English HKSI Paper 7 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP7ET1

Quiz-summary

0 of 187 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

Information

HKSIP7ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 187 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

-

HKSIP7ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- Answered

- Review

-

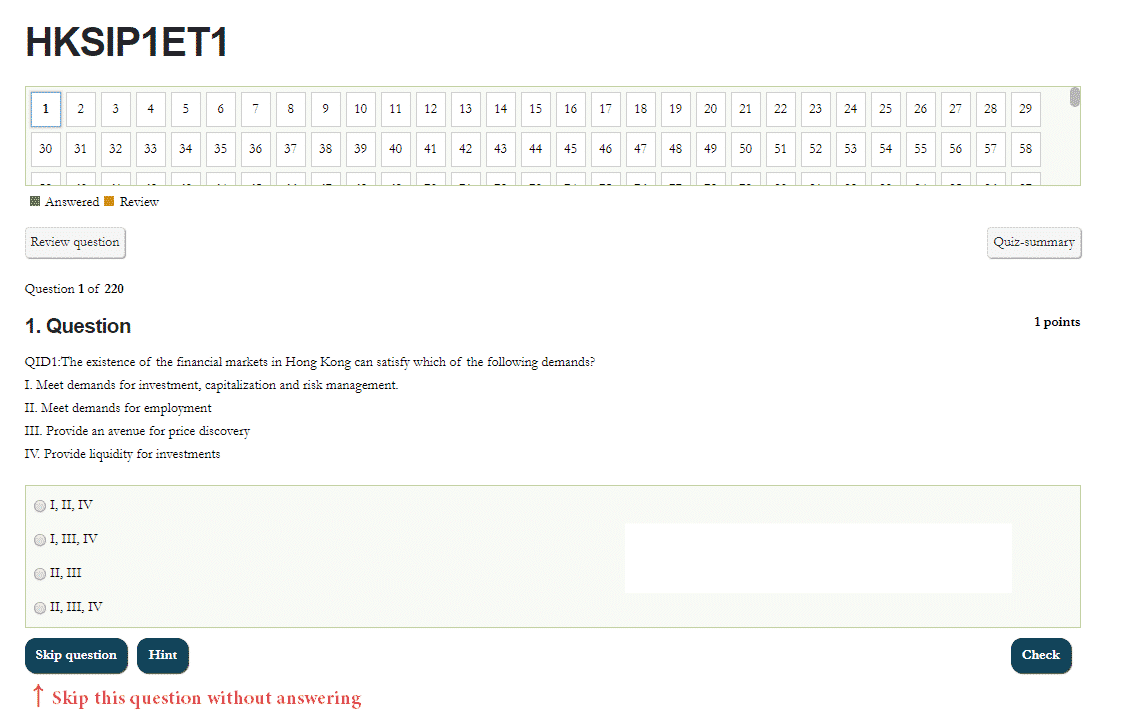

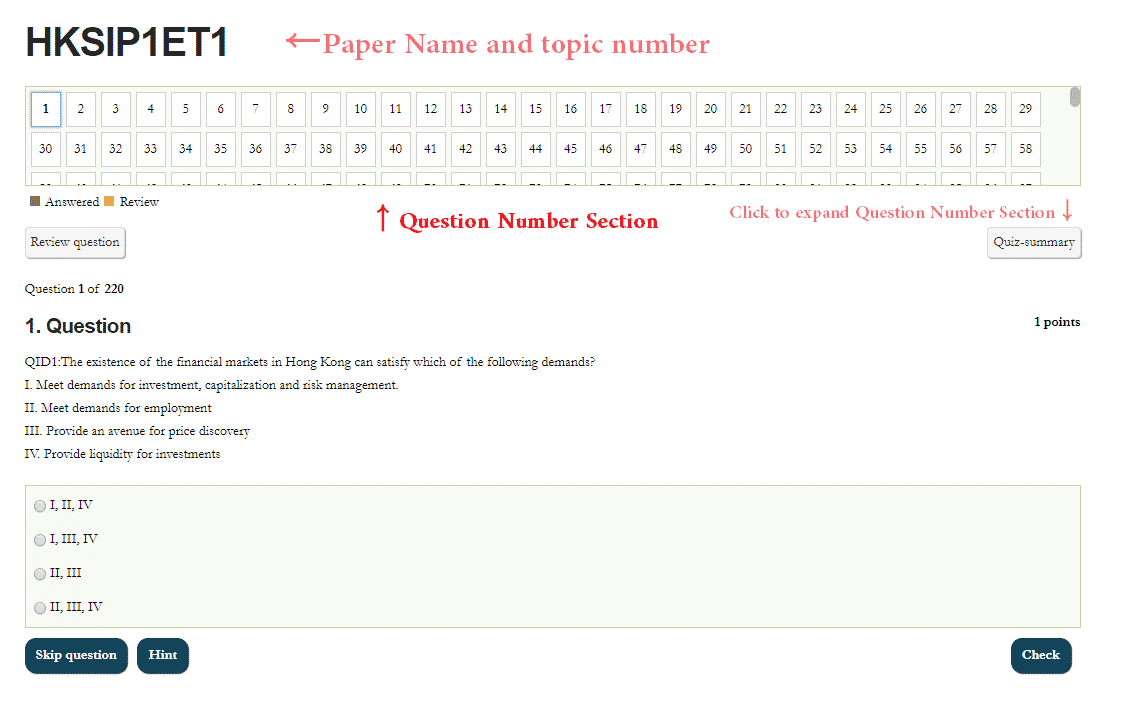

Question 1 of 187

1. Question

1 pointsQID2958:

Correct

Incorrect

Hint

Reference Chapter:1.3.5

-

Question 2 of 187

2. Question

1 pointsQID2419:Which of the following stock market has the least influence to Hong Kong stock market?

Correct

Malaysian has minor trade relations with Hong Kong. Besides, Malaysian stock market has the smallest market cap among the above options and hence has lesser influence on the global market.

Incorrect

Malaysian has minor trade relations with Hong Kong. Besides, Malaysian stock market has the smallest market cap among the above options and hence has lesser influence on the global market.

Hint

Reference Chapter:1.3.4.2

-

Question 3 of 187

3. Question

1 pointsQID2428:Which of the following people GENERALLY holds hedges?

Correct

The wording of the question is actually not the most accurate. Arbitrageurs usually hold opposite positions, but this is the best answer among the existing answers.

Incorrect

The wording of the question is actually not the most accurate. Arbitrageurs usually hold opposite positions, but this is the best answer among the existing answers.

Hint

Reference Chapter:1.3.3.2

-

Question 4 of 187

4. Question

1 pointsQID2241:If the stock market is the leading indicator of the economy, what does a rising stock market imply?

Correct

If the stock market is the leading indicator of the economy, a rising stock market represents continuous expansionary economy.

Incorrect

If the stock market is the leading indicator of the economy, a rising stock market represents continuous expansionary economy.

Hint

Reference Chapter:1.3.1.1

-

Question 5 of 187

5. Question

1 pointsQID2287:Which market uses novation frequently?

Correct

Novation is the process whereby the clearing house undertakes the credit risk and acts as the counterparty of both buyer and seller. Only the exchange-traded market has this kind of arrangement. There is no clearing house used generally in foreign market, OTC market and fund-raising market. Thus, there is no novation.

Incorrect

Novation is the process whereby the clearing house undertakes the credit risk and acts as the counterparty of both buyer and seller. Only the exchange-traded market has this kind of arrangement. There is no clearing house used generally in foreign market, OTC market and fund-raising market. Thus, there is no novation.

