made the Accounts and Audit Rules specifying the form and contents of financial statements and other documents that licensed corporations and associated entities of intermediaries (both licensed corporations and registered institutions) should prepare and the content of auditors’ reports.

錯誤

The SFC has made the Accounts and Audit Rules specifying the form and contents of financial statements and other documents that licensed corporations and associated entities of intermediaries (both licensed corporations and registered institutions) should prepare and the content of auditors’ reports.

提示

Reference Chapter:1.2.23

-

25/108問題

25. 問題

1 分QID2754:For which of the following areas has the SFC not enacted subsidiary legislation?

正確

The SFC mainly makes subsidiary legislation for the following areas:

1. Financial resources

2. Client Money

3. Client Securities

4. Accounts and Audit

5. Keeping records

6. Professional investors

7. Contract Notes錯誤

The SFC mainly makes subsidiary legislation for the following areas:

1. Financial resources

2. Client Money

3. Client Securities

4. Accounts and Audit

5. Keeping records

6. Professional investors

7. Contract Notes提示

Reference Chapter:1.2.26

-

26/108問題

26. 問題

1 分QID758:The Fit and proper guidelines of the SFO are more likely to apply to which of the following individuals or entities?

I. Company that’s applying for a license or registration.

II. Representative of company that’s applying for a license or registration.

III. Executive Director of company that’s applying for a license or registration.

IV. Professional Investor正確

The corporate (including its officers e.g. directors, managers, etc.) and individual applicants for licensing or registration have to satisfy fitness and properness requirements stated in the Fit and Proper Guidelines. These requirements apply to applicants and to licensed and registered persons on an ongoing basis. Compliance with the requirements will be monitored by the HKMA in the case of AFIs and their executive officers and staff, and by the SFC in the case of others.

錯誤

The corporate (including its officers e.g. directors, managers, etc.) and individual applicants for licensing or registration have to satisfy fitness and properness requirements stated in the Fit and Proper Guidelines. These requirements apply to applicants and to licensed and registered persons on an ongoing basis. Compliance with the requirements will be monitored by the HKMA in the case of AFIs and their executive officers and staff, and by the SFC in the case of others.

提示

Reference Chapter:1.2.28

-

27/108問題

27. 問題

1 分QID81:What kind of sanctions can the SFC impose on individuals who violate or breach the code and guidelines of the SFC?

I. Reprimand

II. Imprisonment

III. Suspension of licence

IV. Revocation of licence正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.

€ The SFC has the power to reprimand (privately or publicly), to fine and to suspend or revoke a licence or registration in relation to all or any part of the regulated activities specified on the licence or certificate of registration.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.

€ The SFC has the power to reprimand (privately or publicly), to fine and to suspend or revoke a licence or registration in relation to all or any part of the regulated activities specified on the licence or certificate of registration.提示

Reference Chapter:1.2.29

-

28/108問題

28. 問題

1 分QID80:What are the legal status of the Codes and Guidelines set by the

SFC?

I. They posses the force of law and is enforceable.

II. They do not posses the force of law and is not enforceable.

III. Breach of these codes and guidelines may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.

IV. Breach of these codes and guidelines are violations of the Securities and futures ordinance and can lead to imprisonment.正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.提示

Reference Chapter:1.2.29

-

29/108問題

29. 問題

1 分QID773:The SFC-issued codes, guidelines and guidance notes

正確

Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.

錯誤

Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.

提示

Reference Chapter:1.2.29

-

30/108問題

30. 問題

1 分QID82:Which of the following correctly describe the power of the SFC?

I. Breaches of the subsidiary legislations of the SFO are not criminal offences

II. Breaches of the subsidiary legislations of the SFO are criminal offences

III. The SFC may refer serious cases to law enforcement agencies such as the Commercial Crimes Bureau (“CCB”) of the Hong Kong Police Force or the Independent Commission Against Corruption (“ICAC”) for investigation and action.

