English HKSI Paper 2 Topic 1

This post is also available in: 繁體中文 (Chinese (Traditional)) English

HKSIP2ET1

Quiz-summary

0 of 567 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

Information

HKSIP2ET1

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 567 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

| Average score |

|

| Your score |

|

Categories

- Topic 1 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500

- 501

- 502

- 503

- 504

- 505

- 506

- 507

- 508

- 509

- 510

- 511

- 512

- 513

- 514

- 515

- 516

- 517

- 518

- 519

- 520

- 521

- 522

- 523

- 524

- 525

- 526

- 527

- 528

- 529

- 530

- 531

- 532

- 533

- 534

- 535

- 536

- 537

- 538

- 539

- 540

- 541

- 542

- 543

- 544

- 545

- 546

- 547

- 548

- 549

- 550

- 551

- 552

- 553

- 554

- 555

- 556

- 557

- 558

- 559

- 560

- 561

- 562

- 563

- 564

- 565

- 566

- 567

- Answered

- Review

-

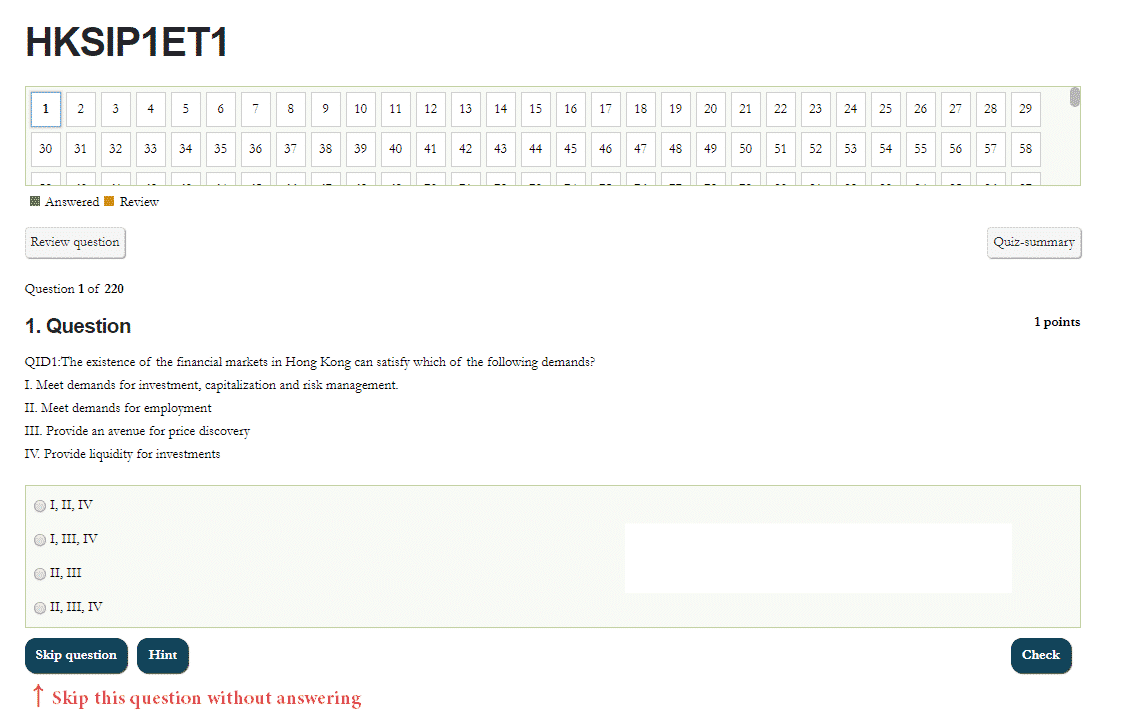

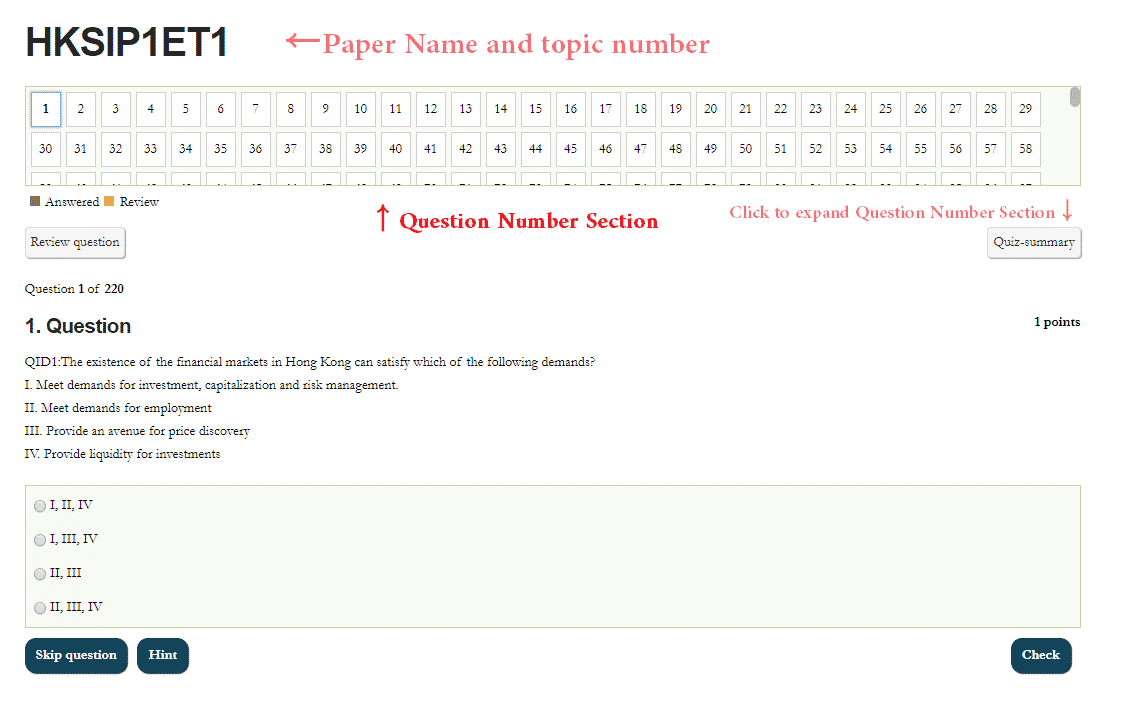

Question 1 of 567

1. Question

1 pointsQID2680:Which of the following description does not fit financial regulators in Hong Kong?