Hint

Reference Chapter:1.2.4.2

-

Question 6 of 187

6. Question

1 pointsQID973:If a company wishes to issue new shares to the public in order to raise capital, the company should proceed at which of the following markets?

Correct

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Incorrect

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Hint

Reference Chapter:1.2.4.1

-

Question 7 of 187

7. Question

1 pointsQID493:Primary market is:

Correct

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Incorrect

The primary market is where new capital is raised and securities are issued for the first time. For example, the government issues a new debt security or a company issues new equity securities to raise funds from the public by listing on the stock market.

Hint

Reference Chapter:1.2.4.2

-

Question 8 of 187

8. Question

1 pointsQID2434:Which of the following risks does a client need to bear when buying stock options on The Stock Exchange of Hong Kong Limited?

I Liquidity risk

II Option value decline

III Counterparty risk

IV Market riskCorrect

The risk of counterparties on the Stock Exchange is extremely low because the clearing house will carry out novation.

Exchange-traded stock option has very low liquidity risk, but still exists, the suggested answer is to exclude this optionIncorrect

The risk of counterparties on the Stock Exchange is extremely low because the clearing house will carry out novation.

Exchange-traded stock option has very low liquidity risk, but still exists, the suggested answer is to exclude this optionHint

Reference Chapter:1.2.2.2

-

Question 9 of 187

9. Question

1 pointsQID1044:Which of the following is the best description about arbitragers?

Correct

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Incorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Hint

Reference Chapter:1.3.3.2

-

Question 10 of 187

10. Question

1 pointsQID1045:Arbitragers rely mainly on what to profit?

Correct

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Incorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Hint

Reference Chapter:1.3.3.2

-

Question 11 of 187

11. Question

1 pointsQID62:Financial markets can be classified as exchange-traded market and:

Correct

Financial markets are broadly categorized as being either exchange-traded or OTC.

Incorrect

Financial markets are broadly categorized as being either exchange-traded or OTC.

Hint

Reference Chapter:1.2.3

-

Question 12 of 187

12. Question

1 pointsQID63:Which of the following activities are related to primary market:

I. Government issues bonds to raise money.

II. Firms issue new stocks.

III. Trading stocks in stock exchange

IV. Trading bonds in OTC market.Correct

The primary market is where new capital is raised and securities are issued for the first time. (e.g. new debt security issued by govt. or new equity securities issued by company.) Option III and IV are found in secondary markets.

Incorrect

The primary market is where new capital is raised and securities are issued for the first time. (e.g. new debt security issued by govt. or new equity securities issued by company.) Option III and IV are found in secondary markets.

Hint

Reference Chapter:1.2.4.1

-

Question 13 of 187

13. Question

1 pointsQID64:What is the advantage of exchange-traded market over the OTC market:

I. high liquidity

II. higher resilience

III. lower credit risk

IV. more types of productsCorrect

Exchange-traded markets are those that operate via a centralized exchange, so it has higher liquidity and resilience. “Novation” operates and guarantee every transaction effectively, the credit risk is therefore lowered.

Incorrect

Exchange-traded markets are those that operate via a centralized exchange, so it has higher liquidity and resilience. “Novation” operates and guarantee every transaction effectively, the credit risk is therefore lowered.

Hint

Reference Chapter:1.2.4.2

-

Question 14 of 187

14. Question

1 pointsQID65:Which of the following is a misstatement of secondary market?

Correct

The secondary market is where all subsequent trading takes place so the primary market relies on the existence of a liquid secondary market. Therefore, option C is incorrect.

Incorrect

The secondary market is where all subsequent trading takes place so the primary market relies on the existence of a liquid secondary market. Therefore, option C is incorrect.

Hint

Reference Chapter:1.2.4.2

-

Question 15 of 187

15. Question

1 pointsQID66:What is the main products traded in exchange-traded market:

I. Stocks

II. Bonds

III. Foreign exchange

IV. OTC derivativesCorrect

The OTC foreign exchange and derivatives are traded on OTC markets.

Incorrect

The OTC foreign exchange and derivatives are traded on OTC markets.

Hint

Reference Chapter:1.2.4.2

-

Question 16 of 187

16. Question

1 pointsQID67:Which of the following sentence is incorrect with regard to exchange-traded market?

Correct

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Incorrect

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Hint

Reference Chapter:1.2.4.2

-

Question 17 of 187

17. Question

1 pointsQID68:The exchange clearing house effectively guarantees every transaction in each case assuming the role of counterparty via a “novation” system, reducing which type of risk?

Correct

A system of “novation” operates in exchange-traded markets, whereby the exchange clearing house effectively guarantees every transaction. The credit risk is therefore lowered.

Incorrect

A system of “novation” operates in exchange-traded markets, whereby the exchange clearing house effectively guarantees every transaction. The credit risk is therefore lowered.

Hint

Reference Chapter:1.2.4.2

-

Question 18 of 187

18. Question

1 pointsQID69:The exchange clearing house effectively guarantees every transaction in each case assuming the role of counterparty, reducing credit risk. This system is called:

Correct

A system of “novation” operates in exchange-traded markets, whereby the exchange clearing house effectively guarantees every transaction.

Incorrect

A system of “novation” operates in exchange-traded markets, whereby the exchange clearing house effectively guarantees every transaction.

Hint

Reference Chapter:1.2.4.2

-

Question 19 of 187

19. Question

1 pointsQID70:The biggest OTC market is:

Correct

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Incorrect

The global foreign exchange market is the biggest such market, and operates globally via a network of telephones and computer screens.

Hint

Reference Chapter:1.2.4.2

-

Question 20 of 187

20. Question

1 pointsQID71:Which of the following is not equity securities?

Correct

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Incorrect

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Hint

Reference Chapter:1.2.4.3

-

Question 21 of 187

21. Question

1 pointsQID72:What is the main assets traded in money market?

Correct

The market is divided into the short-term debt market, also referred to as the money market, and the

long-term debt market, or capital market. Those with a maturity of up to one year are money market.

Securities.Incorrect

The market is divided into the short-term debt market, also referred to as the money market, and the

long-term debt market, or capital market. Those with a maturity of up to one year are money market.

Securities.Hint

Reference Chapter:1.2.4.4

-

Question 22 of 187

22. Question

1 pointsQID73:What is the main assets traded in capital market?

Correct

The asset with a maturity of more than a year are capital market securities (commonly

referred to as bonds).Incorrect

The asset with a maturity of more than a year are capital market securities (commonly

referred to as bonds).Hint

Reference Chapter:1.2.4.4

-

Question 23 of 187

23. Question

1 pointsQID74:Which of the following is equity securities?

Correct

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Incorrect

Types of equity securities include: ordinary shares, preference shares, equity warrants.

Hint

Reference Chapter:1.2.4.3

-

Question 24 of 187

24. Question

1 pointsQID75:Which of the following statement is incorrect?

Correct

Debt securities with a maturity of up to one year are money market securities.

Incorrect

Debt securities with a maturity of up to one year are money market securities.

Hint

Reference Chapter:1.2.4.4

-

Question 25 of 187

25. Question

1 pointsQID76:Which of the following assets are short-term debt securities:

I. Bankers’ acceptances

II. Certificates of deposits

III. Promissory notes

IV. Commercial papersCorrect

Types of short-term debt securities include: bills of exchange, negotiable certificates of deposit, promissory notes/commercial papers.

