English IIQE Paper 1 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

IIQEP1ET1

Quiz-summary

0 of 262 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

Information

IIQEP1ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 262 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic_1 0%

-

IIQEP1ET1

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

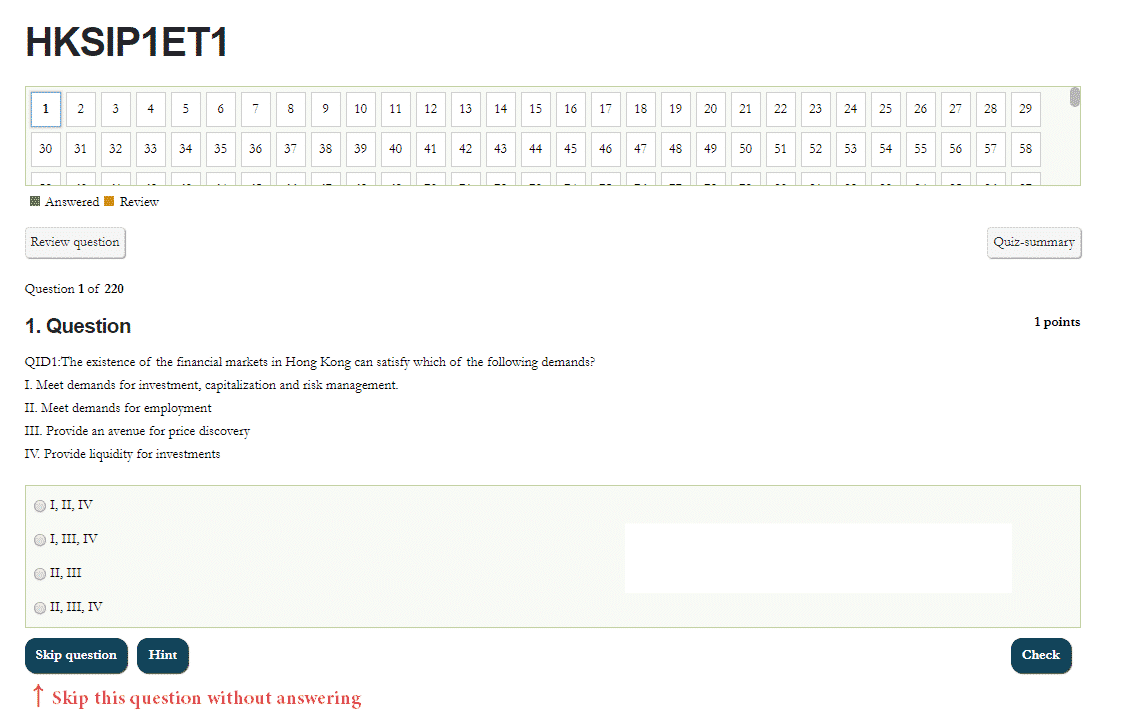

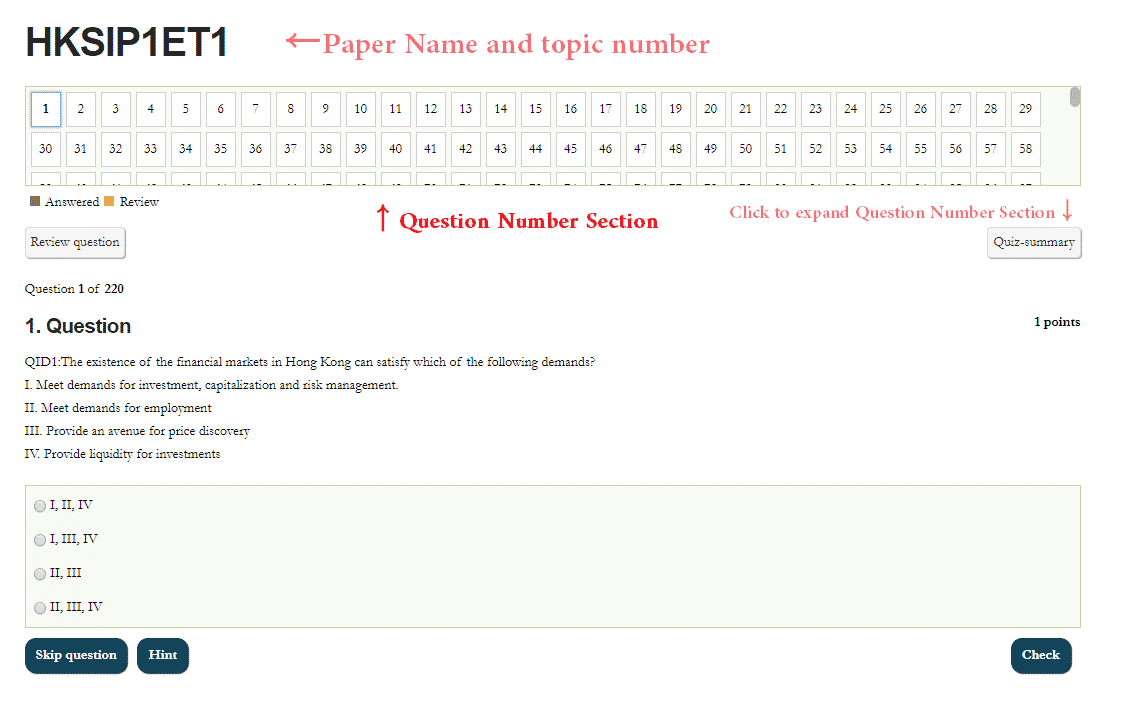

- Answered

- Review

-

Question 1 of 262

1. Question

1 pointsQID57:Which of the following are more likely to be insurable risks?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Hint

