English HKSI Paper 11 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP11ET1

Quiz-summary

0 of 164 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

Information

HKSIP11ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 164 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

-

HKSIP11ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- Answered

- Review

-

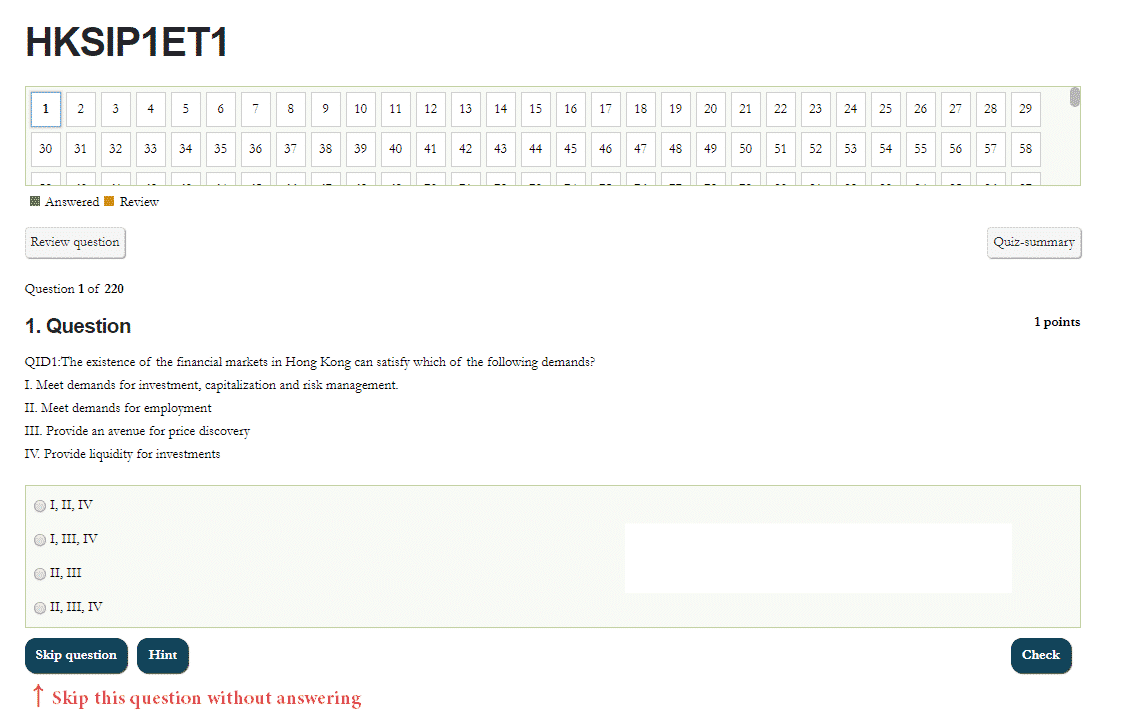

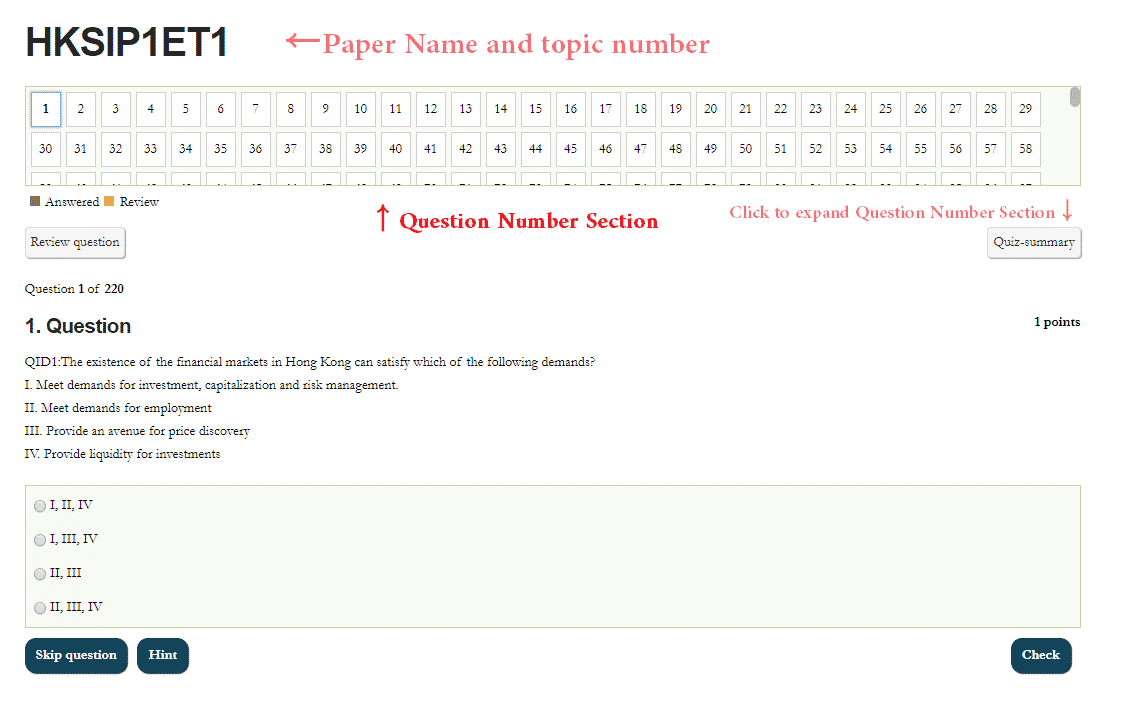

Question 1 of 164

1. Question

1 pointsQID2685:The objectives of improving the liquidity of the securities markets include:

I. Professionals to serve as intermediaries on the markets

II.Companies to have their securities listed and traded with the markets

III. Allowing investors and lenders to trade with confidence

IV. Reducing regulatory overlap among regulatorsCorrect

The objectives of improving the liquidity of the securities markets include:

I.Companies to have their securities listed and traded with the markets

II.Investors and lenders to enter into transactions through the markets

III.Professionals to serve as intermediaries on the marketsIncorrect

The objectives of improving the liquidity of the securities markets include:

I.Companies to have their securities listed and traded with the markets

II.Investors and lenders to enter into transactions through the markets

III.Professionals to serve as intermediaries on the marketsHint

Reference Chapter:1.1.10

-

Question 2 of 164

2. Question

1 pointsQID2692:Which of the following statements about convertible notes is true?

Correct

The note holder loses the note when the convertible note is converted into shares. The holder of a note receives a coupon rather than a dividend on the note before the conversion date. Holders of notes are classified as secured and unsecured, and are classified as creditors rather than shareholders when the company is wound up. When the market price is higher than the exchange price on the convertible note, the note holder tends to convert the note into shares.

Incorrect

The note holder loses the note when the convertible note is converted into shares. The holder of a note receives a coupon rather than a dividend on the note before the conversion date. Holders of notes are classified as secured and unsecured, and are classified as creditors rather than shareholders when the company is wound up. When the market price is higher than the exchange price on the convertible note, the note holder tends to convert the note into shares.

