English HKSI Paper 8 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP8ET1

Quiz-summary

0 of 244 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

Information

HKSIP8ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 244 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

-

HKSIP8ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- Answered

- Review

-

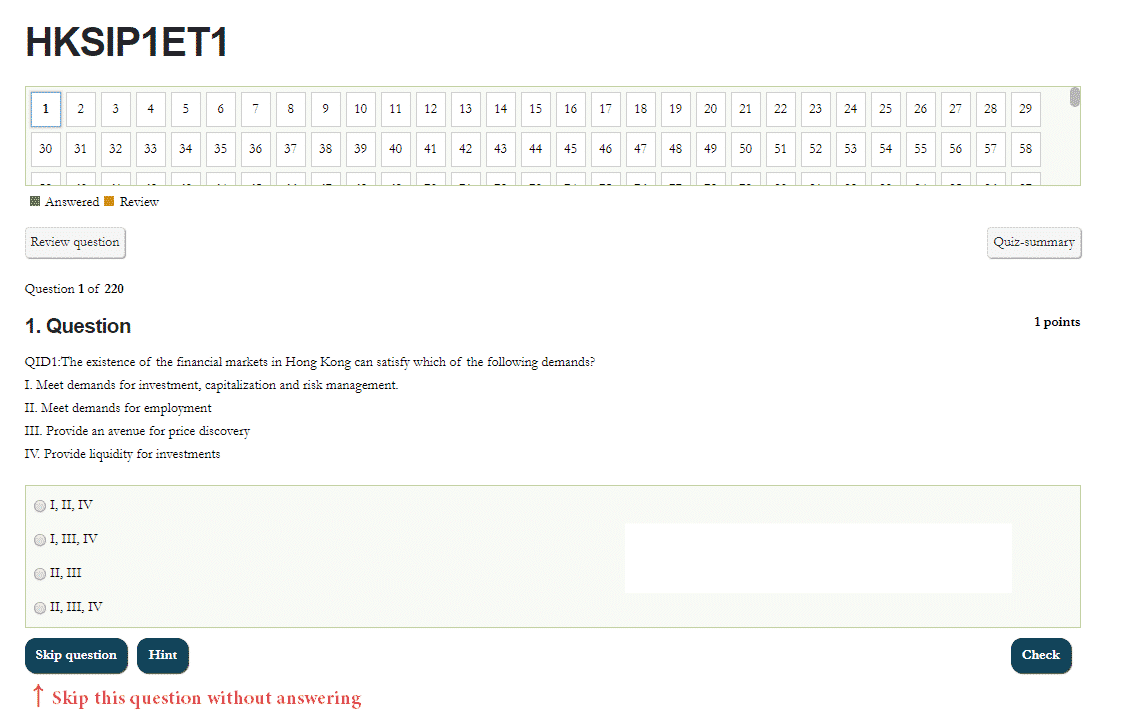

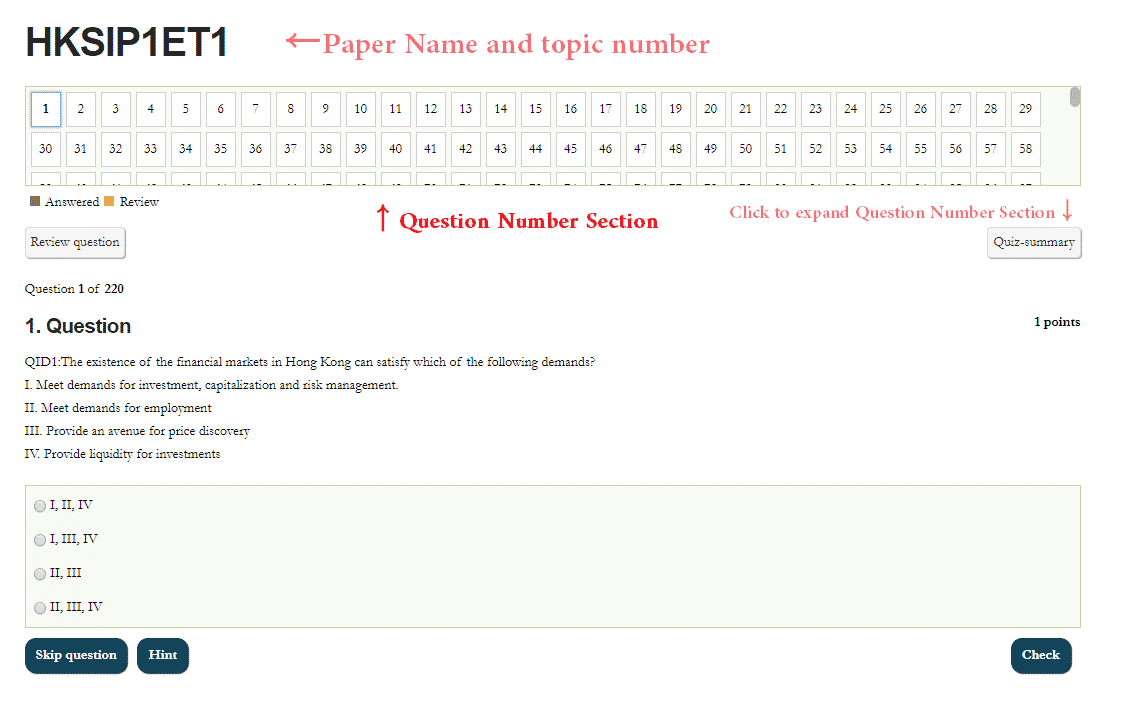

Question 1 of 244

1. Question

1 pointsQID2957:

Correct

Incorrect

Hint

Reference Chapter:1.4.3

-

Question 2 of 244

2. Question

1 pointsQID2949:Which of the following statements about China’s A or B shares is true?

I. A shares are settled in renminbi

II. B shares are settled in renminbi in Shenzhen

III. B shares are settled in Hong Kong dollars in Shanghai

IV.B shares in Shenzhen and Shanghai were initially available only to foreign investors, but have now been opened up to domestic investors with a foreign exchange accountCorrect

Correct descriptions of China’s A or B shares include

I. A shares are settled in renminbi

II. B shares are settled in Hong Kong dollars in Shenzhen

III. B shares are settled in US dollars in Shanghai

IV. B shares in Shenzhen and Shanghai were initially available only to foreign investors, but have now been opened up to domestic investors with a foreign exchange accountIncorrect

Correct descriptions of China’s A or B shares include

I. A shares are settled in renminbi

II. B shares are settled in Hong Kong dollars in Shenzhen

III. B shares are settled in US dollars in Shanghai

IV. B shares in Shenzhen and Shanghai were initially available only to foreign investors, but have now been opened up to domestic investors with a foreign exchange accountHint

Reference Chapter:1.2.3

-

Question 3 of 244

3. Question

1 pointsQID2419:Which of the following stock market has the least influence to Hong Kong stock market?

Correct

Malaysian has minor trade relations with Hong Kong. Besides, Malaysian stock market has the smallest market cap among the above options and hence has lesser influence on the global market.

Incorrect

Malaysian has minor trade relations with Hong Kong. Besides, Malaysian stock market has the smallest market cap among the above options and hence has lesser influence on the global market.

Hint

Reference Chapter:1.3.

-

Question 4 of 244

4. Question

1 pointsQID2421:China B shares settled in HKD are traded in which of the below exchanges?

Correct

B shares traded in the Shenzhen Stock Exchange are denoted in Hong Kong dollars

Incorrect

B shares traded in the Shenzhen Stock Exchange are denoted in Hong Kong dollars

Hint

Reference Chapter:1.2.3.2

-

Question 5 of 244

5. Question

1 pointsQID2424:If the nominal interest rate is 4% and the inflation rate is 2%, which of the following is the most accurate value of the real interest rate?