Correct

Decisions made by the regulators can be overturned or overruled.

Incorrect

Decisions made by the regulators can be overturned or overruled.

Hint

Reference Chapter:1.1.1

-

Question 2 of 567

2. Question

1 pointsQID1034:Globalisation and advances in technology have enabled investors to

I. Participate in different markets

II. Arbitrage between markets

III. Arbitrage between products

IV. Increase investment returns by diversifyingCorrect

Globalisation and advances in technology have enabled investors to move rapidly from one market to another, arbitraging between markets, products and transactions.

The main purpose of diversification is not to increase investment returns, but to reduce risk.Incorrect

Globalisation and advances in technology have enabled investors to move rapidly from one market to another, arbitraging between markets, products and transactions.

The main purpose of diversification is not to increase investment returns, but to reduce risk.Hint

Reference Chapter:1.1.1

-

Question 3 of 567

3. Question

1 pointsQID780:Which of the following demands have to be satisfied by the wide range of financial products and services available in Hong Kong?

I. Meet demands for investmentII. Employment opportunities for locals

III. Employment opportunities for expatriates

IV. Capital and investment protection

Correct

Hong Kong’s status as an international financial centre is reflected in the wide range of financial products and services available in Hong Kong, developed to meet demands for investment, capital and income formation and capital raising, the facilitation of cash and capital flows, capital and investment protection (for example, hedging), safe custody and security, speculation and insurance. The financial markets also provide an avenue for price discovery and liquidity of investments.

Incorrect

Hong Kong’s status as an international financial centre is reflected in the wide range of financial products and services available in Hong Kong, developed to meet demands for investment, capital and income formation and capital raising, the facilitation of cash and capital flows, capital and investment protection (for example, hedging), safe custody and security, speculation and insurance. The financial markets also provide an avenue for price discovery and liquidity of investments.

Hint

Reference Chapter:1.1.1

-

Question 4 of 567

4. Question

1 pointsQID784:A risk-based regulatory system refers to a system in which:

Correct

The regulatory approach adopted by the SFC is a risk-based one, meaning that regulation is weighted towards the areas where the SFC perceives the highest risk to lie.

Incorrect

The regulatory approach adopted by the SFC is a risk-based one, meaning that regulation is weighted towards the areas where the SFC perceives the highest risk to lie.

Hint

Reference Chapter:1.1.2

-

Question 5 of 567

5. Question

1 pointsQID785:The SFC regime adopts which of the following regulatory approaches?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.2

-

Question 6 of 567

6. Question

1 pointsQID782:The SFC is a/an _______ in Hong Kong.

Correct

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above. It is considered the securities and futures market prime regulator.Incorrect

The SFC was created by law under the Securities and Futures Commission Ordinance (now repealed and subsumed in the SFO). It is independent, meaning that it is not part of the

Government machinery of the Civil Service or the ministerial system. Nevertheless, it reports to and is accountable to the Government as described in section 2 above. It is considered the securities and futures market prime regulator.Hint

Reference Chapter:1.1.2

-

Question 7 of 567

7. Question

1 pointsQID10:Which approach to regulation is adopted by the SFC to regulate securities and futures markets?

Correct

The SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

The SFC adopts a“risk-based”approach towards regulations. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.2

-

Question 8 of 567

8. Question

1 pointsQID786:Which of the following regulatory approaches adopted by the SFC is given more regulatory attention towards the areas where the SFC perceives the highest risks to lie?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.2

-

Question 9 of 567

9. Question

1 pointsQID783:What approach does the SFC take to regulate market intermediaries?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.2

-

Question 10 of 567

10. Question

1 pointsQID3103:Which of the following best describes the role of the Securities and Futures Commission (SFC) in Hong Kong?

Correct

The SFC’s role includes the supervision of licensed corporations and their associated entities, focusing on areas where it perceives the highest risk. It is not primarily responsible for regulating international trade laws, supervising the banking system, or providing cybersecurity training.

Incorrect

The SFC’s role includes the supervision of licensed corporations and their associated entities, focusing on areas where it perceives the highest risk. It is not primarily responsible for regulating international trade laws, supervising the banking system, or providing cybersecurity training.

Hint

Reference Chapter:1.1.2

-

Question 11 of 567

11. Question

1 pointsQID3080:What is the primary approach adopted by the SFC for regulating market intermediaries?

Correct

The SFC employs a risk-based supervision approach, focusing on regulation in areas where the risks are perceived to be greatest to ensure the integrity and stability of the financial markets.

Incorrect

The SFC employs a risk-based supervision approach, focusing on regulation in areas where the risks are perceived to be greatest to ensure the integrity and stability of the financial markets.

Hint

Reference Chapter:1.1.2

-

Question 12 of 567

12. Question

1 pointsQID3076:Which of the following entities is responsible for the regulation of securities-related products such as equities, warrants, and bonds in Hong Kong?

Correct

The Securities and Futures Commission (SFC) is the principal regulator of the securities industry in Hong Kong, overseeing the regulation and discipline of participants in the securities and futures markets. The SFC adopts a risk-based regulatory approach, focusing on areas perceived to have the highest risk. In contrast, HKMA is Hong Kong’s central banking institution, SEHK is a securities exchange, and HKFE is a futures exchange, making options A, B, and D incorrect.

Incorrect

The Securities and Futures Commission (SFC) is the principal regulator of the securities industry in Hong Kong, overseeing the regulation and discipline of participants in the securities and futures markets. The SFC adopts a risk-based regulatory approach, focusing on areas perceived to have the highest risk. In contrast, HKMA is Hong Kong’s central banking institution, SEHK is a securities exchange, and HKFE is a futures exchange, making options A, B, and D incorrect.

Hint

Reference Chapter:1.1.2

-

Question 13 of 567

13. Question

1 pointsQID787:Which of the following regulatory approach is adopted by the SFC?

Correct

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Incorrect

An expression used by the SFC to explain its approach to regulation is that it is “risk-based”. This basically means that regulation is weighted towards the areas that pose the greatest risk to the markets and the participants.

