English HKSI Paper 1 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP1ET1

Quiz-summary

0 of 229 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

Information

HKSIP1ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 229 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

-

HKSIP1ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- Answered

- Review

-

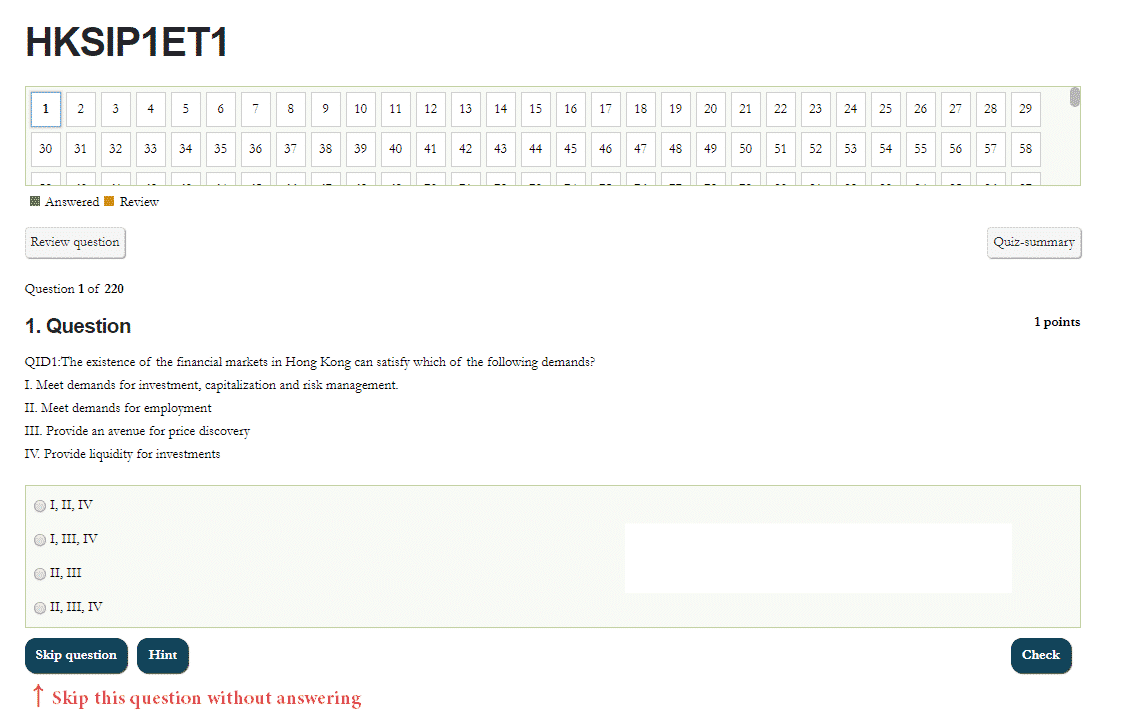

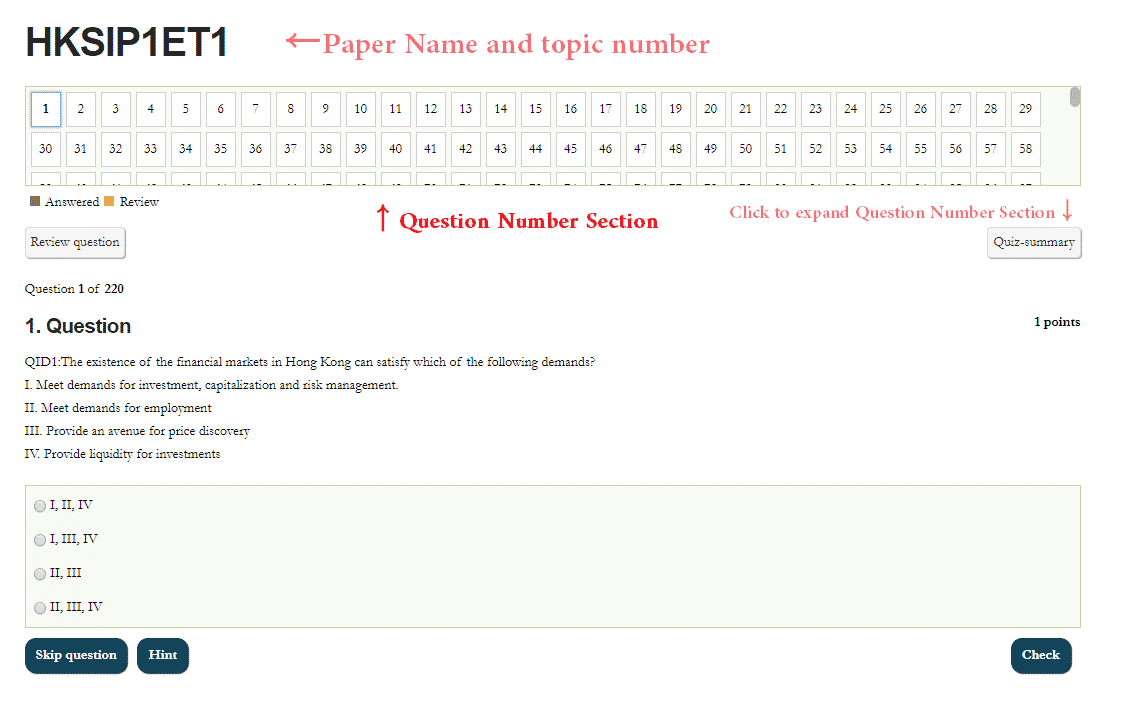

Question 1 of 229

1. Question

1 pointsQID780:Which of the following demands have to be satisfied by the wide range of financial products and services available in Hong Kong?

I. Meet demands for investmentII. Employment opportunities for locals

III. Employment opportunities for expatriates

IV. Capital and investment protection

Correct

Hong Kong’s status as an international financial centre is reflected in the wide range of financial products and services available in Hong Kong, developed to meet demands for investment, capital and income formation and capital raising, the facilitation of cash and capital flows, capital and investment protection (for example, hedging), safe custody and security, speculation and insurance. The financial markets also provide an avenue for price discovery and liquidity of investments.

Incorrect

Hong Kong’s status as an international financial centre is reflected in the wide range of financial products and services available in Hong Kong, developed to meet demands for investment, capital and income formation and capital raising, the facilitation of cash and capital flows, capital and investment protection (for example, hedging), safe custody and security, speculation and insurance. The financial markets also provide an avenue for price discovery and liquidity of investments.

Hint

Reference Chapter:1.1.1

-

Question 2 of 229

2. Question

1 pointsQID2:Which of the following demands or needs can be satisfied by the wide range of financial products and services available in Hong Kong?