IV. The SFC may also apply to the courts for an injunction to restrain a person from dealing with his assets, or from carrying on all or a part of his business, if the SFC can make a case to show that it is in the public interest to issue such an order.正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(a) Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken; the SFC may refer serious cases to law enforcement agencies such as the Commercial Crimes Bureau (“CCB”) of the Hong Kong Police Force or the Independent Commission Against Corruption (“ICAC”) for investigation and action.

(b) The SFC may also apply to the courts for an injunction to restrain a person from dealing with his assets, or from carrying on all or a part of his business, if it can make a case to show that it is in the public interest to issue such an order.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(a) Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken; the SFC may refer serious cases to law enforcement agencies such as the Commercial Crimes Bureau (“CCB”) of the Hong Kong Police Force or the Independent Commission Against Corruption (“ICAC”) for investigation and action.

(b) The SFC may also apply to the courts for an injunction to restrain a person from dealing with his assets, or from carrying on all or a part of his business, if it can make a case to show that it is in the public interest to issue such an order.提示

Reference Chapter:1.2.29

-

31/108問題

31. 問題

1 分QID83:Which of the following correctly describes the status of SFC’s code of conducts and guidelines?

正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.提示

Reference Chapter:1.2.29

-

32/108問題

32. 問題

1 分QID85:What is the legal status of codes and guidelines issued by the SFC?

I. Codes of conduct are subsidiary legislation and have the force of law.

II. Guidelines are subsidiary legislation and have the force of law.

III. Codes of conduct do not have the force of law, a breach does not by itself render a person liable to any judicial or other proceedings.

IV. Guidelines do not have the force of law, a breach does not by itself render a person liable to any judicial or other proceedings.正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines: (d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines: (d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.提示

Reference Chapter:1.2.29

-

33/108問題

33. 問題

1 分QID86:Which of the following correctly describes the legal status of the Securities and Futures Commission’s codes and guidelines?

正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines: (d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines: (d) Codes and guidelines do not have the force of law and are not legally enforceable.

However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.提示

Reference Chapter:1.2.29

-

34/108問題

34. 問題

1 分QID87:Under the provisions of the Securities and Futures Ordinance (SFO), which of the following statements relating to rules and codes of conduct are correct?

I. Failure by a licensed person to comply with a material provision of a code of conduct will of itself make the person liable to judicial proceedings.

II. A code of conduct violation shall be admissible as evidence in court proceedings.

III. The Securities and Futures Commission (SFC) is empowered under the SFO to make rules or codes of conduct.

IV. A breach of a provision in a code of conduct by a licensed person may cast doubts on his fitness and properness to hold the licence.正確

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(c) Persons prejudiced by the perpetration of market misconduct may take civil action against the wrongdoer through the courts to obtain redress. The SFO has provisions for the findings of the Market Misconduct Tribunal to be admissible in evidence in private civil actions.

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.錯誤

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes and guidelines:

(c) Persons prejudiced by the perpetration of market misconduct may take civil action against the wrongdoer through the courts to obtain redress. The SFO has provisions for the findings of the Market Misconduct Tribunal to be admissible in evidence in private civil actions.

(d) Codes and guidelines do not have the force of law and are not legally enforceable. However, the SFC is able to penalise licensed or registered persons breaching the codes and guidelines by applying the blanket principle that a breach of these may impugn the licensed or registered person’s fitness and properness to remain licensed or registered.提示

Reference Chapter:1.2.29

-

35/108問題

35. 問題

1 分QID819:If an intermediary has been convicted of violation of the SFO. How can the SFC sanction such intermediary?

I. Revoke or suspend approval as a responsible officer

II. Fines

III. Reprimand, publicly or privately

IV. Jail sentence正確

Section 194, SFO provides that if a “regulated person” is guilty of “misconduct”, or is not a fit and proper person, the SFC may:

(a) in the case of a licensed corporation or representative, revoke or suspend the licence in respect of all or part of the licensed regulated activity;

(b) in the case of a responsible officer (see section 1.3 of Topic 4 for the definition of this term), revoke or suspend approval as a responsible officer;

(c) publicly or privately reprimand the regulated person;