Hint

Reference Chapter:1.1.2

-

Question 14 of 567

14. Question

1 pointsQID781:The principal regulator of the securities industry in Hong Kong is the

Correct

The principal regulator of the securities industry in Hong Kong is the SFC, which assumes responsibility for front-line regulation and discipline of participants trading on the securities and futures exchanges and also of other securities intermediaries.

Incorrect

The principal regulator of the securities industry in Hong Kong is the SFC, which assumes responsibility for front-line regulation and discipline of participants trading on the securities and futures exchanges and also of other securities intermediaries.

Hint

Reference Chapter:1.1.2

-

Question 15 of 567

15. Question

1 pointsQID2832:Which of the following is not a financial regulator in Hong Kong?

Correct

The Securities Commission option is wrong, the correct name is Securities and Futures Commission.

Incorrect

The Securities Commission option is wrong, the correct name is Securities and Futures Commission.

Hint

Reference Chapter:1.1.3

-

Question 16 of 567

16. Question

1 pointsQID1188:Which of the following organizations cooperate closely with the SFC on issues of common interest?

I. HKMA

II. Companies Registry

III. Inland Revenue Department

IV. Hong Kong Exchanges and ClearingCorrect

There are fewer opportunities for cooperation between the SFCand the tax bureau than other agencies.

Incorrect

There are fewer opportunities for cooperation between the SFCand the tax bureau than other agencies.

Hint

Reference Chapter:1.1.3

-

Question 17 of 567

17. Question

1 pointsQID1658:Hong Kong Financial Regulatory Regime is

Correct

Hong Kong Financial Regulatory Regime is able to address new and complex financial products.

Incorrect

Hong Kong Financial Regulatory Regime is able to address new and complex financial products.

Hint

Reference Chapter:1.1.3

-

Question 18 of 567

18. Question

1 pointsQID903:Which of the following are not common objectives of financial regulators in Hong Kong?

I. Promote intervention to enhance international and local market confidence.

II. Provide investment advice to retail investors

III. Encourage the installation of a sound technical infrastructure for the functioning of the financial markets

IV. Ensure that the legal framework of financial regulation is certain, adequate and fairly enforcedCorrect

Frequent Intervention is not an objective of financial regulators in Hong Kong. Providing Investment advice is not a job that regulators will do, it’s the job of intermediaries.

Incorrect

Frequent Intervention is not an objective of financial regulators in Hong Kong. Providing Investment advice is not a job that regulators will do, it’s the job of intermediaries.

Hint

Reference Chapter:1.1.3

-

Question 19 of 567

19. Question

1 pointsQID3077:Which of the following products are included in the securities-related products addressed by the manual for the licensing regime?

I. Unit trusts/mutual funds

II. Equity linked instruments

III. Virtual assets regarded as securities IV. Exchange-traded futuresCorrect

Unit trusts/mutual funds (I), equity-linked instruments(II), and virtual assets regarded as securities (III) are traded on SEHK. However, Exchange-traded futures (IV) are traded on HKFE.

Incorrect

Unit trusts/mutual funds (I), equity-linked instruments(II), and virtual assets regarded as securities (III) are traded on SEHK. However, Exchange-traded futures (IV) are traded on HKFE.

Hint

Reference Chapter:1.1.4

-

Question 20 of 567

20. Question

1 pointsQID3073:Which of the following securities-related products is NOT traded on The Stock Exchange of Hong Kong Limited (SEHK)?

Correct

Exchange-traded futures are traded on the Hong Kong Futures Exchange Limited (HKFE) and not on The Stock Exchange of Hong Kong Limited (SEHK), making option D the correct answer.

Incorrect

Exchange-traded futures are traded on the Hong Kong Futures Exchange Limited (HKFE) and not on The Stock Exchange of Hong Kong Limited (SEHK), making option D the correct answer.

Hint

Reference Chapter:1.1.4

-

Question 21 of 567

21. Question

1 pointsQID3074:Which of the following are securities-related products addressed in the context of the licensing regime?

I. Equities

II. Bonds and other debt instruments

III. Equity linked instruments

IV. Standard futures contractsCorrect

Equities (I), bonds and other debt instruments (II), and equity-linked instruments (III) are securities-related products under the licensing regime. However, Standard futures contracts (IV) are not regarded as securities-related products.

Incorrect

Equities (I), bonds and other debt instruments (II), and equity-linked instruments (III) are securities-related products under the licensing regime. However, Standard futures contracts (IV) are not regarded as securities-related products.

Hint

Reference Chapter:1.1.4

-

Question 22 of 567

22. Question

1 pointsQID790:Which of the following categories does not fall under the securities and futures services in Hong Kong?

Correct

Advising a trust is not a securities and futures service in Hong Kong.

Incorrect

Advising a trust is not a securities and futures service in Hong Kong.

Hint

Reference Chapter:1.1.6

-

Question 23 of 567

23. Question

1 pointsQID789:Which of the following activities falls under Hong Kong’s securities and futures services?

I. Trading securities on behalf of clients on the Stock Exchange of Hong Kong (SEHK).

II. Providing margin financing and accommodation on securities trading

III. Acting as an “introducing agent”

IV. Conducting stock borrowing and lending transactions.Correct

All of these services fall under Hong Kong’s securities and futures services.

Incorrect

All of these services fall under Hong Kong’s securities and futures services.

Hint

Reference Chapter:1.1.6

-

Question 24 of 567

24. Question

1 pointsQID4:Which of the following activities is a financial service provided by a financial intermediary?

Correct

Financial intermediaries must be compensated to be classified as providers of financial transactions and services. Establishing a tutorial company offers educational services, not financial ones. Managing assets without compensation doesn’t fall under financial services. Therefore, signing a rental agreement for a bank, which is not a financial contract but a real estate contract, is not considered a financial intermediary service. However, loaning money to others and charging interest for the principal is a financial service that involves compensation for a financial transaction.

Incorrect

Financial intermediaries must be compensated to be classified as providers of financial transactions and services. Establishing a tutorial company offers educational services, not financial ones. Managing assets without compensation doesn’t fall under financial services. Therefore, signing a rental agreement for a bank, which is not a financial contract but a real estate contract, is not considered a financial intermediary service. However, loaning money to others and charging interest for the principal is a financial service that involves compensation for a financial transaction.