I. The demands for investment opportunities

II. Employment opportunities for professional locals in overseas

III. Local employment opportunities for unskilled locals

IV. The demand for insurance and reinsuranceCorrect

The existence of financial markets is to meet the demands of different financial needs. Providing employment opportunities is not a primary function of the financial markets, therefore II and III are incorrect.

Incorrect

The existence of financial markets is to meet the demands of different financial needs. Providing employment opportunities is not a primary function of the financial markets, therefore II and III are incorrect.

Hint

Reference Chapter:1.1.1

-

Question 3 of 229

3. Question

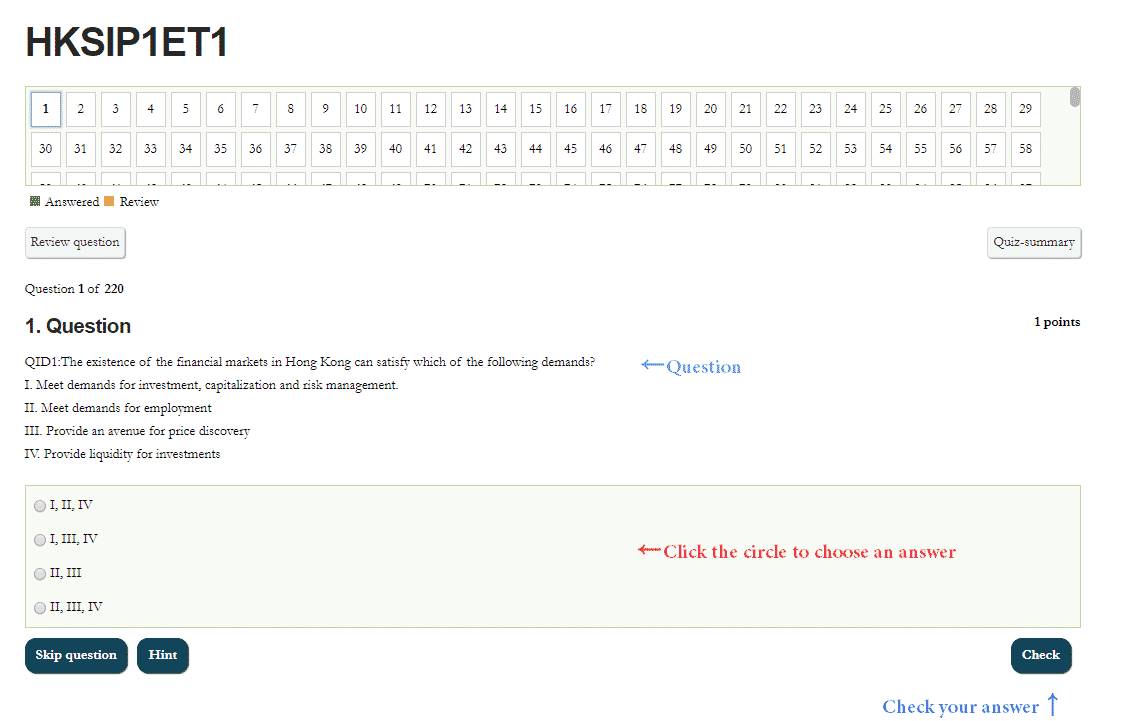

1 pointsQID1:The existence of the financial markets in Hong Kong can satisfy which of the following demands?

I. Meet demands for investment, capitalization and risk management.

II. Meet demands for employment

III. Provide an avenue for price discovery

IV. Provide liquidity for investmentsCorrect

The demands for employment is not a function satisfied by financial market alone, thus is not a primary reason for the existence of the financial markets in Hong Kong.

Incorrect

The demands for employment is not a function satisfied by financial market alone, thus is not a primary reason for the existence of the financial markets in Hong Kong.

Hint

Reference Chapter:1.1.1

-

Question 4 of 229

4. Question

1 pointsQID786:Which of the following regulatory approaches adopted by the SFC is given more regulatory attention towards the areas where the SFC perceives the highest risks to lie?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 5 of 229

5. Question

1 pointsQID785:The SFC regime adopts which of the following regulatory approaches?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 6 of 229

6. Question

1 pointsQID783:What approach does the SFC take to regulate market intermediaries?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 7 of 229

7. Question

1 pointsQID10:Which system or philosophy of regulations is adopted by the SFC to regulate securities and futures markets?

Correct

SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 8 of 229

8. Question

1 pointsQID787:Which of the following regulatory approach is adopted by the SFC?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 9 of 229

9. Question

1 pointsQID784:A risk-based regulatory system refers to a system in which:

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.11

-

Question 10 of 229

10. Question

1 pointsQID11:Under what circumstance can the Government intervene in the securities market in Hong Kong?

Correct

The broad points stated by the Securities Review Committee under Ian Hay Davison were the need for: (e) checks and balances on the system, with the exchanges being supervised by a

commission independent of the Government, with the Government only to intervene if and when the Commission failed to regulate properly.Incorrect

The broad points stated by the Securities Review Committee under Ian Hay Davison were the need for: (e) checks and balances on the system, with the exchanges being supervised by a

commission independent of the Government, with the Government only to intervene if and when the Commission failed to regulate properly.Hint

Reference Chapter:1.1.16

-

Question 11 of 229

11. Question

1 pointsQID172:Which of the following is an accurate description of Hong Kong’s financial regulatory structure?

Correct

The broad points stated by the Securities Review Committee under Ian Hay Davison were

the need for:

(e) checks and balances on the system, with the exchanges being supervised by a

commission independent of the Government, with the Government only to intervene if

and when the Commission failed to regulate properlyIncorrect

The broad points stated by the Securities Review Committee under Ian Hay Davison were

the need for:

(e) checks and balances on the system, with the exchanges being supervised by a

commission independent of the Government, with the Government only to intervene if

and when the Commission failed to regulate properlyHint

Reference Chapter:1.1.16

-

Question 12 of 229

12. Question

1 pointsQID12:Which of the following statements regarding the development of the securities and futures markets in Hong Kong after 1980 are true?

I. The number of exchanges decreased

II. The government imposed direct control on the industries

III. Suggested by the Davison Committee, there is only one regulator for the Securities and Banking Industry.

IV. A consolidation of a number of ordinances regulating the securities and futures industries.Correct

The structure recommended by the Securities Review Committee under Ian Hay Davison has functioned since 1989 and remains basically unchanged. The current SFO is largely a consolidation of ten diverse ordinances regulating the securities, futures and leveraged foreign exchange industries.

Incorrect

The structure recommended by the Securities Review Committee under Ian Hay Davison has functioned since 1989 and remains basically unchanged. The current SFO is largely a consolidation of ten diverse ordinances regulating the securities, futures and leveraged foreign exchange industries.