Hint

Reference Chapter:1.1.5

-

Question 3 of 164

3. Question

1 pointsQID2715:Saltwater is a gold mining company that has invited you to evaluate its legal status. The characteristics of the company are as follows:

I. The agreement of the company gives all three parties the right of preemption in the event that any of the shareholders of the company wish to sell their ownership

II. Each member shall share in the production of the gold mine in proportion to its ownership

III. Members of Saltwater Company are all CorporationsSaltwater Company is more likely

Correct

The members of an unincorporated joint venture are primarily corporations and the agreement governs their activities. A private company would have been an acceptable answer, but because it is a mining company, so the better answer is an unincorporated joint venture.

Incorrect

The members of an unincorporated joint venture are primarily corporations and the agreement governs their activities. A private company would have been an acceptable answer, but because it is a mining company, so the better answer is an unincorporated joint venture.

Hint

Reference Chapter:1.2.3

-

Question 4 of 164

4. Question

1 pointsQID2287:Which market uses novation frequently?

Correct

Novation is the process whereby the clearing house undertakes the credit risk and acts as the counterparty of both buyer and seller. Only the exchange-traded market has this kind of arrangement. There is no clearing house used generally in foreign market, OTC market and fund-raising market. Thus, there is no novation.

Incorrect

Novation is the process whereby the clearing house undertakes the credit risk and acts as the counterparty of both buyer and seller. Only the exchange-traded market has this kind of arrangement. There is no clearing house used generally in foreign market, OTC market and fund-raising market. Thus, there is no novation.

Hint

Reference Chapter:1.1.7

-

Question 5 of 164

5. Question

1 pointsQID2289:The father of “Principal” who is from a rich market just died. He will get the heritage after 3 months. He plans to lend this heritage to a ship company called “Hai Nan Ship” which is going to be bankrupt after 3 months. If he is afraid that the drop in interest rate after 3 months will lead to a decreased return, the reason he chooses forward interest rate agreement rather than interest rate futures is least likely:

Correct

The usage of OTC derivatives may increase credit risk rather than decrease. The benefits of using derivatives:

I. no requirement to pay margin when signing a contract

II. more flexible in terms of the contract period

III. more flexible in terms of contract valueIncorrect

The usage of OTC derivatives may increase credit risk rather than decrease. The benefits of using derivatives:

I. no requirement to pay margin when signing a contract

II. more flexible in terms of the contract period

III. more flexible in terms of contract valueHint

Reference Chapter:1.1.7

-

Question 6 of 164

6. Question

1 pointsQID973:If a company wishes to issue new shares to the public in order to raise capital, the company should proceed at which of the following markets?

Correct

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Incorrect

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Hint

Reference Chapter:1.1.7

-

Question 7 of 164

7. Question

1 pointsQID974:What is the main reason companies want to be listed?

Correct

Companies listed on the stock exchange enjoy a number of advantages including potential to increase their capital base. Fund-raising by issuing shares to the public means that the issuer is able to fund its current and future capital requirements and expansion plans by issuing new shares to the public.

Incorrect

Companies listed on the stock exchange enjoy a number of advantages including potential to increase their capital base. Fund-raising by issuing shares to the public means that the issuer is able to fund its current and future capital requirements and expansion plans by issuing new shares to the public.

Hint

Reference Chapter:1.1.7

-

Question 8 of 164

8. Question

1 pointsQID141:Vitamilk company issued bond to some private investors through Kaohsiung security in order to raise capital. Mr. GAO was one of the private investor. In this transaction, Mr. GAO was:

Correct

The lenders who provide funds to the borrowers by buying the debt securities are the holders of the securities and the creditors of the borrowers.

Incorrect

The lenders who provide funds to the borrowers by buying the debt securities are the holders of the securities and the creditors of the borrowers.

Hint

Reference Chapter:1.1.1

-

Question 9 of 164

9. Question

1 pointsQID142:Vitamilk company issued bond to some private investors through Kaohsiung security in order to raise capital. Mr. GAO was one of the private investor. In this transaction, Vitamilk was:

Correct

As the borrowers acquire funds by issuing debt securities, they are also called the “issuers”.

Incorrect

As the borrowers acquire funds by issuing debt securities, they are also called the “issuers”.

Hint

Reference Chapter:1.1.1

-

Question 10 of 164

10. Question

1 pointsQID144:Which of the following statement is correct regarding debt?

Correct

Interest is paid by the borrower to the lender at a specific interval(s) and according to a specific formula which is agreed by the two parties.

Incorrect

Interest is paid by the borrower to the lender at a specific interval(s) and according to a specific formula which is agreed by the two parties.

Hint

Reference Chapter:1.1.4

-

Question 11 of 164

11. Question

1 pointsQID145:Which of the following is correct regarding debt securities?

I. Generally, they can be transferred without limitation.

II. Can have multiple holders

III. Unless floating-rate debt securities, incomes are fixed.

IV. Debt securities markets are also called fixed income securities markets.Correct

As a tradable security, there may be many holders of the security before it matures, apart from the original lender. A floating interest rate changes in line with changes in the pre-determined reference indicator or benchmark rate. Since debts have pre-determined cash flow, debt securities are also known as “fixed income” securities and the debt market the “fixed income market”.

Incorrect

As a tradable security, there may be many holders of the security before it matures, apart from the original lender. A floating interest rate changes in line with changes in the pre-determined reference indicator or benchmark rate. Since debts have pre-determined cash flow, debt securities are also known as “fixed income” securities and the debt market the “fixed income market”.

Hint

Reference Chapter:1.1.4

-

Question 12 of 164

12. Question

1 pointsQID146:Some investors prefer debt securities to equity securities. The reasons may be:

I. Debt securities have lower risk in general.

II. Incomes of debt securities are more stable and easy to estimate.

III. Debt securities have lower principal requirement than equity securities.

IV. Debt securities have claims prior to equity securities when companies liquidate.Correct

Equity investors do not have any guaranteed returns in the form of income (dividends) or capital gain. The investors carry a risk where they may not recoup their investment. On the other hand, investors in debt invest on the basis of an agreed income stream throughout the period of the investment (loan) and the return of the capital at the end of the agreed period. Debt holders are entitled to claim on the company’s assets prior to equity holders in the event of liquidation.

Incorrect

Equity investors do not have any guaranteed returns in the form of income (dividends) or capital gain. The investors carry a risk where they may not recoup their investment. On the other hand, investors in debt invest on the basis of an agreed income stream throughout the period of the investment (loan) and the return of the capital at the end of the agreed period. Debt holders are entitled to claim on the company’s assets prior to equity holders in the event of liquidation.

Hint

Reference Chapter:1.1.4

-

Question 13 of 164

13. Question

1 pointsQID148:What is the main purpose of issuing debt securities and equity securities?

Correct

Debt holders are the lenders of funds (creditors) to the debt issuers (borrowers). Equity capital is raised to fund the start-up of a new business, to expand an existing business or for recapitalization.

Incorrect

Debt holders are the lenders of funds (creditors) to the debt issuers (borrowers). Equity capital is raised to fund the start-up of a new business, to expand an existing business or for recapitalization.

Hint

Reference Chapter:1.1.4

-

Question 14 of 164

14. Question

1 pointsQID149:Which of the following is correct regarding debt securities?

Correct

In order to obtain the services provided by the lender(debt issuers), the borrower (debt holders) is usually required to pay an additional amount of money at a specific interval(s), called “interest”. Thus, the return is fixed as long as you hold it until maturity and the company does not default.