Incorrect

Types of short-term debt securities include: bills of exchange, negotiable certificates of deposit, promissory notes/commercial papers.

Hint

Reference Chapter:1.2.4.4

-

Question 26 of 187

26. Question

1 pointsQID77:Which of the following assets are long-term debt securities:

I. Bonds

II. Corporate bonds

III. floating-rate notes

IV. Mortgage-backed securitiesCorrect

Types of long-term debt securities include: government bonds or notes, corporate bonds floating rate notes, mortgage-backed securities.

Incorrect

Types of long-term debt securities include: government bonds or notes, corporate bonds floating rate notes, mortgage-backed securities.

Hint

Reference Chapter:1.2.4.4

-

Question 27 of 187

27. Question

1 pointsQID78:What is the advantage of bond-holders over stock-holders?

I. Relatively stable income

II. No need to bear risk

III.Have higher priority to receive allocated assets when liquidation

IV. Guaranteed principal paymentCorrect

The borrower of bond need to repay the principal amount at the maturity date and an interest component periodically. Since bond is a kind of debt, bond-holders have higher priority to receive allocated assets when liquidation. Default risk exists in bonds.

Incorrect

The borrower of bond need to repay the principal amount at the maturity date and an interest component periodically. Since bond is a kind of debt, bond-holders have higher priority to receive allocated assets when liquidation. Default risk exists in bonds.

Hint

Reference Chapter:1.2.4.4

-

Question 28 of 187

28. Question

1 pointsQID79:Short-term debt securities:

Correct

Those debt securities with a maturity of up to one year are money market.

Incorrect

Those debt securities with a maturity of up to one year are money market.

Hint

Reference Chapter:1.2.4.4

-

Question 29 of 187

29. Question

1 pointsQID1040:Which of the following is the most important to arbitragers?

Correct

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Incorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Hint

Reference Chapter:1.3.3.2

-

Question 30 of 187

30. Question

1 pointsQID1041:Which of the following market innovation benefits arbitragers the most?

Correct

Un-limitation of other markets increases the investments opportunities of arbitragers. It is because they can have more chance for taking risk-free advantage of countervailing prices in different markets.

Incorrect

Un-limitation of other markets increases the investments opportunities of arbitragers. It is because they can have more chance for taking risk-free advantage of countervailing prices in different markets.

Hint

Reference Chapter:1.3.3.2

-

Question 31 of 187

31. Question

1 pointsQID1042:Which of the following activity is arbitrage?

I. Making risk-free profit by buying stocks and selling stock futures simultaneously

II. Making risk-free profit by buying stocks in A market and selling stocks in B market simultaneously

III. Sell stocks in the stock market and then buy it back when the price declines

IV. Buy A stock and then sell B stockCorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Incorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Hint

Reference Chapter:1.3.3.2

-

Question 32 of 187

32. Question

1 pointsQID1043:People who rely on making risk-free profits in the market are called:

Correct

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Incorrect

Arbitrage means taking risk-free advantage of countervailing prices in different markets. For example, buying an asset at a low price in one market and then selling it at the same time at a higher price in another.

Hint

Reference Chapter:1.3.3.2

-

Question 33 of 187

33. Question

1 pointsQID2314:Buying Hang Seng Index components and then short selling it at the same time to obtain risk free profit is generally called:

Correct

Buying Hang Seng Index components and then short selling it at the same time to obtain risk free profit is generally called arbitrage.

Incorrect

Buying Hang Seng Index components and then short selling it at the same time to obtain risk free profit is generally called arbitrage.

Hint

Reference Chapter:1.3.3.2

-

Question 34 of 187

34. Question

1 pointsQID2320:Which method cannot be used to increase liquidity?

Correct

The purpose of increasing liquidity is to make it easier for market participants to trade. Margin financing makes it easier for buyers to buy securities, hence increase liquidity. Lowering the requirement of lending makes it easier for buyers to buy securities, hence increase liquidity. Short selling allows more sellers to participate in the market, hence increase liquidity. Increasing the margin requirement makes it more difficult for buyers to participate in the market, hence decrease liquidity.

Incorrect

The purpose of increasing liquidity is to make it easier for market participants to trade. Margin financing makes it easier for buyers to buy securities, hence increase liquidity. Lowering the requirement of lending makes it easier for buyers to buy securities, hence increase liquidity. Short selling allows more sellers to participate in the market, hence increase liquidity. Increasing the margin requirement makes it more difficult for buyers to participate in the market, hence decrease liquidity.

Hint

Reference Chapter:1.2.3

-

Question 35 of 187

35. Question

1 pointsQID2322:How do undeveloped countries benefit from globalization?

Correct

Increased capital flows can facilitate that developed countries provide capital-importing countries with capital and technologies, enhancing productivity and efficiency.

Incorrect

Increased capital flows can facilitate that developed countries provide capital-importing countries with capital and technologies, enhancing productivity and efficiency.

Hint

Reference Chapter:1.3.3

-

Question 36 of 187

36. Question

1 pointsQID2324:Which of the following instrument is not debt security?

Correct

Forward rate agreement is the derivative to bet on the change of interest rates.

Incorrect

Forward rate agreement is the derivative to bet on the change of interest rates.

Hint

Reference Chapter:1.2.4.4

-

Question 37 of 187

37. Question

1 pointsQID2325:Which of the following is the exchange-traded derivative?

Correct

All futures are traded in the exchange. Agreements and swaps etc are generally referred to over-the-counter derivatives.

Incorrect

All futures are traded in the exchange. Agreements and swaps etc are generally referred to over-the-counter derivatives.

Hint

Reference Chapter:1.2.4.6

-

Question 38 of 187

38. Question

1 pointsQID80:Long-term debt securities:

Correct

Those debt securities with a maturity of more than a year are capital market securities (commonly

referred to as bonds).Incorrect

Those debt securities with a maturity of more than a year are capital market securities (commonly

referred to as bonds).Hint

Reference Chapter:1.2.4.4

-

Question 39 of 187

39. Question

1 pointsQID81:The system where currency value is determined by market demand and supply is called:

Correct

Under the floating rates, market supply and demand determine the value of a currency.

Incorrect

Under the floating rates, market supply and demand determine the value of a currency.

Hint

Reference Chapter:1.2.4.5

-

Question 40 of 187

40. Question

1 pointsQID82:The system where the government and/or their monetary authorities determine a fixed rate of exchange with other currencies is called:

Correct

Under the fixed rates, governments and/or their monetary authorities determine a fixed rate of exchange with other currencies.

Incorrect

Under the fixed rates, governments and/or their monetary authorities determine a fixed rate of exchange with other currencies.

Hint

Reference Chapter:1.2.4.5

-

Question 41 of 187

41. Question

1 pointsQID83:In a floating rates regime, currency value is determined by which of the following party?

Correct

Under the floating rates, market supply and demand determine the value of a currency.

Incorrect

Under the floating rates, market supply and demand determine the value of a currency.

Hint

Reference Chapter:1.2.4.5

-

Question 42 of 187

42. Question

1 pointsQID84:Derivatives include

I. Options

II. Equity warrants

III. Futures

IV. SwapsCorrect

Derivatives include futures, forwards, swaps and options (or a combination of one or more of these categories). Equity warrants are classified as equity securities.

Incorrect

Derivatives include futures, forwards, swaps and options (or a combination of one or more of these categories). Equity warrants are classified as equity securities.