Hint

Reference Chapter:1.1.17

-

Question 13 of 229

13. Question

1 pointsQID790:Which of the following is NOT a major financial service provided in Hong Kong?

Correct

This service is not provided by any Hong Kong financial actor.

Incorrect

This service is not provided by any Hong Kong financial actor.

Hint

Reference Chapter:1.1.3

-

Question 14 of 229

14. Question

1 pointsQID789:Which of the following are major financial services provided in Hong Kong?

I. Trading securities on behalf of clients on the Stock Exchange of Hong Kong (SEHK).

II. Providing margin financing and accommodation on securities trading

III. Acting as an “introducing agent”

IV. Conducting stock borrowing and lending transactions.Correct

All of these services are provided by Hong Kong financial companies.

Incorrect

All of these services are provided by Hong Kong financial companies.

Hint

Reference Chapter:1.1.3

-

Question 15 of 229

15. Question

1 pointsQID5:Which of the followings is not a service provider in the asset management industry?

Correct

The definition of asset management is to manage securities and futures portfolio or real estate investment trust for others. Auditors do not manage asset; they merely audit as their primary business. Fund managers manage Collective Investment Schemes; that is managing portfolios of securities and futures or real estate trust for a group of people. Therefore they are service providers in the asset management industry. Stockbrokers buy and sell Collective Investments Schemes on behalf of clients and may also manage securities portfolio for clients. Therefore they are service providers in the asset management industry. Independent Financial Advisers (IFA) provides advice on buying and selling Collective Investment Schemes. Therefore they are service providers of the asset management industry.

Incorrect

The definition of asset management is to manage securities and futures portfolio or real estate investment trust for others. Auditors do not manage asset; they merely audit as their primary business. Fund managers manage Collective Investment Schemes; that is managing portfolios of securities and futures or real estate trust for a group of people. Therefore they are service providers in the asset management industry. Stockbrokers buy and sell Collective Investments Schemes on behalf of clients and may also manage securities portfolio for clients. Therefore they are service providers in the asset management industry. Independent Financial Advisers (IFA) provides advice on buying and selling Collective Investment Schemes. Therefore they are service providers of the asset management industry.

Hint

Reference Chapter:1.1.3

-

Question 16 of 229

16. Question

1 pointsQID1499:Which of the following are service providers of the Asset Management Industry in Hong Kong?

I. Fund houses

II. Auditors

III. Fund management companies

IV. StockbrokersCorrect

Typical service providers include:

(a) fund houses; (b) fund management companies; (c.) stockbrokersIncorrect

Typical service providers include:

(a) fund houses; (b) fund management companies; (c.) stockbrokersHint

Reference Chapter:1.1.3

-

Question 17 of 229

17. Question

1 pointsQID2674:Which of the following activity is subject to supervision by the financial regulators?

Correct

Providing a loan and charging interest is a financial actitiy that is subjected to supervision by the financial regulators.

Incorrect

Providing a loan and charging interest is a financial actitiy that is subjected to supervision by the financial regulators.

Hint

Reference Chapter:1.1.3

-

Question 18 of 229

18. Question

1 pointsQID1500:Which of the following are service providers in the asset management industry?

I. Banks

II. Trustees

III. Custodians

IV. Financial PlannersCorrect

Typical service providers include:

(d) banks; (e.) trustees; (f) custodians; (g) financial plannersIncorrect

Typical service providers include:

(d) banks; (e.) trustees; (f) custodians; (g) financial plannersHint

Reference Chapter:1.1.3

-

Question 19 of 229

19. Question

1 pointsQID1658:Hong Kong Financial Regulatory Regime is

Correct

Hong Kong Financial Regulatory Regime is able to address new and complex financial products.

Incorrect

Hong Kong Financial Regulatory Regime is able to address new and complex financial products.

Hint

Reference Chapter:1.1.4

-

Question 20 of 229

20. Question

1 pointsQID6:Which of the following is a primary objective of Hong Kong financial regulators?

Correct

Encouraging the development of new products, operating profitable exchanges in Hong Kong and reducing trading hours are all actions. They are action verbs but not objective description. Objectives can only be objective description, therefore, these phrases can never be objectives and primary objective of Hong Kong financial regulators. Objectives are status that financial regulators hope for, enhancing confidence is an objective description that financial regulators hope for.

Incorrect

Encouraging the development of new products, operating profitable exchanges in Hong Kong and reducing trading hours are all actions. They are action verbs but not objective description. Objectives can only be objective description, therefore, these phrases can never be objectives and primary objective of Hong Kong financial regulators. Objectives are status that financial regulators hope for, enhancing confidence is an objective description that financial regulators hope for.

Hint

Reference Chapter:1.1.7

-

Question 21 of 229

21. Question

1 pointsQID7:Which of the following is not a common objective of the financial regulators in Hong Kong?

Correct

A common objective is something that all financial regulators must achieve, maintaining currency stability is an objective specific to the HKMA. Other financial regulators are not responsible for maintaining currency stability of the Hong Kong Dollar, thus its not a common objective.

Incorrect

A common objective is something that all financial regulators must achieve, maintaining currency stability is an objective specific to the HKMA. Other financial regulators are not responsible for maintaining currency stability of the Hong Kong Dollar, thus its not a common objective.

Hint

Reference Chapter:1.1.7

-

Question 22 of 229

22. Question

1 pointsQID2680:Which of the following description does not fit financial regulators in Hong Kong?

Correct

Decisions made by the regulators can be overturned or overruled.

Incorrect

Decisions made by the regulators can be overturned or overruled.

Hint

Reference Chapter:1.1.7

-

Question 23 of 229

23. Question

1 pointsQID903:Which of the following are not common objectives of financial regulators in Hong Kong?

I. Promote intervention to enhance international and local market confidence.

II. Provide investment advice to retail investors

III. Encourage the installation of a sound technical infrastructure for the functioning of the financial markets

IV. Ensure that the legal framework of financial regulation is certain, adequate and fairly enforcedCorrect

Frequent Intervention is not an objective of financial regulators in Hong Kong. Providing Investment advice is not a job that regulators will do, it’s the job of intermediaries.

Incorrect

Frequent Intervention is not an objective of financial regulators in Hong Kong. Providing Investment advice is not a job that regulators will do, it’s the job of intermediaries.

Hint

Reference Chapter:1.1.7

-

Question 24 of 229

24. Question

1 pointsQID8:Which two of the following philosophies and systems of regulations are commonly used by financial regulators in Hong Kong?