References:1.1.1

-

Question 2 of 262

2. Question

1 pointsQID38:The potential loss that risk presents may be:

Correct

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Incorrect

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Hint

References:1.1.1

-

Question 3 of 262

3. Question

1 pointsQID40:Risk means:

Correct

The definition of risk is “uncertainty concerning a potential loss”. The answer is B.

Incorrect

The definition of risk is “uncertainty concerning a potential loss”. The answer is B.

Hint

References:1.1.1

-

Question 4 of 262

4. Question

1 pointsQID41:Which of the following is likely to be commercially uninsurable?

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 5 of 262

5. Question

1 pointsQID42:Which of the following is likely to be commercially insurable?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Hint

References:1.1.1

-

Question 6 of 262

6. Question

1 pointsQID43:Some risks will make people feel grief and sorrow, but won’t bring any financial loss. The risks are:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 7 of 262

7. Question

1 pointsQID45:Emotional loss:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 8 of 262

8. Question

1 pointsQID46:In many cases, when insurers talk about “risk management”, they mean which of the following?

Correct

When insurers talk about “risk management”, they could well be referring to ways and means of reducing or improving the insured loss potential of the “risks” they are insuring, or being invited to insure. The answer is A.

Incorrect

When insurers talk about “risk management”, they could well be referring to ways and means of reducing or improving the insured loss potential of the “risks” they are insuring, or being invited to insure. The answer is A.

Hint

References:1.1.1

-

Question 9 of 262

9. Question

1 pointsQID47:What is the connection between “insurance” and “risk”?

Correct

B)The insured may have chance to bear responsibility, like deductible;

C) There are other methods to deal with risks, such as risk avoidance;

D) Emotional risks are likely to be commercially uninsurable.The answer is A.

Incorrect

B)The insured may have chance to bear responsibility, like deductible;

C) There are other methods to deal with risks, such as risk avoidance;

D) Emotional risks are likely to be commercially uninsurable.The answer is A.

Hint

References:1.1.1

-

Question 10 of 262

10. Question

1 pointsQID48:For an insurance policy purchased on an “all risks” basis, the expected definition of “peril” is:

Correct

The peril means the cause of loss. The answer is A.

Incorrect

The peril means the cause of loss. The answer is A.

Hint

References:1.1.1

-

Question 11 of 262

11. Question

1 pointsQID49:Which of the following is the definition of risk?

Correct

The definition of risk is the “uncertainty concerning a potential loss”. The answer is D.

Incorrect

The definition of risk is the “uncertainty concerning a potential loss”. The answer is D.

Hint

References:1.1.1

-

Question 12 of 262

12. Question

1 pointsQID50:From the insurance company’s point of view, which of the following is/are insurable loss(es)?

i. Financial loss

ii. Physical loss

iii. Emotional loss

iv. Specific lossCorrect

Financial and physical losses are likely to be (commercially) insurable risks. The answer is C.

Incorrect

Financial and physical losses are likely to be (commercially) insurable risks. The answer is C.

Hint

References:1.1.1

-

Question 13 of 262

13. Question

1 pointsQID51:When an insurance policy insures on an “all risks” basis, the “risks” means:

Correct

The peril (risk) means the cause of loss. The answer is A.

Incorrect

The peril (risk) means the cause of loss. The answer is A.

Hint

References:1.1.1

-

Question 14 of 262

14. Question

1 pointsQID52:Emotional loss caused by some accidents:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 15 of 262

15. Question

1 pointsQID37:Which of the following statements relates to the meaning of the word “risk”?

i. The peril insured

ii. The property at risk that insurers are considering insuring

iii. The person at risk that insurers are insuring

iv. Uncertainty concerning a potential lossCorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insured

4. The property at risk that insurers are considering insuringThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insured

4. The property at risk that insurers are considering insuringThe answer is D.

Hint

References:1.1.1

-

Question 16 of 262

16. Question

1 pointsQID66:In different situations, a word can be used to describe the potential of loss, an insured peril, an insured person or property. This word is:

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Hint

References:1.1.1

-

Question 17 of 262

17. Question

1 pointsQID1:Potential sadness and feelings of grief but no financial loss. In this case, what kind of loss could it be?

Correct

The potential loss that risk presents may be:

1. Financial: i.e. measurable in monetary terms;

2. Physical: death or personal injury;

3. Emotional: feelings of grief and sorrow.The answer is C.

Incorrect

The potential loss that risk presents may be:

1. Financial: i.e. measurable in monetary terms;

2. Physical: death or personal injury;

3. Emotional: feelings of grief and sorrow.The answer is C.

Hint

References:1.1.1

-

Question 18 of 262

18. Question

1 pointsQID72:Which of the following is/are more likely to be the meaning(s) of insurers using the word “risk”?