Hint

Reference Chapter:1.2.4.6

-

Question 43 of 187

43. Question

1 pointsQID85:Which of the following is highly leveraged institution?

Correct

A highly leveraged institution (“HLI”) is a financial institution that employs high leverage over its asset investment. Hedge funds are currently the best-known examples.

Incorrect

A highly leveraged institution (“HLI”) is a financial institution that employs high leverage over its asset investment. Hedge funds are currently the best-known examples.

Hint

Reference Chapter:1.2.6.5

-

Question 44 of 187

44. Question

1 pointsQID86:The characteristics of offshore financial centre are:

I. low tax rate

II. lower regulation

III. high level of secrecy

IV. sounder law systemCorrect

There are three reasons for offshore financial centres (“OFCs”) success: low taxes, less burdensome regulation and supervision, and (in most cases) strict secrecy laws protecting bank clients.

Incorrect

There are three reasons for offshore financial centres (“OFCs”) success: low taxes, less burdensome regulation and supervision, and (in most cases) strict secrecy laws protecting bank clients.

Hint

Reference Chapter:1.2.6.6

-

Question 45 of 187

45. Question

1 pointsQID87:In which of the following institution in Hong Kong monitor credit rating agencies?

Correct

In 2011, the SFC introduced a regulatory framework for the provision of credit rating services in

Hong Kong.Incorrect

In 2011, the SFC introduced a regulatory framework for the provision of credit rating services in

Hong Kong.Hint

Reference Chapter:1.2.6.7

-

Question 46 of 187

46. Question

1 pointsQID88:Sound regulation and surveillance require:

I. authority to force participants to obey laws and regulation

II. a highly liquid market

III. Providing protection for investors and depositors

IV. strict control and regulating daily operationCorrect

Safeguards for investors and depositors and the power to enforce financial intermediaries to comply with laws and regulations.) should be included in regulation. Without dictation, information affecting liquid markets should not be controlled.

Incorrect

Safeguards for investors and depositors and the power to enforce financial intermediaries to comply with laws and regulations.) should be included in regulation. Without dictation, information affecting liquid markets should not be controlled.

Hint

Reference Chapter:1.2.6.1

-

Question 47 of 187

47. Question

1 pointsQID89:Which of the following problems may occur if the monitoring system is not robust:

I. The public loses confidence in financial system.

II. Liquidity decreases.

III. The financial market stagnates.

IV. The economy stagnates.Correct

If people do not have confidence in the financial system, they would never lend or invest funds and the financial markets (and ultimately the economy) would stagnate. The number of buyer and seller will decrease as well.

Incorrect

If people do not have confidence in the financial system, they would never lend or invest funds and the financial markets (and ultimately the economy) would stagnate. The number of buyer and seller will decrease as well.

Hint

Reference Chapter:1.2.6.1

-

Question 48 of 187

48. Question

1 pointsQID98:Higher consumer confidence, business confidence and spending are more likely to produce:

Correct

Demand-pull inflation: this results when production cannot keep up with demand for goods and services. Excess demand (i.e. when productivity levels are already maximized) leads to higher

prices in the economy.Incorrect

Demand-pull inflation: this results when production cannot keep up with demand for goods and services. Excess demand (i.e. when productivity levels are already maximized) leads to higher

prices in the economy.Hint

Reference Chapter:1.3.1.2

-

Question 49 of 187

49. Question

1 pointsQID99:Increase in wage and price may lead to:

Correct

Cost-push inflation: this is caused by increases in costs that translate into increases in wages and prices in the economy. Cost-push inflation can also be caused by relatively expensive imports (i.e. imported inflation).

Incorrect

Cost-push inflation: this is caused by increases in costs that translate into increases in wages and prices in the economy. Cost-push inflation can also be caused by relatively expensive imports (i.e. imported inflation).

Hint

Reference Chapter:1.3.1.2

-

Question 50 of 187

50. Question

1 pointsQID100:”From trough to expansion” stage in economic cycle is less likely to incur:

Correct

Trough to expansion: this represents economic recovery. Interest rates decrease and investment activity increases.

Incorrect

Trough to expansion: this represents economic recovery. Interest rates decrease and investment activity increases.

Hint

Reference Chapter:1.3.1.1

-

Question 51 of 187

51. Question

1 pointsQID7:Which factor most likely determines the demand of goods and services?

Correct

The willingness of consumers to purchase an item is influenced by various factors while price is generally the most important factor.

Incorrect

The willingness of consumers to purchase an item is influenced by various factors while price is generally the most important factor.

Hint

Reference Chapter:1.1.1

-

Question 52 of 187

52. Question

1 pointsQID8:Generally demand curve is:

Correct

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price. Thus, demand curve is generally shown as negatively sloped curve.

Incorrect

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price. Thus, demand curve is generally shown as negatively sloped curve.

Hint

Reference Chapter:1.1.1

-

Question 53 of 187

53. Question

1 pointsQID9:Which factor most likely determines the supply of goods and services?

Correct

The objective of the producer is to make a profit from the item. Hence, the most important factor, from the producer’s perspective, is the price that can be obtained from selling the item.

Incorrect

The objective of the producer is to make a profit from the item. Hence, the most important factor, from the producer’s perspective, is the price that can be obtained from selling the item.

Hint

Reference Chapter:1.1.1

-

Question 54 of 187

54. Question

1 pointsQID10:What’s the condition for equilibrium price?

Correct

The price at which quantity supplied equals quantity demanded at any given time is the “equilibrium” price for that item.

Incorrect

The price at which quantity supplied equals quantity demanded at any given time is the “equilibrium” price for that item.

Hint

Reference Chapter:1.1.1

-

Question 55 of 187

55. Question

1 pointsQID11:What will the quantity demanded and supplied change if the price of the commodity increases?

Correct

Quantity demanded is inversely related to price. Thus, quantity demanded decreases when the price of the commodity increases. Oppositely, the quantity supplied is positively related to price. Thus, quantity supplied increases when the price increases.

Incorrect

Quantity demanded is inversely related to price. Thus, quantity demanded decreases when the price of the commodity increases. Oppositely, the quantity supplied is positively related to price. Thus, quantity supplied increases when the price increases.

Hint

Reference Chapter:1.1.1

-

Question 56 of 187

56. Question

1 pointsQID12:What will the quantity demanded and supplied change if the price of the commodity decreases?

Correct

Quantity demanded is inversely related to price. Thus, quantity demanded increases when the price of the commodity decreases. Oppositely, the quantity supplied is positively related to price. Thus, quantity supplied decreases when the price decreases.

Incorrect

Quantity demanded is inversely related to price. Thus, quantity demanded increases when the price of the commodity decreases. Oppositely, the quantity supplied is positively related to price. Thus, quantity supplied decreases when the price decreases.

Hint

Reference Chapter:1.1.1

-

Question 57 of 187

57. Question

1 pointsQID13:Which of the following cases is in need of indirect financing/intermediation?

Correct

The role of intermediaries is to channel the flow of funds between the borrowers and lenders. Therefore, indirect financing, or intermediation, occurs when the needs of borrowers and lenders do not match.

Incorrect

The role of intermediaries is to channel the flow of funds between the borrowers and lenders. Therefore, indirect financing, or intermediation, occurs when the needs of borrowers and lenders do not match.

Hint

Reference Chapter:1.1.3

-

Question 58 of 187

58. Question

1 pointsQID14:Economic sectors include:

I. household sector

II. business sector

III. government sector

IV. overseas sectorCorrect

The economic sectors are classified as:

Household sector; Business sector; Government sector; Overseas sector; Finance sector.