Incorrect

In order to obtain the services provided by the lender(debt issuers), the borrower (debt holders) is usually required to pay an additional amount of money at a specific interval(s), called “interest”. Thus, the return is fixed as long as you hold it until maturity and the company does not default.

Hint

Reference Chapter:1.1.4

-

Question 15 of 164

15. Question

1 pointsQID491:Mr. GAO is elderly and risk-averse. Which of the following investment tool is more suitable for him?

Correct

The advantages of investing in debt securities include: (1)Lower risk than equities under normal circumstances. (2)Stable and predictable source of income; (3) Generally higher yield (return) when compared with bank deposit rates.

Incorrect

The advantages of investing in debt securities include: (1)Lower risk than equities under normal circumstances. (2)Stable and predictable source of income; (3) Generally higher yield (return) when compared with bank deposit rates.

Hint

Reference Chapter:1.1.4

-

Question 16 of 164

16. Question

1 pointsQID2434:Which of the following risks does a client need to bear when buying stock options on The Stock Exchange of Hong Kong Limited?

I Liquidity risk

II Option value decline

III Counterparty risk

IV Market riskCorrect

The risk of counterparties on the Stock Exchange is extremely low because the clearing house will carry out novation.

Exchange-traded stock option has very low liquidity risk, but still exists, the suggested answer is to exclude this optionIncorrect

The risk of counterparties on the Stock Exchange is extremely low because the clearing house will carry out novation.

Exchange-traded stock option has very low liquidity risk, but still exists, the suggested answer is to exclude this optionHint

Reference Chapter:1.1.6.4

-

Question 17 of 164

17. Question

1 pointsQID2250:Is there anything the same between bonds and ordinary shares?

Correct

Bonds and ordinary shares can either be traded at the Stock Exchange of Hong Kong Limited(SEHK) or at the OTC without trading at the SEHK. Generally, bonds have fixed return, but ordinary shares don’t have fixed return. Both may have the chance to incur a loss due to market changes.

Incorrect

Bonds and ordinary shares can either be traded at the Stock Exchange of Hong Kong Limited(SEHK) or at the OTC without trading at the SEHK. Generally, bonds have fixed return, but ordinary shares don’t have fixed return. Both may have the chance to incur a loss due to market changes.

Hint

Reference Chapter:1.1.4

-

Question 18 of 164

18. Question

1 pointsQID64:What is the advantage of exchange-traded market over the OTC market:

I. high liquidity

II. higher resilience

III. lower credit risk

IV. more types of productsCorrect

Exchange-traded markets are those that operate via a centralized exchange, so it has higher liquidity and resilience. “Novation” operates and guarantee every transaction effectively, the credit risk is therefore lowered.

Incorrect

Exchange-traded markets are those that operate via a centralized exchange, so it has higher liquidity and resilience. “Novation” operates and guarantee every transaction effectively, the credit risk is therefore lowered.

Hint

Reference Chapter:1.1.7

-

Question 19 of 164

19. Question

1 pointsQID67:Which of the following sentence is incorrect with regard to exchange-traded market?

Correct

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Incorrect

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Hint

Reference Chapter:1.1.7

-

Question 20 of 164

20. Question

1 pointsQID71:Which of the following is not equity securities?

Correct

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Incorrect

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Hint

Reference Chapter:1.1.4

-

Question 21 of 164

21. Question

1 pointsQID74:Which of the following is equity securities?

Correct

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Incorrect

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Hint

Reference Chapter:1.1.4

-

Question 22 of 164

22. Question

1 pointsQID78:What is the advantage of bond-holders over stock-holders?

I. Relatively stable income

II. No need to bear risk

III.Have higher priority to receive allocated assets when liquidation

IV. Guaranteed principal paymentCorrect

The borrower of bond need to repay the principal amount at the maturity date and an interest component periodically. Since bond is a kind of debt, bond-holders have higher priority to receive allocated assets when liquidation. Default risk exists in bonds.

Incorrect

The borrower of bond need to repay the principal amount at the maturity date and an interest component periodically. Since bond is a kind of debt, bond-holders have higher priority to receive allocated assets when liquidation. Default risk exists in bonds.

Hint

Reference Chapter:1.1.4

-

Question 23 of 164

23. Question

1 pointsQID339:What are the min reasons investors invest in equity?

I. Hedging risks

II. Dividends income

III. Capital appreciation

IV. ProtectionCorrect

The return to investors consists of dividend income and capital gain.

Incorrect

The return to investors consists of dividend income and capital gain.

Hint

Reference Chapter:1.1.4

-

Question 24 of 164

24. Question

1 pointsQID525:Which of the following is not the main reason to invest in derivatives?

Correct

Derivatives will not distribute dividends.

Incorrect

Derivatives will not distribute dividends.

Hint

Reference Chapter:1.1.6.2

-

Question 25 of 164

25. Question

1 pointsQID526:”It is an agreement in which two parties agree to the purchase and sell of an asset at some future date under such conditions as they agree OTC.” What is the kind of derivative depicted above?

Correct

A forward contract, which is traded OTC, is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree.

Incorrect

A forward contract, which is traded OTC, is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree.

Hint

Reference Chapter:1.1.6.1

-

Question 26 of 164

26. Question

1 pointsQID720:Which of the following statement is correct regarding forward contract?

Correct

A forward contract is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree. In contrast to futures contracts, forward contracts are traded OTC, and their terms are not standardized.

Incorrect

A forward contract is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree. In contrast to futures contracts, forward contracts are traded OTC, and their terms are not standardized.

Hint

Reference Chapter:1.1.6.1

-

Question 27 of 164

27. Question

1 pointsQID723:Derivatives can satisfy which of the following needs?

I. Manage investment portfolios

II. Hedge

III. Asset transferIV. Increase income

Correct

In summary, the functions of derivatives can be classified as: risk management (i.e. hedging exposures). Speculation (i.e. taking profit from price movements). Arbitrage (i.e. buying or selling an asset in one market and immediately transacting an opposite trade of an equal amount of the same asset in a different market, in order to capture a risk-free profit).

Incorrect

In summary, the functions of derivatives can be classified as: risk management (i.e. hedging exposures). Speculation (i.e. taking profit from price movements). Arbitrage (i.e. buying or selling an asset in one market and immediately transacting an opposite trade of an equal amount of the same asset in a different market, in order to capture a risk-free profit).

Hint

Reference Chapter:1.1.6.2

-

Question 28 of 164

28. Question

1 pointsQID724:Derivatives traded over-the-counter have which of the following properties?

I. Flexible with specific design

II. Novation

III. Diversified marketIV. Collective market

Correct

OTC volume dominates the derivatives market. Such contracts are tailor-made to the requirements of the parties involved. The transactions are arranged by phone and computer networks and not through a centralized marketplace. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Incorrect

OTC volume dominates the derivatives market. Such contracts are tailor-made to the requirements of the parties involved. The transactions are arranged by phone and computer networks and not through a centralized marketplace. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Hint

Reference Chapter:1.1.7

-

Question 29 of 164

29. Question

1 pointsQID1149:Which of the following is not the disadvantages of stock warrants?

Correct

The entry level of stock warrants is much less than that of underlying assets.

Incorrect

The entry level of stock warrants is much less than that of underlying assets.