(d) prohibit the regulated person from applying for a licence, registration, approval as a responsible officer or entry in the HKMA register, or to act as an executive officer; and

(e) separately or in addition order the regulated person to pay a penalty up to the greater of HK$10 million or three times any profit gained or loss avoided as a result of his misconduct.錯誤

Section 194, SFO provides that if a “regulated person” is guilty of “misconduct”, or is not a fit and proper person, the SFC may:

(a) in the case of a licensed corporation or representative, revoke or suspend the licence in respect of all or part of the licensed regulated activity;

(b) in the case of a responsible officer (see section 1.3 of Topic 4 for the definition of this term), revoke or suspend approval as a responsible officer;

(c) publicly or privately reprimand the regulated person;

(d) prohibit the regulated person from applying for a licence, registration, approval as a responsible officer or entry in the HKMA register, or to act as an executive officer; and

(e) separately or in addition order the regulated person to pay a penalty up to the greater of HK$10 million or three times any profit gained or loss avoided as a result of his misconduct.提示

Reference Chapter:1.2.29

-

36/108問題

36. 問題

1 分QID204:How does the court take into account the codes and guidelines issued by the SFC?

正確

A failure on the part of an intermediary or its representative to comply with a code of conduct is not a breach of law and does not by itself constitute an offence under the law.

However, it should be noted that breaches of codes of conduct may be taken into account in two important respects:

(b) a court hearing legal proceedings under the SFO shall consider the provisions of the codes if the court considers it relevant to the determination of any question arising in

the proceedings. This gives the codes a degree of legal recognition.錯誤

A failure on the part of an intermediary or its representative to comply with a code of conduct is not a breach of law and does not by itself constitute an offence under the law.

However, it should be noted that breaches of codes of conduct may be taken into account in two important respects:

(b) a court hearing legal proceedings under the SFO shall consider the provisions of the codes if the court considers it relevant to the determination of any question arising in

the proceedings. This gives the codes a degree of legal recognition.提示

Reference Chapter:1.2.29

-

37/108問題

37. 問題

1 分QID123:Which of the following descriptions about subsidiary legislations are correct?

I. Subsidiary legislations are enacted by the Chief Executive of Hong Kong after consulting the advice of the Legco

II. Subsidiary legislations are some laws made by a process of delegation from LegCo to other bodies.

III. Subsidiary legislations do not possess the force of law and are not enforceable.

IV. Subsidiary legislations possess the force of law and are enforceable.正確

The laws passed by the Legislative Council of the Hong Kong Special Administrative Region (“LegCo”) are called ordinances. They are enacted by the Chief Executive of the

Hong Kong Special Administrative Region (“HKSAR”) with the advice of LegCo. Some laws are made by a process of delegation from LegCo to other bodies, such delegation usually being done under an ordinance. For example, the Securities and Futures Commission (“SFC”) has extensive powers to make rules under the Securities and Futures Ordinance (“SFO”). This process is, in the case of the SFC, generally required to be completed by a process of tabling in LegCo, which gives LegCo an opportunity to review the subsidiary legislation before it becomes law.錯誤

The laws passed by the Legislative Council of the Hong Kong Special Administrative Region (“LegCo”) are called ordinances. They are enacted by the Chief Executive of the

Hong Kong Special Administrative Region (“HKSAR”) with the advice of LegCo. Some laws are made by a process of delegation from LegCo to other bodies, such delegation usually being done under an ordinance. For example, the Securities and Futures Commission (“SFC”) has extensive powers to make rules under the Securities and Futures Ordinance (“SFO”). This process is, in the case of the SFC, generally required to be completed by a process of tabling in LegCo, which gives LegCo an opportunity to review the subsidiary legislation before it becomes law.提示

Reference Chapter:1.2.3

-

38/108問題

38. 問題

1 分QID847:The rules issued by the SFC, such as Client Securities Rules, are

正確

These are some of the Major Subsidiary Legislation:

1.1 Securities and Futures (Financial Resources) Rules

1.2 Securities and Futures (Client Securities) Rules

1.3 Securities and Futures (Client Money) Rules

1.4 Securities and Futures (Keeping of Records) Rules

1.5 Securities and Futures (Contract Notes, Statements of Account and Receipts) Rules

1.6 Securities and Futures (Accounts and Audit) Rules,

plus many others.錯誤

These are some of the Major Subsidiary Legislation:

1.1 Securities and Futures (Financial Resources) Rules

1.2 Securities and Futures (Client Securities) Rules

1.3 Securities and Futures (Client Money) Rules

1.4 Securities and Futures (Keeping of Records) Rules

1.5 Securities and Futures (Contract Notes, Statements of Account and Receipts) Rules

1.6 Securities and Futures (Accounts and Audit) Rules,

plus many others.提示

Reference Chapter:1.2.3

-

39/108問題

39. 問題

1 分QID542:In Hong Kong, which of the following short selling operations are legitimate?

I. Secured short selling stock.

II. Non-secured short selling stock.

III. Short stock futures.

IV. Short stock options.正確

Regulated short selling is defined in Schedule 1, SFO and in the Eleventh Schedule of the Rules of the Exchange to mean the sale of a security in respect of which the seller, or a person for whose benefit or on whose behalf the sale is made, has a currently exercisable and unconditional right to vest the security in the purchaser by virtue of:

(a) having under an securities borrowing and lending (“SBL”) agreement.

(b) a title to other security which is convertible into or exchangeable for the security to which the sale relates;

© an option to acquire the security to which the sale relates;

(d) rights or warrants to subscribe for and receive the security to which the sale relates; or

€ having entered into with another person an agreement or an arrangement of a description prescribed by rules made under s. 397, SFO.錯誤

Regulated short selling is defined in Schedule 1, SFO and in the Eleventh Schedule of the Rules of the Exchange to mean the sale of a security in respect of which the seller, or a person for whose benefit or on whose behalf the sale is made, has a currently exercisable and unconditional right to vest the security in the purchaser by virtue of:

(a) having under an securities borrowing and lending (“SBL”) agreement.

(b) a title to other security which is convertible into or exchangeable for the security to which the sale relates;

© an option to acquire the security to which the sale relates;

(d) rights or warrants to subscribe for and receive the security to which the sale relates; or

€ having entered into with another person an agreement or an arrangement of a description prescribed by rules made under s. 397, SFO.提示

Reference Chapter:1.2.32

-

40/108問題

40. 問題

1 分QID543:Which of the following short selling is NOT allowed?

正確

Regulated short selling is defined in Schedule 1, SFO and in the Eleventh Schedule of the Rules of the Exchange to mean the sale of a security in respect of which the seller, or a person for whose benefit or on whose behalf the sale is made, has a currently exercisable and unconditional right to vest the security in the purchaser by virtue of:

(a) having under an securities borrowing and lending (“SBL”) agreement.

(b) a title to other security which is convertible into or exchangeable for the security to which the sale relates;

© an option to acquire the security to which the sale relates;

(d) rights or warrants to subscribe for and receive the security to which the sale relates; or

€ having entered into with another person an agreement or an arrangement of a description prescribed by rules made under s. 397, SFO.錯誤

Regulated short selling is defined in Schedule 1, SFO and in the Eleventh Schedule of the Rules of the Exchange to mean the sale of a security in respect of which the seller, or a person for whose benefit or on whose behalf the sale is made, has a currently exercisable and unconditional right to vest the security in the purchaser by virtue of:

(a) having under an securities borrowing and lending (“SBL”) agreement.

(b) a title to other security which is convertible into or exchangeable for the security to which the sale relates;

© an option to acquire the security to which the sale relates;

(d) rights or warrants to subscribe for and receive the security to which the sale relates; or

€ having entered into with another person an agreement or an arrangement of a description prescribed by rules made under s. 397, SFO.提示

Reference Chapter:1.2.32

-

41/108問題

41. 問題

1 分QID2366:Which of the following is correct regarding the Investor Compensation Fund?