Incorrect

The economic sectors are classified as:

Household sector; Business sector; Government sector; Overseas sector; Finance sector.

Hint

Reference Chapter:1.1.2

-

Question 59 of 187

59. Question

1 pointsQID15:Generally, quantity demanded and price:

Correct

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price.

Incorrect

Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa. Quantity demanded is therefore inversely related to price.

Hint

Reference Chapter:1.1.1

-

Question 60 of 187

60. Question

1 pointsQID16:Generally, quantity supplied and price:

Correct

The objective of the producer is to make a profit from the item. Hence, the higher the price, the more the producer is willing to supply. The quantity supplied is therefore positively related to price.

Incorrect

The objective of the producer is to make a profit from the item. Hence, the higher the price, the more the producer is willing to supply. The quantity supplied is therefore positively related to price.

Hint

Reference Chapter:1.1.1

-

Question 61 of 187

61. Question

1 pointsQID17:The household sector mainly functions as:

I. fund providers

II. fund seekers

III. buyers of goods and services

IV. sellers of goods and servicesCorrect

Household sector consists of the consumers of goods and services. It is also referred to as the retail sector. The household sector spends and invests money, and mainly consists of fund providers (lenders).

Incorrect

Household sector consists of the consumers of goods and services. It is also referred to as the retail sector. The household sector spends and invests money, and mainly consists of fund providers (lenders).

Hint

Reference Chapter:1.1.2

-

Question 62 of 187

62. Question

1 pointsQID18:The business sector mainly functions as:

I. fund providers

II. fund seekers

III. buyers of goods and services

IV. sellers of goods and servicesCorrect

Business sector consists of the producers of goods and services. This sector also requires funds to produce goods and services, and the sector is therefore mainly made up of fund seekers (borrowers).

Incorrect

Business sector consists of the producers of goods and services. This sector also requires funds to produce goods and services, and the sector is therefore mainly made up of fund seekers (borrowers).

Hint

Reference Chapter:1.1.2

-

Question 63 of 187

63. Question

1 pointsQID19:If a government has a budget surplus, it is more likely to be a:

Correct

Whether a government is a fund seeker or a fund provider depends on its overall budgeting position – if in surplus, it is a fund provider.

Incorrect

Whether a government is a fund seeker or a fund provider depends on its overall budgeting position – if in surplus, it is a fund provider.

Hint

Reference Chapter:1.1.2

-

Question 64 of 187

64. Question

1 pointsQID20:If a government has a budget deficit, it is more likely to be a:

Correct

Whether a government is a fund seeker or a fund provider depends on its overall budgeting position – if in deficit, it is a fund seeker.

Incorrect

Whether a government is a fund seeker or a fund provider depends on its overall budgeting position – if in deficit, it is a fund seeker.

Hint

Reference Chapter:1.1.2

-

Question 65 of 187

65. Question

1 pointsQID21:If a government issues bonds,

Correct

A government requires funds to meet its economic, political and social objectives (such as provision of hospitals, schools and roads), and is primarily a fund seeker.

Incorrect

A government requires funds to meet its economic, political and social objectives (such as provision of hospitals, schools and roads), and is primarily a fund seeker.

Hint

Reference Chapter:1.1.2

-

Question 66 of 187

66. Question

1 pointsQID118:If interest rate goes up, the price of debt securities will:

Correct

If interest rate increases, debt securities are perceived as a less attractive investment option and investors may look to other markets for better return or lessen their exposure to debt securities.

Incorrect

If interest rate increases, debt securities are perceived as a less attractive investment option and investors may look to other markets for better return or lessen their exposure to debt securities.

Hint

Reference Chapter:1.3.4.2

-

Question 67 of 187

67. Question

1 pointsQID119:Under globalization, which of the following statement is incorrect regarding the international flow of funds?

Correct

Under globalization, most economies do not exist in isolation, but as part of the global economy, relying on other countries for trade – that is, imports and exports – to borrow and lend funds and to develop domestic infrastructure by establishing new businesses in the domestic economy.

A disadvantage of this mobility, however, is that it can encourage speculative capital inflows and outflows, and cause economic and financial instability not only to individual countries, but also to entire regions; and additionally, it may also have global implications.

Some investors can find investments which takes place in other places and thus the rate of return can be enhanced.

Incorrect

Under globalization, most economies do not exist in isolation, but as part of the global economy, relying on other countries for trade – that is, imports and exports – to borrow and lend funds and to develop domestic infrastructure by establishing new businesses in the domestic economy.

A disadvantage of this mobility, however, is that it can encourage speculative capital inflows and outflows, and cause economic and financial instability not only to individual countries, but also to entire regions; and additionally, it may also have global implications.

Some investors can find investments which takes place in other places and thus the rate of return can be enhanced.

Hint

Reference Chapter:1.3.3.2

-

Question 68 of 187

68. Question

1 pointsQID120:What is the main cause of Asian financial crisis?

Correct

Up to 1997, companies in the worst-hit countries had borrowed large amounts as their economies boomed, and many of these loans were in US dollars because of the lower interest rate. The exchange rates of local currencies were pegged to the US dollar, and so these companies had no fears of having to earn money in the local currency to pay back loans in US dollars. From the middle of 1995 the US dollar started to rise against most of the world’s currencies. Many Asian economies, prior to the currency crisis, tried to shadow the US dollar through central bank intervention and thus their exports became more expensive and less competitive. Inevitably, Asian countries did devalue, and stock markets plunged because it was clear many companies would have difficulty repaying US dollar loans.

Incorrect

Up to 1997, companies in the worst-hit countries had borrowed large amounts as their economies boomed, and many of these loans were in US dollars because of the lower interest rate. The exchange rates of local currencies were pegged to the US dollar, and so these companies had no fears of having to earn money in the local currency to pay back loans in US dollars. From the middle of 1995 the US dollar started to rise against most of the world’s currencies. Many Asian economies, prior to the currency crisis, tried to shadow the US dollar through central bank intervention and thus their exports became more expensive and less competitive. Inevitably, Asian countries did devalue, and stock markets plunged because it was clear many companies would have difficulty repaying US dollar loans.

Hint

Reference Chapter:1.3.5

-

Question 69 of 187

69. Question

1 pointsQID121:What can we learn from Asian financial crisis?

I. It is important to have a robust, well-regulated and transparent financial system.

II. A financial regulatory system that can detect potential risks is needed.

III. Both government and firms should prudently manage debt.

IV. The government should provide funds for firms when needed to avoid economic crisis.Correct

There are some well-known lessons to be learnt from the Asian financial crisis:(1)A strong, well-regulated and transparent financial sector is important to a sustainable policy framework;

(2)It is necessary to establish an effective mechanism of economic and financial surveillance to identify potential risk;(3)Careful debt management is required to sustain both governments and corporations. Their policies and strategies must be designed to enable them to meet their debt obligations;(4)Good corporate governance is a requirement of corporate sector health, which in turn can provide the foundation of a healthy financial sector.Incorrect

There are some well-known lessons to be learnt from the Asian financial crisis:(1)A strong, well-regulated and transparent financial sector is important to a sustainable policy framework;

(2)It is necessary to establish an effective mechanism of economic and financial surveillance to identify potential risk;(3)Careful debt management is required to sustain both governments and corporations. Their policies and strategies must be designed to enable them to meet their debt obligations;(4)Good corporate governance is a requirement of corporate sector health, which in turn can provide the foundation of a healthy financial sector.Hint

Reference Chapter:1.3.5.1

-

Question 70 of 187

70. Question

1 pointsQID122:What can we learn from the subprime crisis?