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Hint

References:1.1.1

-

Question 19 of 262

19. Question

1 pointsQID71:If a policy is bought on the basis of “all risks”, the predetermined meaning of “peril” in this case is:

Correct

The peril insured means the cause of loss. The answer is A.

Incorrect

The peril insured means the cause of loss. The answer is A.

Hint

References:1.1.1

-

Question 20 of 262

20. Question

1 pointsQID70:If a policy is bought on the basis of “all risks”, the predetermined meaning of “peril” in this case is:

Correct

The peril insured means the cause of loss. The answer is B.

Incorrect

The peril insured means the cause of loss. The answer is B.

Hint

References:1.1.1

-

Question 21 of 262

21. Question

1 pointsQID69:The word “risk” is sometimes interpreted by insurers as:

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Hint

References:1.1.1

-

Question 22 of 262

22. Question

1 pointsQID54:The word “risk”:

Correct

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Incorrect

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Hint

References:1.1.1

-

Question 23 of 262

23. Question

1 pointsQID67:Insurers may use the word “risk” with other meanings, including:

i. Descripting the property or policyholder that they are insuring

ii. Indicating the peril insured or cause of loss

iii. Management of investment and other speculative risks

iv. Make an assessment of any losses and gains that will be facedCorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is A.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is A.

Hint

References:1.1.1

-

Question 24 of 262

24. Question

1 pointsQID56:Which of the following risks may not be insurable?

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 25 of 262

25. Question

1 pointsQID63:There is a type of risk that makes us sad but does not involve a financial loss. Such risks are:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 26 of 262

26. Question

1 pointsQID62:”Risk”:

Correct

The definition of risk is “uncertainty concerning a potential loss”. The answer is D.

Incorrect

The definition of risk is “uncertainty concerning a potential loss”. The answer is D.

Hint

References:1.1.1

-

Question 27 of 262

27. Question

1 pointsQID61:Which of the following risks is more likely to be insurable?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is B.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is B.

Hint

References:1.1.1

-

Question 28 of 262

28. Question

1 pointsQID60:The potential loss that risk presents may be:

Correct

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Incorrect

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Hint

References:1.1.1

-

Question 29 of 262

29. Question

1 pointsQID59:The definition of “risk” is:

Correct

The definition of risk is “uncertainty concerning a potential loss”. The answer is D.

Incorrect

The definition of risk is “uncertainty concerning a potential loss”. The answer is D.

Hint

References:1.1.1

-

Question 30 of 262

30. Question

1 pointsQID53:The definition of “risk” in the insurer’s view is:

Correct

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Incorrect

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Hint

References:1.1.1

-

Question 31 of 262

31. Question

1 pointsQID68:Insurers sometimes use the word “risk” to describe:

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Hint

References:1.1.1

-

Question 32 of 262

32. Question

1 pointsQID10:Risk is defined as:

Correct

Risk is defined as the uncertainty concerning a potential loss. The answer is D.

Incorrect

Risk is defined as the uncertainty concerning a potential loss. The answer is D.

Hint

References:1.1.1

-

Question 33 of 262

33. Question

1 pointsQID19:Which of the following statements about the “concept of risk” is true?

i. All risks are commercially insurable

ii. Emotional risks are not normally insurable

iii. Not all risks are commercially insurable

iv. None of the aboveCorrect

Emotional risks are likely to be commercially uninsurable risks.

Speculative risks are not normally insurable.The answer is C.

Incorrect

Emotional risks are likely to be commercially uninsurable risks.

Speculative risks are not normally insurable.The answer is C.

Hint

References:1.1.1

-

Question 34 of 262

34. Question

1 pointsQID18:The potential loss that risk presents may be:

Correct

The potential loss that risk presents may be:

1. Financial

2. Physical

3. Emotional

The answer is D.Incorrect

The potential loss that risk presents may be:

1. Financial

2. Physical

3. Emotional

The answer is D.Hint

References:1.1.1

-

Question 35 of 262

35. Question

1 pointsQID17:Insurance covers both financial and physical risks. If a person is very sorrow because his friend is ill, this is:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is A.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is A.

Hint

References:1.1.1

-

Question 36 of 262

36. Question

1 pointsQID16:Which of the following is most relevant to “uncertainty concerning a potential loss”?

Correct

“Risk” contains a suggestion of loss or danger. We may therefore define it as “uncertainty concerning a potential loss”. The answer is A.

Incorrect

“Risk” contains a suggestion of loss or danger. We may therefore define it as “uncertainty concerning a potential loss”. The answer is A.

Hint

References:1.1.1

-

Question 37 of 262

37. Question

1 pointsQID14:Which of the following definitions of risk is incorrect?

Correct

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable.

Tools or measures of risk handling include: risk avoidance, loss prevention, loss reduction, risk transfer, risk financing.

The answer is D.

Incorrect

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable.

Tools or measures of risk handling include: risk avoidance, loss prevention, loss reduction, risk transfer, risk financing.

The answer is D.

Hint

References:1.1.1

-

Question 38 of 262

38. Question

1 pointsQID20:Which of the following is more likely to be commercially insurable?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Hint

References:1.1.1

-

Question 39 of 262

39. Question

1 pointsQID11:Which of the following may be insurers’ definition of “risk”?