正確

The Investor Compensation Fund is managed by the Investor Compensation Company Limited in terms of operation, management, and administration. The Investor Compensation Fund is designed to deal with listed stocks of the SEHK and products traded at the Hong Kong Futures Exchange Limited. The Investor Compensation Fund sets a limited quota for each claimant.

錯誤

The Investor Compensation Fund is managed by the Investor Compensation Company Limited in terms of operation, management, and administration. The Investor Compensation Fund is designed to deal with listed stocks of the SEHK and products traded at the Hong Kong Futures Exchange Limited. The Investor Compensation Fund sets a limited quota for each claimant.

提示

Reference Chapter:1.2.36

-

42/108問題

42. 問題

1 分QID2497:Why is the Investor Compensation Fund important?

正確

The Investor Compensation Fund is important because it can enhance the confidence of investors.

錯誤

The Investor Compensation Fund is important because it can enhance the confidence of investors.

提示

Reference Chapter:1.2.38

-

43/108問題

43. 問題

1 分QID189:According to the SFO, an intermediary could mean

I. A Registered Institution

II. A Licensed Corporation

III. A Trust Company

IV. An Authorised Financial Institution正確

Only corporations may become intermediaries. A corporation that obtains a licence will be regarded as a “licensed corporation” unless it is an AFI, in which case it will be regarded as a “registered institution”. Together they are referred to as “intermediaries”. The distinction between the licensing of corporations and the registration of AFIs is reviewed in further detail in section 1 of Topic 4.

錯誤

Only corporations may become intermediaries. A corporation that obtains a licence will be regarded as a “licensed corporation” unless it is an AFI, in which case it will be regarded as a “registered institution”. Together they are referred to as “intermediaries”. The distinction between the licensing of corporations and the registration of AFIs is reviewed in further detail in section 1 of Topic 4.

提示

Reference Chapter:1.2.4

-

44/108問題

44. 問題

1 分QID740:Mr Ko is a representative of a licensed corporation, Kaohsiung Securities. Mr Ko has violated the code of conduct recently. What are the consequences of Mr Ko’s actions?

正確

Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken; the SFC may refer serious cases to law enforcement agencies such as the Commercial Crimes Bureau (“CCB”) of the Hong Kong Police Force or the Independent Commission Against Corruption (“ICAC”) for investigation and action.

錯誤

Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken; the SFC may refer serious cases to law enforcement agencies such as the Commercial Crimes Bureau (“CCB”) of the Hong Kong Police Force or the Independent Commission Against Corruption (“ICAC”) for investigation and action.

提示

Reference Chapter:1.2.4

-

45/108問題

45. 問題

1 分QID1663:Are Registered Institutions bound by the code of conduct?

正確

Registered Institutions need to adhere to the Code of Conduct.

錯誤

Registered Institutions need to adhere to the Code of Conduct.

提示

Reference Chapter:1.2.4

-

46/108問題

46. 問題

1 分QID110:Which of the following correctly describes the level of regulatory protection required by Professional Investors?

正確

PIs are generally persons who are highly experienced in making investments and investment decisions. They would include the class of persons described above as institutional investors.

Details of the definitions of PIs will be discussed in section 2 of Topic 5. Under the SFC’s regulations, PIs are not automatically provided with the same level of regulatory protection as retail investors.錯誤

PIs are generally persons who are highly experienced in making investments and investment decisions. They would include the class of persons described above as institutional investors.

Details of the definitions of PIs will be discussed in section 2 of Topic 5. Under the SFC’s regulations, PIs are not automatically provided with the same level of regulatory protection as retail investors.提示

Reference Chapter:1.2.41

-

47/108問題

47. 問題

1 分QID188:Which of the following description about the single licence regime is correct?

正確

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

錯誤

Although there are ten types of regulated activity, the SFC will grant to a person only one licence (or registration) which will enable the holder to undertake one or more of the ten regulated activities. This is normally referred to as the “single licence regime”.

提示

Reference Chapter:1.2.5

-

48/108問題

48. 問題

1 分QID2803:The objectives of the SFO are to provide a regulatory framework with which of the following characteristics?

I. Promotes a fair, orderly and transparent market.

II. Is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure.

III. Is administered by a regulator with sufficient powers and discretion whose operations are transparent and directly under the government.