I. Merit Based

II. Sanction Based

III. Disclosure Based

IV. Income BasedCorrect

Sanction Based regulations and Income Based regulations do not exist in Hong Kong. Merit Based regulations is to reduce access to unfavourable investment products or projects by investors. The interest of investors are protected by doing so. Disclosure Based regulations require investment products and projects disclose their strengths and weaknesses maximally, so that investors can make an informed decision.

Incorrect

Sanction Based regulations and Income Based regulations do not exist in Hong Kong. Merit Based regulations is to reduce access to unfavourable investment products or projects by investors. The interest of investors are protected by doing so. Disclosure Based regulations require investment products and projects disclose their strengths and weaknesses maximally, so that investors can make an informed decision.

Hint

Reference Chapter:1.1.8

-

Question 25 of 229

25. Question

1 pointsQID1657:A disclosure based system principle is

Correct

The principle of Disclosure based system is Issuers trying their best to disclose information to allow investors to make the right choice.

Incorrect

The principle of Disclosure based system is Issuers trying their best to disclose information to allow investors to make the right choice.

Hint

Reference Chapter:1.1.8

-

Question 26 of 229

26. Question

1 pointsQID9:Which of the following regulatory philosophies does Hong Kong regulators employ when considering share offers and listing matters?

Correct

In Hong Kong, the new Companies Ordinance (“NCO”) is disclosure-based and has legal force. The idea is simply that maximum disclosure is required to protect investors, but there is an obligation on the part of the participants to take responsibility for using the full information to make their own independent investment decisions.

Incorrect

In Hong Kong, the new Companies Ordinance (“NCO”) is disclosure-based and has legal force. The idea is simply that maximum disclosure is required to protect investors, but there is an obligation on the part of the participants to take responsibility for using the full information to make their own independent investment decisions.

Hint

Reference Chapter:1.1.8

-

Question 27 of 229

27. Question

1 pointsQID2711:Which of the following statements regarding disclosure-based and merit-based regulation is correct?

Correct

Financial regulation in Hong Kong is both disclosure-based and merit-based. The Companies Ordinance adopts a disclosure-based regulatory approach. The Listing Rules are mainly merit-based, but there are also many contents that are disclosure-based. Disclosure-based and merit-based regulatory approaches often overlap and there is no clear line between the two.

Incorrect

Financial regulation in Hong Kong is both disclosure-based and merit-based. The Companies Ordinance adopts a disclosure-based regulatory approach. The Listing Rules are mainly merit-based, but there are also many contents that are disclosure-based. Disclosure-based and merit-based regulatory approaches often overlap and there is no clear line between the two.

Hint

Reference Chapter:1.1.8

-

Question 28 of 229

28. Question

1 pointsQID2351:What’s the purposes of merit-based implementation in Hong Kong?

I. To filter out unpopular investment products

II. To ensure the profits of investment products is protected

III. To ensure there is certain balance between risks and returns

IV. To prohibit foreign investment products from absorbing local funds.Correct

Followings are purposes of the merit-based implementation in Hong Kong:

I. To filter out unpopular investment products

II. To ensure there is certain balance between risks and returnsIncorrect

Followings are purposes of the merit-based implementation in Hong Kong:

I. To filter out unpopular investment products

II. To ensure there is certain balance between risks and returnsHint

Reference Chapter:1.1.9

-

Question 29 of 229

29. Question

1 pointsQID1656:A disclosure based system is in place to protect

Correct

Disclosure based system is in place to protect Investors.

Incorrect

Disclosure based system is in place to protect Investors.

Hint

Reference Chapter:1.1.9

-

Question 30 of 229

30. Question

1 pointsQID1181:What are the two regulatory authorities primarily involved in regulating the asset management industry

I. SFC

II. HKMA

III. SEHK

IV. HKEXCorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Incorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Hint

Reference Chapter:1.2.10

-

Question 31 of 229

31. Question

1 pointsQID32:Which of the following descriptions are correct?

I. All banks in Hong Kong are supervised by the SFC.

II. Some of the activities conducted by registered institutions are regulated by the SFO.

III. A memorandum of understanding (“MOU”) has been signed between the SFC and the HKMA to minimize regulatory overlaps.

IV. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.Correct

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. Clearly, the HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.

Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. Clearly, the HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime. The Insurance Authority is the major regulator of the insurance industry in Hong Kong.

Hint

Reference Chapter:1.2.10

-

Question 32 of 229

32. Question

1 pointsQID25:British Construction Bank is an authorised financial institution (AFI). Due to the rapid development of the securities markets, the company plans to provide securities trading services to its customer. How should the company proceed?

Correct

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as

registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as

registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Hint

Reference Chapter:1.2.10

-

Question 33 of 229

33. Question

1 pointsQID1180:Which of the following organizations are supervised, monitored and regulated by the HKMA?

I. The Banking Authority

II. Registered Institutions

III. Licensed Corporation

IV. Authorised Financial InstitutionsCorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Incorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Hint

Reference Chapter:1.2.10

-

Question 34 of 229

34. Question

1 pointsQID1158:Who is responsible for the supervision of registered institutions?

Correct

HKMA is the frontline regulator of registered institutions.

Incorrect

HKMA is the frontline regulator of registered institutions.

Hint

Reference Chapter:1.2.10

-

Question 35 of 229

35. Question

1 pointsQID30:Which of the following is the regulator of Registered Institutions?

Correct

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Incorrect

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Hint

Reference Chapter:1.2.10

-

Question 36 of 229

36. Question

1 pointsQID809:What is the difference between Licensed Corporations and Registered Institutions?

Correct

Registered institutions are regulated by the HKMA. They have to be registered with the SFC if they wish to carry out SFC regulated activities but the front line regulator will be the HKMA.

Incorrect

Registered institutions are regulated by the HKMA. They have to be registered with the SFC if they wish to carry out SFC regulated activities but the front line regulator will be the HKMA.

Hint

Reference Chapter:1.2.10

-

Question 37 of 229

37. Question

1 pointsQID29:Which of the following descriptions about Authorised Financial

Institutions (AFI) are true?

I. All Registered Institutions are banks.

II. If the AFIs are conducting the regulated activities as defined by the SFO, the AFIs should register with the SFC.

III. SFC is responsible for licensing AFIs for all businesses

IV. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFCCorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFC, which may directly review those institutions.

Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-regulated activities to the SFC, which may directly review those institutions.

Hint

Reference Chapter:1.2.10

-

Question 38 of 229

38. Question

1 pointsQID28:Which entity is the frontline regulator of registered institution that conducts regulated activity as defined by the SFO?

Correct

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections.

Incorrect

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections.

Hint

Reference Chapter:1.2.10

-

Question 39 of 229

39. Question

1 pointsQID31:Which of the following is the regulator of Authorised Financial

Institutions?Correct

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.