Correct

Real interest rate = (1+nominal interest rate)/ (1+inflation rate) -1

But these questions can be answered even without a calculator. Since real interest rate is approximately nominal interest rate minus inflation rate, the real interest rate must be positive in this case, so A and B can be eliminated. Although the simple calculation method is 4%-2%, the question emphasizes the MOST ACCURATE, so the answer should be less than 4%-2% by using the most accurate formula. Therefore, the answer is CIncorrect

Real interest rate = (1+nominal interest rate)/ (1+inflation rate) -1

But these questions can be answered even without a calculator. Since real interest rate is approximately nominal interest rate minus inflation rate, the real interest rate must be positive in this case, so A and B can be eliminated. Although the simple calculation method is 4%-2%, the question emphasizes the MOST ACCURATE, so the answer should be less than 4%-2% by using the most accurate formula. Therefore, the answer is CHint

Reference Chapter:1.4.1.2

-

Question 6 of 244

6. Question

1 pointsQID2426:If the face value of a 60-day deposit certificate is $1000, purchased at $970, which is the annual interest rate? (assuming that there are 365 days in a year)

Correct

Present value x (1 is the principal itself + annual interest rate x number of days/365 days in a year) = face value

970x (1+ n% x 60/365) = 1000

1 + n% x 60/365 = 1000/970

n% x 60/365 = 1.03093-1

n% = 0.03093 x 365/60

n%= 0.18814Incorrect

Present value x (1 is the principal itself + annual interest rate x number of days/365 days in a year) = face value

970x (1+ n% x 60/365) = 1000

1 + n% x 60/365 = 1000/970

n% x 60/365 = 1.03093-1

n% = 0.03093 x 365/60

n%= 0.18814Hint

Reference Chapter:1.4.1.1

-

Question 7 of 244

7. Question

1 pointsQID2427:A 10,000,000 demand deposit was made this morning with an interest rate of 7%. How much interest will be received tomorrow? (Assuming there are 365 days in a year)

Correct

Principal x (1 + annual interest rate/number of days per year) ^ interest calculation several times-principal

Tomorrow, interest is given once (1 time a day)

10,000,000x(1+7%/365)^1 – 10,000,000

= 10,000,000×1.000191781 – 10,000,000

= 1917.8082Incorrect

Principal x (1 + annual interest rate/number of days per year) ^ interest calculation several times-principal

Tomorrow, interest is given once (1 time a day)

10,000,000x(1+7%/365)^1 – 10,000,000

= 10,000,000×1.000191781 – 10,000,000

= 1917.8082Hint

Reference Chapter:1.4.1.1

-

Question 8 of 244

8. Question

1 pointsQID2430:Which of the following is the correct description of the inverse yield curve?

Correct

The inverse yield curve indicates that the short-term interest rate is higher than the long-term interest rate, which means that in the future, interest rate will fall

Incorrect

The inverse yield curve indicates that the short-term interest rate is higher than the long-term interest rate, which means that in the future, interest rate will fall

Hint

Reference Chapter:1.4.1.3

-

Question 9 of 244

9. Question

1 pointsQID2431:The definition of QDIIs is?

Correct

QDIIs refers to Mainland Chinese investors who are permitted to invest in overseas financial markets, such as fund houses, banks, insurance companies and securities brokerage firms

Incorrect

QDIIs refers to Mainland Chinese investors who are permitted to invest in overseas financial markets, such as fund houses, banks, insurance companies and securities brokerage firms

Hint

Reference Chapter:1.4.7

-

Question 10 of 244

10. Question

1 pointsQID2432:Which of the following indices covers a wider range?

Correct

The Hang Seng Composite Index Series covers the top 95% of the market value of shares listed on the main board of the exchange which has a wider range than the other two HSIs

The S & P / HKEx Large Cap Index covers only dozens of stockIncorrect

The Hang Seng Composite Index Series covers the top 95% of the market value of shares listed on the main board of the exchange which has a wider range than the other two HSIs

The S & P / HKEx Large Cap Index covers only dozens of stockHint

Reference Chapter:1.5.2.1

-

Question 11 of 244

11. Question

1 pointsQID2237:To approximate financial instrument’s real interest rate:

Correct

To approximate financial instrument’s real interest rate: nominal interest rate – inflation

Incorrect

To approximate financial instrument’s real interest rate: nominal interest rate – inflation

Hint

Reference Chapter:1.4.1.2

-

Question 12 of 244

12. Question

1 pointsQID2238:When the long-term interest rate is smaller than the short-term interest rate, it means that:

Correct

When the long-term interest rate is smaller than the short-term interest rate, it means that the yield curve is reversed. It probably represents decreased inflation and economic downturn. The government may implement expansionary monetary policies to drive down the interest rate.

Incorrect

When the long-term interest rate is smaller than the short-term interest rate, it means that the yield curve is reversed. It probably represents decreased inflation and economic downturn. The government may implement expansionary monetary policies to drive down the interest rate.

Hint

Reference Chapter:1.4.1.3

-

Question 13 of 244

13. Question

1 pointsQID2240:Which of the following is incorrect:

Correct

A decrease in the exchange rate leads to the weakening of the currency of a country. To foreign consumers, the products exporting from the nation become cheaper. It may strengthen the export of a country rather than weakening.

Incorrect

A decrease in the exchange rate leads to the weakening of the currency of a country. To foreign consumers, the products exporting from the nation become cheaper. It may strengthen the export of a country rather than weakening.

Hint

Reference Chapter:1.4.3

-

Question 14 of 244

14. Question

1 pointsQID2242:Which of the following index covers the widest range and biggest market value?

Correct

The Hang Seng Composite Index (“HSCI”) covers the highest 95% of market value on the Mainboard of the exchange.

Incorrect

The Hang Seng Composite Index (“HSCI”) covers the highest 95% of market value on the Mainboard of the exchange.

Hint

Reference Chapter:1.5.2.1

-

Question 15 of 244

15. Question

1 pointsQID2302:There is a deposit of 10000 with a term of 5 years and an interest of 6%. Assuming the interest is not reinvested, the sum of interest in 5 years is:

Correct

There is a deposit of 10000 with a term of 5 years and an interest of 6%. Assuming the interest is not reinvested, the sum of interest in 5 years is:

Principal*terms*interest

10000*5*6%=$3000Incorrect

There is a deposit of 10000 with a term of 5 years and an interest of 6%. Assuming the interest is not reinvested, the sum of interest in 5 years is:

Principal*terms*interest

10000*5*6%=$3000Hint

Reference Chapter:1.4.1.1

-

Question 16 of 244

16. Question

1 pointsQID462:What is the main reason Hong Kong had a slow development in bond market?

I. Hong Kong has a long history of budget surplus such that it has little need to issue government bonds.

II. Hong Kong has a more active stock market to absorb the majority of capital.

III. Government thinks debt securities are not suitable for general investors.

IV. Hong Kong Monetary Authority prohibits retail investors from securities trading.Correct

With its consistent budget surplus, the HKSAR Government does not have any need to raise capital by issuing debts. Thus, Hong Kong’s debt market has historically been illiquid and inactive when compared to its equity markets.

Incorrect

With its consistent budget surplus, the HKSAR Government does not have any need to raise capital by issuing debts. Thus, Hong Kong’s debt market has historically been illiquid and inactive when compared to its equity markets.

Hint

Reference Chapter:1.1.2

-

Question 17 of 244

17. Question

1 pointsQID464:Which of the following actions did the Hong Kong government take to boost the development of debt securities market?

I. The Hong Kong Monetary Authority issues different maturities of exchange fund bill and exchange fund notes.

II. The market-making system is introduced into exchange fund bill and exchange fund notes to increase liquidity.

III. Exchange fund bill and exchange fund notes can be listed on Stock Exchange of Hong Kong Limited(SEHK).

IV. There is no restriction in foreign investors investing in local debt securities market.Correct

To develop the debt market, the Hong Kong Monetary Authority (“HKMA”) issues a number of debt securities on behalf of the HKSAR Government including Exchange Fund Bills (“EFBs”) and Exchange Fund Notes (“EFNs”). To enhance secondary market liquidity, the HKMA has established an effective market-making system for EFBs and EFNs. There are currently no restrictions on foreign borrowers issuing and investing in the Hong Kong debt market, which has resulted in its internationalization. In an effort to appeal to retail investors and to encourage the development of Hong Kong’s debt market, some debt securities, EFNs and government bonds have been listed on the SEHK.