I. Investors should not solely rely on ratings to make their investment decisions.

II. Appropriate policy should strike a balance between improving consumer protection and maintaining the viability of the securitization model.

III. The government should impose less regulation and more flexibility.

IV. The government should be aware of moral hazard.Correct

The subprime crisis case highlights the following lessons:(1)Credit ratings for different types of obligation should be clearly distinguished, and investors should not solely rely on ratings to make their investment decisions;(2)Appropriate policy should strike a balance between improving consumer protection and maintaining the viability of the securitization model;(3)Policymakers should resist pressure for bailouts in order to reduce the danger of reinforcing speculative or fraudulent behaviour.

A moral hazard may occur where the actions of one party may change to the detriment of another after a financial transaction has taken place. The subprime crisis consists of lots of Breach of contract, so the government should be aware of moral hazard.Incorrect

The subprime crisis case highlights the following lessons:(1)Credit ratings for different types of obligation should be clearly distinguished, and investors should not solely rely on ratings to make their investment decisions;(2)Appropriate policy should strike a balance between improving consumer protection and maintaining the viability of the securitization model;(3)Policymakers should resist pressure for bailouts in order to reduce the danger of reinforcing speculative or fraudulent behaviour.

A moral hazard may occur where the actions of one party may change to the detriment of another after a financial transaction has taken place. The subprime crisis consists of lots of Breach of contract, so the government should be aware of moral hazard.Hint

Reference Chapter:1.3.5.1

-

Question 71 of 187

71. Question

1 pointsQID123:If an economy whose productivity reaches its full capacity is rapidly growing and the market expects that the economy is likely to shrink in the short term, the stock price is more likely to:

Correct

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities. Therefore, the prices of stocks decrease when the market expects that the economy is likely to shrink in the short term.

Incorrect

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities. Therefore, the prices of stocks decrease when the market expects that the economy is likely to shrink in the short term.

Hint

Reference Chapter:1.3.4.2

-

Question 72 of 187

72. Question

1 pointsQID124:The functions of Bank for International Settlements include:

I. Promoting discussion and facilitating collaboration among central banks

II. Supporting dialogue with other authorities that are responsible for promoting financial stability

III. Acting as a prime counterparty for central banks in their financial transactions

IV. Serving as an agent or trustee in connection with international financial operationsCorrect

The BIS fulfils this mission by:(1)promoting discussion and facilitating collaboration among central banks;(2)supporting dialogue with other authorities that are responsible for promoting financial stability;(3)conducting research on policy issues confronting central banks and financial supervisory authorities;(4)acting as a prime counterparty for central banks in their financial transactions; and(5)serving as an agent or trustee in connection with international financial operations.

Incorrect

The BIS fulfils this mission by:(1)promoting discussion and facilitating collaboration among central banks;(2)supporting dialogue with other authorities that are responsible for promoting financial stability;(3)conducting research on policy issues confronting central banks and financial supervisory authorities;(4)acting as a prime counterparty for central banks in their financial transactions; and(5)serving as an agent or trustee in connection with international financial operations.

Hint

Reference Chapter:1.1.5.5

-

Question 73 of 187

73. Question

1 pointsQID125:The functions of financial intermediaries include:

I. Reducing credit risk

II. Solving international trade disputes

III. Facilitating international trade

IV. Enhancing liquidityCorrect

Intermediaries will satisfy the exact requirements of lenders and borrowers, so that the credit risk will be lowered. The effective financing encourages international trades. Intermediaries also facilitates the efficient allocation of resources, i.e. funds may be rapidly and easily moved to where they are needed most. Thus, the mobility is enhanced.

Incorrect

Intermediaries will satisfy the exact requirements of lenders and borrowers, so that the credit risk will be lowered. The effective financing encourages international trades. Intermediaries also facilitates the efficient allocation of resources, i.e. funds may be rapidly and easily moved to where they are needed most. Thus, the mobility is enhanced.

Hint

Reference Chapter:1.2.2.1

-

Question 74 of 187

74. Question

1 pointsQID2468:Due to the introduction of discounts by a famous car brand in Hongkong, the demand for gasoline in Hongkong increases. A company that refines petroleum (petroleum is the raw material for gasoline) has increased the production of petroleum in response to soaring sales. Which of the following descriptions are correct?

i. The price of gasoline rises

ii. The price of gasoline falls

iii. Gasoline consumption increases

iv. Gasoline consumption decreasesCorrect

The question is imperfect as it depends on the growth speed of demand and supply. If the growth rate of demand exceeds the growth rate of supply, the price will rise; otherwise, the price will fall. However, since there is no such information, the answer is estimated to be I, III according to the pattern of the examination.

Incorrect

The question is imperfect as it depends on the growth speed of demand and supply. If the growth rate of demand exceeds the growth rate of supply, the price will rise; otherwise, the price will fall. However, since there is no such information, the answer is estimated to be I, III according to the pattern of the examination.

Hint

Reference Chapter:1.1.1

-

Question 75 of 187

75. Question

1 pointsQID2470:If Mainland China adopts a contractionary monetary policy, which of the following economic factors in Hong Kong is relatively unaffected?

Correct

The Hang Seng China Enterprises Index reflects the overall performance of Mainland Chinese companies listed in Hong Kong, so it has a close relationship with enterprises related to Mainland China. Monetary policy affects the supply and cost of CNY, which in turn affects the value of the currency. Therefore, the exchange rate of CNY against the Hong Kong dollar will also change. The Hang Seng Index covers many stocks that are related to China and not related to China. As for the fourth answer, since the Hong Kong dollar and the US dollar have a linked exchange rate system, the currency value of the Hong Kong dollar is directly related to the US dollar, so the Hong Kong dollar interest rate will also follow the rise and fall of the US dollar interest rate, not CNY. Therefore, Hong Kong dollar interest rate has the slightest relationship with Mainland China’s monetary policy.

Incorrect

The Hang Seng China Enterprises Index reflects the overall performance of Mainland Chinese companies listed in Hong Kong, so it has a close relationship with enterprises related to Mainland China. Monetary policy affects the supply and cost of CNY, which in turn affects the value of the currency. Therefore, the exchange rate of CNY against the Hong Kong dollar will also change. The Hang Seng Index covers many stocks that are related to China and not related to China. As for the fourth answer, since the Hong Kong dollar and the US dollar have a linked exchange rate system, the currency value of the Hong Kong dollar is directly related to the US dollar, so the Hong Kong dollar interest rate will also follow the rise and fall of the US dollar interest rate, not CNY. Therefore, Hong Kong dollar interest rate has the slightest relationship with Mainland China’s monetary policy.

Hint

Reference Chapter:1.3.1.2

-

Question 76 of 187

76. Question

1 pointsQID32:Which of the following function does the World Bank has?

Correct

The World Bank help each developing country onto a path of stable, sustainable and equitable growth. Option A is the function of The BIS while option C and option D are the functions of The IMF.

Incorrect

The World Bank help each developing country onto a path of stable, sustainable and equitable growth. Option A is the function of The BIS while option C and option D are the functions of The IMF.

Hint

Reference Chapter:1.1.5

-

Question 77 of 187

77. Question

1 pointsQID33:The major goals of World Trade Organization include:

I. to arbitrate trade disputes between countries

II. to lower trade barriers

III. to lower unemployment rate

IV. to consolidate trade quotaCorrect

The WTO is an international organization dealing with the global rules of trade between nations. Its main function is to ensure that trade flows as smoothly, predictably and freely as possible.