Incorrect

As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.

Hint

Reference Chapter:1.2.10

-

Question 40 of 229

40. Question

1 pointsQID24:If an AFI plans to conduct regulated activities as defined by the SFO, which of the following entities should it register with ?

Correct

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

Hint

Reference Chapter:1.2.10

-

Question 41 of 229

41. Question

1 pointsQID23:British Construction Bank is an AFI regulated by the HKMA. If it plans to conduct Type 9 Regulated Activity (Asset Management) in the near future, how should it proceed?

Correct

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity.

Hint

Reference Chapter:1.2.10

-

Question 42 of 229

42. Question

1 pointsQID1182:The British Construction bank is a licensed bank under the HKMA and plans to provide securities trading services for its clients, it should:

Correct

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Incorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Hint

Reference Chapter:1.2.10

-

Question 43 of 229

43. Question

1 pointsQID1183:If an authorised financial institution would like to conduct regulated actives under the SFO, which organization should it register with?

Correct

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Incorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Hint

Reference Chapter:1.2.10

-

Question 44 of 229

44. Question

1 pointsQID1185:Which entity is the frontline regulator(s) of registered institutions that conducts regulated activities?

Correct

The frontline regulator of AFIs is the HKMA.

Incorrect

The frontline regulator of AFIs is the HKMA.

Hint

Reference Chapter:1.2.10

-

Question 45 of 229

45. Question

1 pointsQID1184:British Construction Bank is and AFI regulated by the HKMA, if it plans to conduct Type 9 Regulated Activity in the near future, how should it proceed?

Correct

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Incorrect

Under the SFO and the Banking Ordinance, AFIs, which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-RA.

Hint

Reference Chapter:1.2.10

-

Question 46 of 229

46. Question

1 pointsQID1494:What is the primary function of Registered Institution in the Asset Management Business?

Correct

Many AFIs participate in the fund management industry as distributors of CISs products. Accordingly, the HKMA, in its capacity as the banking regulatory authority, is concerned with the asset management industry insofar as it affects AFIs engaged in the regulated activity of asset management, i.e. registered institutions.

Incorrect

Many AFIs participate in the fund management industry as distributors of CISs products. Accordingly, the HKMA, in its capacity as the banking regulatory authority, is concerned with the asset management industry insofar as it affects AFIs engaged in the regulated activity of asset management, i.e. registered institutions.

Hint

Reference Chapter:1.2.10

-

Question 47 of 229

47. Question

1 pointsQID26:British Construction Bank is an authorised financial institution. Amid the downfall of the Hong Kong banking sector, it would like to sell fund products of other companies to clients to generate revenue. Where should British Construction Bank apply for a license?

Correct

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Incorrect

Under the SFO and the Banking Ordinance, authorised financial institutions (“AFIs”), which are regulated by the HKMA and include banks, have to be registered with the SFC as registered institutions if they wish to carry out an SFC-regulated activity. As the frontline regulator of AFIs is the HKMA, the latter takes the leading role in vetting applications for such registration and in supervising their SFC-regulated activities, including carrying out

on-site inspections. The HKMA applies all SFC criteria, such as the “fit and proper” criteria, in supervising AFIs registered with the SFC.Hint

Reference Chapter:1.2.10

-

Question 48 of 229

48. Question

1 pointsQID33:British Construction Bank is an AFI regulated by the HKMA. Which of the following entities is responsible for supervising the regulated activities it conducts under the SFO?

Correct

The HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered

institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime.Incorrect

The HKMA and the SFC must work closely together in relation to any SFC-regulated activities that are carried out by registered

institutions. To this end, a memorandum of understanding (“MOU”) has been signed between the two regulators, setting out their roles and responsibilities so as to minimise overlaps under the regulatory regime.Hint

Reference Chapter:1.2.11

-

Question 49 of 229

49. Question

1 pointsQID1186:The HKMA may refer cases of suspected malpractices by registered institutions in respect of the SFC-regulated activities to the:

Correct

The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-RAs to the SFC, which may directly review those institutions.

Incorrect

The HKMA may refer cases of suspected malpractice by registered institutions in respect of the SFC-RAs to the SFC, which may directly review those institutions.

Hint

Reference Chapter:1.2.11

-

Question 50 of 229

50. Question

1 pointsQID34:The Insurance Authority (IA) directly regulates:

I. Insurers (insurance companies)

II. Auditors of insurers

III. Insurance agents

IV. Insurance related investment productsCorrect

The Insurance Authority (IA) directly regulates:

I. Insurers (insurance companies)

II. Insurance agents

III. Insurance related investment productsIncorrect

The Insurance Authority (IA) directly regulates:

I. Insurers (insurance companies)

II. Insurance agents

III. Insurance related investment productsHint

Reference Chapter:1.2.12

-

Question 51 of 229

51. Question

1 pointsQID1189:Which of the following institutions’ principal functions are to ensure that the interests of policy holders are protected and to promote the general stability of the insurance industry in Hong Kong?

Correct

The principal functions of the Insurance Authority are to ensure that the interests of policy holders are protected and to promote the general stability of the insurance industry in Hong Kong.

Incorrect

The principal functions of the Insurance Authority are to ensure that the interests of policy holders are protected and to promote the general stability of the insurance industry in Hong Kong.

Hint

Reference Chapter:1.2.12

-

Question 52 of 229

52. Question

1 pointsQID38:Which of the following entities should Insurance Agent register with?

Correct

Insurance Agents should apply for a licence with the Insurance Authority.

Incorrect

Insurance Agents should apply for a licence with the Insurance Authority.

Hint

Reference Chapter:1.2.13

-

Question 53 of 229

53. Question

1 pointsQID47:Which of the following are duties and functions of the Mandatory

Provident Fund Schemes Authority (MPFA) in MPF Schemes?

I. Registering MPF schemes

II. Approving Pooled Investment Schemes

III. Approving trustees and regulating the affairs and activities of such approved trustees

IV. Dealing with complaints about MPF products and approved trustees, and referring them to the SFC and other regulators for action where necessaryCorrect

The MPFA has responsibility for: (a) registering mandatory provident fund (“MPF”) schemes; (b) approving pooled investment funds; (f) approving trustees and regulating the affairs and activities of such approved trustees; (g) dealing with complaints about MPF products and approved trustees, and referring them to the SFC and other regulators for action where necessary.

Incorrect

The MPFA has responsibility for: (a) registering mandatory provident fund (“MPF”) schemes; (b) approving pooled investment funds; (f) approving trustees and regulating the affairs and activities of such approved trustees; (g) dealing with complaints about MPF products and approved trustees, and referring them to the SFC and other regulators for action where necessary.