Incorrect

To develop the debt market, the Hong Kong Monetary Authority (“HKMA”) issues a number of debt securities on behalf of the HKSAR Government including Exchange Fund Bills (“EFBs”) and Exchange Fund Notes (“EFNs”). To enhance secondary market liquidity, the HKMA has established an effective market-making system for EFBs and EFNs. There are currently no restrictions on foreign borrowers issuing and investing in the Hong Kong debt market, which has resulted in its internationalization. In an effort to appeal to retail investors and to encourage the development of Hong Kong’s debt market, some debt securities, EFNs and government bonds have been listed on the SEHK.

Hint

Reference Chapter:1.1.2

-

Question 18 of 244

18. Question

1 pointsQID2297:Under the same investment horizon, which of the following institution issue bonds with the highest yield?

Correct

The higher the credit risk of the issuer, the higher the yield theoretically. The yield of supranational institutions is lower than England and America, whereas quasi-government entities are higher than the above. As a result, the yield of quasi-government entities is the highest in theory.

Incorrect

The higher the credit risk of the issuer, the higher the yield theoretically. The yield of supranational institutions is lower than England and America, whereas quasi-government entities are higher than the above. As a result, the yield of quasi-government entities is the highest in theory.

Hint

Reference Chapter:1.4.1.3

-

Question 19 of 244

19. Question

1 pointsQID2301:What does a positive yield curve means?

Correct

A positive yield curve means the long-term yield is higher than short-term yield, and it is expected that the inflation will become worse in the future.

Incorrect

A positive yield curve means the long-term yield is higher than short-term yield, and it is expected that the inflation will become worse in the future.

Hint

Reference Chapter:1.4.1.3

-

Question 20 of 244

20. Question

1 pointsQID487:What is the main reason Hong Kong issues exchange fund notes and exchange fund bills?

Correct

To develop the debt market, the Hong Kong Monetary Authority (“HKMA”) issues a number of debt securities on behalf of the HKSAR Government including Exchange Fund Bills (“EFBs”) and Exchange Fund Notes (“EFNs”) .

Incorrect

To develop the debt market, the Hong Kong Monetary Authority (“HKMA”) issues a number of debt securities on behalf of the HKSAR Government including Exchange Fund Bills (“EFBs”) and Exchange Fund Notes (“EFNs”) .

Hint

Reference Chapter:1.4.1.2

-

Question 21 of 244

21. Question

1 pointsQID876:Assume an annual nominal interest rate of 22% and then borrow HKD$20,000 for ten years with daily compounding. What is the return?

Correct

[(1+0.22/365) ^ (10)(365)] – 1=8.019

Thus, the return is 801.9%

Incorrect

[(1+0.22/365) ^ (10)(365)] – 1=8.019

Thus, the return is 801.9%

Hint

Reference Chapter:1.4.1.2

-

Question 22 of 244

22. Question

1 pointsQID877:Nominal return =

Correct

Nominal interest rates are the most common way of quoting annual interest rates, without considering the compounding effect. Real interest rates take into account changes in the purchasing power of money over time, i.e. inflation. Therefore, nominal interest rates are the sum of real returns and inflation rate.

Incorrect

Nominal interest rates are the most common way of quoting annual interest rates, without considering the compounding effect. Real interest rates take into account changes in the purchasing power of money over time, i.e. inflation. Therefore, nominal interest rates are the sum of real returns and inflation rate.

Hint

Reference Chapter:1.4.1.2

-

Question 23 of 244

23. Question

1 pointsQID497:What is it meant by upward-sloping yield curves?

Correct

Positive, or normal: this is the normal situation where yield increases with an increase in the term to maturity. The longer the term to maturity, the greater the uncertainty and therefore the greater the risk. Yields on securities therefore increase to reflect this greater risk for investors. A positive yield curve is consistent with expectations of rising inflation over the longer term.

Incorrect

Positive, or normal: this is the normal situation where yield increases with an increase in the term to maturity. The longer the term to maturity, the greater the uncertainty and therefore the greater the risk. Yields on securities therefore increase to reflect this greater risk for investors. A positive yield curve is consistent with expectations of rising inflation over the longer term.

Hint

Reference Chapter:1.4.1.3

-

Question 24 of 244

24. Question

1 pointsQID899:Exchanges in Hong Kong are listed in which of the following exchanges?

Correct

Hong Kong Exchanges and Clearing Limited (“Hex”) was listed its shares on the SEHK on 27 June 2000.

Incorrect

Hong Kong Exchanges and Clearing Limited (“Hex”) was listed its shares on the SEHK on 27 June 2000.

Hint

Reference Chapter:1.1.

-

Question 25 of 244

25. Question

1 pointsQID900:Stocks listed in the Main Board of the Stock Exchange of Hong Kong Limited(SEHK) have which of the following characteristics?

I. Larger size

II. Longer life since inception

III. Longer record of earnings

IV. More suitable for professional investorsCorrect

Main board listing: this refers to the main group of publicly listed companies with proven profitability records and size to justify being publicly listed. An example is the Main Board of the SEHK.

Incorrect

Main board listing: this refers to the main group of publicly listed companies with proven profitability records and size to justify being publicly listed. An example is the Main Board of the SEHK.

Hint

Reference Chapter:1.1.1

-

Question 26 of 244

26. Question

1 pointsQID1686:B shares traded in Shenzhen Stock Exchange are settled in

Correct

Shenzhen Stock Exchange was established in December 1990, and also trades in A and B shares. A shares are traded and settled in the local currency (i.e. RMB) and B shares in Hong Kong dollars.

Incorrect

Shenzhen Stock Exchange was established in December 1990, and also trades in A and B shares. A shares are traded and settled in the local currency (i.e. RMB) and B shares in Hong Kong dollars.

Hint

Reference Chapter:1.2.3.2

-

Question 27 of 244

27. Question

1 pointsQID1687:The main purpose for China to promote new securities laws in 1998 is

Correct

In 1998, the government passed new securities laws to govern the emerging securities market, aiming to increase the levels of disclosure and to prevent insider trading.

Incorrect

In 1998, the government passed new securities laws to govern the emerging securities market, aiming to increase the levels of disclosure and to prevent insider trading.

Hint

Reference Chapter:1.2.3

-

Question 28 of 244

28. Question

1 pointsQID1688:The most representative market in Europe is

Correct

London is still the largest stock market in Europe and its total market capitalisation at the end of June 2016 was USD 3,480 billion. The Financial Times Stock Exchange (“FTSE”) 100 Index tracks the performance of the London stock market’s top 100 shares and is the most common performance indicator for the UK equity market.

Incorrect

London is still the largest stock market in Europe and its total market capitalisation at the end of June 2016 was USD 3,480 billion. The Financial Times Stock Exchange (“FTSE”) 100 Index tracks the performance of the London stock market’s top 100 shares and is the most common performance indicator for the UK equity market.

Hint

Reference Chapter:1.3.2

-

Question 29 of 244

29. Question

1 pointsQID939:Risk premium is:

Correct

The component above the risk-free rate, the risk premium, represents the additional reward to investors for investing in higher risk securities.

Incorrect

The component above the risk-free rate, the risk premium, represents the additional reward to investors for investing in higher risk securities.

Hint

Reference Chapter:1.4.1.3

-

Question 30 of 244

30. Question

1 pointsQID940:Duration measures:

Correct

Duration measures the sensitivity of securities to changes in interest rates, by taking into account the maturity date and the coupon cash flows. It approximates to the percentage bond price change that results from a 1% change in interest rates. It also measures the average number of years it takes for the discounted cash flow to be returned to an investor.

Incorrect

Duration measures the sensitivity of securities to changes in interest rates, by taking into account the maturity date and the coupon cash flows. It approximates to the percentage bond price change that results from a 1% change in interest rates. It also measures the average number of years it takes for the discounted cash flow to be returned to an investor.

Hint

Reference Chapter:1.4.1.4

-

Question 31 of 244

31. Question

1 pointsQID941:Which of the following factors affect the security market?

I. Exchange rate

II. Inflation

III. Economic cycle

IV. Political factorCorrect

All factors above affects the security market.

Incorrect

All factors above affects the security market.

Hint

Reference Chapter:1.4.1.3

-

Question 32 of 244

32. Question

1 pointsQID951:In Hong Kong, the nominal interest rate is 4% whereas the inflation is 8%. What is the real interest rate in Hong Kong?