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insured

The answer is D.Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insured

The answer is D.Hint

References:1.1.1

-

Question 40 of 262

40. Question

1 pointsQID4:How can risk be described?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Hint

References:1.1.1

-

Question 41 of 262

41. Question

1 pointsQID7:Which of the following is unlikely to be compensated?

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 42 of 262

42. Question

1 pointsQID6:Which of the following risks is most likely to be insurable?

Correct

Financial risks are likely to be commercially insurable risks. The answer is C.

Incorrect

Financial risks are likely to be commercially insurable risks. The answer is C.

Hint

References:1.1.1

-

Question 43 of 262

43. Question

1 pointsQID5:Mr. Liang is very sorrow because of his friend’s death. What is the risk he faced?

Correct

Emotional risks are feelings of grief and sorrow. The answer is C.

Incorrect

Emotional risks are feelings of grief and sorrow. The answer is C.

Hint

References:1.1.1

-

Question 44 of 262

44. Question

1 pointsQID36:Some risks will make people feel grief and sorrow, but won’t bring any financial loss. The risks are:

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 45 of 262

45. Question

1 pointsQID3:Which of the following concepts is true?

Correct

Risk is defined as the uncertainty concerning a potential loss. The answer is C.

Incorrect

Risk is defined as the uncertainty concerning a potential loss. The answer is C.

Hint

References:1.1.1

-

Question 46 of 262

46. Question

1 pointsQID55:When the word “risk” is used, the insurer may interpret it as which of the following?

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)The answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)The answer is D.

Hint

References:1.1.1

-

Question 47 of 262

47. Question

1 pointsQID13:Which of the following statements relates to the meaning of the word “risk”?

i. The peril insured

ii. The property at risk that they are considering insuring

iii. The person at risk that they are insuring

iv. Uncertainty concerning a potential lossCorrect

Insurance companies may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insured

The answer is D.Incorrect

Insurance companies may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insured

The answer is D.Hint

References:1.1.1

-

Question 48 of 262

48. Question

1 pointsQID32:What does the “uncertainty concerning a potential loss” mean?

Correct

The definition of risk is “uncertainty concerning a potential loss”. The answer is B.

Incorrect

The definition of risk is “uncertainty concerning a potential loss”. The answer is B.

Hint

References:1.1.1

-

Question 49 of 262

49. Question

1 pointsQID2:Which of the following statements about “insurance and risk” is true?

Correct

Emotional risks are likely to be commercially uninsurable risks.

Speculative risks are also uninsurable risks.

Tools or measures of risk handling include: risk avoidance, loss prevention, etc.The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks.

Speculative risks are also uninsurable risks.

Tools or measures of risk handling include: risk avoidance, loss prevention, etc.The answer is D.

Hint

References:1.1.1

-

Question 50 of 262

50. Question

1 pointsQID33:Which of the following statements about the risk is true?

i. All risks are commercially insurable

ii. Not all risks are commercially insurable

iii. The only way to deal with risk is insurance

iv. Insurers may use the word “risk” with other meaningsCorrect

Not all risks are commercially insurable. There are several ways to manage risk, including: risk avoidance, loss prevention, loss reduction. The answer is B.

Incorrect

Not all risks are commercially insurable. There are several ways to manage risk, including: risk avoidance, loss prevention, loss reduction. The answer is B.

Hint

References:1.1.1

-

Question 51 of 262

51. Question

1 pointsQID31:Which of the following is more likely to be insurable for the potential loss caused by risks?

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is A.

Hint

References:1.1.1

-

Question 52 of 262

52. Question

1 pointsQID30:In insurance, the cause of insured loss or insured property is called:

Correct

In insurance, the cause of insured loss or insured property is called Risk.

Incorrect

In insurance, the cause of insured loss or insured property is called Risk.

Hint

References:1.1.1

-

Question 53 of 262

53. Question

1 pointsQID29:The “risk” is:

Correct

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Incorrect

Financial risks and physical risks are likely to be commercially insurable risks. The answer is C.

Hint

References:1.1.1

-

Question 54 of 262

54. Question

1 pointsQID28:Which of the following statements about risk is true?

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)The answer is C.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)The answer is C.

Hint

References:1.1.1

-

Question 55 of 262

55. Question

1 pointsQID27:Which of the following risks is likely to be commercially uninsurable?

Correct

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Incorrect

Emotional risks are likely to be commercially uninsurable risks. The answer is D.

Hint

References:1.1.1

-

Question 56 of 262

56. Question

1 pointsQID25:Risk means:

Correct

The definition of risk is the “uncertainty concerning a potential loss”. The answer is C.

Incorrect

The definition of risk is the “uncertainty concerning a potential loss”. The answer is C.

Hint

References:1.1.1

-

Question 57 of 262

57. Question

1 pointsQID24:The potential loss that risk presents may be:

Correct

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Incorrect

The potential loss that risk presents may be:

1. Financial

2. Physical

3. EmotionalThe answer is D.

Hint

References:1.1.1

-

Question 58 of 262

58. Question

1 pointsQID23:Which of the following is/are true of the definition of “risk”?

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss) insuredThe answer is D.