Hint

Reference Chapter:1.2.13

-

Question 54 of 229

54. Question

1 pointsQID36:Insurance Brokers should register with which of the following institutions?

Correct

Insurance Brokers should apply for a licence with the Insurance Authority.

Incorrect

Insurance Brokers should apply for a licence with the Insurance Authority.

Hint

Reference Chapter:1.2.13

-

Question 55 of 229

55. Question

1 pointsQID39:Which of the following are duties and functions of the office of

Insurance Authority?

I. Maintain a product registry of all insurance products online

II. Regulate and supervise insurance intermediaries directly

III. The promotion of self-regulation by the industry

IV. Since all insurance products are not approved by the SFC, therefore, there are no linkages between the spheres of activity of the Insurance Authority and the SFCCorrect

The Insurance Authority directly supervises the insurance industry.

Incorrect

The Insurance Authority directly supervises the insurance industry.

Hint

Reference Chapter:1.2.13

-

Question 56 of 229

56. Question

1 pointsQID40:What is the most material difference between the Insurance Authority and other regulators?

Correct

The Insurance Authority has the following major duties and powers:

(d) the promotion of self-regulation by the industry and the maintenance of close contact with the industry through a consultative process.Incorrect

The Insurance Authority has the following major duties and powers:

(d) the promotion of self-regulation by the industry and the maintenance of close contact with the industry through a consultative process.Hint

Reference Chapter:1.2.13

-

Question 57 of 229

57. Question

1 pointsQID2508:The regulator of the trustee of an MPF Scheme is?

Correct

The regulator of the trustee of an MPF Scheme is MPFA.

Incorrect

The regulator of the trustee of an MPF Scheme is MPFA.

Hint

Reference Chapter:1.2.13

-

Question 58 of 229

58. Question

1 pointsQID1193:The Insurance Authority is responsible for prudential supervision of the insurance industry, it seeks to

I. ensure the financial stability of the industry

II. promote a high level efficiency in the administration of the industry

III. encourage the professionalism of the fund managers participating in insurance-related business, the insurance agents and brokers

IV. achieve the best balance between its overall supervision and the maximum effective self-regulation of the industry through

self-regulatory organizationsCorrect

The Insurance Authority has the following major duties and powers:

(a) the authorization and regulation of insurers;

(b) the regulation of insurance agents, who must be appointed by an insurer and registered with the Insurance Agents Registration Board, established by The Hong Kong Federation of Insurers. The agents are not directly authorised or supervised by the Insurance Authority. Supervision is by the appointing insurers, who are required to comply with the Code of Practice for the Administration of Insurance Agents issued by The Hong Kong Federation of Insurers and approved by the Insurance Authority;

(c) the regulation of insurance brokers, who may obtain authorization from the Insurance Authority or from one of two bodies approved by the Insurance Authority, the Hong Kong

Confederation of Insurance Brokers and the Professional Insurance Brokers Association. These bodies are charged with the responsibility of ensuring that their members comply with the statutory requirements and that the interests of policy holders are properly protected; they also handle complaints; and

(d) the promotion of self-regulation by the industry and the maintenance of close contact with the industry through a consultative process.Incorrect

The Insurance Authority has the following major duties and powers:

(a) the authorization and regulation of insurers;

(b) the regulation of insurance agents, who must be appointed by an insurer and registered with the Insurance Agents Registration Board, established by The Hong Kong Federation of Insurers. The agents are not directly authorised or supervised by the Insurance Authority. Supervision is by the appointing insurers, who are required to comply with the Code of Practice for the Administration of Insurance Agents issued by The Hong Kong Federation of Insurers and approved by the Insurance Authority;

(c) the regulation of insurance brokers, who may obtain authorization from the Insurance Authority or from one of two bodies approved by the Insurance Authority, the Hong Kong

Confederation of Insurance Brokers and the Professional Insurance Brokers Association. These bodies are charged with the responsibility of ensuring that their members comply with the statutory requirements and that the interests of policy holders are properly protected; they also handle complaints; and

(d) the promotion of self-regulation by the industry and the maintenance of close contact with the industry through a consultative process.Hint

Reference Chapter:1.2.13

-

Question 59 of 229

59. Question

1 pointsQID1192:Insurance brokers should register with which of the following organizations?

Correct

Insurance Brokers should apply for a licence with the Insurance Authority.

Incorrect

Insurance Brokers should apply for a licence with the Insurance Authority.

Hint

Reference Chapter:1.2.13

-

Question 60 of 229

60. Question

1 pointsQID1191:Insurance agents should register with which of the following organizations?

Correct

Insurance Agents should apply for a licence with the Insurance Authority.

Incorrect

Insurance Agents should apply for a licence with the Insurance Authority.

Hint

Reference Chapter:1.2.13

-

Question 61 of 229

61. Question

1 pointsQID1190:The Insurance Authority is responsible for:

I. Authorizing and regulating Insurance Companies (Insurer).

II. Regulating Insurance Agents.

III. Regulating Insurance Brokers.

IV. Handling complaints of insurance products.Correct

The Insurance Authority is responsible for:

I. Authorizing and regulating Insurance Companies (Insurer).

II. Regulating Insurance Agents.

III. Regulating Insurance Brokers.

IV. Handling complaints of insurance products.Incorrect

The Insurance Authority is responsible for:

I. Authorizing and regulating Insurance Companies (Insurer).

II. Regulating Insurance Agents.

III. Regulating Insurance Brokers.

IV. Handling complaints of insurance products.Hint

Reference Chapter:1.2.13

-

Question 62 of 229

62. Question

1 pointsQID35:Which of the following is responsible for authorizing and supervising Insurance Companies?

Correct

The Insurance Authority is concerned with the regulation of insurance companies and insurance intermediaries.

Incorrect

The Insurance Authority is concerned with the regulation of insurance companies and insurance intermediaries.

Hint

Reference Chapter:1.2.14

-

Question 63 of 229

63. Question

1 pointsQID1194:The major linkages between the spheres of activity of the Insurance Authority and the SFC are:

I. The authorization of general insurance schemes.

II. The authorization of independent retirement funds.

III. The authorization of investment-linked assurance schemes.

IV. The authorization of pooled retirement funds.Correct

There are two classes of funds authorised by the SFC which do

have certain linkage with the Insurance Authority: investment-linked assurance schemes and pooled retirement funds, both of which are marketed by the insurance industry. Authorization of these has been delegated by the SFC to the Committee on Investment-Linked Assurance Schemes and Pooled Retirement Funds. The Insurance Authority is represented on this committee, as insurance companies wishing to promote these schemes will need to be authorised under the Insurance Companies Ordinance.Incorrect

There are two classes of funds authorised by the SFC which do

have certain linkage with the Insurance Authority: investment-linked assurance schemes and pooled retirement funds, both of which are marketed by the insurance industry. Authorization of these has been delegated by the SFC to the Committee on Investment-Linked Assurance Schemes and Pooled Retirement Funds. The Insurance Authority is represented on this committee, as insurance companies wishing to promote these schemes will need to be authorised under the Insurance Companies Ordinance.Hint

Reference Chapter:1.2.15

-

Question 64 of 229

64. Question

1 pointsQID41:Which of the following are not broad activities of the SFC in respect of the regulation of CIS?