Correct

Nominal interest rate = Real Interest rate + Inflation rate

4-8 = -4

The real interest rate in Hong Kong is -4%.

Incorrect

Nominal interest rate = Real Interest rate + Inflation rate

4-8 = -4

The real interest rate in Hong Kong is -4%.

Hint

Reference Chapter:1.4.1.2

-

Question 33 of 244

33. Question

1 pointsQID952:In Hong Kong, the nominal interest rate is 4% whereas the inflation is 8%. What is the approximate real interest rate in Hong Kong?

Correct

Nominal interest rate = Real Interest rate + Inflation rate

4-8 = -4

The real interest rate in Hong Kong is -4%.

Incorrect

Nominal interest rate = Real Interest rate + Inflation rate

4-8 = -4

The real interest rate in Hong Kong is -4%.

Hint

Reference Chapter:1.4.1.2

-

Question 34 of 244

34. Question

1 pointsQID427:Mr. GAO works as a manager for the Dog Charity Fund whose assets are mainly invested in fixed-rate bonds. Mr. GAO got an insider information from the Monetary Authority such that there will be a huge increase in Hong Kong’s interest rate, knowing that earnings yield on 10-year and 30-year bonds will increase 1%. Not concerning about moral and legal problems, which of the following ways is more likely to make profits for the Dog Charity Fund?

Correct

The interest payment or coupon on a fixed rate bond remains constant throughout the life of the bond while interest payment or coupon of a floating rate bond is based on a reference rate. If there will be a huge increase in Hong Kong’s interest rate, The interest payment on a fixed rate bond remains unchanged but that on a floating rate bond may increase. Therefore, he will benefit from the increased returns resulting from higher interest rates after selling sell 10-year and 30-year fixed-rate bond and purchasing floating-rate bond.

Incorrect

The interest payment or coupon on a fixed rate bond remains constant throughout the life of the bond while interest payment or coupon of a floating rate bond is based on a reference rate. If there will be a huge increase in Hong Kong’s interest rate, The interest payment on a fixed rate bond remains unchanged but that on a floating rate bond may increase. Therefore, he will benefit from the increased returns resulting from higher interest rates after selling sell 10-year and 30-year fixed-rate bond and purchasing floating-rate bond.

Hint

Reference Chapter:1.4.1.4

-

Question 35 of 244

35. Question

1 pointsQID428:Mr. GAO works as a manager for the Dog Charity Fund whose assets are mainly invested in fixed-rate bonds. Mr. GAO got an insider information from the Monetary Authority such that there will be a huge increase in Hong Kong’s interest rate, knowing that earnings yield on 10-year and 30-year bonds will increase 1%. Which of the following is more likely to occur.

Correct

An increase in short-term interest rates results in a decrease in the value of long-term debt securities. Since 30-year bond is longer than 10-year bond, it will drop more when short-term interest rates increases.

Incorrect

An increase in short-term interest rates results in a decrease in the value of long-term debt securities. Since 30-year bond is longer than 10-year bond, it will drop more when short-term interest rates increases.

Hint

Reference Chapter:1.4.1.4

-

Question 36 of 244

36. Question

1 pointsQID430:Ms. Yu wanted to get married and forced his conservative boyfriend Mr. Zhou to invest. Ms. Yu’s mother requested a gift of money of 500,000. The interest rate in banks is 5% with a semi-annual interest payment. How much should Mr. Zhou invest if he wants to have that amount of money in two years?

Correct

S=P(1+r/m)^(tm)

500000=P(1+0.05/2)^(2X2)

P=4529753

Thus, Mr. Zhou need to invest $452,975.Incorrect

S=P(1+r/m)^(tm)

500000=P(1+0.05/2)^(2X2)

P=4529753

Thus, Mr. Zhou need to invest $452,975.Hint

Reference Chapter:1.4.1.2

-

Question 37 of 244

37. Question

1 pointsQID413:What is the main difference between simple interest and compound interest?

Correct

Simple interest involves interest being calculated on a constant principal amount throughout the period of the loan. Compound interest assumes that all income earned in a period is reinvested at the same interest rate so that for each succeeding period that the interest is calculated, the principal amount has increased by the amount of interest earned up to the end of the previous period.

Incorrect

Simple interest involves interest being calculated on a constant principal amount throughout the period of the loan. Compound interest assumes that all income earned in a period is reinvested at the same interest rate so that for each succeeding period that the interest is calculated, the principal amount has increased by the amount of interest earned up to the end of the previous period.

Hint

Reference Chapter:1.4.1.1

-

Question 38 of 244

38. Question

1 pointsQID414:Nominal interest rate British construction bank paid is 5%. What is the real interest rate if compounded monthly?

Correct

Real interest rate =[(1+0.05/12)^12]-1 = 0.0512

Thus, the real interest rate is 5.12%

Incorrect

Real interest rate =[(1+0.05/12)^12]-1 = 0.0512

Thus, the real interest rate is 5.12%

Hint

Reference Chapter:1.4.1.2

-

Question 39 of 244

39. Question

1 pointsQID415:Nominal interest rate British construction bank paid is 5%. What is the real interest rate if compounded semi-annually?

Correct

Real interest rate =[(1+0.05/2)^2]-1=0.0506

Thus, the real interest rate is 5.06%

Incorrect

Real interest rate =[(1+0.05/2)^2]-1=0.0506

Thus, the real interest rate is 5.06%

Hint

Reference Chapter:1.4.1.2

-

Question 40 of 244

40. Question

1 pointsQID416:Mr. GAO has a business of making usurious loan. According to Hong Kong’s law, interest rate cannot be higher than 60%. Which of the following loans may exceed the legal interest rate limit?

Correct

Real interest rate for the daily payment:

[(1+0.475/365)^365]-1 = 0.608Thus, the real interest rate is 60.8% and it exceeds the legal interest rate limit.

Incorrect

Real interest rate for the daily payment:

[(1+0.475/365)^365]-1 = 0.608Thus, the real interest rate is 60.8% and it exceeds the legal interest rate limit.

Hint

Reference Chapter:1.4.1.2

-

Question 41 of 244

41. Question

1 pointsQID417:Vitamilk bond has a 5-year time-to-maturity with a coupon rate of 6% whose interest can be reinvested continuously with a 6% return. What is the future value if investing $20,000 now?

Correct

Future value:

20000(1×0.06)^5

=26764Thus, the future value is $26,764.

Incorrect

Future value:

20000(1×0.06)^5

=26764Thus, the future value is $26,764.

Hint

Reference Chapter:1.4.1.1

-

Question 42 of 244

42. Question

1 pointsQID418:Ms. Yu wanted to get married and forced his conservative boyfriend Mr. Zhou to invest. Mr. Zhou had a deposit of HK$500,000 now. Mr. GAO, an obliging bank clerk recommended Mr. Zhou to buy a high risk bond of a Chinese company with a coupon rate of 30% paying interest annually which can be reinvested with the same coupon rate. How much can Mr. Zhou have five years later if he invests HK$500,000 and upcoming interests in this bond?

Correct

500000(1+0.3)^5 = 1856465

Mr. Zhou will have $1,856,465 after 5 years.

Incorrect

500000(1+0.3)^5 = 1856465

Mr. Zhou will have $1,856,465 after 5 years.

Hint

Reference Chapter:1.4.1.2

-

Question 43 of 244

43. Question

1 pointsQID419:Ms. Yu wanted to get married and forced his conservative boyfriend Mr. Zhou to invest. Mr. Zhou had a deposit of HK$500,000 now. Mr. GAO, an obliging bank clerk recommended Mr. Zhou to buy a high risk bond of a Chinese company with a coupon rate of 30% paying interest annually which can be reinvested with the same coupon rate. How much interests can Mr. Zhou have five years later if he invests HK$500,000 and upcoming interests in this bond?

Correct

1856465-500000 = 1,356,465

Mr. Zhou will have $1,856,465 after 5 years.

Incorrect

1856465-500000 = 1,356,465

Mr. Zhou will have $1,856,465 after 5 years.