Hint

Reference Chapter:1.1.6.4

-

Question 30 of 164

30. Question

1 pointsQID2303:If a cervitable bond doesn’t convert to ordinary shares upon expiration, the investors will face what kind of situation:

Correct

If a cervitable bond doesn’t convert to ordinary shares upon expiration, it will be redeemed like ordinary bonds to receive the principal.

Incorrect

If a cervitable bond doesn’t convert to ordinary shares upon expiration, it will be redeemed like ordinary bonds to receive the principal.

Hint

Reference Chapter:1.1.5

-

Question 31 of 164

31. Question

1 pointsQID2304:Why do investors favour bonds?

I. lower risks than stocks

II. higher returns than stocks

III. fixed and more stable income

IV. The principal can be redeemed as long as there is no default.Correct

Why do investors favour bonds?

I. lower risks than stocks

II. fixed and more stable income

III. The principal can be redeemed as long as there is no default.Incorrect

Why do investors favour bonds?

I. lower risks than stocks

II. fixed and more stable income

III. The principal can be redeemed as long as there is no default.Hint

Reference Chapter:1.1.4

-

Question 32 of 164

32. Question

1 pointsQID2324:Which of the following instrument is not debt security?

Correct

Forward rate agreement is the derivative to bet on the change of interest rates.

Incorrect

Forward rate agreement is the derivative to bet on the change of interest rates.

Hint

Reference Chapter:1.1.6.1

-

Question 33 of 164

33. Question

1 pointsQID2325:Which of the following is the exchange-traded derivative?

Correct

All futures are traded in the exchange. Agreements and swaps etc are generally referred to over-the-counter derivatives.

Incorrect

All futures are traded in the exchange. Agreements and swaps etc are generally referred to over-the-counter derivatives.

Hint

Reference Chapter:1.1.6.2

-

Question 34 of 164

34. Question

1 pointsQID84:Derivatives include

I. Options

II. Equity warrants

III. Futures

IV. SwapsCorrect

Derivatives include futures, forwards, swaps and options (or a combination of one or more of these categories). Equity warrants are classified as equity securities.

Incorrect

Derivatives include futures, forwards, swaps and options (or a combination of one or more of these categories). Equity warrants are classified as equity securities.

Hint

Reference Chapter:1.6.

-

Question 35 of 164

35. Question

1 pointsQID3:To hedge current market positions, one must take which of the following positions in the derivatives market?

Correct

To hedge current market positions, one must take an opposite position in the derivatives market.

Incorrect

To hedge current market positions, one must take an opposite position in the derivatives market.

Hint

Reference Chapter:1.1.6.2

-

Question 36 of 164

36. Question

1 pointsQID4:To hedge futures market positions, one must take which of the following positions in the derivatives market?

Correct

To hedge futures market positions, one must take an identical position to the current market position in the derivatives market?

Incorrect

To hedge futures market positions, one must take an identical position to the current market position in the derivatives market?

Hint

Reference Chapter:1.1.6.2

-

Question 37 of 164

37. Question

1 pointsQID13:Which of the following cases is in need of indirect financing/intermediation?

Correct

The role of intermediaries is to channel the flow of funds between the borrowers and lenders. Therefore, indirect financing, or intermediation, occurs when the needs of borrowers and lenders do not match.

Incorrect

The role of intermediaries is to channel the flow of funds between the borrowers and lenders. Therefore, indirect financing, or intermediation, occurs when the needs of borrowers and lenders do not match.

Hint

Reference Chapter:1.1.1

-

Question 38 of 164

38. Question

1 pointsQID408:In order to have service lenders provide, the cost borrowers need to pay is called:

Correct

In order to obtain the services provided by the lender, the borrower is usually required to pay an additional amount of money, called “interest”.

Incorrect

In order to obtain the services provided by the lender, the borrower is usually required to pay an additional amount of money, called “interest”.

Hint

Reference Chapter:1.1.4

-

Question 39 of 164

39. Question

1 pointsQID582:Investor has position now. What to do if he wants to hedge the adverse effect in the future?

Correct

The purpose of hedging current positions is to maintain the portfolio value when spot market falls. Therefore, to successfully hedge the position, the investor should take an opposite position in the futures market.

Incorrect

The purpose of hedging current positions is to maintain the portfolio value when spot market falls. Therefore, to successfully hedge the position, the investor should take an opposite position in the futures market.

Hint

Reference Chapter:1.1.6.2

-

Question 40 of 164

40. Question

1 pointsQID587:The participants of derivatives include:

I. Speculators

II. Arbitragers

III. Hedgers

IV. InvestorsCorrect

Participants in the derivatives market include borrowers and lenders of the underlying assets who use derivatives transactions for hedging, speculative or arbitrage purposes.

Incorrect

Participants in the derivatives market include borrowers and lenders of the underlying assets who use derivatives transactions for hedging, speculative or arbitrage purposes.

Hint

Reference Chapter:1.1.6.2

-

Question 41 of 164

41. Question

1 pointsQID34:The major functions of currency include:

I. Means of storing wealth

II. a path to increase wealth

III. unit against which to value other goods and services

IV. medium of exchangeCorrect

Money plays an important role in the financial system. Money acts as a

-means of storing wealth

– medium of exchange

-unit against which to value other goods and services.Incorrect

Money plays an important role in the financial system. Money acts as a

-means of storing wealth

– medium of exchange

-unit against which to value other goods and services.Hint

Reference Chapter:1.1.1

-

Question 42 of 164

42. Question

1 pointsQID35:Money needs to be:

I. storable

II. portable

III. durable

IV. hard to obtainCorrect

In order to fulfil its functions, money needs to be durable, storable and portable.

Incorrect

In order to fulfil its functions, money needs to be durable, storable and portable.

Hint

Reference Chapter:1.1.1

-

Question 43 of 164

43. Question

1 pointsQID42:Money plays an important role in the financial system which includes:

I. medium of exchange

II. unit against which to value other goods and services

III. means of storing wealth

IV. keeping constant purchasing power perpetuallyCorrect

Money plays an important role in the financial system. Money acts as a

– means of storing wealth

– medium of exchange

– unit against which to value other goods and services.Incorrect

Money plays an important role in the financial system. Money acts as a

– means of storing wealth

– medium of exchange

– unit against which to value other goods and services.Hint

Reference Chapter:1.1.1

-

Question 44 of 164

44. Question

1 pointsQID49:Which of the following statement pertaining to intermediation is correct?

Correct

Financial intermediaries may perform the function of “market makers”, who quote two-way prices in the market – that is, they quote a bid and an ask, so that they encourage securities trading and thus increase liquidity in the market.

Incorrect

Financial intermediaries may perform the function of “market makers”, who quote two-way prices in the market – that is, they quote a bid and an ask, so that they encourage securities trading and thus increase liquidity in the market.

Hint

Reference Chapter:1.1.1

-

Question 45 of 164

45. Question

1 pointsQID50:Which of the following is the advantage of intermediation?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors. Intermediaries channel funds from where there is a surplus to where there is a deficit, this improves the efficiency of the allocation.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors. Intermediaries channel funds from where there is a surplus to where there is a deficit, this improves the efficiency of the allocation.

Hint

Reference Chapter:1.1.1

-

Question 46 of 164

46. Question

1 pointsQID51:What is the advantage of intermediation to lenders?