Hint

Reference Chapter:1.1.6

-

Question 25 of 567

25. Question

1 pointsQID2674:Which of the following activity is subject to supervision by the financial regulators?

Correct

Providing loans and collecting interest is money lending and is a regulated financial intermediary activity.

Incorrect

Providing loans and collecting interest is money lending and is a regulated financial intermediary activity.

Hint

Reference Chapter:1.1.6

-

Question 26 of 567

26. Question

1 pointsQID792:Which of the following individuals/institutions is NOT a provider of securities and futures investment products and services in Hong Kong?

Correct

Intermediaries are providers of securities and futures investment products and services in Hong Kong. Institutional investors are participants but not providers.

Incorrect

Intermediaries are providers of securities and futures investment products and services in Hong Kong. Institutional investors are participants but not providers.

Hint

Reference Chapter:1.1.7

-

Question 27 of 567

27. Question

1 pointsQID5:Which of the followings is not a financial service provider?

Correct

In financial markets, providers of financial products and services include principals and intermediaries. Fund managers, stockbrokers, and independent financial advisers are all intermediaries. Auditors are professionals supporting financial markets.

Incorrect

In financial markets, providers of financial products and services include principals and intermediaries. Fund managers, stockbrokers, and independent financial advisers are all intermediaries. Auditors are professionals supporting financial markets.

Hint

Reference Chapter:1.1.7

-

Question 28 of 567

28. Question

1 pointsQID791:Which of the following are major providers of securities investment and advisory service in Hong Kong?

I. An intermediary trading securities on the Stock Exchange of Hong Kong Limited (SEHK)

II. An intermediary acting on behalf of a foreign intermediary

III. An underwriter

IV. Insurance companiesCorrect

The principal service providers in the securities investment and advising business are:

(a) intermediaries who are participants of the SEHK;

(b) intermediaries who act for foreign securities companies;

(c) underwriters;

(d) fund and portfolio managers;

(e) approved agents who introduce clients to exchange participants or other brokers but do not handle client assets;

(f) corporate finance advisers;

(g) advisers to retail investors;

(h) virtual asset service providers;

(i) financial planners for collective investment schemes (“CISs”);

(j) securities analysts;

(k) licensed banks;

(l) trust companies;

(m) securities margin financiers;

(n) support service providers: lawyers, accountants, auditors and valuers;

(o) listed companies;

(p) financial journalists and radio broadcasters;

(q) market operators who provide exchange and/or clearing functions for transactions in securities, i.e. HKEX, including the SEHK and Hong Kong Securities Clearing Company Limited;

(r) The Investor Compensation Company Limited (“ICC”): the ICC is an independent company recognised by the SFC for dealing with investor compensation matters;

(s) ATS providers: provide by means of electronic facilities, a trading mechanism for securities and futures contracts other than the operations of a recognised exchange company or a recognised clearing house (at the moment this would only cover the SEHK, HKFE and their related clearing houses), for example, trade confirmation and matching systems provided by brokers;

(t) exchanges from outside Hong Kong: there are dealers in Hong Kong who provide local investors with access to overseas exchanges;

(u) share registrars (who have formed a Federation of Share Registrars, with the approval of the SFC) providing share registry services to issuers of listed securities; and

(v) nominee companies that hold client assets of intermediaries.Incorrect

The principal service providers in the securities investment and advising business are:

(a) intermediaries who are participants of the SEHK;

(b) intermediaries who act for foreign securities companies;

(c) underwriters;

(d) fund and portfolio managers;

(e) approved agents who introduce clients to exchange participants or other brokers but do not handle client assets;

(f) corporate finance advisers;

(g) advisers to retail investors;

(h) virtual asset service providers;

(i) financial planners for collective investment schemes (“CISs”);

(j) securities analysts;

(k) licensed banks;

(l) trust companies;

(m) securities margin financiers;

(n) support service providers: lawyers, accountants, auditors and valuers;

(o) listed companies;

(p) financial journalists and radio broadcasters;

(q) market operators who provide exchange and/or clearing functions for transactions in securities, i.e. HKEX, including the SEHK and Hong Kong Securities Clearing Company Limited;

(r) The Investor Compensation Company Limited (“ICC”): the ICC is an independent company recognised by the SFC for dealing with investor compensation matters;

(s) ATS providers: provide by means of electronic facilities, a trading mechanism for securities and futures contracts other than the operations of a recognised exchange company or a recognised clearing house (at the moment this would only cover the SEHK, HKFE and their related clearing houses), for example, trade confirmation and matching systems provided by brokers;

(t) exchanges from outside Hong Kong: there are dealers in Hong Kong who provide local investors with access to overseas exchanges;

(u) share registrars (who have formed a Federation of Share Registrars, with the approval of the SFC) providing share registry services to issuers of listed securities; and

(v) nominee companies that hold client assets of intermediaries.Hint

Reference Chapter:1.1.7

-

Question 29 of 567

29. Question

1 pointsQID3081:Which of the following entities provides electronic facilities for trading and clearing mechanisms for securities and futures contracts, other than the operations of a recognized exchange company or a recognized clearing house?

Correct

ATS providers offer electronic facilities that include both trading and clearing mechanisms for securities and futures contracts, which are distinct from the operations of recognized exchange companies or recognized clearing houses.

Incorrect

ATS providers offer electronic facilities that include both trading and clearing mechanisms for securities and futures contracts, which are distinct from the operations of recognized exchange companies or recognized clearing houses.

Hint

Reference Chapter:1.1.7

-

Question 30 of 567

30. Question

1 pointsQID2718:Which of the following is not a common consequence of inadequate corporate governance standards?

Correct

Common consequences of deficit in corporate governance standards:

I. Insider trading and other forms of market misconduct

II. Misfeasance, fraud, and misconduct by directors, managers, and other staff causing losses to the company or shareholders

IV. The price of the connected transaction deviates from the market price, causing losses to the company and shareholdersIncorrect

Common consequences of deficit in corporate governance standards:

I. Insider trading and other forms of market misconduct

II. Misfeasance, fraud, and misconduct by directors, managers, and other staff causing losses to the company or shareholders

IV. The price of the connected transaction deviates from the market price, causing losses to the company and shareholdersHint

Reference Chapter:1.10.10

-

Question 31 of 567

31. Question

1 pointsQID1243:In order to achieve the goal of supervising the industry, the SFC:

I. Regular inspections, including on-site inspections.

II. Unscheduled inspections, including on-site inspections.

III. Obtaining information from Licensed Corporations (LC)s.

IV. Obtaining information from the Registered Institutions (RI)s.Correct

In furtherance of these aims, the SFC conducts regular inspections of licensed corporations which may be conducted either on-site or via a request for information to be provided. The maintenance of proper documentation is critical in this regard.