Hint

References:1.1.1

-

Question 59 of 262

59. Question

1 pointsQID22:Insurers use the word “risk” to mean:

Correct

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Incorrect

Insurers may use the word “risk” with other meanings, including:

1. uncertainty concerning a potential loss

2. the property or person at risk that they are insuring or considering insuring

3. the peril (i.e. cause of loss)insuredThe answer is D.

Hint

References:1.1.1

-

Question 60 of 262

60. Question

1 pointsQID21:Which of the following risks is unlikely to be insurable?

Correct

Emotional risks are likely to be uninsurable risks. The answer is B.

Incorrect

Emotional risks are likely to be uninsurable risks. The answer is B.

Hint

References:1.1.1

-

Question 61 of 262

61. Question

1 pointsQID26:Risk means:

Correct

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Incorrect

The definition of risk is the “uncertainty concerning a potential loss”. The answer is B.

Hint

References:1.1.1

-

Question 62 of 262

62. Question

1 pointsQID34:A surveyor employed by an insurer requires to check the details of a particular “risk” when assessing the risk. “Risk” means:

Correct

The risk assessed by the surveyor must be insurable. Option A, B and C are commercially insurable risks. The answer is D.

Incorrect

The risk assessed by the surveyor must be insurable. Option A, B and C are commercially insurable risks. The answer is D.

Hint

References:1.1.1

-

Question 63 of 262

63. Question

1 pointsQID110:Which of the following should be described as a fundamental risk?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Hint

References:1.1.2

-

Question 64 of 262

64. Question

1 pointsQID120:Some risks are very likely to be uninsurable. Which of the following is/are this type of risks?

Correct

The majority of the risks which are insured by commercial insurers are pure and particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Incorrect

The majority of the risks which are insured by commercial insurers are pure and particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Hint

References:1.1.2

-

Question 65 of 262

65. Question

1 pointsQID119:When a risk becomes a fact, it affects a relatively small scope. This risk is called a:

Correct

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is C.

Incorrect

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is C.

Hint

References:1.1.2

-

Question 66 of 262

66. Question

1 pointsQID118:The pure risk means:

Correct

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 67 of 262

67. Question

1 pointsQID117:Which of the following is a “pure risk”?

Correct

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 68 of 262

68. Question

1 pointsQID116:We may classify risk under two broad

headings, namely, potential financial results and:Correct

We may classify risk under two broad headings (each having two categories) according to:

(a) its potential financial results

(b) its cause and effectThe answer is B.

Incorrect

We may classify risk under two broad headings (each having two categories) according to:

(a) its potential financial results

(b) its cause and effectThe answer is B.

Hint

References:1.1.2

-

Question 69 of 262

69. Question

1 pointsQID107:According to the effect, risks can be classified as fundamental risks and:

Correct

According to the effect, risks can be considered as being either particular or fundamental. The answer is D.

Incorrect

According to the effect, risks can be considered as being either particular or fundamental. The answer is D.

Hint

References:1.1.2

-

Question 70 of 262

70. Question

1 pointsQID115:The risk which offers the potential of gain or loss is a:

Correct

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is A.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is A.

Hint

References:1.1.2

-

Question 71 of 262

71. Question

1 pointsQID114:If classified from the effect of risk, risks can be divided into:

Correct

If classified from the effect of risk, risks can be divided into fundamental risks and particular risks. The answer is C.

Incorrect

If classified from the effect of risk, risks can be divided into fundamental risks and particular risks. The answer is C.

Hint

References:1.1.2

-

Question 72 of 262

72. Question

1 pointsQID113:Which of the following is most suitable to describe the particular risk?

Correct

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is B.

Incorrect

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is B.

Hint

References:1.1.2

-

Question 73 of 262

73. Question

1 pointsQID111:Which of the following can be described as a “speculative risk”?

i. Fluctuations in the hang Seng index

ii. Casino loss caused by fire

iii. A horse racing result at Happy Valley Racecourse

iv. Research on the effectiveness of antibioticsCorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities.

(ii) is a pure risk, which offers the potential of loss only.

The answer is C.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities.

(ii) is a pure risk, which offers the potential of loss only.

The answer is C.

Hint

References:1.1.2

-

Question 74 of 262

74. Question

1 pointsQID109:Exclusions in most property insurance refer to which of the following risks?

Correct

Most property insurance exclusions are “standard” exclusions (war, nuclear accident, etc.), which are fundamental risks. The answer is C.

Incorrect

Most property insurance exclusions are “standard” exclusions (war, nuclear accident, etc.), which are fundamental risks. The answer is C.

Hint

References:1.1.2

-

Question 75 of 262

75. Question

1 pointsQID121:Which of the following can be described as a “speculative risk”?

i. Fluctuations in the hang Seng index

ii. The production of a new model of car

iii. Casino loss caused by fire

iv. The result of a football matchCorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is C.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is C.

Hint

References:1.1.2

-

Question 76 of 262

76. Question

1 pointsQID135:When a risk becomes a fact, it will offer the potential of loss or gain, which can be called a:

Correct

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is B.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is B.

Hint

References:1.1.2

-

Question 77 of 262

77. Question

1 pointsQID108:Which of the following correctly describes the “fundamental risk”?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters which are problems for society or mankind rather than just the “particular” individuals

involved.The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially.