Correct

The main advantage of intermediation is the transfer of risk from borrowers and lenders to intermediaries. This lowers the credit risk

Incorrect

The main advantage of intermediation is the transfer of risk from borrowers and lenders to intermediaries. This lowers the credit risk

Hint

Reference Chapter:1.1.1

-

Question 47 of 164

47. Question

1 pointsQID52:Intermediation matches which type of people?

Correct

Intermediation (indirect financing) involves third parties, financial institutions or intermediaries, acting as a link between fund providers (lenders) and fund seekers (borrowers).

Incorrect

Intermediation (indirect financing) involves third parties, financial institutions or intermediaries, acting as a link between fund providers (lenders) and fund seekers (borrowers).

Hint

Reference Chapter:1.1.1

-

Question 48 of 164

48. Question

1 pointsQID53:How does intermediation transfer credit risk?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Hint

Reference Chapter:1.1.1

-

Question 49 of 164

49. Question

1 pointsQID54:Which of the following is not the advantage of intermediation?

Correct

The main disadvantage of intermediation is the additional cost that is passed on to borrowers and investors in the form of higher interest costs, fees, brokerage or commission. Disintermediation or direct financing may be less costly.

Incorrect

The main disadvantage of intermediation is the additional cost that is passed on to borrowers and investors in the form of higher interest costs, fees, brokerage or commission. Disintermediation or direct financing may be less costly.

Hint

Reference Chapter:1.1.1

-

Question 50 of 164

50. Question

1 pointsQID55:Who is the one who bears credit risk in intermediation?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Hint

Reference Chapter:1.1.1

-

Question 51 of 164

51. Question

1 pointsQID57:Effective and efficient financial market do not have which of the following characteristic?

Correct

Under an effective financial market, there must be an efficient payment and settlement system. Thus, buyers and sellers cannot trade without cost.

Incorrect

Under an effective financial market, there must be an efficient payment and settlement system. Thus, buyers and sellers cannot trade without cost.

Hint

Reference Chapter:1.1.1

-

Question 52 of 164

52. Question

1 pointsQID2024:Which place are stapled securities traded on?

Correct

Stapled securities are traded, cleared and settled on the SEHK and quoted on a single price.

Incorrect

Stapled securities are traded, cleared and settled on the SEHK and quoted on a single price.

Hint

Reference Chapter:1.1.3

-

Question 53 of 164

53. Question

1 pointsQID2502:What are the benefits of intermediation (indirect financing) for lenders?

Correct

Lenders refer to people who lend money to financial institutions or borrowers. Intermediation may not be able to reduce lenders’ costs, because direct financing may be more profitable and not necessarily has costs. However, there will be credit risks for direct financing for not every borrower repays the outstanding amounts totally and as scheduled. Alternatively, through intermediation, the intermediary will bear the credit risk of the borrower, so the lender can rest assured they can recover the loan and recover it more easily.

Incorrect

Lenders refer to people who lend money to financial institutions or borrowers. Intermediation may not be able to reduce lenders’ costs, because direct financing may be more profitable and not necessarily has costs. However, there will be credit risks for direct financing for not every borrower repays the outstanding amounts totally and as scheduled. Alternatively, through intermediation, the intermediary will bear the credit risk of the borrower, so the lender can rest assured they can recover the loan and recover it more easily.

Hint

Reference Chapter:1.1.1

-

Question 54 of 164

54. Question

1 pointsQID150:Which of the following is correct regarding interest rate?

I. Interest rate reflects the risk of borrowers.

II. Interest rate reflects the cost of borrowers.

III. Interest rate may be affected by monetary policy.

IV. Interest rate is the foundation of the pricing of debt security.Correct

Interest represents the cost of the borrowing and the interest rate is affected by the economic conditions and the creditworthiness (default risk) of the borrower. A floating interest rate changes in line with changes in the pre-determined reference indicator or benchmark rate. Common reference rates in Hong Kong are the HIBOR or the London Interbank Offer Rate (“LIBOR”).

Incorrect

Interest represents the cost of the borrowing and the interest rate is affected by the economic conditions and the creditworthiness (default risk) of the borrower. A floating interest rate changes in line with changes in the pre-determined reference indicator or benchmark rate. Common reference rates in Hong Kong are the HIBOR or the London Interbank Offer Rate (“LIBOR”).

Hint

Reference Chapter:1.1.4

-

Question 55 of 164

55. Question

1 pointsQID153:Which of the following belongs to derivatives?

I. Bonds

II. Options

III. Physical silver

IV. Forward currency contractCorrect

Derivatives are fundamentally classified into four basic types: futures; forwards; swaps ; options.

Incorrect

Derivatives are fundamentally classified into four basic types: futures; forwards; swaps ; options.

Hint

Reference Chapter:1.6.

-

Question 56 of 164

56. Question

1 pointsQID154:What is the main difference between futures and forward contracts?

Correct

Futures contracts are exchange-traded and therefore have standardized features. In contrast to futures contracts, forward contracts are traded OTC, and their terms are not standardized.

Incorrect

Futures contracts are exchange-traded and therefore have standardized features. In contrast to futures contracts, forward contracts are traded OTC, and their terms are not standardized.

Hint

Reference Chapter:1.6.2

-

Question 57 of 164

57. Question

1 pointsQID155:Which of the following is the difference between futures and forward contracts?

I. Futures are standardized contracts.

II. Futures trade at the exchanges.

III. Forward contracts don’t have counterparty risk.

IV. The clearing house/exchanges become the settlement counterparty of futures contracts.Correct

A forward contract is not transferable and there is no margin or collateral requirement to assure performance of the contract. Thus, there is counterparty risk.

Incorrect

A forward contract is not transferable and there is no margin or collateral requirement to assure performance of the contract. Thus, there is counterparty risk.

Hint

Reference Chapter:1.1.6.1

-

Question 58 of 164

58. Question

1 pointsQID156:Which of the following statement is correct regarding the difference between futures and forward contracts?

Correct

Generally, the exchange acts as the counterparty to both the buyer and the seller for settlement and clearance. Thus, counterparty risk is eliminated, which means that investors need not worry that the other side of the transaction might default. Since forward contracts are traded OTC, the counterparty risk is higher.

Incorrect

Generally, the exchange acts as the counterparty to both the buyer and the seller for settlement and clearance. Thus, counterparty risk is eliminated, which means that investors need not worry that the other side of the transaction might default. Since forward contracts are traded OTC, the counterparty risk is higher.

Hint

Reference Chapter:1.1.6.1

-

Question 59 of 164

59. Question

1 pointsQID157:Which of the following statement is incorrect regarding the difference between futures and forward contracts?

Correct

Forward contracts are kind of OTC derivatives. The contractual arrangement is made directly between the buyer and seller and the trade have customized features. Thus, the volumes of forward contracts are lower than that of futures contracts which are exchange-traded derivatives.

Incorrect

Forward contracts are kind of OTC derivatives. The contractual arrangement is made directly between the buyer and seller and the trade have customized features. Thus, the volumes of forward contracts are lower than that of futures contracts which are exchange-traded derivatives.

Hint

Reference Chapter:1.1.6.1

-

Question 60 of 164

60. Question

1 pointsQID158:Which of the following is correct regarding the characteristic of OTC market?