I. Authorizing CISs

II. Monitoring and supervising the intermediaries involved with CISs

III. Directly managing CIS

IV. Vetting Insurance Intermediaries who sell and market Investment Linked Insurance SchemesCorrect

There are only two circumstances in which a CIS may be offered or marketed to the public in Hong Kong: it must be either (i) structured as a company which is listed on the SEHK, or

(ii) authorised by the SFC. Notwithstanding the above, there are two classes of funds authorised by the SFC which do have certain linkage with the Insurance Authority: investment-linked assurance schemes and pooled retirement funds, both of which are marketed by the insurance industry. Authorisation of these has been delegated by the SFC to the Products Advisory Committee. The Insurance Authority is represented on this committee, as insurance companies wishing to promote these schemes will need to be authorised under the Insurance Ordinance.Incorrect

There are only two circumstances in which a CIS may be offered or marketed to the public in Hong Kong: it must be either (i) structured as a company which is listed on the SEHK, or

(ii) authorised by the SFC. Notwithstanding the above, there are two classes of funds authorised by the SFC which do have certain linkage with the Insurance Authority: investment-linked assurance schemes and pooled retirement funds, both of which are marketed by the insurance industry. Authorisation of these has been delegated by the SFC to the Products Advisory Committee. The Insurance Authority is represented on this committee, as insurance companies wishing to promote these schemes will need to be authorised under the Insurance Ordinance.Hint

Reference Chapter:1.2.15

-

Question 65 of 229

65. Question

1 pointsQID51:Which of the following matters is the Securities and Futures Commission (SFC) responsible for relating to Mandatory Provident Fund (MPF) products?

I. Authorisation of the offering documents for the investment products of MPF Schemes.

II. Licensing of investment managers of investment products of MPF Schemes.

III. Regulate, supervise and monitor MPF Schemes

IV. Registration of employer sponsored MPF schemes for employers.Correct

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are:

(a) vetting and authorising MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF productsIncorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are:

(a) vetting and authorising MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF productsHint

Reference Chapter:1.2.16

-

Question 66 of 229

66. Question

1 pointsQID50:Which of the following spheres of the MPF schemes has linkage with the SFC?

I. The SFC vets and authorizes investment products of MPF Schemes.

II. The SFC vets and authorizes marketing materials of investment products of MPF Schemes.

III. The SFC authorizes Pooled Investment Funds.

IV. The SFC approves trustees of MPF Schemes and regulates the affairs and activities of such approved trusteesCorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are:

(a) vetting and authorising MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO).Incorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are:

(a) vetting and authorising MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO).Hint

Reference Chapter:1.2.16

-

Question 67 of 229

67. Question

1 pointsQID49:Which of the following statements is incorrect?

Correct

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are: (a) vetting and authorising MPF products and related marketing materials in accordance

with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO). This means the IA doesn’t regulate MPF products at all.Incorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC, which are: (a) vetting and authorising MPF products and related marketing materials in accordance

with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO). This means the IA doesn’t regulate MPF products at all.Hint

Reference Chapter:1.2.16

-

Question 68 of 229

68. Question

1 pointsQID48:Which of the following activities is Mandatory Provident Fund Schemes Authority (“MPFA”) responsible for ?

Correct

The MPFA has responsibility for: (f) approving MPF trustees and regulating the affairs and activities of such approved trustees.

Incorrect

The MPFA has responsibility for: (f) approving MPF trustees and regulating the affairs and activities of such approved trustees.

Hint

Reference Chapter:1.2.16

-

Question 69 of 229

69. Question

1 pointsQID46:Which of the following activities is Mandatory Provident Fund Schemes Authority (“MPFA”) responsible for ?

Correct

The MPFA has responsibility for: (f) approving trustees and regulating the affairs and activities of such approved trustees.

Incorrect

The MPFA has responsibility for: (f) approving trustees and regulating the affairs and activities of such approved trustees.

Hint

Reference Chapter:1.2.16

-

Question 70 of 229

70. Question

1 pointsQID45:Which of the following are primary functions of the MPFA?

I. Approving fund managers of the investment products of MPF Schemes

II. Regulating supervise and monitoring MPF Schemes

III. Monitoring compliance with the MPFSO

IV. Authorizing the offer documents and marketing materials of the investment products of the MPF prior to their issue or publicationCorrect

The MPFA has responsibility for: (d) ongoing monitoring of compliance by MPF products with the Mandatory Provident

Fund Schemes Ordinance (“MPFSO”); (e) investigating alleged breaches of the provisions of the MPFSO;Incorrect

The MPFA has responsibility for: (d) ongoing monitoring of compliance by MPF products with the Mandatory Provident

Fund Schemes Ordinance (“MPFSO”); (e) investigating alleged breaches of the provisions of the MPFSO;Hint

Reference Chapter:1.2.16

-

Question 71 of 229

71. Question

1 pointsQID1495:The Mandatory Provident Fund Schemes Authority (MPFA) does NOT have which ONE of the following objectives?

Correct

It is not an obligation on the MPFA’s part to ensure that the schemes are operated to maximise the capital or income growth specified in the objectives of the schemes.

Incorrect

It is not an obligation on the MPFA’s part to ensure that the schemes are operated to maximise the capital or income growth specified in the objectives of the schemes.

Hint

Reference Chapter:1.2.16

-

Question 72 of 229

72. Question

1 pointsQID1198:The Mandatory Provident Fund Schemes Authority (MPFA) is responsible for which of the following matters relating to Mandatory Provident Fund (MPF) products?

I. Authorisation of the offering documents for the products.

II. Licensing of investment managers of MPF products.

III. Overall administration of MPF schemes.

IV. Registration of employer-sponsored MPF schemes.Correct

The MPFA has responsibility for:

(a) registering MPF schemes;

(d) ongoing monitoring of compliance by MPF products with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”);

(e) investigating alleged breaches of the provisions of the MPFSO;

(g) dealing with complaints about MPF products and approved trustees, and referring them to the SFC and other regulators for action where necessary.Incorrect

The MPFA has responsibility for:

(a) registering MPF schemes;

(d) ongoing monitoring of compliance by MPF products with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”);

(e) investigating alleged breaches of the provisions of the MPFSO;

(g) dealing with complaints about MPF products and approved trustees, and referring them to the SFC and other regulators for action where necessary.Hint

Reference Chapter:1.2.16

-

Question 73 of 229

73. Question

1 pointsQID1573:MPF Intermediaries are regulated by?