IV. Is a system that can satisfy PRC mainland legal standards, being compatible with PRC mainland laws and practices and meet local needs.正確

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances.錯誤

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances.提示

Reference Chapter:1.2.6

-

49/108問題

49. 問題

1 分QID171:The objectives of the SFO are to provide a regulatory framework with which of the following characteristics?

I. Promotes a fair, orderly and transparent market.

II. Is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure.

III. Is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate checks and balance.

IV. Is a system that can satisfy PRC mainland legal standards, being compatible with PRC mainland laws and practices and meet local needs.正確

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances.錯誤

The objectives of the SFO are to provide a regulatory framework which:

(a) promotes a fair, orderly and transparent market;

(b) is flexible enough to cope with new products and other innovations, and further advances in technological infrastructure;

(c) is administered by a regulator with sufficient powers and discretion whose operations are transparent and who is accountable to the stakeholders through a system of adequate

checks and balances.提示

Reference Chapter:1.2.6

-

50/108問題

50. 問題

1 分QID2738:The Securities and Futures Commission (SFC) is a/an

正確

The SFC is an independent statutory body, not a government department.

錯誤

The SFC is an independent statutory body, not a government department.

提示

Reference Chapter:1.3.1

-

51/108問題

51. 問題

1 分QID781:The principal regulator of the securities industry in Hong Kong is the

正確

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above.

錯誤

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above.

提示

Reference Chapter:1.3.1

-

52/108問題

52. 問題

1 分QID782:The SFC is a/an _______ in Hong Kong.

正確

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above. It is considered the securities and futures market prime regulator.錯誤

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above. It is considered the securities and futures market prime regulator.提示

Reference Chapter:1.3.1

-

53/108問題

53. 問題

1 分QID732:Which of the following descriptions about the SFC is correct?

正確

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government.錯誤

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government.提示

Reference Chapter:1.3.1

-

54/108問題

54. 問題

1 分QID2834:Which department of the SFC is responsible for monitoring listed companies’ announcements and identifying misconduct or non-compliance?

正確

The SFC’s Corporate Finance Division monitors listed companies’ announcements and identifies misconduct or non-compliance by listed companies.

錯誤

The SFC’s Corporate Finance Division monitors listed companies’ announcements and identifies misconduct or non-compliance by listed companies.

提示

Reference Chapter:1.3.10

-

55/108問題

55. 問題

1 分QID73:Which of the following are functions of the Corporate Finance Division of the SFC?

I. Administer the Codes on Takeovers and Mergers and Share Buy-backs and regulates takeovers, mergers and share buy- backs of applicable companies

II. Provide advice on corporate restructuring to listed company in

Hong Kong

III. Supervise the listing-related activities of The Stock Exchange

of Hong Kong Limited (“SEHK”)

IV. Provide advice on takeover activities to minority shareholders正確

Corporate Finance Division:

(a) administers The Codes on Takeovers and Mergers and Share Buy-backs and regulates takeovers, mergers and share buy-backs of applicable companies;

(b) supervises the listing-related activities of The Stock Exchange of Hong Kong Limited (“SEHK”).錯誤

Corporate Finance Division:

(a) administers The Codes on Takeovers and Mergers and Share Buy-backs and regulates takeovers, mergers and share buy-backs of applicable companies;

(b) supervises the listing-related activities of The Stock Exchange of Hong Kong Limited (“SEHK”).提示

Reference Chapter:1.3.10

-

56/108問題

56. 問題

1 分QID998:The SFC is not responsible for supervising which of the following?

正確

Exchanges and clearing houses are supervised by the Supervision of Markets Division of the SFC. Intermediaries are supervised by the Intermediaries Division of the SFC. Market Misconduct Tribunal is independent of the SFC and not supervised by it.

錯誤

Exchanges and clearing houses are supervised by the Supervision of Markets Division of the SFC. Intermediaries are supervised by the Intermediaries Division of the SFC. Market Misconduct Tribunal is independent of the SFC and not supervised by it.