I. Diversified market

II. Buyers and sellers can enter an agreement based on their specific needs.

III. The clearing house acts as counterparty of both sides.

IV. Futures contracts have lower default risk than forward contracts.Correct

Exchange-traded derivatives have standardized features such as size per contract, exercise price and time to maturity. Generally, the exchange acts as the counterparty to both the buyer and the seller for settlement and clearance. Thus, counterparty risk is eliminated, which means that investors need not worry that the other side of the transaction might default. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Incorrect

Exchange-traded derivatives have standardized features such as size per contract, exercise price and time to maturity. Generally, the exchange acts as the counterparty to both the buyer and the seller for settlement and clearance. Thus, counterparty risk is eliminated, which means that investors need not worry that the other side of the transaction might default. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Hint

Reference Chapter:1.1.6.2

-

Question 61 of 164

61. Question

1 pointsQID159:The most common derivatives include:

I. Futures

II. Forward contracts

III. Swaps

IV. OptionsCorrect

Derivatives are fundamentally classified into four basic types: futures; forwards; swaps ; options.

Incorrect

Derivatives are fundamentally classified into four basic types: futures; forwards; swaps ; options.

Hint

Reference Chapter:1.6.

-

Question 62 of 164

62. Question

1 pointsQID160:”It is exchanged-traded and is an agreement to buy or sell an underlying asset at a specified price and date in the future.” What is the kind of derivative depicted above?

Correct

A futures contract are exchange-traded and it is an agreement to buy or sell an underlying asset at a specified price and date in the future.

Incorrect

A futures contract are exchange-traded and it is an agreement to buy or sell an underlying asset at a specified price and date in the future.

Hint

Reference Chapter:1.1.6.2

-

Question 63 of 164

63. Question

1 pointsQID168:Which of the following tools are traded over the counter?

I. Hang Seng index futures

II. Forward currency contract

III. Three month HIBOR futures

IV. Interest rate swapsCorrect

OTC derivatives traded in Hong Kong consist predominantly of FX instruments such as currency swaps, forwards, interest rate swaps and FRAs.

Incorrect

OTC derivatives traded in Hong Kong consist predominantly of FX instruments such as currency swaps, forwards, interest rate swaps and FRAs.

Hint

Reference Chapter:1.6.

-

Question 64 of 164

64. Question

1 pointsQID169:Which of the following tools are traded in the exchanges?

I. Hang Seng index futures

II. Forward currency contract

III. Three month HIBOR futures

IV. Interest rate swapsCorrect

Contracts traded on HKFE can be classified as: (1) equity derivatives; (2) index derivatives; (3) interest rate (or debt) derivatives; (4) commodity derivatives

Incorrect

Contracts traded on HKFE can be classified as: (1) equity derivatives; (2) index derivatives; (3) interest rate (or debt) derivatives; (4) commodity derivatives

Hint

Reference Chapter:1.6.

-

Question 65 of 164

65. Question

1 pointsQID182:Bondholders are the __ of issuers.

Correct

Debt holders are the lenders of funds (creditors) to the debt issuers (borrowers).

Incorrect

Debt holders are the lenders of funds (creditors) to the debt issuers (borrowers).

Hint

Reference Chapter:1.1.4

-

Question 66 of 164

66. Question

1 pointsQID184:Which of the following is not the advantage of bonds over stocks?

Correct

Lower capital appreciation is the disadvantage of debt.

Incorrect

Lower capital appreciation is the disadvantage of debt.

Hint

Reference Chapter:1.1.4

-

Question 67 of 164

67. Question

1 pointsQID537:Which of the following statement is incorrect regarding derivatives in OTC market?

Correct

Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Incorrect

Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Hint

Reference Chapter:1.1.7

-

Question 68 of 164

68. Question

1 pointsQID538:Which of the following statement is correct regarding swaps?

I. Swaps are generally traded over the counter.

II. Swaps have counterparty risk.

III. A swap is an agreement between two parties to exchange the financial obligations or income.

IV. A swap is a kind of forward contract.Correct

A swap is an agreement between two parties to exchange (or swap) the financial obligations – or income-C – they derive from a portfolio of assets or liabilities. Swaps are traded OTC and are highly customized. OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. Thus, it has counterparty risk.

A forward contract is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree. However, swaps are not trading with asset.

Incorrect

A swap is an agreement between two parties to exchange (or swap) the financial obligations – or income-C – they derive from a portfolio of assets or liabilities. Swaps are traded OTC and are highly customized. OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. Thus, it has counterparty risk.

A forward contract is an agreement in which two parties agree to the purchase and sale of an asset at some future time under such conditions as they agree. However, swaps are not trading with asset.

Hint

Reference Chapter:1.1.6.3

-

Question 69 of 164

69. Question

1 pointsQID543:”It is an agreement between two parties to exchange(or swap) the financial obligations or income derive from a portfolio of assets or liabilities” It is more likely to be which of the following derivative instrument?

Correct

A swap is an agreement between two parties to exchange (or swap) the financial obligations – or income-C – they derive from a portfolio of assets or liabilities.

Incorrect

A swap is an agreement between two parties to exchange (or swap) the financial obligations – or income-C – they derive from a portfolio of assets or liabilities.

Hint

Reference Chapter:1.1.6.3

-

Question 70 of 164

70. Question

1 pointsQID1197:Investors of bonds can have:

I. voting rights.

II. ownership.

III. dividends.

IV. coupons.Correct

Fixed-income securities generally involve regular interest repayments throughout the life of the loan, and repayment of the principal amount at maturity together with the final interest instalment. The regular interest amounts known as coupons..

Incorrect

Fixed-income securities generally involve regular interest repayments throughout the life of the loan, and repayment of the principal amount at maturity together with the final interest instalment. The regular interest amounts known as coupons..

Hint

Reference Chapter:1.1.4

-

Question 71 of 164

71. Question

1 pointsQID1386:Over-the-counter Options and stock warrants, compared to exchange-traded Options and stock warrants, have what kind of main advantages?

Correct

All over-the-counter instruments are flexible to negotiate based on the needs of each party.

Incorrect

All over-the-counter instruments are flexible to negotiate based on the needs of each party.

Hint

Reference Chapter:1.1.6.4

-

Question 72 of 164

72. Question

1 pointsQID972:Primary market allows:

Correct

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Incorrect

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Hint

Reference Chapter:1.1.7

-

Question 73 of 164

73. Question

1 pointsQID673:The responsibility of corporate finance advisors include:

I. Help corporations hire professional advisors

II. Provide corporations with strategic advice

III. Provide corporations with financial advice

IV. Provide customers with advice related to mergers and acquisitionsCorrect

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Incorrect

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Hint

Reference Chapter:1.1.2

-

Question 74 of 164

74. Question

1 pointsQID674:Which of the following is the responsibility of corporate finance advisors?

I. Provide customers with loans

II. Provide independent advice to customer who is being accquired.

III. Carrying out valuation of customer’s subsidiary

IV. Making investments on behalf of customersCorrect

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Incorrect

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Hint

Reference Chapter:1.1.2

-

Question 75 of 164

75. Question

1 pointsQID675:Which of the following is not the responsibility of corporate finance advisors?