Incorrect

In furtherance of these aims, the SFC conducts regular inspections of licensed corporations which may be conducted either on-site or via a request for information to be provided. The maintenance of proper documentation is critical in this regard.

Hint

Reference Chapter:1.10.12

-

Question 32 of 567

32. Question

1 pointsQID1244:In order to facilitate compliance with applicable legal and regulatory requirements in Hong Kong and overseas jurisdictions, which of the following measures can intermediaries take for better coordination?

I. Engage a dedicated compliance officer to oversee adherence to the compliance manual.

II. Appoint a director to serve as a Compliance Officer to oversee adherence to the compliance manual.

III. Maintain close contact with the regulators.

IV. Complement the manual with well defined operational procedures and practices.Correct

In order to facilitate compliance with applicable legal and regulatory requirements (in Hong Kong and, where applicable, in overseas jurisdictions), there is a growing tendency to adopt a detailed compliance manual which sets out the securities dealer’s or adviser’s policies and procedures in relation to matters of regulatory concern. In many cases, a dedicated compliance officer is engaged to oversee adherence to the manual, maintain close contact with the regulators and keep abreast of regulatory developments affecting the securities dealer’s or adviser’s business.

Incorrect

In order to facilitate compliance with applicable legal and regulatory requirements (in Hong Kong and, where applicable, in overseas jurisdictions), there is a growing tendency to adopt a detailed compliance manual which sets out the securities dealer’s or adviser’s policies and procedures in relation to matters of regulatory concern. In many cases, a dedicated compliance officer is engaged to oversee adherence to the manual, maintain close contact with the regulators and keep abreast of regulatory developments affecting the securities dealer’s or adviser’s business.

Hint

Reference Chapter:1.10.14

-

Question 33 of 567

33. Question

1 pointsQID507:Which of the following functions are related to the compliance function of a licensed corporation?

I. The review of record keeping

II. The review of prevention of money laundering

III. The review of client, proprietary and staff dealings

IV. The review of Compliance with all legal and regulator requirementsCorrect

All of these functions are essential as stated in different regulations and guidelines such as the Code of Conduct, the FMCC, AMLO, PDPO, and others.

Incorrect

All of these functions are essential as stated in different regulations and guidelines such as the Code of Conduct, the FMCC, AMLO, PDPO, and others.

Hint

Reference Chapter:1.10.3

-

Question 34 of 567

34. Question

1 pointsQID1238:To promote, encourage and enforce good compliance practices. Senior management of Licensed Corporations (LC)s and Registered Institutions (RI)s must establish:

I. Good line and reporting structures.

II. Well defined functions and responsibilities.

III. Effective communications channels.

IV. Appropriate transparency and disclosure practices.Correct

Senior management must provide the leadership and drive to promote, encourage and enforce, if necessary, good compliance practices. It must establish:

(a) good line and reporting structures;

(b) clearly defined functions and responsibilities;

(c.) effective communications;

(d) appropriate transparency and disclosure practices.Incorrect

Senior management must provide the leadership and drive to promote, encourage and enforce, if necessary, good compliance practices. It must establish:

(a) good line and reporting structures;

(b) clearly defined functions and responsibilities;

(c.) effective communications;

(d) appropriate transparency and disclosure practices.Hint

Reference Chapter:1.10.3

-

Question 35 of 567

35. Question

1 pointsQID2441:A good corporate-governance is not related to which of the following people?

Correct

A good corporate-governance is not related to former employees.

Incorrect

A good corporate-governance is not related to former employees.

Hint

Reference Chapter:1.10.5

-

Question 36 of 567

36. Question

1 pointsQID1237:Which of the following descriptions about corporate governance are correct?

I. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders.

II. The governance issue is also concerned with the system by which companies are directed and controlled.

III. The activities of intermediaries frequently concern listed corporations. Accordingly, in addition to considering their own regulatory and corporate governance position, intermediaries need to be aware of the wider impact of corporate governance on their clients and the market.

IV. Markets which exhibit a higher degree of good corporate governance are regarded as more competitive in the international arena.Correct

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers). The governance issue is therefore also concerned with the system by which companies are directed and controlled.

The activities of intermediaries frequently concern listed corporations. Accordingly, in addition to considering their own regulatory and corporate governance position, intermediaries need to be aware of the wider impact of corporate governance on their clients and the market. It is now generally accepted that investors attach considerable importance to corporate governance when assessing the value of a stock, and that markets which exhibit a higher degree of good corporate governance are regarded as more competitive in the international arena.Incorrect

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers). The governance issue is therefore also concerned with the system by which companies are directed and controlled.

The activities of intermediaries frequently concern listed corporations. Accordingly, in addition to considering their own regulatory and corporate governance position, intermediaries need to be aware of the wider impact of corporate governance on their clients and the market. It is now generally accepted that investors attach considerable importance to corporate governance when assessing the value of a stock, and that markets which exhibit a higher degree of good corporate governance are regarded as more competitive in the international arena.Hint

Reference Chapter:1.10.5

-

Question 37 of 567

37. Question

1 pointsQID508:Which of the following is NOT included the set of core principles of corporate governance?

Correct

The Organisation for Economic Co-operation and Development (“OECD”) has issued a set of core principles of corporate governance practices to include fairness, transparency, accountability and responsibility. Leadership is not one of those principles.

Incorrect

The Organisation for Economic Co-operation and Development (“OECD”) has issued a set of core principles of corporate governance practices to include fairness, transparency, accountability and responsibility. Leadership is not one of those principles.

Hint

Reference Chapter:1.10.5

-

Question 38 of 567

38. Question

1 pointsQID1239:Corporate governance describes which of the following relationship?

Correct

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers).

Incorrect

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers).

Hint

Reference Chapter:1.10.5

-

Question 39 of 567

39. Question

1 pointsQID509:Corporate governance refers to the system of by which companies are directed and controlled and concerns which of the following groups of people?