Incorrect

The WTO is an international organization dealing with the global rules of trade between nations. Its main function is to ensure that trade flows as smoothly, predictably and freely as possible.

Hint

Reference Chapter:1.1.5

-

Question 78 of 187

78. Question

1 pointsQID34:The major functions of currency include:

I. Means of storing wealth

II. a path to increase wealth

III. unit against which to value other goods and services

IV. medium of exchangeCorrect

Money plays an important role in the financial system. Money acts as a

-means of storing wealth

– medium of exchange

-unit against which to value other goods and services.Incorrect

Money plays an important role in the financial system. Money acts as a

-means of storing wealth

– medium of exchange

-unit against which to value other goods and services.Hint

Reference Chapter:1.1.6

-

Question 79 of 187

79. Question

1 pointsQID35:Money needs to be:

I. storable

II. portable

III. durable

IV. hard to obtainCorrect

In order to fulfil its functions, money needs to be durable, storable and portable.

Incorrect

In order to fulfil its functions, money needs to be durable, storable and portable.

Hint

Reference Chapter:1.1.6

-

Question 80 of 187

80. Question

1 pointsQID36:Narrow money represents:

Correct

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks (the authorized institutions in Hong Kong under the Banking Ordinance). It is collectively known as “narrow money”.

Incorrect

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks (the authorized institutions in Hong Kong under the Banking Ordinance). It is collectively known as “narrow money”.

Hint

Reference Chapter:1.1.6

-

Question 81 of 187

81. Question

1 pointsQID37:Broad money represents:

Correct

M3 consists of M2 plus deposits in other financial institutions. It is collectively termed “broad money”.

Incorrect

M3 consists of M2 plus deposits in other financial institutions. It is collectively termed “broad money”.

Hint

Reference Chapter:1.1.6

-

Question 82 of 187

82. Question

1 pointsQID38:Which of the following is not “narrow money” (M1)?

I. all notes and coins in circulation

II. customers’ demand deposits placed with licensed banks

III. savings in licensed banks

IV. time deposits accountsCorrect

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks (the authorized institutions in Hong Kong under the Banking Ordinance).Option III and option IV are classified as M2.

Incorrect

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks (the authorized institutions in Hong Kong under the Banking Ordinance).Option III and option IV are classified as M2.

Hint

Reference Chapter:1.1.6

-

Question 83 of 187

83. Question

1 pointsQID39:all notes and coins and customers’ demand deposits placed with licensed banks belong to which types of the following money?

I. M1

II. M2

III. M3

IV. M4Correct

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks. Meanwhile, M2 consists of M1 and M3 consists of M2.

Incorrect

M1 consists of all notes and coins in circulation and customers’ demand deposits placed with licensed banks. Meanwhile, M2 consists of M1 and M3 consists of M2.

Hint

Reference Chapter:1.1.6

-

Question 84 of 187

84. Question

1 pointsQID40:Savings in licensed banks and time deposits belong to which type of the following money?

I. M1

II. M2

III. M3

IV. M4Correct

M2 consists of savings and time (term) deposit accounts with licensed banks while M3 consists of M2.

Incorrect

M2 consists of savings and time (term) deposit accounts with licensed banks while M3 consists of M2.

Hint

Reference Chapter:1.1.6

-

Question 85 of 187

85. Question

1 pointsQID41:Deposits in other financial institutions belong to which type of the following money?

I. M1

II. M2

III. M3

IV. M4Correct

M3 consists of M2 plus deposits in other financial institutions. It is collectively termed “broad money”.

Incorrect

M3 consists of M2 plus deposits in other financial institutions. It is collectively termed “broad money”.

Hint

Reference Chapter:1.1.6

-

Question 86 of 187

86. Question

1 pointsQID42:Money plays an important role in the financial system which includes:

I. medium of exchange

II. unit against which to value other goods and services

III. means of storing wealth

IV. keeping constant purchasing power perpetuallyCorrect

Money plays an important role in the financial system. Money acts as a

– means of storing wealth

– medium of exchange

– unit against which to value other goods and services.Incorrect

Money plays an important role in the financial system. Money acts as a

– means of storing wealth

– medium of exchange

– unit against which to value other goods and services.Hint

Reference Chapter:1.1.6

-

Question 87 of 187

87. Question

1 pointsQID43:How do banks facilitate funds circulation in financial systems?

I. move funds

II. provide investment opportunities

III. implement fiscal policy

IV. implement monetary policyCorrect

Banks are financial intermediaries and they have an important role in facilitating the flow of funds in the banking system by performing the following functions:

1.Mobilization of funds

2.Investment opportunities

3.Implementation of monetary policyIncorrect

Banks are financial intermediaries and they have an important role in facilitating the flow of funds in the banking system by performing the following functions:

1.Mobilization of funds

2.Investment opportunities

3.Implementation of monetary policyHint

Reference Chapter:1.1.6

-

Question 88 of 187

88. Question

1 pointsQID44:Which of the following organization holds deposits in Bank for International Settlements?

Correct

The BIS offers a range of financial services specifically designed to assist central banks in the management of their foreign exchange.

Incorrect

The BIS offers a range of financial services specifically designed to assist central banks in the management of their foreign exchange.

Hint

Reference Chapter:1.2.1

-

Question 89 of 187

89. Question

1 pointsQID45:In Hong Kong, which of the following organization holds deposits in Bank for International Settlements?

Correct

In Hong Kong, Hong Kong Monetary Authority plays a role as central bank. Meanwhile, the BIS offers a range of financial services specifically designed to assist central banks in the management of their foreign exchange.

Incorrect

In Hong Kong, Hong Kong Monetary Authority plays a role as central bank. Meanwhile, the BIS offers a range of financial services specifically designed to assist central banks in the management of their foreign exchange.

Hint

Reference Chapter:1.2.1

-

Question 90 of 187

90. Question

1 pointsQID46:In Hong Kong, which of the following organization plays a role as central bank?

Correct

Central banks are generally the authorities responsible for regulating the monetary and banking systems, and the money supply. Hong Kong Monetary Authority also responsible for such matters in Hong Kong.

Incorrect

Central banks are generally the authorities responsible for regulating the monetary and banking systems, and the money supply. Hong Kong Monetary Authority also responsible for such matters in Hong Kong.

Hint

Reference Chapter:1.2.1

-

Question 91 of 187

91. Question

1 pointsQID47:Generally central bank controls which of the following economic indicators?

I. Gross domestic product

II. Exchange rate

III. Interest rate

IV. Inflation rateCorrect

Although central banks do not dictate interest and exchange rates per se, the actions they take in foreign exchange and domestic fixed income markets, particularly in the sale and purchase of government bonds, have a profound effect on financial markets.

Incorrect

Although central banks do not dictate interest and exchange rates per se, the actions they take in foreign exchange and domestic fixed income markets, particularly in the sale and purchase of government bonds, have a profound effect on financial markets.

Hint

Reference Chapter:1.2.1

-

Question 92 of 187

92. Question

1 pointsQID48:The role of central banks include:

I. implementing monetary policy.

II. implement fiscal policy

III. monitor the banking system.

IV. maintain the stability of financial systems.Correct

Duties of central banks: 1) Conduct the nation’s monetary policy.2) Maintain the stability of the financial system.3) Supervise and regulate banking institutions.4) Provide financial services to certain institutions, government and public.