The answer is D.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters which are problems for society or mankind rather than just the “particular” individuals

involved.The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially.

The answer is D.

Hint

References:1.1.2

-

Question 78 of 262

78. Question

1 pointsQID112:Which of the following is a “pure risk”?

i. Plane crash

ii. Launch new insurance products

iii. The building destroyed accidentally by fire

iv. A valuable painting was stolen from the museumCorrect

Pure risks offer the potential of loss only (no gain). The answer is B.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is B.

Hint

References:1.1.2

-

Question 79 of 262

79. Question

1 pointsQID73:This risk affects large numbers of people and is a widespread disaster, which refers to:

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Hint

References:1.1.2

-

Question 80 of 262

80. Question

1 pointsQID106:In terms of degree of insurability, particular risks:

Correct

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is D.

Incorrect

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is D.

Hint

References:1.1.2

-

Question 81 of 262

81. Question

1 pointsQID142:Which of the following is more likely to be a “speculative risk”?

i. Fluctuations in the hang Seng index

ii. Develop a new sports car

iii. Property was destroyed in an accidental fire

iv. Bet on the outcome of a football matchCorrect

Speculative risks offer the potential of gain or loss. The answer is D.

Incorrect

Speculative risks offer the potential of gain or loss. The answer is D.

Hint

References:1.1.2

-

Question 82 of 262

82. Question

1 pointsQID140:Which of the following is a correct statement of speculative risks?

Correct

Speculative risks offer the potential of gain or loss. The answer is D.

Incorrect

Speculative risks offer the potential of gain or loss. The answer is D.

Hint

References:1.1.2

-

Question 83 of 262

83. Question

1 pointsQID139:Which of the following is true to describe the “pure risk”?

Correct

Pure risks offer the potential of loss only (no gain). The answer is B.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is B.

Hint

References:1.1.2

-

Question 84 of 262

84. Question

1 pointsQID138:Which of the following is more likely to be a speculative risk?

Correct

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is A.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is A.

Hint

References:1.1.2

-

Question 85 of 262

85. Question

1 pointsQID133:Which of the following should be described as a fundamental risk?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Hint

References:1.1.2

-

Question 86 of 262

86. Question

1 pointsQID136:Which of the following is more likely to be a “speculative risk”?

i. Fluctuations in the prime rate

ii. Research and develop a new model sports car

iii. Financial loss of casino caused by fire

iv. Gambling on a race at Sha Tin RacecourseCorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Hint

References:1.1.2

-

Question 87 of 262

87. Question

1 pointsQID122:Which of the following can be described as a “speculative risk”?

i. Fluctuations in the hang Seng index

ii. Development and research of avian influenza vaccine

iii. Casino loss caused by fire

iv. A horse racing result at Sha Tin RacecourseCorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is B.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is B.

Hint

References:1.1.2

-

Question 88 of 262

88. Question

1 pointsQID134:When a risk becomes a fact, losses will occur. According to its effect, risks may be classified as:

Correct

When a risk becomes a fact, losses will occur. According to its effect, risks may be classified as particular risks and fundamental risks. The answer is C.

Incorrect

When a risk becomes a fact, losses will occur. According to its effect, risks may be classified as particular risks and fundamental risks. The answer is C.

Hint

References:1.1.2

-

Question 89 of 262

89. Question

1 pointsQID131:According to the potential financial results, risks can be classified into speculative risks and:

Correct

According to the potential financial results, risks may be considered as being either pure or speculative. The answer is A.

Incorrect

According to the potential financial results, risks may be considered as being either pure or speculative. The answer is A.

Hint

References:1.1.2

-

Question 90 of 262

90. Question

1 pointsQID129:Which of the following is true about “pure risks”?

Correct

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Incorrect

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Hint

References:1.1.2

-

Question 91 of 262

91. Question

1 pointsQID128:Which of the following is a “pure risk”?

Correct

Pure risks offer the potential of loss only (no gain). The answer is D.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is D.

Hint

References:1.1.2

-

Question 92 of 262

92. Question

1 pointsQID124:Which of the following are more likely to be “pure risks”?

i. The building was destroyed in the air crash

ii. Develop a new weapon

iii. The building was destroyed by an accidental fire

iv. A valuable painting was stolen from the museumCorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 93 of 262

93. Question

1 pointsQID123:When a risk becomes a fact, it affects a relatively wide scope. This risk is called a:

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Hint

References:1.1.2

-

Question 94 of 262

94. Question

1 pointsQID137:Which of the following is not a pure risk?

Correct

Pure risks offer the potential of loss only (no gain). The answer is D.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is D.

Hint

References:1.1.2

-

Question 95 of 262

95. Question

1 pointsQID78:Which of the following is/are pure risk(s)?

i. The building was destroyed in the air crash

ii. Developing a new marine drilling technology

iii. The building was accidentally destroyed by fire

iv. A valuable painting was stolen from the museumCorrect

Pure risks offer the potential of loss only (no gain). (ii) may have gains. The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). (ii) may have gains. The answer is C.

Hint

References:1.1.2

-

Question 96 of 262

96. Question

1 pointsQID75:Which of the following is true about fundamental risks?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Hint

References:1.1.2

-

Question 97 of 262

97. Question

1 pointsQID85:Which of the following is unlikely to be insurable?