Hint

Reference Chapter:1.4.1.2

-

Question 44 of 244

44. Question

1 pointsQID420:Ms. Yu wanted to get married and forced his conservative boyfriend Mr. Zhou to invest. Mr. Zhou had a deposit of HK$500,000 now. Mr. GAO, an obliging bank clerk recommended Mr. Zhou to buy a high risk bond of a Chinese company with a coupon rate of 30% paying interest semi-annually which can be reinvested with the same coupon rate. How much can Mr. Zhou have five years later if he invests HK$500,000 and upcoming interests in this bond?

Correct

500000[(1+(0.3/2)]^(5×2)= 2022778.868

Mr. Zhou will have $2,022,779 after 5 years.

Incorrect

500000[(1+(0.3/2)]^(5×2)= 2022778.868

Mr. Zhou will have $2,022,779 after 5 years.

Hint

Reference Chapter:1.4.1.2

-

Question 45 of 244

45. Question

1 pointsQID849:Which of the following statements is correct regarding yield curve?

Correct

When the yield curve is upward-sloping, the curve is showing the positive or normal one. This is the normal situation where yield increases with an increase in the term to maturity. The longer the term to maturity, the greater the uncertainty and therefore the greater the risk. The investors require additional risk premium and the yields on securities therefore increase to reflect this greater risk for investors.

Incorrect

When the yield curve is upward-sloping, the curve is showing the positive or normal one. This is the normal situation where yield increases with an increase in the term to maturity. The longer the term to maturity, the greater the uncertainty and therefore the greater the risk. The investors require additional risk premium and the yields on securities therefore increase to reflect this greater risk for investors.

Hint

Reference Chapter:1.4.1.3

-

Question 46 of 244

46. Question

1 pointsQID850:Generally, with respect to fixed income securities, what is the difference between long-term securities and short-term securities?

Correct

Generally, the longer the term to maturity, the greater the uncertainty and therefore the greater the risk. The investors require additional risk premium and the yields on securities therefore increase to reflect this greater risk for investors.

Incorrect

Generally, the longer the term to maturity, the greater the uncertainty and therefore the greater the risk. The investors require additional risk premium and the yields on securities therefore increase to reflect this greater risk for investors.

Hint

Reference Chapter:1.4.1.3

-

Question 47 of 244

47. Question

1 pointsQID851:Generally, the lower the credit risk of fixed income securities,

Correct

The lower the credit risk of fixed income securities, the lower the risk premium. Thus, the additional yields on securities will also become lower in fixed income securities with low credit risk.

Incorrect

The lower the credit risk of fixed income securities, the lower the risk premium. Thus, the additional yields on securities will also become lower in fixed income securities with low credit risk.

Hint

Reference Chapter:1.4.1.3

-

Question 48 of 244

48. Question

1 pointsQID852:If short-term rate is lower than long-term rate, then

Correct

When short-term rate is lower than long-term rate, the yield curve is positive or normal. This is the normal situation where yield increases with an increase in the term to maturity. There is thus an upward-sloping yield curve.

Incorrect

When short-term rate is lower than long-term rate, the yield curve is positive or normal. This is the normal situation where yield increases with an increase in the term to maturity. There is thus an upward-sloping yield curve.

Hint

Reference Chapter:1.4.1.3

-

Question 49 of 244

49. Question

1 pointsQID853:If short-term rate equals to long-term rate, then

Correct

A flat yield curve reflects market expectations that interest rates will remain stable in the future. There is a horizontal yield curve.

Incorrect

A flat yield curve reflects market expectations that interest rates will remain stable in the future. There is a horizontal yield curve.

Hint

Reference Chapter:1.4.1.3

-

Question 50 of 244

50. Question

1 pointsQID854:If short-term rate is greater than long-term rate, then

Correct

Downward-sloping yield curve represents the negative, or inverse yield curve. An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates.

Incorrect

Downward-sloping yield curve represents the negative, or inverse yield curve. An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates.

Hint

Reference Chapter:1.4.1.3

-

Question 51 of 244

51. Question

1 pointsQID855:Which of the following are less likely to be the causes of a downward-sloping yield curve?

I. The market expects an interest rate hike in the future.

II. The market expects an interest rate drop in the future.

III. Investors require additional risk premium in borrowing long-term debt.

IV. Investors require additional risk premium in borrowing short-term debt.Correct

An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates. This may indicate that there are expectations of falling interest rates in the future. In other words, investors require additional risk premium in borrowing short-term debt in this situation.

Incorrect

An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates. This may indicate that there are expectations of falling interest rates in the future. In other words, investors require additional risk premium in borrowing short-term debt in this situation.

Hint

Reference Chapter:1.4.1.3

-

Question 52 of 244

52. Question

1 pointsQID942:If long-term bond yield is lower than short-term bond yield, it is more likely to represent:

Correct

An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates. This may indicate that there are expectations of falling interest rates in the future.

Incorrect

An inverse yield curve reflects a situation where short-term interest rates are higher than long-term interest rates. This may indicate that there are expectations of falling interest rates in the future.

Hint

Reference Chapter:1.4.1.3

-

Question 53 of 244

53. Question

1 pointsQID891:Required return =

Correct

The component above the risk-free rate, the risk premium, represents the additional reward to investors for investing in higher risk securities. Risk premium = yield(Required return) – rise-free rate

Incorrect

The component above the risk-free rate, the risk premium, represents the additional reward to investors for investing in higher risk securities. Risk premium = yield(Required return) – rise-free rate

Hint

Reference Chapter:1.4.1.3

-

Question 54 of 244

54. Question

1 pointsQID896:Hong Kong’s first stock exchange was established in which of the following year?

Correct

The first reported trading of equity securities in Hong Kong dates back to the mid 19th century. In 1891, the first formalized stock exchange, the Association of Stockbrokers in Hong Kong, was established. This was renamed the Hong Kong Stock Exchange in 1914.

Incorrect

The first reported trading of equity securities in Hong Kong dates back to the mid 19th century. In 1891, the first formalized stock exchange, the Association of Stockbrokers in Hong Kong, was established. This was renamed the Hong Kong Stock Exchange in 1914.

Hint

Reference Chapter:1.1.

-

Question 55 of 244

55. Question

1 pointsQID897:The Stock Exchange of Hong Kong Limited(SEHK) are responsible for operating which of the following two stock markets?

I. Main board

II. Hang Seng index

III. China Enterprise index

IV. Growth Enterprise MarketCorrect

There are generally two tiers of listing: (1) Main board listing: this refers to the main group of publicly listed companies with proven profitability records and size to justify being publicly listed. An example is the Main Board of the SEHK. (2) Second board listing: this generally caters for smaller companies that do not qualify for main board listing. An example is the Growth Enterprise Market (“GEM”) in Hong Kong.

Incorrect

There are generally two tiers of listing: (1) Main board listing: this refers to the main group of publicly listed companies with proven profitability records and size to justify being publicly listed. An example is the Main Board of the SEHK. (2) Second board listing: this generally caters for smaller companies that do not qualify for main board listing. An example is the Growth Enterprise Market (“GEM”) in Hong Kong.

Hint

Reference Chapter:1.1.1

-

Question 56 of 244

56. Question

1 pointsQID898:The duty of Securities and Futures Commission include:

I. Execute Securities and Futures Ordinance

II. Monitor the exchanges

III. Ensure the fairness of securities trading

IV. License professionals in securities and futures industryCorrect

The objectives of the SFC in relation to the securities and futures industry, as stated in the SFO, are to: (1) maintain and promote the fairness, efficiency, competitiveness, transparency and orderliness of the industry; (2) promote understanding by the public of financial services including the operation and functioning of the industry; (3) provide protection to the investing public; (4) minimize crime and misconduct in the industry; (5) reduce systemic risks in the industry; and (6) assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the industry.

Incorrect

The objectives of the SFC in relation to the securities and futures industry, as stated in the SFO, are to: (1) maintain and promote the fairness, efficiency, competitiveness, transparency and orderliness of the industry; (2) promote understanding by the public of financial services including the operation and functioning of the industry; (3) provide protection to the investing public; (4) minimize crime and misconduct in the industry; (5) reduce systemic risks in the industry; and (6) assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the industry.

Hint

Reference Chapter:1.1.

-

Question 57 of 244

57. Question

1 pointsQID716:If the price of stock index rises, what does it mean?

Correct

A stock market index represents the average price movement in a sample of shares traded on the stock market. If the price of stock index rises, the average price of stocks in the index rises for sure.