Incorrect

Duties of central banks: 1) Conduct the nation’s monetary policy.2) Maintain the stability of the financial system.3) Supervise and regulate banking institutions.4) Provide financial services to certain institutions, government and public.

Hint

Reference Chapter:1.2.1

-

Question 93 of 187

93. Question

1 pointsQID49:Which of the following statement pertaining to intermediation is correct?

Correct

Financial intermediaries may perform the function of “market makers”, who quote two-way prices in the market – that is, they quote a bid and an ask, so that they encourage securities trading and thus increase liquidity in the market.

Incorrect

Financial intermediaries may perform the function of “market makers”, who quote two-way prices in the market – that is, they quote a bid and an ask, so that they encourage securities trading and thus increase liquidity in the market.

Hint

Reference Chapter:1.2.2

-

Question 94 of 187

94. Question

1 pointsQID50:Which of the following is the advantage of intermediation?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors. Intermediaries channel funds from where there is a surplus to where there is a deficit, this improves the efficiency of the allocation.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors. Intermediaries channel funds from where there is a surplus to where there is a deficit, this improves the efficiency of the allocation.

Hint

Reference Chapter:1.2.2.3

-

Question 95 of 187

95. Question

1 pointsQID51:What is the advantage of intermediation to lenders?

Correct

The main advantage of intermediation is the transfer of risk from borrowers and lenders to intermediaries. This lowers the credit risk

Incorrect

The main advantage of intermediation is the transfer of risk from borrowers and lenders to intermediaries. This lowers the credit risk

Hint

Reference Chapter:1.2.2.2

-

Question 96 of 187

96. Question

1 pointsQID52:Intermediation matches which type of people?

Correct

Intermediation (indirect financing) involves third parties, financial institutions or intermediaries, acting as a link between fund providers (lenders) and fund seekers (borrowers).

Incorrect

Intermediation (indirect financing) involves third parties, financial institutions or intermediaries, acting as a link between fund providers (lenders) and fund seekers (borrowers).

Hint

Reference Chapter:1.2.2.1

-

Question 97 of 187

97. Question

1 pointsQID53:How does intermediation transfer credit risk?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Hint

Reference Chapter:1.2.2.2

-

Question 98 of 187

98. Question

1 pointsQID54:Which of the following is not the advantage of intermediation?

Correct

The main disadvantage of intermediation is the additional cost that is passed on to borrowers and investors in the form of higher interest costs, fees, brokerage or commission. Disintermediation or direct financing may be less costly.

Incorrect

The main disadvantage of intermediation is the additional cost that is passed on to borrowers and investors in the form of higher interest costs, fees, brokerage or commission. Disintermediation or direct financing may be less costly.

Hint

Reference Chapter:1.2.2.5

-

Question 99 of 187

99. Question

1 pointsQID55:Who is the one who bears credit risk in intermediation?

Correct

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Incorrect

Intermediation transfers risk to intermediaries but additional cost to borrowers and investors.

Hint

Reference Chapter:1.2.2.2

-

Question 100 of 187

100. Question

1 pointsQID56:Efficient financial markets have which of the following characteristics?

I. gain information for free(symmetric information)

II. Either buyer or seller can trade without limitation.

III. Both buyer and seller are assured that payment will be exercised.

IV. strict monitor by the government to stable the financial marketCorrect

Efficient financial markets have:

1. freely available information

2.able to buy and sell freely;

3.people must be confident that payments will be honoured

4.operate with high standards of honesty, integrity and credibility.Incorrect

Efficient financial markets have:

1. freely available information

2.able to buy and sell freely;

3.people must be confident that payments will be honoured

4.operate with high standards of honesty, integrity and credibility.Hint

Reference Chapter:1.2.3

-

Question 101 of 187

101. Question

1 pointsQID57:Effective and efficient financial market do not have which of the following characteristic?

Correct

Under an effective financial market, there must be an efficient payment and settlement system. Thus, buyers and sellers cannot trade without cost.

Incorrect

Under an effective financial market, there must be an efficient payment and settlement system. Thus, buyers and sellers cannot trade without cost.

Hint

Reference Chapter:1.2.3

-

Question 102 of 187

102. Question

1 pointsQID58:Which of the following factors determines liquidity?

I. Depth

II. Spread

III. Immediacy

IV. ResilienceCorrect

Liquidity are measured by:

Depth: volume of buyers and sellers

Spread: difference between bid and ask prices

Immediacy: time taken to effect the transaction

Resilience: the speed at which prices respond to disruptions caused by large transactionsIncorrect

Liquidity are measured by:

Depth: volume of buyers and sellers

Spread: difference between bid and ask prices

Immediacy: time taken to effect the transaction

Resilience: the speed at which prices respond to disruptions caused by large transactionsHint

Reference Chapter:1.2.3

-

Question 103 of 187

103. Question

1 pointsQID59:The characteristic of being able to trade quickly with huge amounts is called:

Correct

liquidity means the ease with which an investment can be converted into cash with little or no loss of capital value during the conversion, and with minimum delay.

Incorrect

liquidity means the ease with which an investment can be converted into cash with little or no loss of capital value during the conversion, and with minimum delay.

Hint

Reference Chapter:1.2.3

-

Question 104 of 187

104. Question

1 pointsQID60:Which of the following is not a factor of effective financial markets:

I. gain information for free

II. strict monitor

III. trade with limitation

IV. high volumeCorrect

Effective financial markets require freely available (though not necessarily free) information and operate with high standards of honesty, integrity and credibility. No one will otherwise have the confidence to borrow and lend funds.

Incorrect

Effective financial markets require freely available (though not necessarily free) information and operate with high standards of honesty, integrity and credibility. No one will otherwise have the confidence to borrow and lend funds.

Hint

Reference Chapter:1.2.3

-

Question 105 of 187

105. Question

1 pointsQID61:Financial markets can be classified as primary market and:

Correct

Financial markets are broadly categorized as being either primary or secondary.

Incorrect

Financial markets are broadly categorized as being either primary or secondary.

Hint

Reference Chapter:1.2.4

-

Question 106 of 187

106. Question

1 pointsQID90:Which stage in economic cycle best describes the following: “a decrease in economic growth, marked by a decrease in business investment and industrial production”

Correct

Peak to contraction: this is a decrease in economic growth, marked by a decrease in business investment and industrial production. For example, the Asian financial crisis in 1997–1998 constituted a period of peak to contraction in Hong Kong.

Incorrect

Peak to contraction: this is a decrease in economic growth, marked by a decrease in business investment and industrial production. For example, the Asian financial crisis in 1997–1998 constituted a period of peak to contraction in Hong Kong.

Hint

Reference Chapter:1.3.1.1

-

Question 107 of 187

107. Question

1 pointsQID91:Which stage in economic cycle best describes the following: “economic recovery, interest rates decrease and investment activity increases”

Correct

Trough to expansion: this represents economic recovery. Interest rates decrease and investment activity increases.

Incorrect

Trough to expansion: this represents economic recovery. Interest rates decrease and investment activity increases.

Hint

Reference Chapter:1.3.1.1

-

Question 108 of 187

108. Question

1 pointsQID101:Which stage in economic cycle best describes the following: “Household spending increases and the unemployment rate is declining”

Correct

Trough to expansion: this represents economic recovery.

Incorrect

Trough to expansion: this represents economic recovery.

Hint

Reference Chapter:1.3.1.1

-