Correct

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Incorrect

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Hint

References:1.1.2

-

Question 98 of 262

98. Question

1 pointsQID84:From the insurable point of view, pure risks:

Correct

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Incorrect

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Hint

References:1.1.2

-

Question 99 of 262

99. Question

1 pointsQID83:Which of the following is a fundamental risk?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is A.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is A.

Hint

References:1.1.2

-

Question 100 of 262

100. Question

1 pointsQID82:According to the classification of financial results, risks can be divided into two types, including speculative risks and:

Correct

According to the classification of financial results, risks can be divided into two types, including speculative risks and pure risks. The answer is A.

Incorrect

According to the classification of financial results, risks can be divided into two types, including speculative risks and pure risks. The answer is A.

Hint

References:1.1.2

-

Question 101 of 262

101. Question

1 pointsQID81:According to the classification of financial results, risks can be divided into two types, including pure risks and:

Correct

According to the classification of financial results, risks can be divided into two types, including pure risks and speculative risks. The answer is A.

Incorrect

According to the classification of financial results, risks can be divided into two types, including pure risks and speculative risks. The answer is A.

Hint

References:1.1.2

-

Question 102 of 262

102. Question

1 pointsQID87:Which of the following is a “speculative risk” but not a “pure risk”?

Correct

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Hint

References:1.1.2

-

Question 103 of 262

103. Question

1 pointsQID79:There is a type of risk which is very likely to be uninsurable. Which of the following is that kind of risk?

Correct

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Incorrect

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Hint

References:1.1.2

-

Question 104 of 262

104. Question

1 pointsQID88:Which of the following is not a pure risk?

Correct

Pure risks offer the potential of loss only (no gain), or, at best, no change. Such risks include fire, accident and other undesirable happenings. The answer is B.

Incorrect

Pure risks offer the potential of loss only (no gain), or, at best, no change. Such risks include fire, accident and other undesirable happenings. The answer is B.

Hint

References:1.1.2

-

Question 105 of 262

105. Question

1 pointsQID77:Which of the following is a fundamental risk?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Hint

References:1.1.2

-

Question 106 of 262

106. Question

1 pointsQID76:Which of the following is true about fundamental risks?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Hint

References:1.1.2

-

Question 107 of 262

107. Question

1 pointsQID147:According to the financial results, if risks offer the potential of loss only but no gain, or, at best, no change. For example: fire or car accident. Such risks are:

Correct

Pure risks offer the potential of loss only (no gain). The answer is A.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is A.

Hint

References:1.1.2

-

Question 108 of 262

108. Question

1 pointsQID74:Only have the potential of loss but no gain are called:

Correct

Pure risks offer the potential of loss only (no gain). The answer is B.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is B.

Hint

References:1.1.2

-

Question 109 of 262

109. Question

1 pointsQID145:Which of the following are “pure risks”?

i. Ship sank

ii. Develop a new oil drilling technology

iii. The building was accidentally destroyed by fire

iv. Plane crashCorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 110 of 262

110. Question

1 pointsQID15:Which of the following is incorrect in terms of the meaning of risk?

Correct

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is B.

Incorrect

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is B.

Hint

References:1.1.2

-

Question 111 of 262

111. Question

1 pointsQID80:Based on their effect, risks can be classified into two types, including particular risks and:

Correct

Based on their effect, risks can be classified into two types, including particular risks and fundamental risks. The answer is B.

Incorrect

Based on their effect, risks can be classified into two types, including particular risks and fundamental risks. The answer is B.

Hint

References:1.1.2

-

Question 112 of 262

112. Question

1 pointsQID96:There is a type of risks that may have a very large and wide effect. Such risks are called:

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is D.

Hint

References:1.1.2

-

Question 113 of 262

113. Question

1 pointsQID104:If risks classified according to the effect, in addition to fundamental risks, the other are:

Correct

If risks classified according to the effect, in addition to fundamental risks, the other are particular risks. The answer is C.

Incorrect

If risks classified according to the effect, in addition to fundamental risks, the other are particular risks. The answer is C.

Hint

References:1.1.2

-

Question 114 of 262

114. Question

1 pointsQID103:Which of the following are “pure risks”?

i. Ship sank

ii. Weapon development

iii. The building was accidentally destroyed by fire

iv. Plane crashCorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 115 of 262

115. Question

1 pointsQID102:Which of the following is/are the fundamental risk(s)?

i. War

ii. Famine

iii. Traffic accidentCorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is C.

Hint

References:1.1.2

-

Question 116 of 262

116. Question

1 pointsQID101:We may classify risk under two broad headings, including financial results and which of the following?

Correct

We may classify risk under two broad headings according to:

(a) its potential financial results

(b) its cause and effectThe answer is B.

Incorrect

We may classify risk under two broad headings according to:

(a) its potential financial results

(b) its cause and effectThe answer is B.

Hint

References:1.1.2

-

Question 117 of 262

117. Question

1 pointsQID100:Which of the following is most likely to be uninsurable in terms of degree of insurability?

Correct

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Incorrect

Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Hint

References:1.1.2

-

Question 118 of 262

118. Question

1 pointsQID99:Which of the following is true about “pure risks”?