Correct

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Incorrect

The work of corporate finance professionals includes the following: (1) providing strategic advice for corporations; (2) providing financial advice for corporations; (3) carrying out valuation of companies, specific company assets or specific company securities; (4)raising capital for corporations – debt, equity and hybrid forms; (5) lending to corporations; (6)restructuring the business or the finances of a corporation; (7) advising a company on merger and acquisition strategies.

Hint

Reference Chapter:1.1.2

-

Question 76 of 164

76. Question

1 pointsQID24:What is the advantage of intermediation?

Correct

Intermediaries are compensated for assuming the risk involved by receiving a fee (brokerage or commission) or by charging higher rates to borrowers than they pay to lenders.

Incorrect

Intermediaries are compensated for assuming the risk involved by receiving a fee (brokerage or commission) or by charging higher rates to borrowers than they pay to lenders.

Hint

Reference Chapter:1.1.1

-

Question 77 of 164

77. Question

1 pointsQID1024:The intermediary between the buyers and sellers of securities is called:

Correct

In the primary market, the role of dealers includes forming “brokers’ panels” that underwrite, manage and promote a new issue to the public. In the secondary market, brokers and traders actively buy and sell debt securities either on their own account or as agents for principal borrowers and investors.

Incorrect

In the primary market, the role of dealers includes forming “brokers’ panels” that underwrite, manage and promote a new issue to the public. In the secondary market, brokers and traders actively buy and sell debt securities either on their own account or as agents for principal borrowers and investors.

Hint

Reference Chapter:1.1.1

-

Question 78 of 164

78. Question

1 pointsQID791:Properties of interest rate derivatives traded over the counter include:

I. Flexibility

II. Traded at diversified marketsIII. Settlement is not guaranteed by the clearing houses.

IV Higher liquidityCorrect

OTC markets enable buyers and sellers to trade derivatives products that have been tailored to meet their specific needs in a decentralized marketplace. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Incorrect

OTC markets enable buyers and sellers to trade derivatives products that have been tailored to meet their specific needs in a decentralized marketplace. Unlike exchange-traded derivatives, OTC derivatives do not have standardized features and are therefore not generally traded to third parties, remaining a contractual arrangement between the two parties for the life of the contract. This implies that OTC derivatives have a higher risk of default (counterparty risk) than the exchange-traded type.

Hint

Reference Chapter:1.1.7

-

Question 79 of 164

79. Question

1 pointsQID794:If an investor worries about an interest rate hike and wishes to hedge via swaps, he should:

Correct

Swaps allow parties to exchange their exposure to suit their own outlook better. If the investor had borrowings at a floating rate of interest and had the view that interest rates were going to rise, they could look to swap their financial obligations with another investor, who had borrowings at a fixed rate of interest.

Incorrect

Swaps allow parties to exchange their exposure to suit their own outlook better. If the investor had borrowings at a floating rate of interest and had the view that interest rates were going to rise, they could look to swap their financial obligations with another investor, who had borrowings at a fixed rate of interest.

Hint

Reference Chapter:1.1.6.3

-

Question 80 of 164

80. Question

1 pointsQID1471:What is the difference between futures and forwards?

I. Futures are standardized

II. Futures are traded on the exchange

III. There is no counterparty risk in Forward Contracts

IV. The Clearing House / Exchange becomes the counterparty to the futures contractCorrect

Forward contracts and futures are agreements of a similar nature, the difference being that forward contracts are traded over and over the exchange.

Exchange-traded products are subject to change of appointment, regardless of the counterparty’s credit status, which is commonly referred to as counterparty risk or settlement risk.Incorrect

Forward contracts and futures are agreements of a similar nature, the difference being that forward contracts are traded over and over the exchange.

Exchange-traded products are subject to change of appointment, regardless of the counterparty’s credit status, which is commonly referred to as counterparty risk or settlement risk.Hint

Reference Chapter:1.1.6.2

-

Question 81 of 164

81. Question

1 pointsQID403:When companies liquidate, what is the correct priority to claim assets?

Correct

Where the issuing company is liquidated, preference shareholders rank above ordinary shareholders but below other creditors, when it comes to repayment.

Incorrect

Where the issuing company is liquidated, preference shareholders rank above ordinary shareholders but below other creditors, when it comes to repayment.

Hint

Reference Chapter:1.1.4

-

Question 82 of 164

82. Question

1 pointsQID407:Which of the following statement is correct regarding debt?

Correct

A debt is a contractual agreement between the borrower of funds and the lender of funds, and represents the existence of a loan.

Incorrect

A debt is a contractual agreement between the borrower of funds and the lender of funds, and represents the existence of a loan.

Hint

Reference Chapter:1.1.4

-

Question 83 of 164

83. Question

1 pointsQID1105:Mr. Liao bought call option without holding the underlying stock. His purpose was more likely:

Correct

Mr. Liao bought call option without holding the underlying stock. This reflect he is not willing to hedge or arbitrage. He is willing to take profile from the change of price and he is speculating.

Incorrect

Mr. Liao bought call option without holding the underlying stock. This reflect he is not willing to hedge or arbitrage. He is willing to take profile from the change of price and he is speculating.

Hint

Reference Chapter:1.1.6.2

-

Question 84 of 164

84. Question

1 pointsQID1106:Mr. Liao bought put option without holding the underlying stock. His purpose was more likely:

Correct

Mr. Liao bought put option without holding the underlying stock. This reflect he is not willing to hedge or arbitrage. He is willing to take profile from the change of price and he is speculating.

Incorrect

Mr. Liao bought put option without holding the underlying stock. This reflect he is not willing to hedge or arbitrage. He is willing to take profile from the change of price and he is speculating.

Hint

Reference Chapter:1.1.6.2

-

Question 85 of 164

85. Question

1 pointsQID1107:Mr. Liao bought put option while holding the underlying stock. His purpose was more likely:

Correct

Mr. Liao bought put option with holding the underlying stock. He may want to hedge exposures.

Incorrect

Mr. Liao bought put option with holding the underlying stock. He may want to hedge exposures.

Hint

Reference Chapter:1.1.6.2

-

Question 86 of 164

86. Question

1 pointsQID375:Which of the following is “hybrid” securities?

Correct

Convertible notes are a form of hybrid security. They are effectively a combination of debt and equity.

Incorrect

Convertible notes are a form of hybrid security. They are effectively a combination of debt and equity.

Hint

Reference Chapter:1.1.5

-

Question 87 of 164

87. Question

1 pointsQID378:Which of the following statement is incorrect regarding ordinary shareholders?

Correct

When company liquidates, bondholders have claims prior to ordinary shareholders.

Incorrect

When company liquidates, bondholders have claims prior to ordinary shareholders.

Hint

Reference Chapter:1.1.4

-

Question 88 of 164

88. Question

1 pointsQID380:Why invest in ordinary shares?

I. Capital appreciation

II. Unlimited dividends income

III. Having voting rights to choose new managers

IV. Having claims prior to bondholdersCorrect

Ordinary shareholders have voting rights, representing their status as part-owners of the company. Voting occurs at the annual general meeting (“AGM”) or at a specially convened extraordinary general meeting (“EGM”). In the event of the company being liquidated, ordinary shareholders receive payment after other creditors have been fully paid. They are entitled to share the company’s profits in the form of a dividend, paid at the discretion of the company.