Incorrect

A stock market index represents the average price movement in a sample of shares traded on the stock market. If the price of stock index rises, the average price of stocks in the index rises for sure.

Hint

Reference Chapter:1.5.

-

Question 58 of 244

58. Question

1 pointsQID2317:The People’s Bank Of China adjusts the interest rate. Which of the following index will be affected the least?

Correct

Due to the linked exchange rate system, the interest rate on Hong Kong dollars is affected by the interest rate on US dollars rather than the interest rate on RMB.

Incorrect

Due to the linked exchange rate system, the interest rate on Hong Kong dollars is affected by the interest rate on US dollars rather than the interest rate on RMB.

Hint

Reference Chapter:1.4.2

-

Question 59 of 244

59. Question

1 pointsQID2318:Which of the central bank has the biggest impact on the interest rate of Hong Kong dollars?

Correct

Due to the linked exchange rate system, the interest rate on Hong Kong dollars is affected by the interest rate on US dollars rather than the interest rate on RMB.

Incorrect

Due to the linked exchange rate system, the interest rate on Hong Kong dollars is affected by the interest rate on US dollars rather than the interest rate on RMB.

Hint

Reference Chapter:1.4.2

-

Question 60 of 244

60. Question

1 pointsQID2321:Deflation is more likely to be caused by:

Correct

Government purchasing bonds increase the funds in the market which worsens inflation rather than deflation. An increase in the oil price will worsen the inflation rather than deflation. Foreign funds coming in will worsen the inflation rather than deflation. An appreciation of the currency leads to a decrease in the price of imported goods which may cause deflation.

Incorrect

Government purchasing bonds increase the funds in the market which worsens inflation rather than deflation. An increase in the oil price will worsen the inflation rather than deflation. Foreign funds coming in will worsen the inflation rather than deflation. An appreciation of the currency leads to a decrease in the price of imported goods which may cause deflation.

Hint

Reference Chapter:1.4.4

-

Question 61 of 244

61. Question

1 pointsQID2201:What’s the sum of the principal and interest for a deposit of $10000 compounded at 4% after two years?

Correct

Sum of principal and interest = principal*(1+annual interest)^term

Sum of principal and interest = 10000*(1+4%)^2

Sum of principal and interest = 10816Incorrect

Sum of principal and interest = principal*(1+annual interest)^term

Sum of principal and interest = 10000*(1+4%)^2

Sum of principal and interest = 10816Hint

Reference Chapter:1.4.1.1

-

Question 62 of 244

62. Question

1 pointsQID2202:What’s the sum of the interest for a deposit of $10000 compounded at 4% after two years?

Correct

interest = principal*(1+annual interest)^term – principal

interest = 10000*(1+4%)^2-10000

interest = 10816-10000

interest = 816Incorrect

interest = principal*(1+annual interest)^term – principal

interest = 10000*(1+4%)^2-10000

interest = 10816-10000

interest = 816Hint

Reference Chapter:1.4.1.1

-

Question 63 of 244

63. Question

1 pointsQID2203:What securities should you buy if there is a negative yield curve in the future?

Correct

A negative yield curve represents that short-term interest rate is higher than long-term interest rate. It is expected that the interest rate will drop and the government impose an expansionary monetary policy. Therefore, you should buy long-term bonds or bond portfolios with extended terms.

Incorrect

A negative yield curve represents that short-term interest rate is higher than long-term interest rate. It is expected that the interest rate will drop and the government impose an expansionary monetary policy. Therefore, you should buy long-term bonds or bond portfolios with extended terms.

Hint

Reference Chapter:1.4.1.3

-

Question 64 of 244

64. Question

1 pointsQID2204:What securities shouldn’t you buy if there is a positive yield curve and expected high inflation pressure?

Correct

A positive yield curve represents that the short-term interest rate is lower than long-term interest rate. It is expected that the interest rate will increase and the government imposes a contractionary monetary policy. Therefore, you should not buy long-term bonds or bond portfolios with extended terms.

Incorrect

A positive yield curve represents that the short-term interest rate is lower than long-term interest rate. It is expected that the interest rate will increase and the government imposes a contractionary monetary policy. Therefore, you should not buy long-term bonds or bond portfolios with extended terms.

Hint

Reference Chapter:1.4.1.3

-

Question 65 of 244

65. Question

1 pointsQID192:The main differences between Hang Seng China-Affiliated Corporations Index and Hang Seng China Enterprises Index is

Correct

China-Affiliated Corporations mean that the funds of the enterprises come from China but are registered in Hong Kong or overseas.

China Enterprises mean that the funds of the enterprises come from China and are registered in China at the same time.

Incorrect

China-Affiliated Corporations mean that the funds of the enterprises come from China but are registered in Hong Kong or overseas.

China Enterprises mean that the funds of the enterprises come from China and are registered in China at the same time.

Hint

Reference Chapter:1.5.2.3

-

Question 66 of 244

66. Question

1 pointsQID193:Which of the following description about H share is not correct?

Correct

The H Shares are shares issued by companies incorporated in the Mainland of China and which listed on the SEHK. Also, anyone can become H-share company’s major shareholder.

Incorrect

The H Shares are shares issued by companies incorporated in the Mainland of China and which listed on the SEHK. Also, anyone can become H-share company’s major shareholder.

Hint

Reference Chapter:1.5.2.3

-

Question 67 of 244

67. Question

1 pointsQID440:Both 5-year and 10-year bonds of the Exchange Fund had a 0.25% increase in the earnings yield. Which of the following is more likely to occur?

Correct

Bonds with longer term are more sensitive to interest rate than those with short term. It is because long-term bonds have longer maturity date and the attraction of each dividend drops when the interest rate rise. Therefore, the price decline effectively. Short-term bonds have short maturity date and there is less effect of the increasing interest rate on the each dividend.

Incorrect

Bonds with longer term are more sensitive to interest rate than those with short term. It is because long-term bonds have longer maturity date and the attraction of each dividend drops when the interest rate rise. Therefore, the price decline effectively. Short-term bonds have short maturity date and there is less effect of the increasing interest rate on the each dividend.

Hint

Reference Chapter:1.4.1.4

-

Question 68 of 244

68. Question

1 pointsQID441:The Dog Charity Fund is composed of 30% floating-rate bond and 70% fixed-rate bond. If interest rate decrease, the manager of Dog Charity Fund should:

Correct

The Dog Charity Fund should rebalance his portfolio by reducing the weighting of floating rate bonds and increasing that of fixed rate bonds. In this way, it will benefit from the increased returns resulting from higher interest rates when the interest rate decreases.

Incorrect

The Dog Charity Fund should rebalance his portfolio by reducing the weighting of floating rate bonds and increasing that of fixed rate bonds. In this way, it will benefit from the increased returns resulting from higher interest rates when the interest rate decreases.

Hint

Reference Chapter:1.4.1.4

-

Question 69 of 244

69. Question

1 pointsQID2463:Which of the following index can represent the US stock market?

Correct

S&P 500 can best represent the US stock market.

Incorrect

S&P 500 can best represent the US stock market.

Hint

Reference Chapter:1.5.4.3

-

Question 70 of 244

70. Question

1 pointsQID2472:In terms of compound interest, Ms. Tse deposited a 100,000 Cat Medical Fund into Brown Cat Bank. The interest is calculated every six months and the annual interest rate is 4%. After 3 years, how much interest can be recovered?

Correct

Principal x (1 + annual interest rate/how many times the interest is calculated annually) ^ (remaining period x how many times the interest is calculated annually)-principal = interest

100,000 x (1 + 0.04/2) ^ (3×2) -100,000

= $12,616.2419Incorrect

Principal x (1 + annual interest rate/how many times the interest is calculated annually) ^ (remaining period x how many times the interest is calculated annually)-principal = interest

100,000 x (1 + 0.04/2) ^ (3×2) -100,000

= $12,616.2419Hint

Reference Chapter:1.4.1.1(b)

-

Question 71 of 244

71. Question

1 pointsQID110:A phenomenon of a continuous increase in price in the past three years is called:

Correct

Inflation refers to the tendency for prices to continue to rise over a period of time, resulting in a decrease in the purchasing power of money – more money is needed to purchase the same value of goods and services.