I. Company management.

II. Board of Directors.

III. Shareholders.

IV. Stakeholders.Correct

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers).

Incorrect

Corporate governance has been defined in various ways. It can be seen as primarily concerned with the proper relationship between a company’s management, its board and its shareholders, and possibly also its stakeholders (i.e. groups who have a stake in the healthy existence of a corporation, such as employees, creditors and customers).

Hint

Reference Chapter:1.10.5

-

Question 40 of 567

40. Question

1 pointsQID512:Good governance practices can include which of the following ways?

I. Installing appropriate checks and balances on the board of

directors and senior management.

II. Having sufficient transparency and disclosure of important facts and information to stakeholders.

III. Installing strong protective structures for majority shareholder.

IV. Identifying and penalizing corporate wrongdoing.Correct

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances.

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c) installing strong protective structures for minority shareholders, creditors and other lenders.

(d) identifying and penalising corporate wrongdoing.Incorrect

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances.

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c) installing strong protective structures for minority shareholders, creditors and other lenders.

(d) identifying and penalising corporate wrongdoing.Hint

Reference Chapter:1.10.9

-

Question 41 of 567

41. Question

1 pointsQID510:Good corporate governance includes which of the following features?

I. The recruitment of experienced executive directors who are realistically rewarded to ensure that the business is run

efficiently.

II. The installation of a well regulated structure incorporating close and detailed top managerial supervision of day-to-day

operations of the business.

III. The recruitment of experienced non-executive directors with the objective of ensuring a good balance between executive

and non-executive directors.

IV. Installation of audit and remuneration committees who will ensure independent audits and fair performance geared reward structures.Correct

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances, such as separating the functions of Chairman and CEO; appointment of independent non-executive directors; establishment of independent audit committees; setting up committees to control the remuneration and benefits of directors and senior management.Incorrect

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances, such as separating the functions of Chairman and CEO; appointment of independent non-executive directors; establishment of independent audit committees; setting up committees to control the remuneration and benefits of directors and senior management.Hint

Reference Chapter:1.10.9

-

Question 42 of 567

42. Question

1 pointsQID929:Which of the following are not examples of good corporate governance?

I. Set up remuneration committee to control the remuneration of management.

II. Assign the management to multiple roles to cut cost.

III. Offer high degree of discretionary powers to the management to allow them to enhance efficiency.

IV. Install check and balances to limited the power of the managementCorrect

The essence of corporate governance is to enhance transparency and check and balance. The powers of the management should be limited, therefore, installation of check and balances and limiting the management’s remuneration are good practices.

Incorrect

The essence of corporate governance is to enhance transparency and check and balance. The powers of the management should be limited, therefore, installation of check and balances and limiting the management’s remuneration are good practices.

Hint

Reference Chapter:1.10.9

-

Question 43 of 567

43. Question

1 pointsQID1240:Which of the following is NOT a probable measure that can be taken to improve corporate governance?

Correct

It’s not required to protect the interests of the management.

Incorrect

It’s not required to protect the interests of the management.

Hint

Reference Chapter:1.10.9

-

Question 44 of 567

44. Question

1 pointsQID1241:The primary objective of good corporate governance is to:

Correct

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company.

Incorrect

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company.

Hint

Reference Chapter:1.10.9

-

Question 45 of 567

45. Question

1 pointsQID1242:A company may improve its corporate governance through the following means with the exception of:

Correct

Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances, such as separating the functions of the chairman and chief executive officer, appointment of independent non-executive directors, establishment of independent audit committees, and setting up committees to control the remuneration and benefits of directors and senior management;

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c.) adopting international accounting and auditing standards;

(d) installing strong protective structures for minority shareholders, creditors and other lenders.

(e) identifying and penalising corporate wrongdoing.Incorrect

Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances, such as separating the functions of the chairman and chief executive officer, appointment of independent non-executive directors, establishment of independent audit committees, and setting up committees to control the remuneration and benefits of directors and senior management;

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c.) adopting international accounting and auditing standards;

(d) installing strong protective structures for minority shareholders, creditors and other lenders.

(e) identifying and penalising corporate wrongdoing.Hint

Reference Chapter:1.10.9

-

Question 46 of 567

46. Question

1 pointsQID511:Which of the following measures reflect effective corporate governance?

I. Installing appropriate checks and balances.

II. Increasing transparency and disclosure to shareholders , stakeholders and the public.

III. Adopting international accounting and auditing standards.

IV. Installing strong protective structures for minority shareholders, creditors and other lenders.Correct

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances.

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c) adopting international accounting and auditing standards;

(d) installing strong protective structures for minority shareholders, creditors and other lenders.Incorrect

A key objective of good governance in any corporate business is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of the company. Having regard to the general concepts set out by the OECD, some of the ways a company may improve its governance are as follows:

(a) installing appropriate checks and balances.

(b) increasing transparency and disclosure to shareholders, stakeholders and the public;

(c) adopting international accounting and auditing standards;

(d) installing strong protective structures for minority shareholders, creditors and other lenders.Hint

Reference Chapter:1.10.9

-

Question 47 of 567

47. Question

1 pointsQID2676:Whats the objective of SFC requiring the disclosure of rights?

Correct

Disclosure requiremetns are in place to enhance transperancy

Incorrect

Disclosure requiremetns are in place to enhance transperancy

Hint

Reference Chapter:1.10.9

-

Question 48 of 567

48. Question

1 pointsQID1684:Good Corporate governance are not required to be responsible for the interest of which of the following

Correct

A key objective of good governance in any company is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of thecompany.

Good Corporate governance are not required to be responsible for the interest of Former Employees.Incorrect

A key objective of good governance in any company is to avoid management taking improper advantage of its position to benefit itself in preference to the legitimate interests of thecompany.

Good Corporate governance are not required to be responsible for the interest of Former Employees.Hint

Reference Chapter:1.10.9

-

Question 49 of 567

49. Question

1 pointsQID971:Good corporate governance should separate the functions of

Correct

Good corporate governance should separate the functions of Chairman and CEO.

Incorrect

Good corporate governance should separate the functions of Chairman and CEO.

Hint

Reference Chapter:1.10.9

-

Question 50 of 567

50. Question

1 pointsQID2757:Which of the following is a concept provided by the Organisation for Economic Co-operation and Development that a company can improve the level of corporate governance?