提示

Reference Chapter:1.3.13

-

57/108問題

57. 問題

1 分QID104:Which of the following entity is responsible for monitoring the exchanges and clearing houses in Hong Kong?

正確

The SFC supervises and monitors the activities of HKEX, the exchange companies and the clearing houses, approves their rules and amendments to the rules, approves the fees they charge, and administers and enforces the applicable legislation. It also carries out regular reviews of these activities.

錯誤

The SFC supervises and monitors the activities of HKEX, the exchange companies and the clearing houses, approves their rules and amendments to the rules, approves the fees they charge, and administers and enforces the applicable legislation. It also carries out regular reviews of these activities.

提示

Reference Chapter:1.3.13

-

58/108問題

58. 問題

1 分QID2761:Which of the following statements about the SFC is correct?

正確

The SFC is responsible for the regulation of all securities and futures activities, including the regulatory activities carried out by banks. It is also responsible for regulating the exchange controller.

錯誤

The SFC is responsible for the regulation of all securities and futures activities, including the regulatory activities carried out by banks. It is also responsible for regulating the exchange controller.

提示

Reference Chapter:1.3.13

-

59/108問題

59. 問題

1 分QID105:Which of the following organization is responsible for front-line prudential and conduct regulation of market participants?

正確

Except in relation to the management of business risk, and the enforcement of their own listing, trading, clearing and settlement rules, HKEX, the exchanges and the clearing houses are not responsible for front-line prudential and conduct regulation of market participants, which is carried out by the SFC.

錯誤

Except in relation to the management of business risk, and the enforcement of their own listing, trading, clearing and settlement rules, HKEX, the exchanges and the clearing houses are not responsible for front-line prudential and conduct regulation of market participants, which is carried out by the SFC.

提示

Reference Chapter:1.3.14

-

60/108問題

60. 問題

1 分QID78:Which department/division of the SFC licenses asset management corporation and their staff and approves responsible officers?

正確

Licensing Department:

(a) licenses corporations and individuals seeking to conduct business in Hong Kong in the regulated activities for which a licence is required under the SFO.錯誤

Licensing Department:

(a) licenses corporations and individuals seeking to conduct business in Hong Kong in the regulated activities for which a licence is required under the SFO.提示

Reference Chapter:1.3.15

-

61/108問題

61. 問題

1 分QID79:Which department/division of the SFC supervises licensed corporations and individual licensees on an ongoing basis?

正確

Intermediaries Supervision Department:

(a) supervises the business conduct of licensed corporations and individual licensees on an ongoing basis, by conducting on-site inspection and off-site monitoring; and

(b) monitors the financial integrity of licensed corporations.錯誤

Intermediaries Supervision Department:

(a) supervises the business conduct of licensed corporations and individual licensees on an ongoing basis, by conducting on-site inspection and off-site monitoring; and

(b) monitors the financial integrity of licensed corporations.提示

Reference Chapter:1.3.16

-

62/108問題

62. 問題

1 分QID90:In which of the following circumstances will the Securities and

Futures Commission (SFC) investigate a licensed corporation?

I. When the licensed corporation’s operations go downhill and it

is unable to pay the license fee.

II. When clients lodge complaints against the licensed corporation for its failure to inform clients about the whereabouts of funds deposited by clients upon clients requests.

III. When an informant provides information that the licensed corporation is being mismanaged, the growth has slowed down and it is planning a sale.

IV. When an informant provides information that the licensed corporation is being mismanaged and it is suffering from losses.正確

The SFC may (i) conduct supervisory inspections for the purposes of ascertaining whether an intermediary or an associated entity of an intermediary has complied with the SFO and

any related notices and requirements, any terms and condition of any licence or registration, or any other imposed condition; or (ii) require copies of documents or inquire into the affairs of a licensed corporation or its related corporations for the purpose of providing assistance, in relation to the licensed corporation, to an authority or regulatory organisation outside Hong Kong.錯誤

The SFC may (i) conduct supervisory inspections for the purposes of ascertaining whether an intermediary or an associated entity of an intermediary has complied with the SFO and

any related notices and requirements, any terms and condition of any licence or registration, or any other imposed condition; or (ii) require copies of documents or inquire into the affairs of a licensed corporation or its related corporations for the purpose of providing assistance, in relation to the licensed corporation, to an authority or regulatory organisation outside Hong Kong.提示

Reference Chapter:1.3.16

-

63/108問題

63. 問題

1 分QID788:Which of the following regulators in Hong Kong assumes responsibility for front-line regulation and discipline of participants of the securities and futures industry?