Correct

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Incorrect

The majority of the risks which are insured by commercial insurers are pure risks, and speculative risks are not normally insurable. The answer is C.

Hint

References:1.1.2

-

Question 119 of 262

119. Question

1 pointsQID86:Which of the following is a “speculative risk” but not a “pure risk”?

Correct

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. The answer is D.

Hint

References:1.1.2

-

Question 120 of 262

120. Question

1 pointsQID97:After risks become facts, according to the actual scope of effect, what can the risks be classified into?

Correct

According to the actual scope of effect, risks can be considered as being either particular or fundamental. The answer is B.

Incorrect

According to the actual scope of effect, risks can be considered as being either particular or fundamental. The answer is B.

Hint

References:1.1.2

-

Question 121 of 262

121. Question

1 pointsQID105:Links between risk and insurance:

Correct

(ii) Sometimes the insured is also responsible for the loss, such as the deductible;

(iii) There are other ways (risk management), such as risk avoidance;

(iv) Not all risk are insurable, such as emotional risksThe answer is A.

Incorrect

(ii) Sometimes the insured is also responsible for the loss, such as the deductible;

(iii) There are other ways (risk management), such as risk avoidance;

(iv) Not all risk are insurable, such as emotional risksThe answer is A.

Hint

References:1.1.2

-

Question 122 of 262

122. Question

1 pointsQID95:Which of the following is a particular risk?

Correct

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. Such risks include motor accidents, personal injuries and the like. The answer is B.

Incorrect

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. Such risks include motor accidents, personal injuries and the like. The answer is B.

Hint

References:1.1.2

-

Question 123 of 262

123. Question

1 pointsQID94:Which of the following is a “pure risk”?

Correct

Pure risks offer the potential of loss only (no gain). The answer is C.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is C.

Hint

References:1.1.2

-

Question 124 of 262

124. Question

1 pointsQID93:Which of the following can be described as a “speculative risk”?

i. Fluctuations in the hang Seng index

ii. Introducing a new form of savings life insurance

iii. Casino loss caused by fire

iv. A horse racing result at Sha Tin RacecourseCorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. (iii) is a pure risk, which offers the potential of loss only. The answer is C.

Incorrect

Speculative risks offer the potential of gain or loss. Such risks include gambling, business ventures and entrepreneurial activities. (iii) is a pure risk, which offers the potential of loss only. The answer is C.

Hint

References:1.1.2

-

Question 125 of 262

125. Question

1 pointsQID92:There is a type of risks that when they become reality, they may have relatively limited rather than widespread influence. Such risks are called:

Correct

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is B.

Incorrect

Particular risks have relatively limited consequences, and affect an individual or a fairly small number of people. The answer is B.

Hint

References:1.1.2

-

Question 126 of 262

126. Question

1 pointsQID90:Which of the following is true about fundamental risks?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Fundamental risks are not normally insurable. The answer is C.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Fundamental risks are not normally insurable. The answer is C.

Hint

References:1.1.2

-

Question 127 of 262

127. Question

1 pointsQID89:Only offer the potential of loss but no gain are called:

Correct

Pure risks offer the potential of loss only (no gain). The answer is B.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is B.

Hint

References:1.1.2

-

Question 128 of 262

128. Question

1 pointsQID98:Which of the following is a “pure risk”?

Correct

Pure risks offer the potential of loss only (no gain). The answer is D.

Incorrect

Pure risks offer the potential of loss only (no gain). The answer is D.

Hint

References:1.1.2

-

Question 129 of 262

129. Question

1 pointsQID185:Which of the following is a correct statement of fundamental risks?

Correct

All statements are true about the fundamental risk. The answer is D.

Incorrect

All statements are true about the fundamental risk. The answer is D.

Hint

References:1.1.2

-

Question 130 of 262

130. Question

1 pointsQID175:In terms of commercial insurance, particular risks:

Correct

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Incorrect

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is C.

Hint

References:1.1.2

-

Question 131 of 262

131. Question

1 pointsQID176:According to the effect, risks can be divided into:

Correct

According to the effect, risks can be considered as being either particular or fundamental. The answer is D.

Incorrect

According to the effect, risks can be considered as being either particular or fundamental. The answer is D.

Hint

References:1.1.2

-

Question 132 of 262

132. Question

1 pointsQID177:Particular risks are:

Correct

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is B.

Incorrect

The majority of the risks which are insured by commercial insurers are particular risks. Fundamental risks are not normally insurable because it is considered financially infeasible for insurers to handle them commercially. The answer is B.

Hint

References:1.1.2

-

Question 133 of 262

133. Question

1 pointsQID178:Which of the following can be described as a “fundamental risk”?

Correct

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Incorrect

The causes of fundamental risks are outside the control of any one individual or even a group of individual, and their outcome affects large numbers of people. Such risks include famine, war, terrorist attack, widespread flood and other disasters. The answer is B.

Hint

References:1.1.2

-

Question 134 of 262

134. Question

1 pointsQID179:According to the effect, risks can be classified as:

Correct

According to the effect, risks can be considered as being either particular or fundamental. The answer is B.

Incorrect

According to the effect, risks can be considered as being either particular or fundamental. The answer is B.

Hint

References:1.1.2

-

Question 135 of 262

135. Question