I. Distinguish between the Chief Executive Officer and the Chairman of the Board

II. Enhance transparency disclosure to shareholders and stakeholders

III. Establish a compensation committee to monitor senior management compensation

IV. Establish a robust protection structure for minority shareholders, creditors or other stakeholdersCorrect

The Organisation for Economic Co-operation and Development offers the concept that companies can improve the level of corporate governance by the following methods:

I. Distinguish between the Chief Executive Officer and the Chairman

II. Enhance transparency disclosure to shareholders and stakeholders

III. Establish a compensation committee to monitor senior management compensation

IV. Establish a strong protection structure for minority shareholders, creditors, or other stakeholders

V. Establish an independent audit committee

VI. Identify business misconduct

VII. Adopt international accounting and auditing standardsIncorrect

The Organisation for Economic Co-operation and Development offers the concept that companies can improve the level of corporate governance by the following methods:

I. Distinguish between the Chief Executive Officer and the Chairman

II. Enhance transparency disclosure to shareholders and stakeholders

III. Establish a compensation committee to monitor senior management compensation

IV. Establish a strong protection structure for minority shareholders, creditors, or other stakeholders

V. Establish an independent audit committee

VI. Identify business misconduct

VII. Adopt international accounting and auditing standardsHint

Reference Chapter:1.10.9

-

Question 51 of 567

51. Question

1 pointsQID90:In which of the following circumstances will the Securities and Futures Commission (SFC) investigate a licensed corporation?

I. When the licensed corporation’s operations deteriorate and it is unable to pay the licence fee.

II. When clients lodge complaints against the licensed corporation for failing to inform them about the whereabouts of deposited funds upon their requests.

III. When an informant provides information that the licensed corporation is mismanaged, growth has slowed, and it is contemplating a sale.

IV. When an informant provides information that the licensed corporation is mismanaged and is incurring losses.Correct

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes, and guidelines.

Failure to pay license fees on time is a violation of the Securities and Futures (Fees) Rules;

Failure to tell clients where their money is going is a breach of the Securities and Futures (Client Money) Rules.

So options I and II are correct.Incorrect

The SFC may enquire into or investigate suspected breaches of the SFO and any subsidiary legislation, codes, and guidelines.

Failure to pay license fees on time is a violation of the Securities and Futures (Fees) Rules;

Failure to tell clients where their money is going is a breach of the Securities and Futures (Client Money) Rules.

So options I and II are correct.Hint

Reference Chapter:1.11.3

-

Question 52 of 567

52. Question

1 pointsQID888:Can the SFC conduct supervisory inspections on the associated entity of an intermediary?

Correct

The SFC can conduct supervisory inspections on an intermediary or an associated entity of an intermediary.

Incorrect

The SFC can conduct supervisory inspections on an intermediary or an associated entity of an intermediary.

Hint

Reference Chapter:1.11.3

-

Question 53 of 567

53. Question

1 pointsQID206:These are key provisions of the SFO that give the SFC considerable powers to investigate, among other things, possible breaches of the SFO, misfeasance and activities not in the public interest. The powers that SFC possesses include which of the followings?

I. SFC can only investigate licenced corporation

II. SFC can require an individual to provide evidence to an investigation, regardless of whether the individual is an intermediary or not.

III. SFC may apply to the court to order a person who does not comply with requirements made by the authorised person or investigator under relevant provisions to do so.

IV. SFC may require an individual under investigation to make a statutory declaration that he is unable to provide the evidence for reasons to be stated, if such is the case.Correct

The SFC may authorise an employee (or another person with the consent of the Financial Secretary) to carry out an investigation. The person so authorised may investigate any person. A person under investigation is required to:

(a) provide documents and explanations;

(e.) make a statutory declaration that he is unable to provide the evidence for reasons to be stated, if such is the case.

The SFC may apply to the court to order a person who does not comply with requirements made by the authorised person or investigator under relevant provisions to do so (s. 185, SFO).Incorrect

The SFC may authorise an employee (or another person with the consent of the Financial Secretary) to carry out an investigation. The person so authorised may investigate any person. A person under investigation is required to:

(a) provide documents and explanations;

(e.) make a statutory declaration that he is unable to provide the evidence for reasons to be stated, if such is the case.

The SFC may apply to the court to order a person who does not comply with requirements made by the authorised person or investigator under relevant provisions to do so (s. 185, SFO).Hint

Reference Chapter:1.11.6

-

Question 54 of 567

54. Question

1 pointsQID2690:Ms. Lam, a private investor, is requested by the SFC to assist in an investigation under the SFO. Which of the following statements about her obligations and potential legal consequences is correct?

Correct

Under the SFO, the SFC is authorized to investigate any person and to require assistance in these investigations.A person is guilty of an offense if, without reasonable excuse, they fail to comply with the requests of an investigator, or if they provide a response that is false or misleading. Such offenses can lead to criminal prosecution.

Incorrect

Under the SFO, the SFC is authorized to investigate any person and to require assistance in these investigations.A person is guilty of an offense if, without reasonable excuse, they fail to comply with the requests of an investigator, or if they provide a response that is false or misleading. Such offenses can lead to criminal prosecution.

Hint

Reference Chapter:1.11.6

-

Question 55 of 567

55. Question

1 pointsQID205:The Securities and Futures Commission (SFC) is conducting an investigation on insider trading. Miss Ko, a retail investor, is required to provide information in the course of the investigation. While Miss Ko is not involved in insider trading, is she required to provide information to the SFC?

Correct

The SFC has the power to investigate any person in connection with suspicions of malpractice, fraud, or other market misconduct or situations where the interest of the investing public may be jeopardised. It can require the person under investigation to provide information during such investigations. This includes retail investors like Miss Ko. If the person under investigation is unable to provide evidence, they must make a statutory declaration stating the reasons for their inability.

Incorrect

The SFC has the power to investigate any person in connection with suspicions of malpractice, fraud, or other market misconduct or situations where the interest of the investing public may be jeopardised. It can require the person under investigation to provide information during such investigations. This includes retail investors like Miss Ko. If the person under investigation is unable to provide evidence, they must make a statutory declaration stating the reasons for their inability.