正確

Except in relation to the management of business risk, and the enforcement of their own listing, trading, clearing and settlement rules, HKEX, the exchanges and the clearing houses are not responsible for front-line prudential and conduct regulation of market participants, which is carried out by the SFC.

錯誤

Except in relation to the management of business risk, and the enforcement of their own listing, trading, clearing and settlement rules, HKEX, the exchanges and the clearing houses are not responsible for front-line prudential and conduct regulation of market participants, which is carried out by the SFC.

提示

Reference Chapter:1.3.2

-

64/108問題

64. 問題

1 分QID2751:Which of the following descriptions about the HKEX is incorrect?

正確

HKEX is not responsible for front-line prudential regulation of market participants. Such task is the responsibility of the SFC.

錯誤

HKEX is not responsible for front-line prudential regulation of market participants. Such task is the responsibility of the SFC.

提示

Reference Chapter:1.3.2

-

65/108問題

65. 問題

1 分QID2832:Which of the following is not a financial regulator in Hong Kong?

正確

The Securities Commission option is wrong, the correct name is Securities and Futures Commission.

錯誤

The Securities Commission option is wrong, the correct name is Securities and Futures Commission.

提示

Reference Chapter:1.3.2

-

66/108問題

66. 問題

1 分QID783:What approach does the SFC take to regulate market intermediaries?

正確

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

67/108問題

67. 問題

1 分QID787:Which of the following regulatory approach is adopted by the SFC?

正確

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

68/108問題

68. 問題

1 分QID784:A risk-based regulatory system refers to a system in which:

正確

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

69/108問題

69. 問題

1 分QID785:The SFC regime adopts which of the following regulatory approaches?

正確

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

70/108問題

70. 問題

1 分QID10:Which system or philosophy of regulations is adopted by the SFC to regulate securities and futures markets?

正確

SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

71/108問題

71. 問題

1 分QID786:Which of the following regulatory approaches adopted by the SFC is given more regulatory attention towards the areas where the SFC perceives the highest risks to lie?

正確

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

錯誤

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

提示

Reference Chapter:1.3.3

-

72/108問題

72. 問題

1 分QID6:Which of the following is a primary objective of Hong Kong financial regulators?

正確

Encouraging the development of new products, operating profitable exchanges in Hong Kong and reducing trading hours are all actions. They are action verbs but not objective description. Objectives can only be objective description, therefore, these phrases can never be objectives and primary objective of Hong Kong financial regulators. Objectives are status that financial regulators hope for, enhancing confidence is an objective description that financial regulators hope for.

錯誤

Encouraging the development of new products, operating profitable exchanges in Hong Kong and reducing trading hours are all actions. They are action verbs but not objective description. Objectives can only be objective description, therefore, these phrases can never be objectives and primary objective of Hong Kong financial regulators. Objectives are status that financial regulators hope for, enhancing confidence is an objective description that financial regulators hope for.

提示

Reference Chapter:1.3.6

-

73/108問題

73. 問題

1 分QID58:Which of the following is a regulatory objective of the SFC?

I. Provide protection to the investing public

II. Reduce non-systematic risk in the industry

III. Assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the industry.

IV. Assist the HKMA in maintaining the stability of currency in

Hong Kong正確

The objectives of the SFC in relation to the securities and futures industry, as stated in s. 4, SFO, are to:

(c) provide protection to the investing public;

(f) assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the industry.錯誤

The objectives of the SFC in relation to the securities and futures industry, as stated in s. 4, SFO, are to:

(c) provide protection to the investing public;