Incorrect

Inflation refers to the tendency for prices to continue to rise over a period of time, resulting in a decrease in the purchasing power of money – more money is needed to purchase the same value of goods and services.

Hint

Reference Chapter:1.4.4

-

Question 72 of 244

72. Question

1 pointsQID172:Using simple interest, how many interest and principal will receive in three years assume a deposit of HKD$50,000 and an interest rate of 10%?

Correct

50000 x (1+0.1 x 3)

=65000$65000 interest and principal will receive in three years

Incorrect

50000 x (1+0.1 x 3)

=65000$65000 interest and principal will receive in three years

Hint

Reference Chapter:1.4.1.1

-

Question 73 of 244

73. Question

1 pointsQID173:Mr. Gao deposits HKD$15,000 in the British Construction Bank with an annual interest rate of 4.75%. Using simple interest rate, how many interest will Mr. Gao receive in a year?

Correct

15000 x 1 x 0.0475

=712.5Mr. Gao can receive $712.5 after one year.

Incorrect

15000 x 1 x 0.0475

=712.5Mr. Gao can receive $712.5 after one year.

Hint

Reference Chapter:1.4.1.1

-

Question 74 of 244

74. Question

1 pointsQID174:Mr. Gao deposits HKD$1,000,000 in the British Construction Bank with an annual interest rate of 5.25%. Using compound interest rate, how many interest will Mr. Gao receive in three year?

Correct

[1000000 x (1+5.25%) ^ 3] – 1000000 =165913.5Mr. GAO can receive $165913.5 interest after three years.

Incorrect

[1000000 x (1+5.25%) ^ 3] – 1000000 =165913.5Mr. GAO can receive $165913.5 interest after three years.

Hint

Reference Chapter:1.4.1.1

-

Question 75 of 244

75. Question

1 pointsQID175:Mr. Ma is a civil servant with lower income. His girlfriend Miss Fung wishes that Mr. Ma buys a property and marries her in a year. In order to reduce the burden on Mr. Ma’s property buying, Miss Fung is willing to give her own money to Mr. Ma to invest. Assume the property they like has a down payment of $500,000, the price increase of this property in a year is 0%, and the saving rate is 10%. How much should Miss Fung provide for Mr. Ma?

Correct

500000 / (1+10%) = 454545

Miss Fung should provide $454545 to Mr. Ma.

Incorrect

500000 / (1+10%) = 454545

Miss Fung should provide $454545 to Mr. Ma.

Hint

Reference Chapter:1.4.1.2

-

Question 76 of 244

76. Question

1 pointsQID176:Mr. Ma is a civil servant with lower income. His girlfriend Miss Fung wishes that Mr. Ma buys a property and marries her in a year. In order to reduce the burden on Mr. Ma’s property buying, Miss Fung is willing to give her own money to Mr. Ma to invest. Assume the property they like has a down payment of $500,000, the price increase of this property in a year is 10%, and the saving rate is 10%. How much should Miss Fung provide for Mr. Ma?

Correct

500000 (1+10%) / (1+10%) = 500000

Miss Fung should provide $500000 to Mr. Ma.

Incorrect

500000 (1+10%) / (1+10%) = 500000

Miss Fung should provide $500000 to Mr. Ma.

Hint

Reference Chapter:1.4.1.2

-

Question 77 of 244

77. Question

1 pointsQID177:Interest rate can be classified as:

Correct

Interest rate can be classified as nominal interest rate and official interest rate.

Incorrect

Interest rate can be classified as nominal interest rate and official interest rate.

Hint

Reference Chapter:1.4.1.2

-

Question 78 of 244

78. Question

1 pointsQID178:What is the main difference between nominal interest rate and real interest rate?

Correct

Nominal interest rates is the most common way of quoting annual interest rates, without considering the compounding effect. Real interest rates take into account changes in the purchasing power of money over time, i.e. inflation.

Incorrect

Nominal interest rates is the most common way of quoting annual interest rates, without considering the compounding effect. Real interest rates take into account changes in the purchasing power of money over time, i.e. inflation.

Hint

Reference Chapter:1.4.1.2

-

Question 79 of 244

79. Question

1 pointsQID179:In 2010~2015, nominal interest rate in Hong Kong was all positive. Why did real estate brokers usually state that negative interest rate is coming and encourage the public to buy properties?

Correct

Negative interest rate refers to the rate of inflation higher than nominal interest rates of the bank deposit, the price index (CPI) rapid rise resulting in the real bank deposit interest rate is actually negative.

Incorrect

Negative interest rate refers to the rate of inflation higher than nominal interest rates of the bank deposit, the price index (CPI) rapid rise resulting in the real bank deposit interest rate is actually negative.

Hint

Reference Chapter:1.4.1.2

-

Question 80 of 244

80. Question

1 pointsQID180:If economists expect an economic deflation, which of the following yield curves is more likely to happen?

Correct

A negative yield curve is consistent with expectations of falling inflation (or disinflation) over the longer term.

Incorrect

A negative yield curve is consistent with expectations of falling inflation (or disinflation) over the longer term.

Hint

Reference Chapter:1.4.1.3

-

Question 81 of 244

81. Question

1 pointsQID181:If economists expect an economic hyper-inflation, which of the following yield curve is more likely to happen?

Correct

A positive yield curve is consistent with expectations of rising inflation over the longer term.

Incorrect

A positive yield curve is consistent with expectations of rising inflation over the longer term.

Hint

Reference Chapter:1.4.1.3

-

Question 82 of 244

82. Question

1 pointsQID943:If long-term rate is lower than short-term rate, interest rate in the future may:

Correct

In the situation where short-term interest rates are higher than long-term interest rates, there are expectations of falling interest rates in the future.

Incorrect

In the situation where short-term interest rates are higher than long-term interest rates, there are expectations of falling interest rates in the future.

Hint

Reference Chapter:1.4.1.3

-

Question 83 of 244

83. Question

1 pointsQID944:Why does inflation have a bad effect on the stock price?

Correct

High inflation leads to an increase in interest rate and the borrowing cost of companies increases. Therefore, the profit of the companies is affected by the increasing cost.

Incorrect

High inflation leads to an increase in interest rate and the borrowing cost of companies increases. Therefore, the profit of the companies is affected by the increasing cost.

Hint

Reference Chapter:1.4.4

-

Question 84 of 244

84. Question

1 pointsQID945:Assume a country has a nominal interest rate of 7% and an inflation of 3%. What is the real interest rate?

Correct

Nominal interest rate = Real Interest rate + Inflation rate

Real Interest rate = 7% -3% = 4%

The real interest rate is 4%.

Incorrect

Nominal interest rate = Real Interest rate + Inflation rate

Real Interest rate = 7% -3% = 4%

The real interest rate is 4%.

Hint

Reference Chapter:1.4.1.1

-

Question 85 of 244

85. Question

1 pointsQID946:The fund manager of Kaohsiung fund, Mr. Yin, manages a bond portfolio which includes mainly US country bonds and corporate bonds. Mr. Yin expects the long-term rate will rise whereas short-term rate will be unchanged. Mr. Yin is more likely to take which of the following investment strategies to make the highest return?

Correct

The yields of long-term bond increase when the long-term rate rises. The higher the yield, the lower the price. Thus, the price of long-term bond drops when the long-term rate rises.

Incorrect

The yields of long-term bond increase when the long-term rate rises. The higher the yield, the lower the price. Thus, the price of long-term bond drops when the long-term rate rises.

Hint

Reference Chapter:1.4.1.3

-

Question 86 of 244

86. Question

1 pointsQID948:How can the central bank intervene if the inflation worsens?

Correct

When there are overheating in the economy and inflation, it is likely that the government would institute a contractionary monetary policy by increasing short-term interest rates and discouraging spending.

Incorrect

When there are overheating in the economy and inflation, it is likely that the government would institute a contractionary monetary policy by increasing short-term interest rates and discouraging spending.

Hint

Reference Chapter:1.4.4

-

Question 87 of 244

87. Question

1 pointsQID950:Which of the following events is not the political factor which can affect the stock market?

Correct

The introduction of the Government Bond cannot be classified as political factor.

Incorrect

The introduction of the Government Bond cannot be classified as political factor.