Hint

Reference Chapter:1.11.7

-

Question 56 of 567

56. Question

1 pointsQID219:Mdm. Liu is a senior citizen. She is a stock investment enthusiast but suffers losses often. The SFC recently conducted an investigation on a company called Sana Seoi Bean Curd and discovered that Mdm. Liu traded the company’s stocks frequently. Thus, the SFC suspected Mdm. Liu of being involved in acts of market misconduct such as the manipulation of the stock market and requested that she participate in the investigation process. Mdm. Liu had neither knowledge, nor intention of manipulating the stock market. As the SFC investigations were going on for a long time, Mdm. Liu wanted to end the meeting earlier and thus deliberately provided false information perfunctorily to the SFC so as to complete the investigation. Had Mdm. Liu committed an offence according to the Securities and Futures Ordinance?

Correct

A person commits an offence if he provides to the SFC (whether in applications or in other circumstances) false or misleading information as to a material particular knowingly or recklessly as to whether it is false or misleading (ss. 383 and 384, SFO).

Incorrect

A person commits an offence if he provides to the SFC (whether in applications or in other circumstances) false or misleading information as to a material particular knowingly or recklessly as to whether it is false or misleading (ss. 383 and 384, SFO).

Hint

Reference Chapter:1.11.8

-

Question 57 of 567

57. Question

1 pointsQID208:The issue of warrant that SFC receives when it applies to the magistrate does NOT include which of the following items of power?

Correct

Six months is the longest period permitted for an order to retain documents established by a regular warrant. Any period beyond that must be requested.

Incorrect

Six months is the longest period permitted for an order to retain documents established by a regular warrant. Any period beyond that must be requested.

Hint

Reference Chapter:1.11.9

-

Question 58 of 567

58. Question

1 pointsQID207:An employee of the SFC, an authorised person or an investigator may, under which of the following appropriate circumstances, apply to a magistrate for the issue of a warrant?

I. Authorizing specified persons, a police officer and such other persons as may be necessary to assist in the execution of the warrant to enter specified premises, if necessary by force, at any time within 7 days.

II. Requiring any person on the premises to produce any relevant documents.

III. Prohibiting any person to erase or alter or remove any relevant documents.

IV. Authorizing the specified persons to search for, seize and remove any relevant documents.Correct

An employee of the SFC, an authorised person or an investigator may, in appropriate circumstances, apply to a magistrate for the issue of a warrant:

(a) authorising specified persons, a police officer and such other persons as may be necessary to assist in the execution of the warrant to enter specified premises, if necessary by force, at any time within seven days;

(b) requiring any person on the premises to produce any relevant documents;

© prohibiting any person to erase or alter or remove any relevant documents; and

(d) authorising the specified persons to:

(i) search for, seize and remove any relevant documentsIncorrect

An employee of the SFC, an authorised person or an investigator may, in appropriate circumstances, apply to a magistrate for the issue of a warrant:

(a) authorising specified persons, a police officer and such other persons as may be necessary to assist in the execution of the warrant to enter specified premises, if necessary by force, at any time within seven days;

(b) requiring any person on the premises to produce any relevant documents;

© prohibiting any person to erase or alter or remove any relevant documents; and

(d) authorising the specified persons to:

(i) search for, seize and remove any relevant documentsHint

Reference Chapter:1.11.9

-

Question 59 of 567

59. Question

1 pointsQID794:Please rank the importance of the following in descending order

Correct

Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken. A failure on the part of an intermediary or its representative to comply with a code of conduct is not a breach of law and does not by itself constitute an offence under the law.

Incorrect

Breaches of the SFO and subsidiary legislation are legal offences and will be investigated by the SFC and enforcement action taken. A failure on the part of an intermediary or its representative to comply with a code of conduct is not a breach of law and does not by itself constitute an offence under the law.

Hint

Reference Chapter:1.2.

-

Question 60 of 567

60. Question

1 pointsQID1035:The Securities and Futures Ordinance (SFO) is the principal legislative document governing which markets in Hong Kong?

Correct

The SFO is the principal legislative document governing the securities market in Hong Kong.

Incorrect

The SFO is the principal legislative document governing the securities market in Hong Kong.

Hint

Reference Chapter:1.2.1

-

Question 61 of 567

61. Question

1 pointsQID847:The rules issued by the SFC, such as Client Securities Rules, are

Correct

These are some of the Major Subsidiary Legislation including:

1.1 Securities and Futures (Financial Resources) Rules

1.2 Securities and Futures (Client Securities) Rules

1.3 Securities and Futures (Client Money) Rules

1.4 Securities and Futures (Keeping of Records) Rules

1.5 Securities and Futures (Contract Notes, Statements of Account and Receipts) Rules

1.6 Securities and Futures (Accounts and Audit) Rules,

plus many others.Incorrect

These are some of the Major Subsidiary Legislation including:

1.1 Securities and Futures (Financial Resources) Rules

1.2 Securities and Futures (Client Securities) Rules

1.3 Securities and Futures (Client Money) Rules

1.4 Securities and Futures (Keeping of Records) Rules

1.5 Securities and Futures (Contract Notes, Statements of Account and Receipts) Rules

1.6 Securities and Futures (Accounts and Audit) Rules,

plus many others.Hint

Reference Chapter:1.2.2

-

Question 62 of 567

62. Question

1 pointsQID1036:Which of the following are the power that the Securities and Futures Ordinance (SFO) empowers the SFC with?

I. The power to introduce subsidiary legislation.

II. The power to issue codes and guidelines.

III. The power to amend the Securities and Futures Ordinance.

IV. The power to revoke the Securities and Futures Ordinance.Correct

Part VII empowers the SFC to make subsidiary legislation (s. 168, SFO) and/or codes (s. 169, SFO).

Incorrect

Part VII empowers the SFC to make subsidiary legislation (s. 168, SFO) and/or codes (s. 169, SFO).

Hint

Reference Chapter:1.2.2

-

Question 63 of 567

63. Question

1 pointsQID190:The SFO has provided powers for the SFC to make detailed rules relating to which of the following?

I. Financial Resources

II. Handling of client money and other client assets

III. The keeping of accounts and records

IV. Auditing mattersCorrect

The SFO grants the SFC powers to make detailed rules relating to:

(a.) their financial resources;

(b.) the handling of client money and other client assets;

(c.) the keeping of accounts and records; and