Correct

The SFC, HKMA, MPFA and IA all regulate and supervise intermediaries operating within their respective jurisdictions, and there is considerable overlap in the regulatory regime for intermediaries engaged in the asset management industry.

Incorrect

The SFC, HKMA, MPFA and IA all regulate and supervise intermediaries operating within their respective jurisdictions, and there is considerable overlap in the regulatory regime for intermediaries engaged in the asset management industry.

Hint

Reference Chapter:1.2.16

-

Question 74 of 229

74. Question

1 pointsQID52:Which of the following institution is responsible for investigation into breaches of the SFC Code on MPF Products?

Correct

SFC is reposible for investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action

Incorrect

SFC is reposible for investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action

Hint

Reference Chapter:1.2.19

-

Question 75 of 229

75. Question

1 pointsQID1201:Which of the following responsibilities between the SFC and the MPF schemes are interlinked?

I. Vetting and authorising MPF products and related marketing materials.

II. Registering and approving investment managers.

III. Investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.

IV. Regulate the sales process of sales representatives selling MPF schemes.Correct

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(a) vetting and authorizing MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products;

(d) investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.Incorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(a) vetting and authorizing MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products;

(d) investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.Hint

Reference Chapter:1.2.19

-

Question 76 of 229

76. Question

1 pointsQID1196:The Mandatory Provident Fund Schemes Authority is responsible for:

I. registering provident fund schemes.

II. approving unit trust funds.

III. overseeing and making rules and guidelines for the administration and management of registered schemes and pooled investment funds.

IV. ongoing monitoring of MPF products’ compliance with the Mandatory Provident Fund Schemes Ordinance.Correct

The MPFA has responsibility for:

(a) registering MPF schemes;

(c.) overseeing and making rules and guidelines for the administration and management of registered schemes and pooled investment funds;

(d) ongoing monitoring of compliance by MPF products with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”).Incorrect

The MPFA has responsibility for:

(a) registering MPF schemes;

(c.) overseeing and making rules and guidelines for the administration and management of registered schemes and pooled investment funds;

(d) ongoing monitoring of compliance by MPF products with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”).Hint

Reference Chapter:1.2.19

-

Question 77 of 229

77. Question

1 pointsQID1497:Which of the following is not a general principles followed by the

MPFA?Correct

It is not an obligation on the MPFA’s part to ensure that the schemes are operated to maximise the capital or income growth specified in the objectives of the schemes, or to advise on, or ensure, the employers’ and scheme members’ choice of the best schemes/funds to achieve their objectives.

Incorrect

It is not an obligation on the MPFA’s part to ensure that the schemes are operated to maximise the capital or income growth specified in the objectives of the schemes, or to advise on, or ensure, the employers’ and scheme members’ choice of the best schemes/funds to achieve their objectives.

Hint

Reference Chapter:1.2.19

-

Question 78 of 229

78. Question

1 pointsQID1505:Which of the following duties are performed by the Mandatory Provident Fund Authority (MPFA)?

I. Registering MPF Schemes

II. Approving Pooled Investment Funds.

III. Overseeing and making rules and guidelines for the administration and management of registered schemes and pooled investment funds

IV. Ongoing monitoring of compliance by MPF products with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”)Correct

The functions of the MPFA include:

– registering MPF schemes

– the registration procedures of MPF schemes and approval processes of constituent funds and approved pooled investment

funds;

– ongoing monitoring of compliance of MPF products with the MPFSOIncorrect

The functions of the MPFA include:

– registering MPF schemes

– the registration procedures of MPF schemes and approval processes of constituent funds and approved pooled investment

funds;

– ongoing monitoring of compliance of MPF products with the MPFSOHint

Reference Chapter:1.2.19

-

Question 79 of 229

79. Question

1 pointsQID1200:Which of the following are SFC’s duties towards the MPF Schemes?

I. Vetting and authorising MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO).

II. Registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products.

III. Investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.

IV. Supervising the selling process of the sales representatives selling MPF schemes.Correct

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(a) vetting and authorizing MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products;

(d) investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.Incorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(a) vetting and authorizing MPF products and related marketing materials in accordance with the provisions of the SFC Code on MPF Products and the relevant ordinances (including the SFO);

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products;

(d) investigating alleged breaches of the provisions of the SFC Code on MPF Products and any relevant ordinances, and taking enforcement action.Hint

Reference Chapter:1.2.19

-

Question 80 of 229

80. Question

1 pointsQID1199:Mr. Ko is an investment manager; he wishes to manage a fund under the Kaohsiung Bank Group’s MPF schemes. He needs to be licensed by which of the following?

Correct

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products.Incorrect

Certain responsibilities of the MPFA interlink with the particular responsibilities of the SFC:

(b) registering and approving investment managers and continued monitoring of their conduct in the investment management of MPF products.Hint

Reference Chapter:1.2.19

-

Question 81 of 229

81. Question

1 pointsQID17:Which of the following entities can require the SFC to provide him with information on the principles, practices and policy it is applying in order to meet its objectives and perform its functions?

Correct

The Financial Secretary can require the SFC to provide him with information on the principles, practices and policy it is applying in order to meet its objectives and perform its functions.

Incorrect

The Financial Secretary can require the SFC to provide him with information on the principles, practices and policy it is applying in order to meet its objectives and perform its functions.

Hint

Reference Chapter:1.2.2

-

Question 82 of 229

82. Question

1 pointsQID13:Which of the entities is responsible for the appointment of the board of directors of the SFC?

Correct

The Chief Executive of the HKSAR appoints the Chairman, Deputy Chairman (optional), the Chief Executive Officer (“CEO”) and directors (both executive and non-executive) of

the SFC. He may remove any member of the Commission and also determines their terms and conditions of office (Schedule 2, SFO).Incorrect

The Chief Executive of the HKSAR appoints the Chairman, Deputy Chairman (optional), the Chief Executive Officer (“CEO”) and directors (both executive and non-executive) of

the SFC. He may remove any member of the Commission and also determines their terms and conditions of office (Schedule 2, SFO).Hint

Reference Chapter:1.2.2

-

Question 83 of 229

83. Question

1 pointsQID14:Which of the following entities can give written directions to the SFC regarding how it should seek to meet its objectives and how it should perform its functions?

Correct