Hint

Reference Chapter:1.4.6

-

Question 88 of 244

88. Question

1 pointsQID917:Linked exchange rate regime links:

Correct

Hong Kong has adopted a linked exchange rate regime, which is a variant of the fixed rate regime where the Hong Kong dollar is linked to the US dollar.

Incorrect

Hong Kong has adopted a linked exchange rate regime, which is a variant of the fixed rate regime where the Hong Kong dollar is linked to the US dollar.

Hint

Reference Chapter:1.3.1

-

Question 89 of 244

89. Question

1 pointsQID918:What indicator of the US has the most direct impact on the stock market of Hong Kong?

Correct

Hong Kong has adopted a linked exchange rate regime, which is a variant of the fixed rate regime where the Hong Kong dollar is linked to the US dollar. Thus, the US interest rate affect HK interest rate and the attraction of HK stock market to foreigner directly.

Incorrect

Hong Kong has adopted a linked exchange rate regime, which is a variant of the fixed rate regime where the Hong Kong dollar is linked to the US dollar. Thus, the US interest rate affect HK interest rate and the attraction of HK stock market to foreigner directly.

Hint

Reference Chapter:1.3.

-

Question 90 of 244

90. Question

1 pointsQID919:If the US stock market increases, Hong Kong stock market would most likely:

Correct

The HKD is linked to the USD through the Currency Board system. Any change in the US interest rates (and therefore the value of the USD) will influence interest rates in Hong Kong and the value of the HKD against other currencies. Thus, the performance of US and HK stock markets have positive relationship.

Incorrect

The HKD is linked to the USD through the Currency Board system. Any change in the US interest rates (and therefore the value of the USD) will influence interest rates in Hong Kong and the value of the HKD against other currencies. Thus, the performance of US and HK stock markets have positive relationship.

Hint

Reference Chapter:1.3.1

-

Question 91 of 244

91. Question

1 pointsQID920:Which of the following statements is incorrect regarding the stock market in Hong Kong?

Correct

Any changes in the US economy will therefore be reflected in its levels of trade and investment, which in turn affects Hong Kong’s levels of trade and investment and the value of the HKD.

Incorrect

Any changes in the US economy will therefore be reflected in its levels of trade and investment, which in turn affects Hong Kong’s levels of trade and investment and the value of the HKD.

Hint

Reference Chapter:1.3.1

-

Question 92 of 244

92. Question

1 pointsQID922:Which of the following is not the reason why investors use index?

Correct

Index and futures are made with reference to two different benchmarks. Thus, it cannot be hedged by using futures.

Incorrect

Index and futures are made with reference to two different benchmarks. Thus, it cannot be hedged by using futures.

Hint

Reference Chapter:1.5.

-

Question 93 of 244

93. Question

1 pointsQID908:Which of the following stocks are traded in the Shanghai Stock Exchange(SSE)?

I. A share

II. B share

III. Red chip stocks

IV. H shareCorrect

A share and B share are traded in the Shanghai Stock Exchange(SSE).

Incorrect

A share and B share are traded in the Shanghai Stock Exchange(SSE).

Hint

Reference Chapter:1.2.3

-

Question 94 of 244

94. Question

1 pointsQID909:Which of the following stocks are traded in the Shenzhen Stock Exchange(SZSE)?

I. A share

II. B share

III. Red chip stocks

IV. H shareCorrect

A share and B share are traded in the Shenzhen Stock Exchange(SZSE).

Incorrect

A share and B share are traded in the Shenzhen Stock Exchange(SZSE).

Hint

Reference Chapter:1.2.3.2

-

Question 95 of 244

95. Question

1 pointsQID910:Chinese A share is traded at which of the following exchanges?

I. Shanghai Stock Exchange(SSE)

II. Shenzhen Stock Exchange(SZSE)

II. Stock Exchange of Hong Kong Limited(SEHK)

IV. Shanghai-Hong Kong Stock Connect Stock ExchangesCorrect

A share and B share are traded in the Shenzhen Stock Exchange(SZSE) and the Shanghai Stock Exchange(SSE).

Incorrect

A share and B share are traded in the Shenzhen Stock Exchange(SZSE) and the Shanghai Stock Exchange(SSE).

Hint

Reference Chapter:1.2.3.1

-

Question 96 of 244

96. Question

1 pointsQID911:Shanghai-Hong Kong Stock Connect allows:

Correct

Shanghai-Hong Kong Stock is open to all Hong Kong and foreign investors, including institutions and individuals. Shanghai-Hong Kong Stock can be traded include the 180 index, the SSE 380 index constituent stocks, and the Shanghai Stock Exchange listed A + H shares of the company stock.

Incorrect

Shanghai-Hong Kong Stock is open to all Hong Kong and foreign investors, including institutions and individuals. Shanghai-Hong Kong Stock can be traded include the 180 index, the SSE 380 index constituent stocks, and the Shanghai Stock Exchange listed A + H shares of the company stock.

Hint

Reference Chapter:1.2.3.1

-

Question 97 of 244

97. Question

1 pointsQID912:Which of the following stock markets affects Hong Kong the most?

Correct

The US economy has a significant impact on Hong Kong’s economy because it is a major trading and investment partner, and also because the HKD is linked to the USD and hence the strength or weakness of the USD will affect the trade relations of Hong Kong with other trading partners.

Incorrect

The US economy has a significant impact on Hong Kong’s economy because it is a major trading and investment partner, and also because the HKD is linked to the USD and hence the strength or weakness of the USD will affect the trade relations of Hong Kong with other trading partners.

Hint

Reference Chapter:1.3.1

-

Question 98 of 244

98. Question

1 pointsQID924:Generally the relation between interest rate and the stock price is:

Correct

A decrease in interest rates will result in lower rates from lending institutions, and borrowers – for example, households or businesses – therefore have lower loan interest to pay. This results in borrowers effectively having higher disposable incomes, which may increase consumer and business investment, which in turn leads to stock price increases.

An increase in interest rates by institutions will increase borrowers’ loan interest and therefore effectively lower their disposable incomes. This results in investment in the economy, which could lead to capital market slowdown.

Incorrect

A decrease in interest rates will result in lower rates from lending institutions, and borrowers – for example, households or businesses – therefore have lower loan interest to pay. This results in borrowers effectively having higher disposable incomes, which may increase consumer and business investment, which in turn leads to stock price increases.

An increase in interest rates by institutions will increase borrowers’ loan interest and therefore effectively lower their disposable incomes. This results in investment in the economy, which could lead to capital market slowdown.

Hint

Reference Chapter:1.4.1

-

Question 99 of 244

99. Question

1 pointsQID925:Interest rate reflects:

Correct

A change in short-term interest rates set by the central bank results in authorized banks adjusting interest rates accordingly. Thus, interest rate reflects borrowing cost.

Incorrect

A change in short-term interest rates set by the central bank results in authorized banks adjusting interest rates accordingly. Thus, interest rate reflects borrowing cost.

Hint

Reference Chapter:1.4.1

-

Question 100 of 244

100. Question

1 pointsQID926:Which of the following is the most accurate statement regarding the impact of an interest rate hike on the stock price?

Correct

When the interest rates rises, the borrowing cost of borrower increases correspondingly. This results in borrowers effectively having lower disposable incomes, the profit of the corporations decreases and the cost of expanding the business of corporations will increase.

Incorrect

When the interest rates rises, the borrowing cost of borrower increases correspondingly. This results in borrowers effectively having lower disposable incomes, the profit of the corporations decreases and the cost of expanding the business of corporations will increase.

Hint

Reference Chapter:1.4.1

-

Question 101 of 244

101. Question

1 pointsQID927:Which of the following statements is correct regarding the impact of stocks on interest rate.

Correct

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities.

The relation between interest rate and the stock price is negatively correlated and thus the unexpected increase in interest rate has a bad impact on the stock price.Incorrect

Often news is pre-empted in the market (i.e. market expectations) and as a result the expected impact has already been factored into the prices of securities.

The relation between interest rate and the stock price is negatively correlated and thus the unexpected increase in interest rate has a bad impact on the stock price.Hint

Reference Chapter:1.4.1

-

Question 102 of 244

102. Question

1 pointsQID913:Why does American stock market affect Hong Kong the most?

Correct