Incorrect

Ordinary shareholders have voting rights, representing their status as part-owners of the company. Voting occurs at the annual general meeting (“AGM”) or at a specially convened extraordinary general meeting (“EGM”). In the event of the company being liquidated, ordinary shareholders receive payment after other creditors have been fully paid. They are entitled to share the company’s profits in the form of a dividend, paid at the discretion of the company.

Hint

Reference Chapter:1.1.4

-

Question 89 of 164

89. Question

1 pointsQID387:If Vitamilk company is now facing the risk of bankrupt, which of the following party is the least likely to get their cash back?

Correct

In the event of the company being liquidated, ordinary shareholders receive payment after other creditors and preference shareholders have been fully paid.

Incorrect

In the event of the company being liquidated, ordinary shareholders receive payment after other creditors and preference shareholders have been fully paid.

Hint

Reference Chapter:1.1.4

-

Question 90 of 164

90. Question

1 pointsQID484:Which of the following tool can firms use to raise money in debt markets?

I. Company options

II. Eurobonds

III. Commercial paper

IV. Preference sharesCorrect

Only Eurobonds and Commercial paper are debt securities and raise money in debt markets.

Incorrect

Only Eurobonds and Commercial paper are debt securities and raise money in debt markets.

Hint

Reference Chapter:1.1.4

-

Question 91 of 164

91. Question

1 pointsQID663:Which of the following is not the lessons learned from Enron case?

Correct

From a risk management perspective, the Enron case highlights the following lessons: (1)The role of good corporate governance on the part of the board, setting a business culture of transparency and accountability. (2)The need for high quality, accurate and true information to be provided to the shareholders by the company. (3) The need to avoid conflict of interests, among employees, directors and auditors. (4) The importance of diversifying investment portfolios to manage risk.

Incorrect

From a risk management perspective, the Enron case highlights the following lessons: (1)The role of good corporate governance on the part of the board, setting a business culture of transparency and accountability. (2)The need for high quality, accurate and true information to be provided to the shareholders by the company. (3) The need to avoid conflict of interests, among employees, directors and auditors. (4) The importance of diversifying investment portfolios to manage risk.

Hint

Reference Chapter:1.3.1.2

-

Question 92 of 164

92. Question

1 pointsQID2758:Which of the following is not true about convertible bonds?

Correct

Convertible bonds yield is lower.

Incorrect

Convertible bonds yield is lower.

Hint

Reference Chapter:1.1.5

-

Question 93 of 164

93. Question

1 pointsQID2791:Which of the following is not an action that the finance sector needs to take to improve the quality of financial statements?

Correct

If the finance sector is concerned about the quality of financial statements, it should take action, such as:

(1) insisting that their borrowers and investees take on qualified, experienced, capable and trustworthy accountants and auditors;

(2) insisting that their borrowers and investees receive and review regular, reliable and comprehensive management accounts;

(3) requiring an independent internal audit function within companies;

(4) supporting the auditing profession;

(5) encouraging financial analysts to discuss publicly financials containing cosmetic accounting;

(6) participating in the debate on accounting standards;

(7) reporting misleading and non-transparent financials to the regulatory agencies; and

(8) blacklisting accounting firms that endorse misleading and non-transparent financials.Incorrect

If the finance sector is concerned about the quality of financial statements, it should take action, such as:

(1) insisting that their borrowers and investees take on qualified, experienced, capable and trustworthy accountants and auditors;

(2) insisting that their borrowers and investees receive and review regular, reliable and comprehensive management accounts;

(3) requiring an independent internal audit function within companies;

(4) supporting the auditing profession;

(5) encouraging financial analysts to discuss publicly financials containing cosmetic accounting;

(6) participating in the debate on accounting standards;

(7) reporting misleading and non-transparent financials to the regulatory agencies; and

(8) blacklisting accounting firms that endorse misleading and non-transparent financials.Hint

Reference Chapter:1.3.4

-

Question 94 of 164

94. Question

1 pointsQID2792:Company A is a shipping company. Which of the following is not a good way to improve corporate governance for the company?

Correct

Good corporate governance should have a good division of authority and should not allow operational staff to assist in the audit.

Incorrect

Good corporate governance should have a good division of authority and should not allow operational staff to assist in the audit.

Hint

Reference Chapter:1.3.1.2

-

Question 95 of 164

95. Question

1 pointsQID529:Which of the following statement is correct regarding forward contracts?

I. Forward contracts can not be transferred.

II. There is no margin or collateral requirement to assure performance of the contract.

III. It is not exchange-traded.

IV. The clearing house acts as counterparty.Correct

A forward contract is not transferable and there is no margin or collateral requirement to assure performance of the contract. Forward contracts are traded OTC and thus there is no exchange acts as the counterparty between the buyer and seller.

Incorrect

A forward contract is not transferable and there is no margin or collateral requirement to assure performance of the contract. Forward contracts are traded OTC and thus there is no exchange acts as the counterparty between the buyer and seller.

Hint

Reference Chapter:1.1.6.1

-

Question 96 of 164

96. Question

1 pointsQID530:Which of the following statement is incorrect regarding forward contracts?

Correct

Forward contracts are traded OTC and their terms are not standardized. Thus, forward contracts need not to mark to the market daily.

Incorrect

Forward contracts are traded OTC and their terms are not standardized. Thus, forward contracts need not to mark to the market daily.

Hint

Reference Chapter:1.1.6.1

-

Question 97 of 164

97. Question

1 pointsQID662:Which of the following is not the main reason for the Barings case?

Correct

The collapse of Barings Bank in 1995 was a direct result of losses made by a rogue trader, and provided a valuable insight into the potential consequences of failure to segregate duties or implement transparent reporting lines in business. In addition, the board of Barings had overall responsibility for the culture and corporate governance of the bank. There was very little questioning of the extraordinary profits which were being reported from the Singapore trading operation and on which the bank had become so dependent.

Incorrect

The collapse of Barings Bank in 1995 was a direct result of losses made by a rogue trader, and provided a valuable insight into the potential consequences of failure to segregate duties or implement transparent reporting lines in business. In addition, the board of Barings had overall responsibility for the culture and corporate governance of the bank. There was very little questioning of the extraordinary profits which were being reported from the Singapore trading operation and on which the bank had become so dependent.

Hint

Reference Chapter:1.3.1

-

Question 98 of 164

98. Question

1 pointsQID728:Derivatives are often used to transfer assets. What is the main reason?

Correct

It doesn’t have to change the assets combination of portfolios while we can hedge the exposure by using derivative.

Incorrect

It doesn’t have to change the assets combination of portfolios while we can hedge the exposure by using derivative.

Hint

Reference Chapter:1.1.6.2

-

Question 99 of 164

99. Question

1 pointsQID729:Mr. Yin is a helicopter parent who often pays attention to the trend in AUD in order to prepare for his children’s studying abroad. He thinks that AUD will rise in the future, so he buys AUD futures. Mr. Yin is more likely to be a:

Correct

Mr. Yin buys AUD futures and try to protect (or hedge) against adverse future price movements by “fixing” a predetermined price of AUD.

Incorrect

Mr. Yin buys AUD futures and try to protect (or hedge) against adverse future price movements by “fixing” a predetermined price of AUD.

Hint

Reference Chapter:1.1.6.2

-

Question 100 of 164

100. Question